What does 100 300 insurance mean information

Home » Trending » What does 100 300 insurance mean informationYour What does 100 300 insurance mean images are available. What does 100 300 insurance mean are a topic that is being searched for and liked by netizens now. You can Find and Download the What does 100 300 insurance mean files here. Get all free photos and vectors.

If you’re looking for what does 100 300 insurance mean images information connected with to the what does 100 300 insurance mean interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

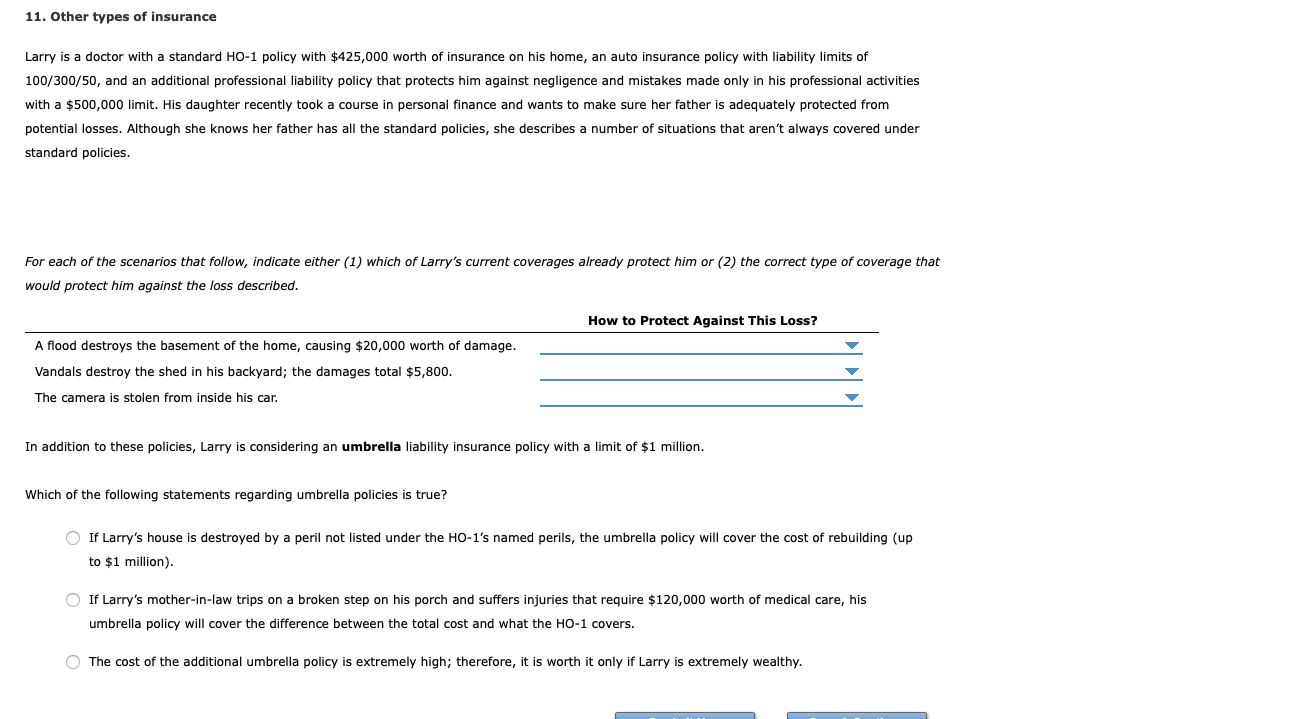

What Does 100 300 Insurance Mean. John has limits of $100,000 per person and $300,000 per accident (written as 100/300) for his uninsured motorist bodily injury coverage and is insuring two vehicles. 2.) what insurance do you need to carry If you have these auto insurance numbers, your insurance company will pay for $100,000 in bodily injury liability per person, $300,000. Some car insurance companies advertise 100/300 plans for added protection.

3 Documentaries About Insurance That may Actually Change From havingsaidthat.net

3 Documentaries About Insurance That may Actually Change From havingsaidthat.net

If an injured person has injuries up to $100,000 — your insurance will pay that amount. The best liability coverage for most drivers is 100/300/100, which is $100,000 per person, $300,000 per accident in bodily. Bodily injury limits:these are the first numbers you usually see. 100/300 insurance is a car insurance policy with $100,000 of bodily injury liability coverage per person and $300,000 of bodily injury liability coverage per accident. The second number, 100, means you have $100,000 maximum liability coverage for the accident and the last number, 100, means you have $100,000 maximum for property damage. Insurance experts recommend liability limits of 100/300/100.

The numbers 100/300/50 represent your policy coverage limits.

$300,000 in bl per accident; 100 / 300 liability split limits are never mandated by state authority, but are typically “standard” limits of liability amongst national auto insurance carriers. Bodily injury liability (bi) insurance is coverage for other people�s injuries or. Typically, increasing your liability limits doesn�t cost much more. 100/300 insurance, or even higher, is recommended for homeowners or people with assets. If you select limits that are too low you could be force to liquidate property, savings and other assets or your future earnings could be attached.

Source: beritatekini.com

Source: beritatekini.com

State requirements are often much lower than the amount necessary to protect you financially in the event of an accident. $100,000 per person and $300,000 per incident for bodily injury and $50,000 for property damage liability coverage. Some car insurance companies advertise 100/300 plans for added protection. If you want the best protection available, that is usually 250/500/100, though a few auto insurers will allow drivers to pick coverage as high as 500/500/300. While financial circumstances do not allow everybody to raise their liability limits, it�s recommended that you buy as much car insurance as you can afford.

Source: cimaworld.com

Source: cimaworld.com

The insurance industry’s recommended coverage amount is 100/300/50: Bodily injury liability (bi) insurance is coverage for other people�s injuries or. Rideshare companies including lyft and uber. What does 100/300/100 coverage on an auto policy mean? For example, if you caused an accident and chose limits of $15,000/$30,000, your bodily injury liability insurance would pay up to $15,000 per person injured, up to a maximum total of $30,000 for all injuries in the entire accident.

Source: simplifiedsenior.com

Source: simplifiedsenior.com

Damaged property in an accident may include a mailbox, fence or building. This article will explore 100/300 insurance cost in detail. Rideshare companies including lyft and uber. If you have these auto insurance numbers, your insurance company will pay for $100,000 in bodily injury liability per person, $300,000. What does 100/300/100 coverage on an auto policy mean?

The second number, 100, means you have $100,000 maximum liability coverage for the accident and the last number, 100, means you have $100,000 maximum for property damage. What does 100/300/100 coverage on an auto policy mean? The insurance industry�s recommended coverage amount is 100/300/50: If you’re involved in an accident, you’re basically liable for all the damages caused and if your insurance limits are low, you may be responsible for any. Tips if your health insurance plan uses the term 100 percent after deductible, this means the plan covers all your qualified medical costs for the rest of the year after you have paid your deductible.

Source: mapfreinsuranceblog.com

Source: mapfreinsuranceblog.com

Food delivery drivers, couriers, and others that use a vehicle for work, may be required by their employer to carry 100/300 insurance limits. For this increased level of protection, you will pay a higher car insurance premium. $100,000 bodily injury coverage per person. $100,000 per person and $300,000 per incident for bodily injury and $50,000 for property damage liability coverage. This $300,000 amount works together with the $100,000 amount as you will see below:

Source: forums.hardwarezone.com.sg

Source: forums.hardwarezone.com.sg

$300,000 bodily injury coverage per accident. Tips if your health insurance plan uses the term 100 percent after deductible, this means the plan covers all your qualified medical costs for the rest of the year after you have paid your deductible. This means the most the policy will pay is $100,000 per person up to $300,000 per accident. Insurance experts recommend liability limits of 100/300/100. The 100/300/50 policy above would cover three people up to $100k each.

Source: insureinfoq.com

Source: insureinfoq.com

If you have these auto insurance numbers, your insurance company will pay for $100,000 in bodily injury liability per person, $300,000. $100,000 bodily injury coverage per person. For this increased level of protection, you will pay a higher car insurance premium. The insurance industry�s recommended coverage amount is 100/300/50: The second number, 100, means you have $100,000 maximum liability coverage for the accident and the last number, 100, means you have $100,000 maximum for property damage.

Source: homewroughtironmirror.blogspot.com

Source: homewroughtironmirror.blogspot.com

If you have these auto insurance numbers, your insurance company will pay for $100,000 in bodily injury liability per person, $300,000. If you select limits that are too low you could be force to liquidate property, savings and other assets or your future earnings could be attached. 100 / 300 liability insurance limits. Buy at least standard 100/300/100 coverage, which translates into $100,000 coverage per person for bodily injury, including death, that you cause to others; Typically, increasing your liability limits doesn�t cost much more.

Source: havingsaidthat.net

Source: havingsaidthat.net

Typically, increasing your liability limits doesn�t cost much more. The 100/300/50 policy above would cover three people up to $100k each. If an injured person has injuries up to $100,000 — your insurance will pay that amount. This means the most the policy will pay is $100,000 per person up to $300,000 per accident. For this increased level of protection, you will pay a higher car insurance premium.

Source: bigstockphoto.com

Source: bigstockphoto.com

$100,000 bodily injury coverage per person. 100/300 insurance is a car insurance policy with $100,000 of bodily injury liability coverage per person and $300,000 of bodily injury liability coverage per accident. And property damage up to $100,000. Food delivery drivers, couriers, and others that use a vehicle for work, may be required by their employer to carry 100/300 insurance limits. What does 100/300/100 coverage on an auto policy mean?

Source: quora.com

Food delivery drivers, couriers, and others that use a vehicle for work, may be required by their employer to carry 100/300 insurance limits. Or nine people as long as the total was less than $300k and no individual needed more than $100k. While financial circumstances do not allow everybody to raise their liability limits, it�s recommended that you buy as much car insurance as you can afford. So the 100 is for the maximum $100,000 per person coverage and the 300 is for the maximum $300,000 limit for all bodily injury claims from one incident or accident. The 100/300/50 policy above would cover three people up to $100k each.

Source: slideshare.net

Source: slideshare.net

The second number, 100, means you have $100,000 maximum liability coverage for the accident and the last number, 100, means you have $100,000 maximum for property damage. 100/300 insurance is a car insurance policy with $100,000 of bodily injury liability coverage per person and $300,000 of bodily injury liability coverage per accident. Tips if your health insurance plan uses the term 100 percent after deductible, this means the plan covers all your qualified medical costs for the rest of the year after you have paid your deductible. Here is an example of stacking: The insurance information institute recommends that you carry at least $100,000 of bodily injury protection per person, $300,000 per accident and $100,000 for property damage (known as 100/300/100).

Source: therathink.com

Source: therathink.com

John has limits of $100,000 per person and $300,000 per accident (written as 100/300) for his uninsured motorist bodily injury coverage and is insuring two vehicles. If an injured person has injuries up to $100,000 — your insurance will pay that amount. Rideshare companies including lyft and uber. Food delivery drivers, couriers, and others that use a vehicle for work, may be required by their employer to carry 100/300 insurance limits. 100/300 insurance is a car insurance policy with $100,000 of bodily injury liability coverage per person and $300,000 of bodily injury liability coverage per accident.

Source: everquote.com

Source: everquote.com

2.) what insurance do you need to carry This article will explore 100/300 insurance cost in detail. Some car insurance companies advertise 100/300 plans for added protection. If an injured person has injuries up to $100,000 — your insurance will pay that amount. In a 100/300 auto insurance policy, the 100 and 300 are referring to the bodily injury liability limits (in thousands) of the insurance coverage policy.

Source: autoinsurance.org

Source: autoinsurance.org

What does 100/300/100 coverage on an auto policy mean? John has limits of $100,000 per person and $300,000 per accident (written as 100/300) for his uninsured motorist bodily injury coverage and is insuring two vehicles. $100,000 bodily injury coverage per person. Bodily injury limits:these are the first numbers you usually see. Insurance experts recommend liability limits of 100/300/100.

Source: caranddriver.com

Source: caranddriver.com

Typically, increasing your liability limits doesn�t cost much more. The insurance industry’s recommended coverage amount is 100/300/50: 100/300 means 100k per person per accident and up to a total of 300k for any one accident no matter the number of claimants. The term 100/300 insurance refers to the minimum and maximum limits an insurance company will pay to cover bodily injury liability. $100,000 per person and $300,000 per incident for bodily injury and $50,000 for property damage liability coverage.

Source: costaricadreamadventures.com

Source: costaricadreamadventures.com

This article will explore 100/300 insurance cost in detail. Rideshare companies including lyft and uber. Bodily injury limits:these are the first numbers you usually see. If an injured person has injuries up to $100,000 — your insurance will pay that amount. The insurance industry�s recommended coverage amount is 100/300/50:

Source: moneypeach.com

Source: moneypeach.com

Um coverage is usually expressed as two numbers, such as 100/300. The second number, 100, means you have $100,000 maximum liability coverage for the accident and the last number, 100, means you have $100,000 maximum for property damage. The 100 allows that the policy will cover up to $100,000 of bodily injury per single person injured in an accident and the 300 means the policy will cover up to $300,000 total for bodily injuries per accident. For example, if you caused an accident and chose limits of $15,000/$30,000, your bodily injury liability insurance would pay up to $15,000 per person injured, up to a maximum total of $30,000 for all injuries in the entire accident. Damaged property in an accident may include a mailbox, fence or building.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what does 100 300 insurance mean by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information