What does contingent mean in life insurance information

Home » Trend » What does contingent mean in life insurance informationYour What does contingent mean in life insurance images are available. What does contingent mean in life insurance are a topic that is being searched for and liked by netizens now. You can Get the What does contingent mean in life insurance files here. Download all free images.

If you’re looking for what does contingent mean in life insurance images information related to the what does contingent mean in life insurance interest, you have come to the right blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

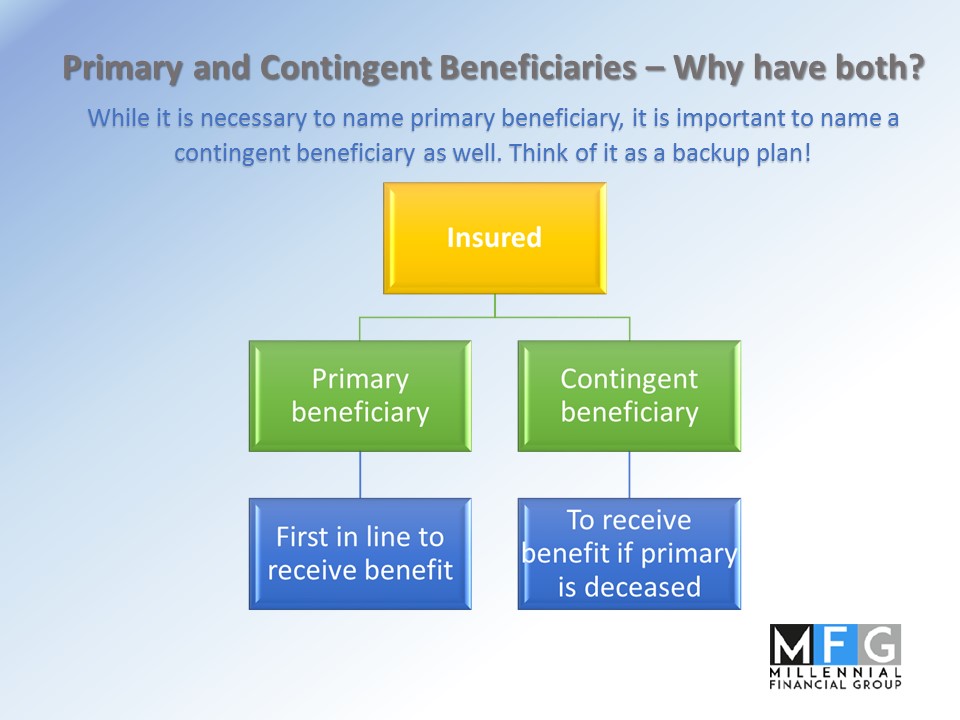

What Does Contingent Mean In Life Insurance. A contingent beneficiary is second in line behind the primary beneficiary of an inheritance. If your primary beneficiary is unable to claim the payout for whatever reason, your contingent beneficiary will be able to claim the life insurance death benefits. Life insurance policies pay death benefits to a beneficiary. Contingent beneficiaries are basically the backup that would receive your life insurance death benefit if all of your primary beneficiaries were deceased.

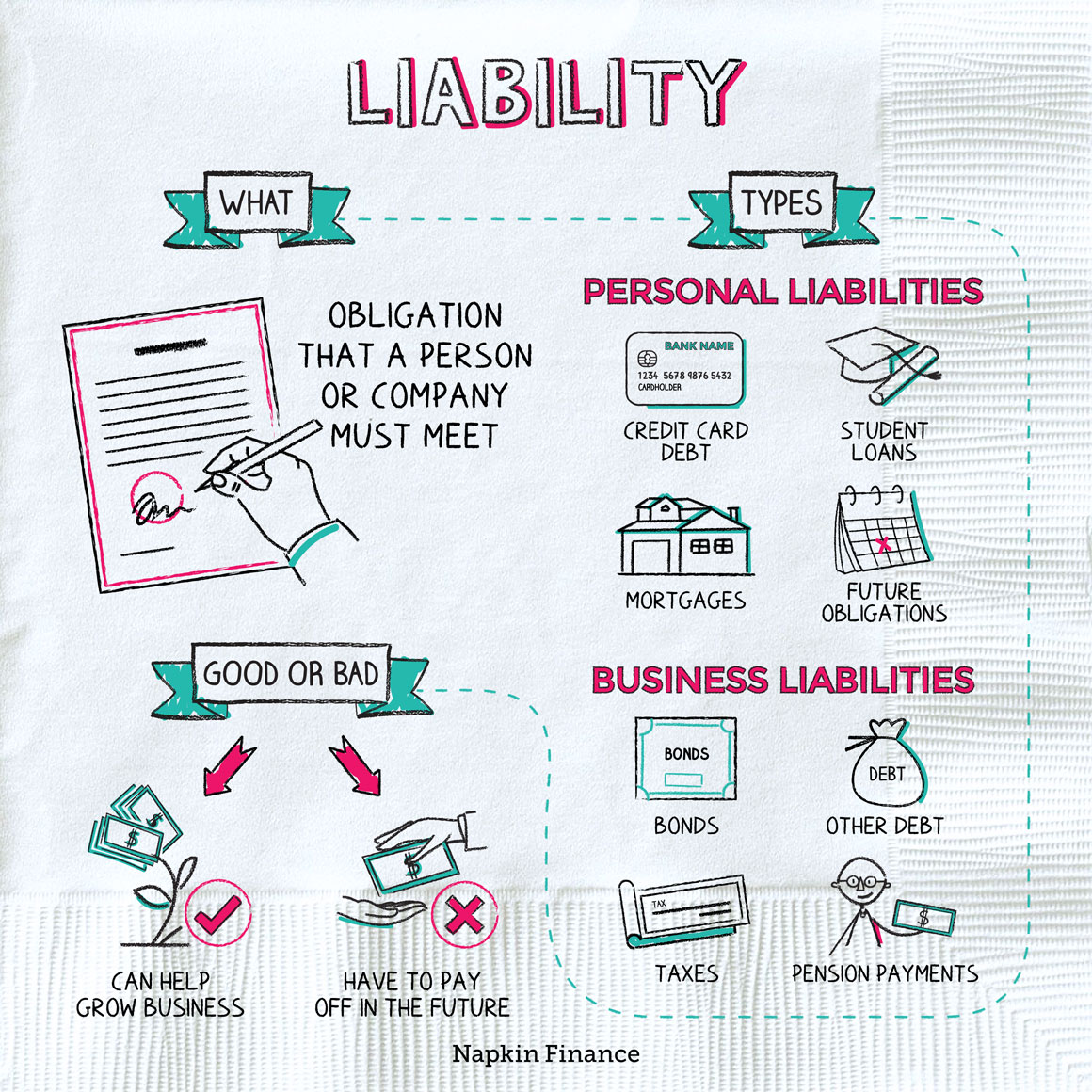

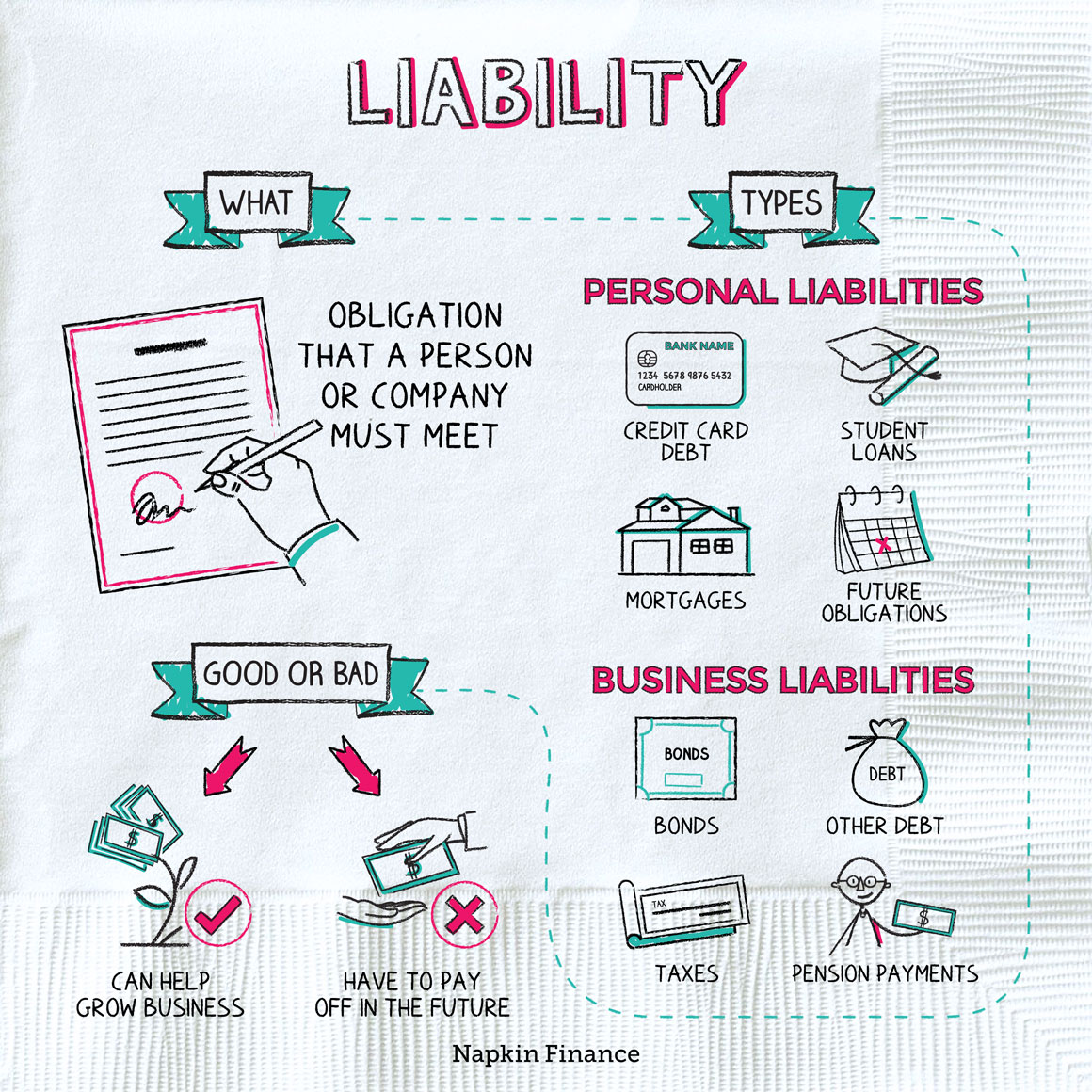

Liability Meaning Liability Definition Liabilities Meaning From napkinfinance.com

Liability Meaning Liability Definition Liabilities Meaning From napkinfinance.com

A contingent life insurance beneficiary is someone who will receive benefits if the primary beneficiary passes away. This person will only inherit the named assets if the primary beneficiary does not. A contingent beneficiary is basically your ‘secondary’ beneficiary. But what does it mean in life insurance? In life insurance terms, it means that the contingent beneficiary exists just in case the primary beneficiary (or all the primary beneficiaries, if there are more than one) are not alive when the insured person dies. A contingent beneficiary is a beneficiary that receives the money when your primary beneficiary predeceases you.

A contingent beneficiary is a beneficiary that receives the money when your primary beneficiary predeceases you.

What does contingent mean in life insurance? In the case your primary beneficiary passes away or becomes impaired, the contingent beneficiary acts as a backup. In the context of insurance, contingency insurance supplements a primary policy or covers remote risks the primary one would be slow to cover. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. Most people name their spouse as the primary beneficiary. In life insurance, you can choose a contingent beneficiary or owner for your policy on the condition that the primary beneficiary or owner dies.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

If you’re in a car accident with your spouse and both of you pass away, the benefits of your policy can be distributed seamlessly to. In the area of life insurance, you might hear the term contingent owner at some point.here are the basics of what a contingent owner is and what rights they have. If you want someone to receive a portion of your death benefit, they need to be a primary beneficiary. A contingent life insurance beneficiary is someone who will receive benefits if the primary beneficiary passes away. In life insurance terms, it means that the contingent beneficiary exists just in case the primary beneficiary (or all the primary beneficiaries, if there are more than one) are not alive when the insured person dies.

Source: istherelifeinsurancetanyogo.blogspot.com

Source: istherelifeinsurancetanyogo.blogspot.com

In the context of insurance, contingency insurance supplements a primary policy or covers remote risks the primary one would be slow to cover. But what does it mean in life insurance? The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. In the context of insurance, contingency insurance supplements a primary policy or covers remote risks the primary one would be slow to cover. If your primary beneficiary is unable to claim the payout for whatever reason, your contingent beneficiary will be able to claim the life insurance death benefits.

Source: pinterest.com

Source: pinterest.com

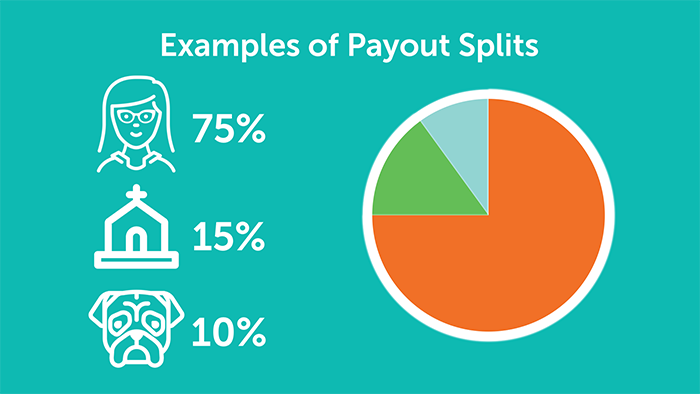

In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured. But what does it mean in life insurance? If you want someone to receive a portion of your death benefit, they need to be a primary beneficiary. The most important thing to keep in mind is that the contingent beneficiary should understand what this means for them. A contingent beneficiary is second in line behind the primary beneficiary of an inheritance.

Source: i-lipolondon.co.uk

Source: i-lipolondon.co.uk

This person will only inherit the named assets if the primary beneficiary does not. What does contingent mean in life insurance? In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured. Most people name their spouse as the primary beneficiary. This is also known as the secondary beneficiary.

Source: insurancenoon.com

Source: insurancenoon.com

The definition of contingent is dependent for existence on something not yet certain. In the context of insurance, contingency insurance supplements a primary policy or covers remote risks the primary one would be slow to cover. Whenever a life insurance policy is purchased by an individual that covers the life of someone else, the person or group that purchased the policy is. The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. If your primary beneficiary is unable to claim the payout for whatever reason, your contingent beneficiary will be able to claim the life insurance death benefits.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

The primary beneficiary is the person who receives your death benefit. The primary beneficiary is the person (or persons) who will receive the proceeds of the life insurance policy when the insured person dies. This is known as having a contingent beneficiary when you sign up for life insurance. It is a very commonly used term in life insurance. A contingent life insurance beneficiary is someone who will receive benefits if the primary beneficiary passes away.

Source: businesspromotionstore.com

Source: businesspromotionstore.com

The most important thing to keep in mind is that the contingent beneficiary should understand what this means for them. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. If your primary beneficiary is unable to claim the payout for whatever reason, your contingent beneficiary will be able to claim the life insurance death benefits. In the context of insurance, contingency insurance supplements a primary policy or covers remote risks the primary one would be slow to cover. The definition of contingent is dependent for existence on something not yet certain.

Source: simple-memorial.blogspot.com

Source: simple-memorial.blogspot.com

The definition of contingent is dependent for existence on something not yet certain. Most people name their spouse as the primary beneficiary. Whenever a life insurance policy is purchased by an individual that covers the life of someone else, the person or group that purchased the policy is known as the primary owner. This beneficiary is not required on a policy, but you should consider naming one. This is also known as the secondary beneficiary.

Source: granvillegrp.com

Source: granvillegrp.com

Life insurance policies pay death benefits to a beneficiary. It is a very commonly used term in life insurance. In life insurance terms, it means that the contingent beneficiary exists just in case the primary beneficiary (or all the primary beneficiaries, if there are more than one) are not alive when the insured person dies. The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. A contingent beneficiary is sometimes known as a “secondary beneficiary.” for example, it’s possible that your primary beneficiary may die before receiving the death benefit.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

If no contingent beneficiary is named and the primary beneficiary or beneficiaries die, the insured�s estate usually becomes the policy�s automatic contingent beneficiary. If you want someone to receive a portion of your death benefit, they need to be a primary beneficiary. The release of those benefits depends on the fulfillment of a set of predetermined rules following the death of an insured individual. If no contingent beneficiary is named and the primary beneficiary or beneficiaries die, the insured�s estate usually becomes the policy�s automatic contingent beneficiary. A contingent beneficiary is second in line behind the primary beneficiary of an inheritance.

Source: napkinfinance.com

Source: napkinfinance.com

In the context of insurance, contingency insurance supplements a primary policy or covers remote risks the primary one would be slow to cover. In the area of life insurance, you might hear the term contingent owner at some point.here are the basics of what a contingent owner is and what rights they have. If no contingent beneficiary is named and the primary beneficiary or beneficiaries die, the insured�s estate usually becomes the policy�s automatic contingent beneficiary. If your primary beneficiary is unable to claim the payout for whatever reason, your contingent beneficiary will be able to claim the life insurance death benefits. The release of those benefits depends on the fulfillment of a set of predetermined rules following the death of an insured individual.

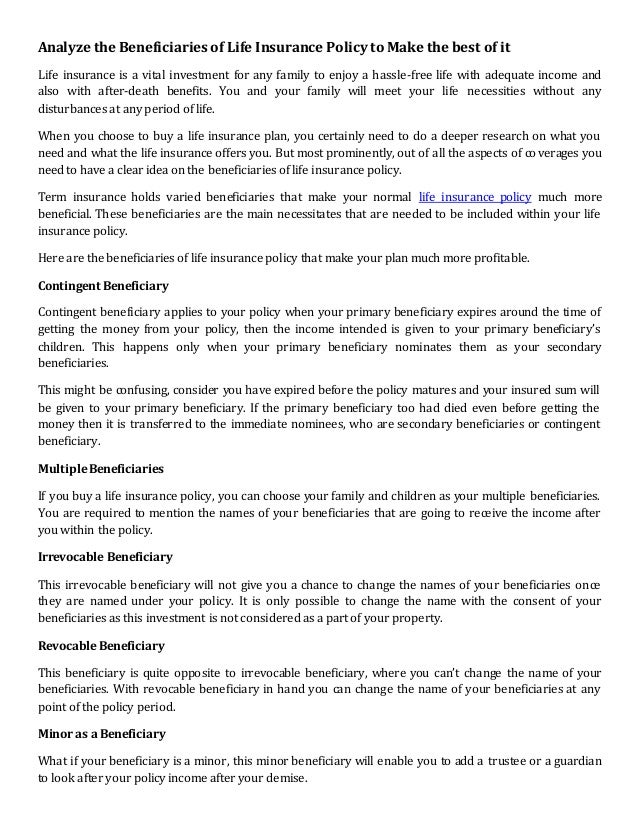

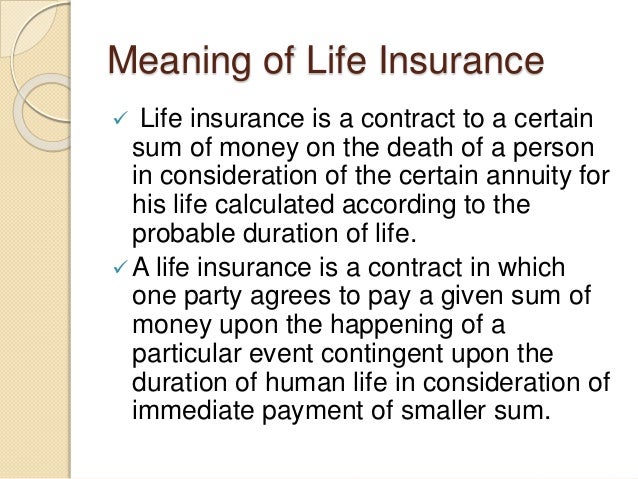

Source: slideshare.net

Source: slideshare.net

If you’re in a car accident with your spouse and both of you pass away, the benefits of your policy can be distributed seamlessly to. Contingent beneficiary is the person you select to collect the death benefits when you are not present. There are two basic types of life insurance beneficiaries: The release of those benefits depends on the fulfillment of a set of predetermined rules following the death of an insured individual. The account you designate to be given to a primary beneficiary will be released to your second beneficiary if your first beneficiary can�t be found, declines the gift.

Source: meanoin.blogspot.com

Source: meanoin.blogspot.com

If you want someone to receive a portion of your death benefit, they need to be a primary beneficiary. It is a very commonly used term in life insurance. The definition of contingent is dependent for existence on something not yet certain. Most people name their spouse as the primary beneficiary. Whenever a life insurance policy is purchased by an individual that covers the life of someone else, the person or group that purchased the policy is known as the primary owner.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

A contingent beneficiary is basically your ‘secondary’ beneficiary. Your secondary, or contingent, life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. If you want someone to receive a portion of your death benefit, they need to be a primary beneficiary. In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured. A contingent beneficiary is sometimes known as a “secondary beneficiary.” for example, it’s possible that your primary beneficiary may die before receiving the death benefit.

A contingency refers to a chance occurrence or uncertain outcome. We need contingent beneficiaries because life can be unpredictable. This is known as having a contingent beneficiary when you sign up for life insurance. A contingency refers to a chance occurrence or uncertain outcome. The primary beneficiary is the person who receives your death benefit.

Source: bestbusinesscommunity.com

Source: bestbusinesscommunity.com

This person will only inherit the named assets if the primary beneficiary does not. In life insurance terms, it means that the contingent beneficiary exists just in case the primary beneficiary (or all the primary beneficiaries, if there are more than one) are not alive when the insured person dies. We need contingent beneficiaries because life can be unpredictable. A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. There are two basic types of life insurance beneficiaries:

Source: elsa-ita.blogspot.com

Source: elsa-ita.blogspot.com

The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. Whenever a life insurance policy is purchased by an individual that covers the life of someone else, the person or group that purchased the policy is. A contingent beneficiary is second in line behind the primary beneficiary of an inheritance. Contingent beneficiaries are basically the backup that would receive your life insurance death benefit if all of your primary beneficiaries were deceased. A contingent beneficiary is a beneficiary that receives the money when your primary beneficiary predeceases you.

Source: whatisinsurancepolicy10.blogspot.com

Source: whatisinsurancepolicy10.blogspot.com

A contingent beneficiary is a person, organization, or entity that receives your life insurance policy’s death benefit if your primary beneficiary dies. If no contingent beneficiary is named and the primary beneficiary or beneficiaries die, the insured�s estate usually becomes the policy�s automatic contingent beneficiary. This is known as having a contingent beneficiary when you sign up for life insurance. Most people name their spouse as the primary beneficiary. Learn about the differences between primary and contingent beneficiaries, as well as how to make sure your death benefit gets to the right family members.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does contingent mean in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information