What does car insurance cover in ontario Idea

Home » Trending » What does car insurance cover in ontario IdeaYour What does car insurance cover in ontario images are available. What does car insurance cover in ontario are a topic that is being searched for and liked by netizens now. You can Find and Download the What does car insurance cover in ontario files here. Get all royalty-free images.

If you’re searching for what does car insurance cover in ontario pictures information related to the what does car insurance cover in ontario interest, you have come to the ideal site. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

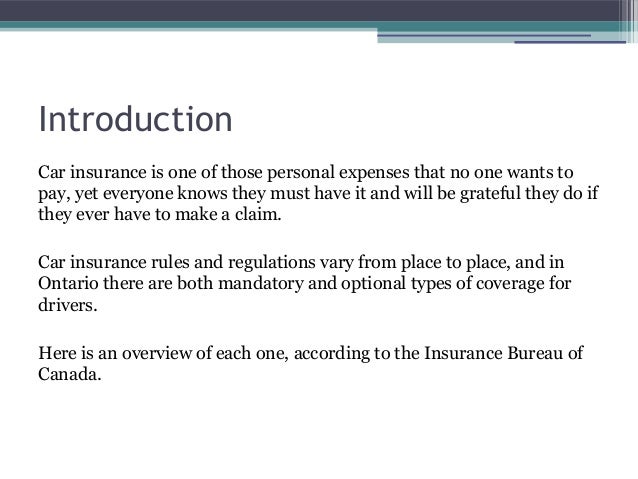

What Does Car Insurance Cover In Ontario. Rental car insurance has 4 options, including: Even though car insurance is mandatory in ontario, there are other reasons you might want car insurance or extras within your policy. Colliding into a road sign, a street light, the ground, an embankment, or other stationary object. It is called direct compensation because even though someone else causes the damage, you collect directly from your own insurer.

Cheapest Car Insurance Ontario Everything You Need to Know From vehiclecheck.ca

Cheapest Car Insurance Ontario Everything You Need to Know From vehiclecheck.ca

Collision coverage (also known as upset coverage) If the primary driver of a vehicle gets into an accident, the policy will respond to cover the medical bills of the driver as well as repair any damage to the car. Where things get trickier is when another driver steps behind the wheel of that vehicle. Under certain conditions, covers you in ontario for damage to your automobile and to property it is carrying when another motorist is responsible. It is called direct compensation because even though someone else causes the damage, you collect directly from your own insurer. Car insurance can cover the cost of damage you caused to someone else’s vehicle or health.

It is called direct compensation because even though someone else causes the damage, you collect directly from your own insurer.

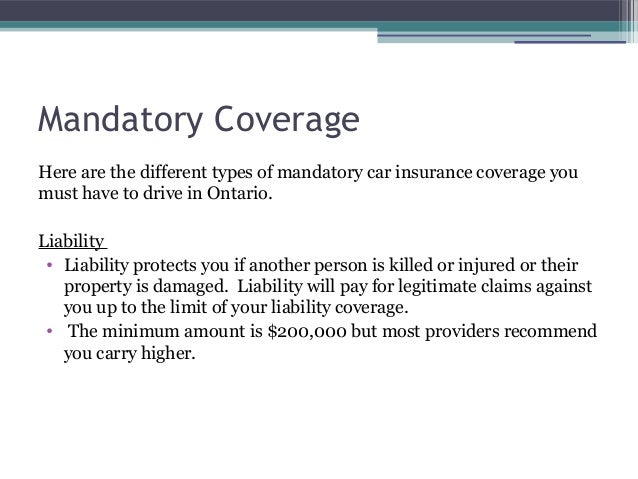

In ontario, $200,000 is the minimum mandatory liability amount available for any one accident. If the cost of the losses or damage is more than your liability limit, you�ll need to pay the balance of the settlement yourself. It also covers damage your vehicle causes to other vehicles. In ontario, it is mandatory for all motorists to have active standard car insurance. As long as that individual has your explicit permission, is not an excluded driver on your policy, and is licensed to use the vehicle as intended, your insurance provider will cover any claim resulting from an. Statutory accident benefits coverage — provides you with.

Source: citynews.ca

Source: citynews.ca

As most people know, ontario’s auto insurance system protects both the driver and the car. In ontario, $200,000 is the minimum mandatory liability amount available for any one accident. If the primary driver of a vehicle gets into an accident, the policy will respond to cover the medical bills of the driver as well as repair any damage to the car. The good thing about uninsured driver insurance is that it is relatively inexpensive. As long as that individual has your explicit permission, is not an excluded driver on your policy, and is licensed to use the vehicle as intended, your insurance provider will cover any claim resulting from an.

Source: bstinsurance.com

Source: bstinsurance.com

If you have uninsured driver insurance, it will cover you. Collision coverage (also known as upset coverage) Your personal belongings inside your home, such as jewelry, artwork, electronics, furniture, etc. To handle the costs of additional living expenses for time away from your home due to an insured loss. Liability insurance covers losses, such as injury or death, which your vehicle causes to other people.

Source: slideshare.net

Source: slideshare.net

As long as that individual has your explicit permission, is not an excluded driver on your policy, and is licensed to use the vehicle as intended, your insurance provider will cover any claim resulting from an. You are responsible for ensuring you have proof of auto insurance (sometimes called a “pink card” or “pink slip”) while driving in ontario. However, there are additional optional coverages that you can tack on to your policy as well. Statutory accident benefits coverage — provides you with. If the primary driver of a vehicle gets into an accident, the policy will respond to cover the medical bills of the driver as well as repair any damage to the car.

Source: pvv-insurance.com

Liability insurance covers losses, such as injury or death, which your vehicle causes to other people. It protects your vehicle from risks unrelated to a collision such as fire, theft, vandalism and weather. Liability insurance is a mandatory coverage that must be included on your car insurance policy in order to legally drive a vehicle in canada. If the cost of the losses or damage is more than your liability limit, you�ll need to pay the balance of the settlement yourself. The good thing about uninsured driver insurance is that it is relatively inexpensive.

Source: compareinsurancesonline.ca

Source: compareinsurancesonline.ca

Statutory accident benefits coverage — provides you with. As long as that individual has your explicit permission, is not an excluded driver on your policy, and is licensed to use the vehicle as intended, your insurance provider will cover any claim resulting from an. Rental car insurance has 4 options, including: Optional car insurance coverage in ontario. Your personal belongings inside your home, such as jewelry, artwork, electronics, furniture, etc.

Source: ratelab.ca

Source: ratelab.ca

In ontario, it is mandatory for all motorists to have active standard car insurance. Liability insurance covers losses, such as injury or death, which your vehicle causes to other people. The damage to your vehicle that it will cover includes : Even though car insurance is mandatory in ontario, there are other reasons you might want car insurance or extras within your policy. Rental car insurance has 4 options, including:

Source: blog.allstate.ca

Source: blog.allstate.ca

Under certain conditions, covers you in ontario for damage to your automobile and to property it is carrying when another motorist is responsible. Liability insurance is mandatory coverage for an automobile policy. Your proof of auto insurance. Statutory accident benefits coverage — provides you with. In ontario, the additional coverage to rent a car is detailed in the ontario policy change form 27 (opcf 27), while in alberta, that is the standard endorsement form 27 (sef 27).

Source: store.lexisnexis.ca

Source: store.lexisnexis.ca

The minimum coverage for liability coverage is $200000 in ontario but you may increase your limit. To handle the costs of additional living expenses for time away from your home due to an insured loss. You only have insurance coverage for a vehicle if your certificate of automobile insurance shows a premium for that vehicle or shows that the coverage is provided at no cost. The chart below provides a summary of minimum coverages required by the ontario government. The good thing about uninsured driver insurance is that it is relatively inexpensive.

Source: ratelab.ca

Source: ratelab.ca

A accident with another vehicle or another vehicle colliding with your automobile. In the case of paint damage, you’ll generally only be able to claim it with comprehensive car insurance, except in some very specific situations, such as paint damage caused by a collision with another driver. In ontario, it is mandatory for all motorists to have active standard car insurance. In ontario, $200,000 is the minimum mandatory liability amount available for any one accident. Statutory accident benefits coverage — provides you with.

Source: gluckstein.com

Source: gluckstein.com

It also covers damage your vehicle causes to other vehicles. Liability insurance is a mandatory coverage that must be included on your car insurance policy in order to legally drive a vehicle in canada. Liability insurance is mandatory coverage for an automobile policy. Even though car insurance is mandatory in ontario, there are other reasons you might want car insurance or extras within your policy. To handle the costs of additional living expenses for time away from your home due to an insured loss.

Source: myinsurancebroker.com

Source: myinsurancebroker.com

Rental car insurance has 4 options, including: A standard car insurance policy in ontario has no clause preventing you from letting someone else drive your car every once in a while. This type of insurance also covers you if you are in an accident with someone that has too little insurance. It is called direct compensation because even though someone else causes the damage, you collect directly from your own insurer. As most people know, ontario’s auto insurance system protects both the driver and the car.

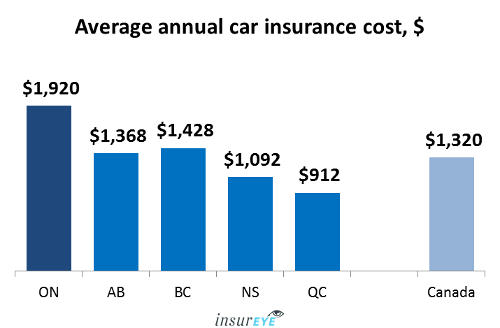

Source: insureye.com

Source: insureye.com

To drive in ontario, you must secure coverage through a private insurer that meets the minimum provincial regulations. What does car insurance cover in an accident when the other driver doesn’t have insurance? Under certain conditions, covers you in ontario for damage to your automobile and to property it is carrying when another motorist is responsible. To legally drive a vehicle in ontario, your car insurance policy must include the following coverages: However, there are additional optional coverages that you can tack on to your policy as well.

Source: slideshare.net

Source: slideshare.net

It is called direct compensation because even though someone else causes the damage, you collect directly from your own insurer. Liability insurance is a mandatory coverage that must be included on your car insurance policy in order to legally drive a vehicle in canada. It protects your vehicle from risks unrelated to a collision such as fire, theft, vandalism and weather. Where things get trickier is when another driver steps behind the wheel of that vehicle. You only have insurance coverage for a vehicle if your certificate of automobile insurance shows a premium for that vehicle or shows that the coverage is provided at no cost.

Source: slideshare.net

Source: slideshare.net

Liability insurance is mandatory coverage for an automobile policy. Your proof of auto insurance. The minimum coverage for liability coverage is $200000 in ontario but you may increase your limit. The damage to your vehicle that it will cover includes : The chart below provides a summary of minimum coverages required by the ontario government.

Source: vehiclecheck.ca

Source: vehiclecheck.ca

A accident with another vehicle or another vehicle colliding with your automobile. Section 6, page 32 optional insurance type of coverage what the coverage does policy section v However, suppose a claim involving both bodily injury and property damage reaches this figure. Loss damage waiver (ldw) / collision damage waiver (cdw) personal effects coverage (pec) personal accident insurance (pai) liability (li) each type of coverage is there to protect you in different ways. In that case, payment for property damage will be capped at $10,000.

Source: thestar.com

Source: thestar.com

Car insurance can cover the cost of damage you caused to someone else’s vehicle or health. Colliding into a road sign, a street light, the ground, an embankment, or other stationary object. A trailer attached to another vehicle a hit and run if the incident is reported to the police. The chart below provides a summary of minimum coverages required by the ontario government. You are responsible for ensuring you have proof of auto insurance (sometimes called a “pink card” or “pink slip”) while driving in ontario.

Source: thinkinsure.ca

Source: thinkinsure.ca

In the case of paint damage, you’ll generally only be able to claim it with comprehensive car insurance, except in some very specific situations, such as paint damage caused by a collision with another driver. This type of insurance also covers you if you are in an accident with someone that has too little insurance. Where things get trickier is when another driver steps behind the wheel of that vehicle. In ontario, repairs to a parked vehicle are covered in section 7 of oap 1, which pays for damage caused by fire, theft, or collision if the automobile is insured against these perils. Your proof of auto insurance.

Source: formsbirds.com

Source: formsbirds.com

Statutory accident benefits coverage — provides you with. If you have uninsured driver insurance, it will cover you. The damage to your vehicle that it will cover includes : Rental car insurance has 4 options, including: As long as that individual has your explicit permission, is not an excluded driver on your policy, and is licensed to use the vehicle as intended, your insurance provider will cover any claim resulting from an.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does car insurance cover in ontario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information