What does life insurance not cover information

Home » Trending » What does life insurance not cover informationYour What does life insurance not cover images are ready in this website. What does life insurance not cover are a topic that is being searched for and liked by netizens now. You can Find and Download the What does life insurance not cover files here. Get all free images.

If you’re searching for what does life insurance not cover pictures information linked to the what does life insurance not cover topic, you have visit the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

What Does Life Insurance Not Cover. Life insurance can help cover pretty much any expense once it’s in the hands of your beneficiaries. Life insurance does not cover suicide or may otherwise deny benefits in. While the exact conditions of what your life insurance policy covers will depend on your individual contract, there are a few common exclusions when insurers generally will not pay the death benefit. Life insurance policies only cover deaths.

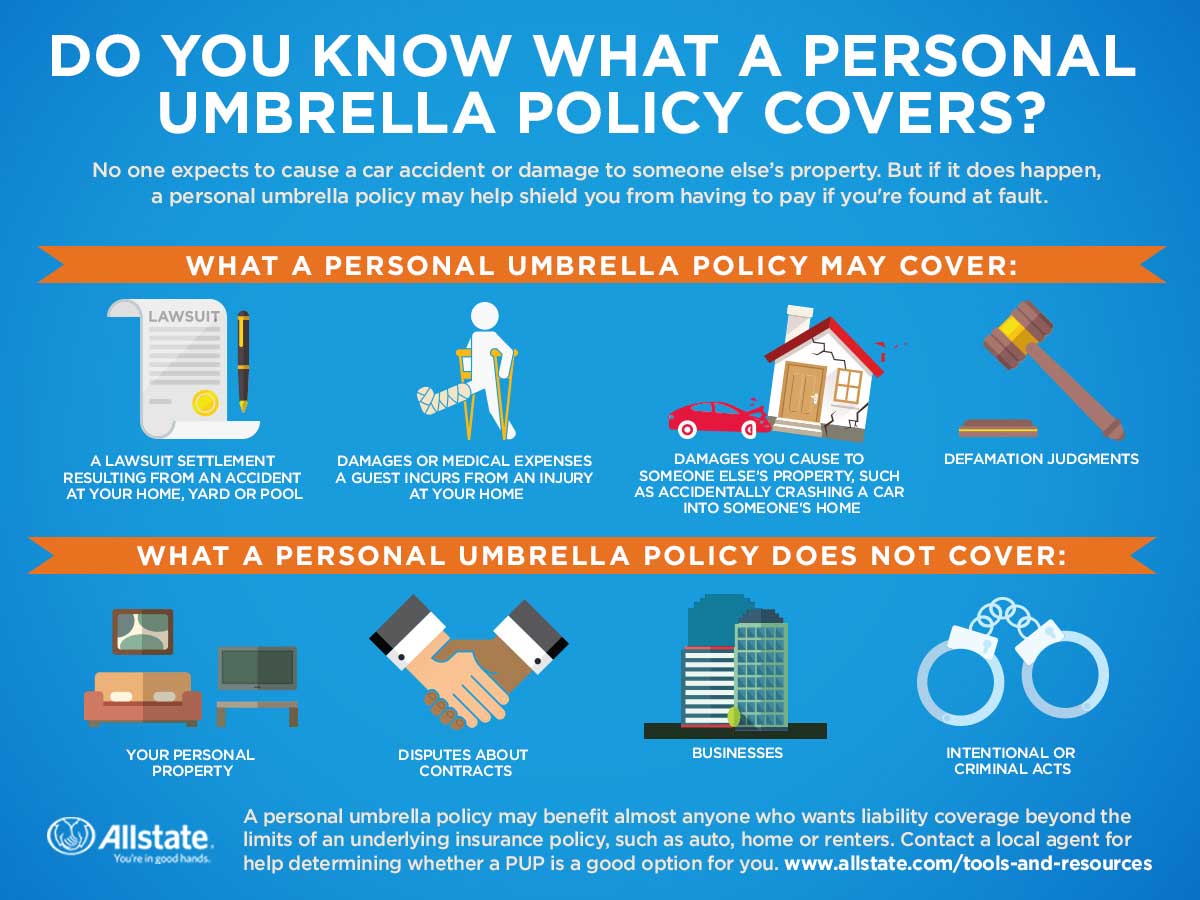

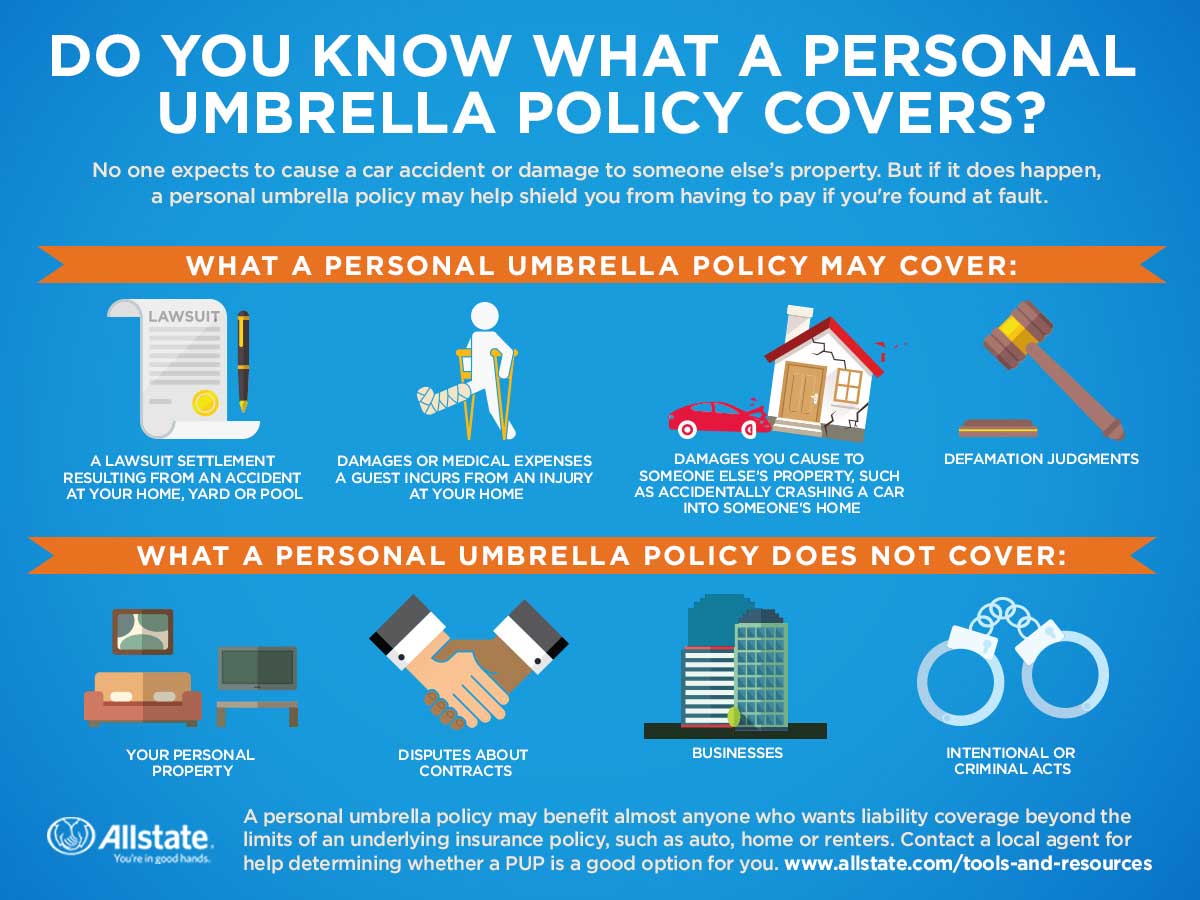

What Does a Personal Umbrella Policy Cover? Allstate From allstate.com

What Does a Personal Umbrella Policy Cover? Allstate From allstate.com

Life insurance does not cover suicide or may otherwise deny benefits in. In general, life insurance covers deaths due to: However, almost every life insurance policy outlines circumstances in which the benefits will not be paid in the event of the death of the insured. At hays and hagan insurance, we work hard to give you the life insurance policy that makes sense for your needs. Life insurance can help cover pretty much any expense once it’s in the hands of your beneficiaries. If your income contributed to the household budget, your death would create financial stress without life insurance.

Your policy will only pay out the death benefit if it’s active.

A life insurance policy can help provide funds for your family if you die unexpectedly. Life insurance policies are expansive. Be aware that life insurance doesn’t cover anything in the event the premium is. However, most policies have a suicide clause—or contestability period—during the policy�s first. If your income contributed to the household budget, your death would create financial stress without life insurance. Beneficiaries, such as your spouse and children, can cover your share of the family expenses if you die.

Source: allstate.com

Source: allstate.com

If your income contributed to the household budget, your death would create financial stress without life insurance. Also term insurance can�t be purchased for a person of 80 or the latest 85 years of age. If your income contributed to the household budget, your death would create financial stress without life insurance. In general, life insurance covers suicide. It is the most apparent reason why your death benefit will be denied.

Source: uxezufymo.xlx.pl

Your policy will only pay out the death benefit if it’s active. Today�s question is, what does life insurance not cover? well, during the first two years of the life insurance policy from the day that it�s issued, they don�t cover suicide. In general, life insurance covers suicide. Beneficiaries, such as your spouse and children, can cover your share of the family expenses if you die. However, if you live in west columbia, tx or the surrounding area, you need to know what your policy covers and what it does not ensure is appropriately used.

Source: univistainsuranceorlando.com

Source: univistainsuranceorlando.com

However, a life insurance policy doesn’t cover every type of death. In some circumstances, though, the policy won’t pay out after you’re gone, leaving your beneficiaries without help: At hays and hagan insurance, we work hard to give you the life insurance policy that makes sense for your needs. Cover bills and household expenses. A life insurance policy can help provide funds for your family if you die unexpectedly.

Source: youtube.com

Source: youtube.com

Unlike whole or permanent life insurance, a term life benefit is only guaranteed for a period of time, or term, determined when the insurance was initially approved. Natural causes like a heart attack, infection or cancer; What life insurance does not cover. So before you choose a plan, you should find out what it covers and does not cover. Life insurance does not cover suicide or may otherwise deny benefits in.

Source: vaping360.com

Source: vaping360.com

Now that we have seen what life insurance covers, let’s find out what it does not cover. Suicide is covered by life insurance, but only after the suicide clause period (typically two years) ends. Unlike whole or permanent life insurance, a term life benefit is only guaranteed for a period of time, or term, determined when the insurance was initially approved. A life insurance policy can help provide funds for your family if you die unexpectedly. Life insurance doesn’t cover any death if the premium is not paid in a timely manner and coverage is no longer in force.

Source: allstate.com

Source: allstate.com

However, if you live in west columbia, tx or the surrounding area, you need to know what your policy covers and what it does not ensure is appropriately used. Natural causes like a heart attack, infection or cancer; Life insurance generally does not cover such deaths. Below we go over 5 types of death that are not typically covered in a standard term life insurance policy; The majority of term insurance policies have a suicide clause.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

While the exact conditions of what your life insurance policy covers will depend on your individual contract, there are a few common exclusions when insurers generally will not pay the death benefit. While the exact conditions of what your life insurance policy covers will depend on your individual contract, there are a few common exclusions when insurers generally will not pay the death benefit. If you lie or withhold information on your life insurance application, your insurance company can refuse to pay the benefit. These exceptions are known as exclusions. Now that we have seen what life insurance covers, let’s find out what it does not cover.

Source: insurancespecialists.com

Source: insurancespecialists.com

Be aware that life insurance doesn’t cover anything in the event the premium is. Life insurance does not cover suicide or may otherwise deny benefits in. You die because of drug or alcohol abuse. The majority of term insurance policies have a suicide clause. A life insurance policy can help provide funds for your family if you die unexpectedly.

Source: aegonlife.com

Source: aegonlife.com

If you lie or withhold information on your life insurance application, your insurance company can refuse to pay the benefit. At hays and hagan insurance, we work hard to give you the life insurance policy that makes sense for your needs. In general, life insurance covers suicide. Life insurance doesn’t cover any death if the premium is not paid in a timely manner and coverage is no longer in force. Even if the term ended the previous.

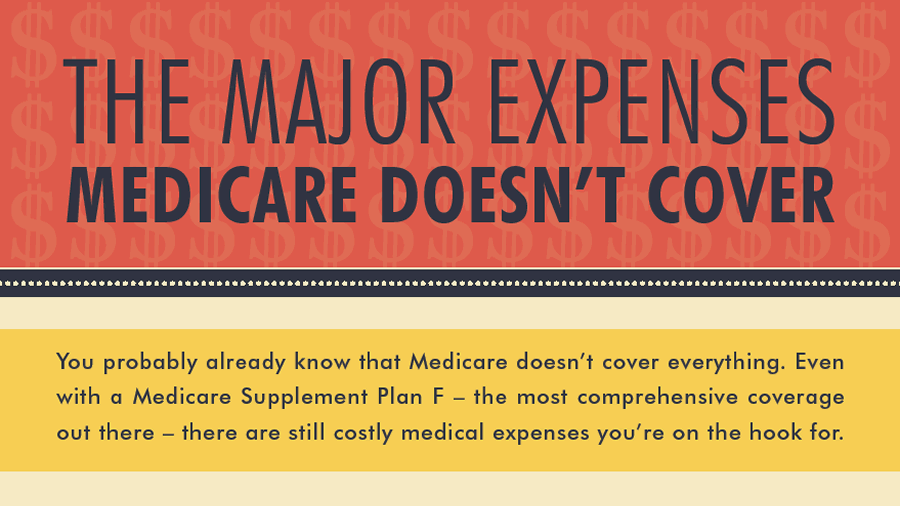

Source: medicareallies.com

Source: medicareallies.com

Death from natural causes or accidents is covered by life insurance. However, almost every life insurance policy outlines circumstances in which the benefits will not be paid in the event of the death of the insured. We get that life gets crazy, but it’s essential to know exactly when your term is set to run out. Beneficiaries, such as your spouse and children, can cover your share of the family expenses if you die. Life insurance policies are expansive.

Source: expatbyexpat.com

Source: expatbyexpat.com

It is important to ensure that you fully understand your life insurance policy when you purchase it or apply for it. Your life insurance may not cover you if: Term insurance or life insurance is taken for a particular term, say, 10, 15, 20, 30, etc. You die because of drug or alcohol abuse. However, most policies have a suicide clause—or contestability period—during the policy�s first.

Source: allstate.com

Source: allstate.com

Be aware that life insurance doesn’t cover anything in the event the premium is. Term life policies don’t last forever. Life insurance can help cover pretty much any expense once it’s in the hands of your beneficiaries. Below we go over 5 types of death that are not typically covered in a standard term life insurance policy; These exceptions are known as exclusions.

Source: iselect.com.au

Source: iselect.com.au

Term life policies don’t last forever. Death from natural causes or accidents is covered by life insurance. At hays and hagan insurance, we work hard to give you the life insurance policy that makes sense for your needs. We get that life gets crazy, but it’s essential to know exactly when your term is set to run out. So before you choose a plan, you should find out what it covers and does not cover.

Source: everquote.com

Source: everquote.com

Life insurance generally does not cover such deaths. And if there are material misstatements or fraud in the contract, the. Exclusions to a policy vary by each individual life insurance company, and may also vary from policy to policy. Life insurance does not cover suicide or may otherwise deny benefits in. Your policy will only pay out the death benefit if it’s active.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The majority of term insurance policies have a suicide clause. If you lie or withhold information on your life insurance application, your insurance company can refuse to pay the benefit. Below we go over 5 types of death that are not typically covered in a standard term life insurance policy; These exceptions are known as exclusions. What does life insurance not cover?

Source: hindustantimes.com

Source: hindustantimes.com

So before you choose a plan, you should find out what it covers and does not cover. Today�s question is, what does life insurance not cover? well, during the first two years of the life insurance policy from the day that it�s issued, they don�t cover suicide. Suicide is covered by life insurance, but only after the suicide clause period (typically two years) ends. Natural causes like a heart attack, infection or cancer; Below we go over 5 types of death that are not typically covered in a standard term life insurance policy;

Source: freepressjournal.in

Source: freepressjournal.in

You have a serious health condition at the time of taking out the life insurance policy and your death is due to that health condition. It is important to ensure that you fully understand your life insurance policy when you purchase it or apply for it. While the exact conditions of what your life insurance policy covers will depend on your individual contract, there are a few common exclusions when insurers generally will not pay the death benefit. What term life insurance does not cover is the risk of death after so many years as specified in the contract. Life insurance policies are expansive.

Source: entrepreneur.com

Source: entrepreneur.com

Death from natural causes or accidents is covered by life insurance. It is important to ensure that you fully understand your life insurance policy when you purchase it or apply for it. Term life policies don’t last forever. Life insurance does not cover suicide or may otherwise deny benefits in the event the insured was determined to have put themselves at obvious risk of bodily injury or death. What term life insurance does not cover is the risk of death after so many years as specified in the contract.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does life insurance not cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

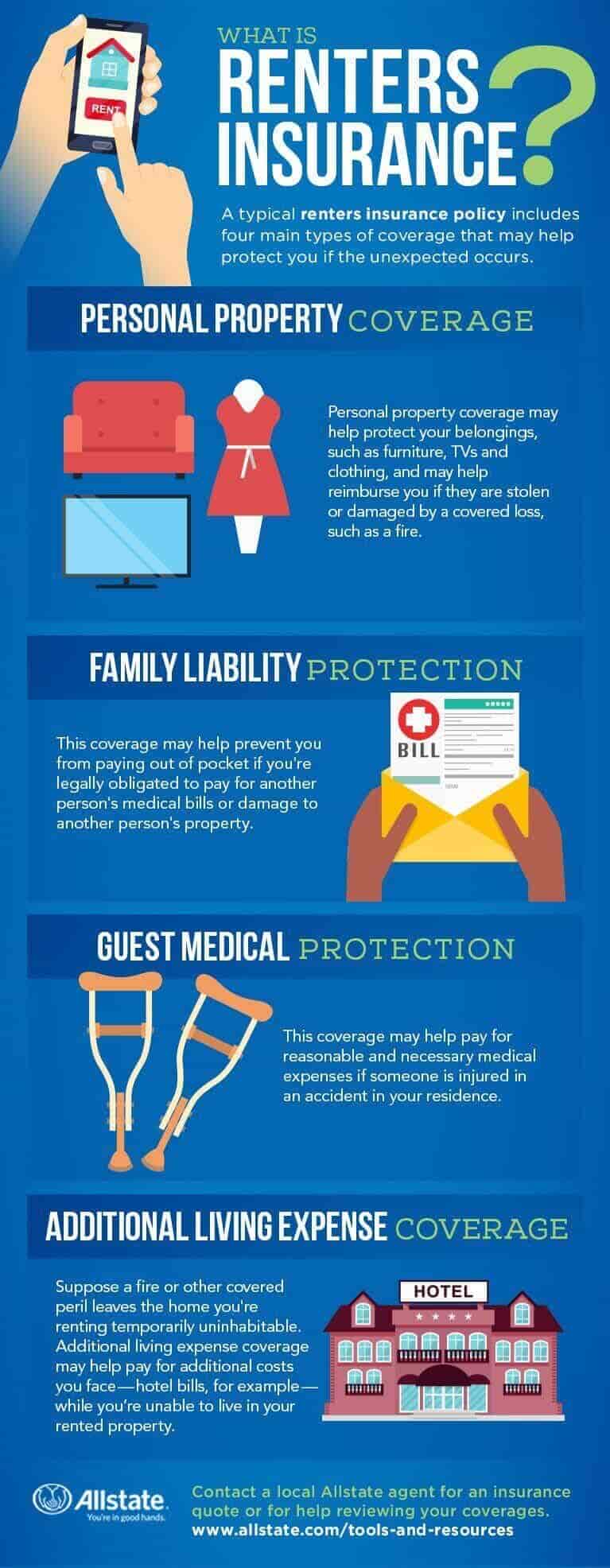

- Renters insurance washington state Idea

- Property protection insurance information