What does face value of life insurance mean information

Home » Trend » What does face value of life insurance mean informationYour What does face value of life insurance mean images are available. What does face value of life insurance mean are a topic that is being searched for and liked by netizens now. You can Get the What does face value of life insurance mean files here. Download all free vectors.

If you’re searching for what does face value of life insurance mean images information connected with to the what does face value of life insurance mean keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

What Does Face Value Of Life Insurance Mean. An insurance company tends to pay this amount as a death benefit after your death. Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the policy. When this happens most policy�s “endow” and the policy owner receives the cash benefit. The face value of a life insurance policy is the amount the policy would pay out if the insured person died at that point in time.

Why use whole life insurance for the infinite banking From tier1capital.com

Why use whole life insurance for the infinite banking From tier1capital.com

Face amount is the gross total amount of cash quantified in an agreement or insurance policy. What is the face value of life insurance? The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to. This event also cancels the life insurance policy. In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder of the insurance.

The face value definition in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured.

Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the policy. What is the face value of a life insurance policy? The face value of a life insurance policy is the amount the policy would pay out if the insured person died at that point in time. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. The face value is stated in the policy documents, and it often, but not always, stays the same as the death benefit throughout the life of the policy. The face value of a life insurance policy is the amount the policy would pay out if the insured person died at that point in time.

Source: slideshare.net

Source: slideshare.net

In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder of the insurance. On the other hand a face amount life insurance policy doesn�t have that option. The death benefit is the amount of money that is paid to the beneficiary upon death.

Source: revisi.net

Source: revisi.net

The cash value is often stated on the top sheet of the policy, hence the name face amount. It can also be referred to as the death benefit or the face amount of life insurance. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract. When you first buy insurance, the face value is the amount stated on the insurance agreement. Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance.

Source: partners4prosperity.com

Source: partners4prosperity.com

In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder of the insurance. When this happens most policy�s “endow” and the policy owner receives the cash benefit. Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. The face value of a life insurance policy is the amount of insurance that is purchased. The face value of life insurance is the dollar amount equated to the worth of your policy.

Source: gajizmo.com

Source: gajizmo.com

The cash value is often stated on the top sheet of the policy, hence the name face amount. The face value of life insurance is the dollar amount equated to the worth of your policy. On the other hand a face amount life insurance policy doesn�t have that option. When this happens most policy�s “endow” and the policy owner receives the cash benefit. Indeed, when the policy starts, the face value and the death benefit remain the same.

Source: aspenwealthmgmt.com

Source: aspenwealthmgmt.com

The face value is stated in the policy documents, and it often, but not always, stays the same as the death benefit throughout the life of the policy. On the other hand a face amount life insurance policy doesn�t have that option. The face value of a life insurance policy is the death benefit. For stocks, the face value is. Within your policy, it is officially denoted as the death benefit.

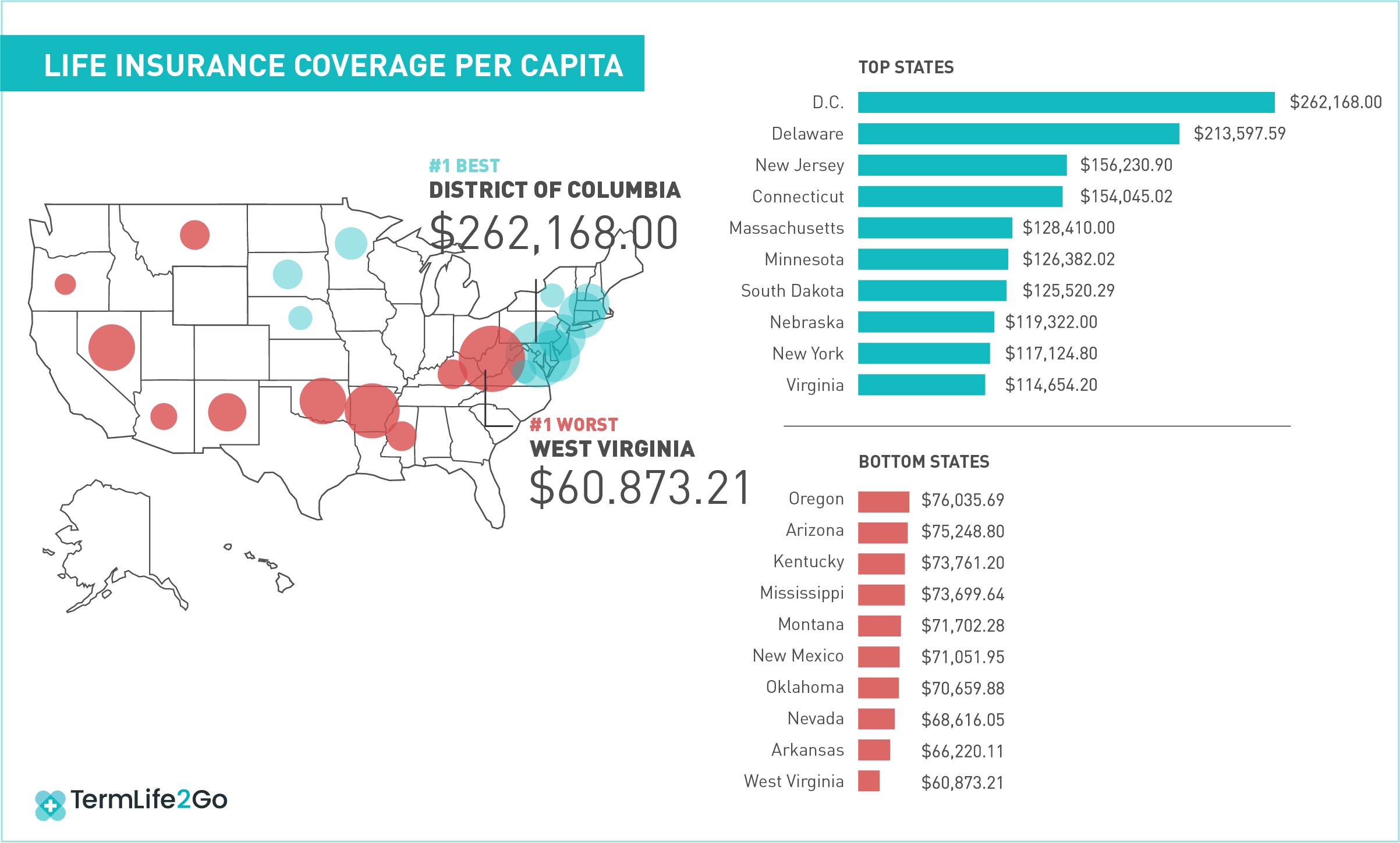

Source: termlife2go.com

Source: termlife2go.com

For stocks, the face value is. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. The face value is the death benefit, or the amount beneficiaries receive if the insured person dies while a policy is in force. The face value definition in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured. Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer.

Source: slideshare.net

Source: slideshare.net

Endowment is a taxable event. The death benefit is the amount of money that is paid to the beneficiary upon death. The face value of a life insurance policy is the amount of insurance that is purchased. Face value is one of the most important factors that influence the cost of a life insurance policy. The face value definition in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured.

Source: tier1capital.com

Source: tier1capital.com

For stocks, the face value is. The face value is stated in the policy documents, and it often, but not always, stays the same as the death benefit throughout the life of the policy. In short, your face value is the amount of money your beneficiaries will receive from. The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy, and it’s a primary factor in determining the amount of premium you pay. For term life insurance, only the face value is paid out upon death, because term life insurance does not build up any cash value.

Source: onettechnologiesindia.com

Source: onettechnologiesindia.com

Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. Simply put a cash value insurance policy allows the policy holder to cash in on the policy up to the equity that has been paid in on the policy. The face value of life insurance is the dollar amount equated to the worth of your policy. The death benefit is the amount of money that is paid to the beneficiary upon death. The face value of a life insurance policy is the death benefit.

Source: demontinsurance.com

Source: demontinsurance.com

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. The face value is the amount of money your insurer has agreed to pay out when you die. The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy, and it’s a primary factor in determining the amount of premium you pay. The cash value is often stated on the top sheet of the policy, hence the name face amount. The face value is stated in the policy documents, and it often, but not always, stays the same as the death benefit throughout the life of the policy.

Source: alqurumresort.com

Source: alqurumresort.com

When this happens most policy�s “endow” and the policy owner receives the cash benefit. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract. The face value of a life insurance policy is the amount the policy would pay out if the insured person died at that point in time. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. It can also be referred to as the death benefit or the face amount of life insurance.

Source: personalcapital.com

Source: personalcapital.com

The face value is the amount of money your insurer has agreed to pay out when you die. The face value can be higher or lower than the original face amount, depending on if the policy grew or if loans were taken out against it. This event also cancels the life insurance policy. The face value of a life insurance policy is the death benefit. What is the face value of life insurance?

Source: bankingtruths.com

Source: bankingtruths.com

Simply put a cash value insurance policy allows the policy holder to cash in on the policy up to the equity that has been paid in on the policy. The face value of a life insurance policy is the amount the policy would pay out if the insured person died at that point in time. Frequently asked and often misunderstood, the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy. Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. The face value is the death benefit, or the amount beneficiaries receive if the insured person dies while a policy is in force.

Source: slideshare.net

Source: slideshare.net

The death benefit is the amount of money that is paid to the beneficiary upon death. Face value can also be used synonymously with “face amount” or “coverage amount.” Simply put a cash value insurance policy allows the policy holder to cash in on the policy up to the equity that has been paid in on the policy. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract. The face value of a life insurance policy is the death benefit.

Source: aspenwealthmgmt.com

Source: aspenwealthmgmt.com

In all cases, life insurance face value is the amount of money given to. That amount is often the amount you choose when you apply for and purchase life insurance coverage. First lets discuss cash value. The cash value is often stated on the top sheet of the policy, hence the name face amount. An insurance company tends to pay this amount as a death benefit after your death.

Source: revisi.net

Source: revisi.net

Only permanent life insurance policies, such as whole life and universal life, have a cash value account. That amount is often the amount you choose when you apply for and purchase life insurance coverage. The cash value is often stated on the top sheet of the policy, hence the name face amount. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy, and it’s a primary factor in determining the amount of premium you pay.

Source: websmostpopular.com

Source: websmostpopular.com

In the case of whole life insurance the face amount is the. Endowment is a taxable event. You might get paid less than that if you have policy loans. The cash value is often stated on the top sheet of the policy, hence the name face amount. That amount is often the amount you choose when you apply for and purchase life insurance coverage.

Source: revisi.net

Source: revisi.net

That amount is often the amount you choose when you apply for and purchase life insurance coverage. Face value can also be used synonymously with “face amount” or “coverage amount.” You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract. Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the policy. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does face value of life insurance mean by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information