What do insurance companies check for in blood tests Idea

Home » Trending » What do insurance companies check for in blood tests IdeaYour What do insurance companies check for in blood tests images are ready. What do insurance companies check for in blood tests are a topic that is being searched for and liked by netizens now. You can Get the What do insurance companies check for in blood tests files here. Find and Download all free images.

If you’re looking for what do insurance companies check for in blood tests images information related to the what do insurance companies check for in blood tests keyword, you have visit the right site. Our site always gives you hints for viewing the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

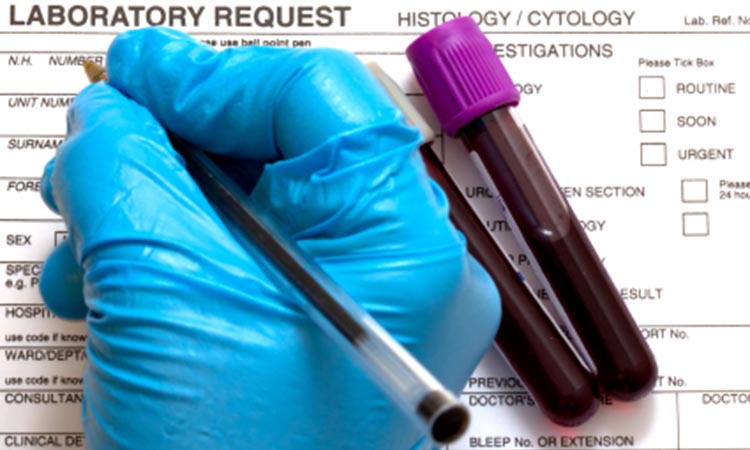

What Do Insurance Companies Check For In Blood Tests. It could reveal the use of any illicit drug use. The underwriter typically would have to work with the applicant�s doctor to further investigate a potential cancer risk. What are they testing for? What they look for blood and urine tests can turn up the presence of hiv, cocaine and cotinine, a.

Why Do I Need a Blood and Urine Test to Buy Disability From disabilityinsuranceadvisor.com

Why Do I Need a Blood and Urine Test to Buy Disability From disabilityinsuranceadvisor.com

A blood test can determine if the applicant has certain substances in their blood. Do life insurance blood tests check for drugs? Your blood work will reveal drugs consumed in the past 3 to 5 months. Urine tests and blood tests, a medical history interview, and prescription drug checks all play a role in the life insurance medical exam. It could reveal the use of any illicit drug use. The urine test is more likely to reveal drugs in your system, especially if you have taken something recently.

In addition, you may be weighed and asked questions about your lifestyle.

Insurers typically look for drugs for that indicate health issues, illegal activity, or addiction. Additionally, your blood test results may reveal drug use, which is something insurance. While the insurer already collected this information during the application process, it will be checking that your test results and answers are consistent. Generally speaking, many health insurance plans will cover the cost of blood work if the testing is deemed medically necessary. Some insurance policies may require just a simple blood test and a personal blood pressure and weight measurement. Foods that help flush out nicotine and cotinine from the body:

Source: audetlaw.com

Source: audetlaw.com

While the insurer already collected this information during the application process, it will be checking that your test results and answers are consistent. The bloodstream only holds onto small amounts of nicotine for a few short days, but it may show cotinine for up to 10 days. It confirms the validity of the answers on your application. What information do insurers look for in blood and urine tests? In addition, you may be weighed and asked questions about your lifestyle.

Source: wikihow.vn

Source: wikihow.vn

Nicotine marijuana methamphetamines cocaine opiates pcp barbiturates benzodiazepines methadone Additionally, your blood test results may reveal drug use, which is something insurance. Insurance companies also ask prospective clients for a release of personal information so the insurer can investigate private doctor files or check with the medical information bureau to collect public medical records and histories. According to the cdc, smoking is the leading cause of preventable disease, disability, and death in america.life insurers use nicotine tests and questions about your smoking history to. Some of what they are looking for shows up in your blood and some of what they are looking for will show up in your urine.

Specifically, they look for diseases like: Blood tests are almost always done as well. Specifically, they look for diseases like: They’re looking at your cholesterol level to determine the health of your cardiovascular system. Eat more and more vitamin c rich fruits!

Source: disabilityinsuranceadvisor.com

Source: disabilityinsuranceadvisor.com

Eat more and more vitamin c rich fruits! Amphetamines, cocaine marijuana methamphetamines opiates nicotine alcohol Your blood work will reveal drugs consumed in the past 3 to 5 months. While the insurer already collected this information during the application process, it will be checking that your test results and answers are consistent. Urine tests and blood tests, a medical history interview, and prescription drug checks all play a role in the life insurance medical exam.

Source: doctorheck.blogspot.com

Source: doctorheck.blogspot.com

The carrier, product type, and the amount of coverage. During your paramed exam (the medical exam for life insurance), the examiner will draw blood. Some insurance companies still use the blood test to check for nicotine, but it’s rare. Some of what they are looking for shows up in your blood and some of what they are looking for will show up in your urine. In most cases, the insurance company you are applying to will test both.

Source: consumer.healthday.com

Source: consumer.healthday.com

It also helps the company spot any lies you tell about your health. Eat more and more vitamin c rich fruits! The carrier, product type, and the amount of coverage. Blood tests are almost always done as well. Most insurance companies will use these rapid antibody tests that use saliva rather than blood because they are much more affordable.

Source: talktomira.com

Source: talktomira.com

If the results reveal high blood pressure, a history of heart disease, or any other underlying medical conditions, the insurance company could charge you more for life insurance coverage. Often, the drugs life insurance companies take a blood of urine sample to test for the following substances: Some of what they are looking for shows up in your blood and some of what they are looking for will show up in your urine. The carrier, product type, and the amount of coverage. As discussed, insurance companies look for indicators that you’re a high risk.

Source: nytimes.com

Source: nytimes.com

It could reveal undisclosed tobacco or marijuana use. Urine tests and blood tests, a medical history interview, and prescription drug checks all play a role in the life insurance medical exam. Oftentimes, insurance carriers will have applicants meet with a paramedical professional who will take blood pressure and pulse reading, as well as collect blood and urine samples. Additionally, your blood test results may reveal drug use, which is something insurance. Why life insurance companies test for nicotine.

Source: gninsurance.com

Source: gninsurance.com

Blood tests are almost always done as well. A basic metabolic panel (bmp) usually checks for levels of eight compounds in the blood: Generally speaking, many health insurance plans will cover the cost of blood work if the testing is deemed medically necessary. They’re also looking for the presence of severe health conditions, like diabetes or hiv. Insurers typically look for drugs for that indicate health issues, illegal activity, or addiction.

Source: healthiculture.com

Source: healthiculture.com

The underwriter typically would have to work with the applicant�s doctor to further investigate a potential cancer risk. What they look for blood and urine tests can turn up the presence of hiv, cocaine and cotinine, a. Oftentimes, insurance carriers will have applicants meet with a paramedical professional who will take blood pressure and pulse reading, as well as collect blood and urine samples. It also helps the company spot any lies you tell about your health. Additionally, the blood test has the following uses:

Source: pinterest.com

Source: pinterest.com

Oftentimes, insurance carriers will have applicants meet with a paramedical professional who will take blood pressure and pulse reading, as well as collect blood and urine samples. Why life insurance companies test for nicotine. In most cases, the insurance company you are applying to will test both. It confirms the validity of the answers on your application. While the insurer already collected this information during the application process, it will be checking that your test results and answers are consistent.

Source: theconversation.com

Source: theconversation.com

If the results reveal high blood pressure, a history of heart disease, or any other underlying medical conditions, the insurance company could charge you more for life insurance coverage. Some of what they are looking for shows up in your blood and some of what they are looking for will show up in your urine. Most insurance companies will use these rapid antibody tests that use saliva rather than blood because they are much more affordable. If you take an oral test, you will be given an oral swab. Your blood and urine samples will be tested for prescription drug use, tobacco use and whether you have any diseases.

Source: fedupwithfatigue.com

Source: fedupwithfatigue.com

Your blood work will reveal drugs consumed in the past 3 to 5 months. Blood tests are almost always done as well. For example, if your doctor has ordered a test to assess your white blood cell count because you are exhibiting signs of a certain illness, you may be able to file a claim, as the blood work is necessary. Specifically, they look for diseases like: In most cases, the insurance company you are applying to will test both.

Source: talktomira.com

Source: talktomira.com

Calcium glucose sodium potassium bicarbonate chloride blood urea nitrogen (bun) creatinine this test may. In addition, you may be weighed and asked questions about your lifestyle. Additionally, the blood test has the following uses: When you get a blood test, the examiners are looking for a few different things. Your blood work will reveal drugs consumed in the past 3 to 5 months.

Source: budgeting.thenest.com

Source: budgeting.thenest.com

They test everything from your liver function, to communicable diseases, to cardiovascular issues. Oftentimes, insurance carriers will have applicants meet with a paramedical professional who will take blood pressure and pulse reading, as well as collect blood and urine samples. It could reveal the use of any illicit drug use. If you take an oral test, you will be given an oral swab. During your paramed exam (the medical exam for life insurance), the examiner will draw blood.

Source: fedupwithfatigue.com

Source: fedupwithfatigue.com

Generally speaking, many health insurance plans will cover the cost of blood work if the testing is deemed medically necessary. Oftentimes, insurance carriers will have applicants meet with a paramedical professional who will take blood pressure and pulse reading, as well as collect blood and urine samples. A doctor’s visit could cost $60 in miami, fl, and up to $165 in anchorage, ak. Your blood and urine samples will be tested for prescription drug use, tobacco use and whether you have any diseases. The underwriter typically would have to work with the applicant�s doctor to further investigate a potential cancer risk.

Source: worksitemed.com

Source: worksitemed.com

One big advantage of online blood tests is that they provide their prices clearly and upfront. Your blood and urine samples will be tested for prescription drug use, tobacco use and whether you have any diseases. Insurance companies also ask prospective clients for a release of personal information so the insurer can investigate private doctor files or check with the medical information bureau to collect public medical records and histories. If you take an oral test, you will be given an oral swab. It is routine for insurance companies to do drug testing through a blood test.

Source: lendedu.com

Source: lendedu.com

The carrier, product type, and the amount of coverage. The bloodstream only holds onto small amounts of nicotine for a few short days, but it may show cotinine for up to 10 days. Most insurance companies will use these rapid antibody tests that use saliva rather than blood because they are much more affordable. Additionally, the blood test has the following uses: Insurers typically look for drugs for that indicate health issues, illegal activity, or addiction.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what do insurance companies check for in blood tests by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information