What does made whole mean in insurance Idea

Home » Trend » What does made whole mean in insurance IdeaYour What does made whole mean in insurance images are ready in this website. What does made whole mean in insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What does made whole mean in insurance files here. Download all free photos and vectors.

If you’re searching for what does made whole mean in insurance pictures information connected with to the what does made whole mean in insurance topic, you have come to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

What Does Made Whole Mean In Insurance. (finance, law) to provide (someone), especially under the terms of a legal judgment or an agreement, with financial compensation for lost money or other lost assets. This is the sum that will be paid to your loved ones (or “beneficiaries”) when you die. Make whole is a term used in reference to compensating a party for a loss sustained. Usually, after five or 10 years, the premiums increase but remain constant thereafter.

![]() What does whole grain really mean!? Made Possible From madepossiblept.com

What does whole grain really mean!? Made Possible From madepossiblept.com

The make whole doctrine means you, the injured person, have to be made whole before any private or public health lien interest (any private or public health insurance plan) can take reimbursement from your gross settlement from a personal injury case. The attorney you hire will handle the claims process from start to finish. How does whole life insurance works? (finance, law) to provide (someone), especially under the terms of a legal judgment or an agreement, with financial compensation for lost money or other lost assets. The policy has cash value, which can be used. Usually, after five or 10 years, the premiums increase but remain constant thereafter.

To indemnify someone means to “make someone whole.” the principle of indemnity is one of the fundamental principles of insurance because it is the part of an insurance contract that ensures the insured has the right to compensation and sets limits on how much they can get.

In the beginning, you and the insurance company will decide your policy amount—what they call the “death benefit.”. A whole life insurance policy will cover you as long as you live. Modified whole life insurance is permanent life insurance in which premiums increase after a specific period. What is a make whole call (provision)? (set phrase) to repair or restore (something). It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Whole life insurance is a specifically designed life insurance plan which aims to provide whole life cover to the insured so that they can live a financially secured life and create a financial cushion for the future, in case of accidental death. Whole life insurance works as a permanent policy that builds cash value over time. These life insurance plans provide death benefit along with maturity and survival benefit to the. A whole life insurance policy will cover you as long as you live. Make whole is a term used in reference to compensating a party for a loss sustained.

Source: allstate.com

Source: allstate.com

(set phrase) to repair or restore (something). As long as the premiums are current, the policy remains active for the entire life of the policyholder, and beneficiaries will receive a set death benefit upon the insured�s death. The concept of made whole in an insurance settlement made whole doctrine. Whole life insurance is a specifically designed life insurance plan which aims to provide whole life cover to the insured so that they can live a financially secured life and create a financial cushion for the future, in case of accidental death. How does a make whole call (provision) work?

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

Make whole is a term used in reference to compensating a party for a loss sustained. What does the insurance term made whole mean? To indemnify someone means to “make someone whole.” the principle of indemnity is one of the fundamental principles of insurance because it is the part of an insurance contract that ensures the insured has the right to compensation and sets limits on how much they can get. The insured pays fixed level premiums, which are allotted between several portions: In the beginning, you and the insurance company will decide your policy amount—what they call the “death benefit.”.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

(finance, law) to provide (someone), especially under the terms of a legal judgment or an agreement, with financial compensation for lost money or other lost assets. People sometimes pursue multiple sources of reimbursement of their expenses at the same time. The make you whole saying comes from the bodily injury portion of your case. (set phrase) to repair or restore (something). Modified whole life insurance is permanent life insurance in which premiums increase after a specific period.

Source: insurance-companies.co

Source: insurance-companies.co

How does whole life insurance works? The made whole doctrine is a common law principle in insurance subrogation law that a policyholder must be made whole before the insurance company may take any money from the person (or the settlement) to reimburse itself for the payments it has already made. How does whole life insurance works? In the beginning, you and the insurance company will decide your policy amount—what they call the “death benefit.”. (set phrase) to repair or restore (something).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

How does a make whole call (provision) work? Whole life insurance is known as a type of “permanent” life insurance, meant to be in place for your entire life. Whole life insurance premiums never increase as a condition of continued coverage. You�re going to need to hire a lawyer in order to get results. In its decision, the court held that before an insurer could initiate an action for subrogation, the insured must be “made whole.” while the.

Source: pinterest.com

Source: pinterest.com

(set phrase) to restore (someone) to a sound, healthy, or otherwise favorable condition. Whole life insurance premiums never increase as a condition of continued coverage. The insurance term for this schedule of premiums is the “premium payment period” (how creative), and it�s often a defining feature of a whole life contract. For money it paid out on a claim. Whole life insurance is a type of permanent life insurance contract that covers the insured individual — usually the policy owner — until they die or reach 100 years of age, whichever occurs first.

Source: revisi.net

Source: revisi.net

(set phrase) to repair or restore (something). Whole life insurance is a type of permanent life insurance contract that covers the insured individual — usually the policy owner — until they die or reach 100 years of age, whichever occurs first. These life insurance plans provide death benefit along with maturity and survival benefit to the. What is whole life insurance? Whole life insurance works as a permanent policy that builds cash value over time.

Source: abiteofculture.com

Source: abiteofculture.com

Whole life insurance is a type of permanent life insurance contract that covers the insured individual — usually the policy owner — until they die or reach 100 years of age, whichever occurs first. Modified whole life insurance is permanent life insurance in which premiums increase after a specific period. The policy has cash value, which can be used. The presise definition varies, according to contract terms and local laws. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

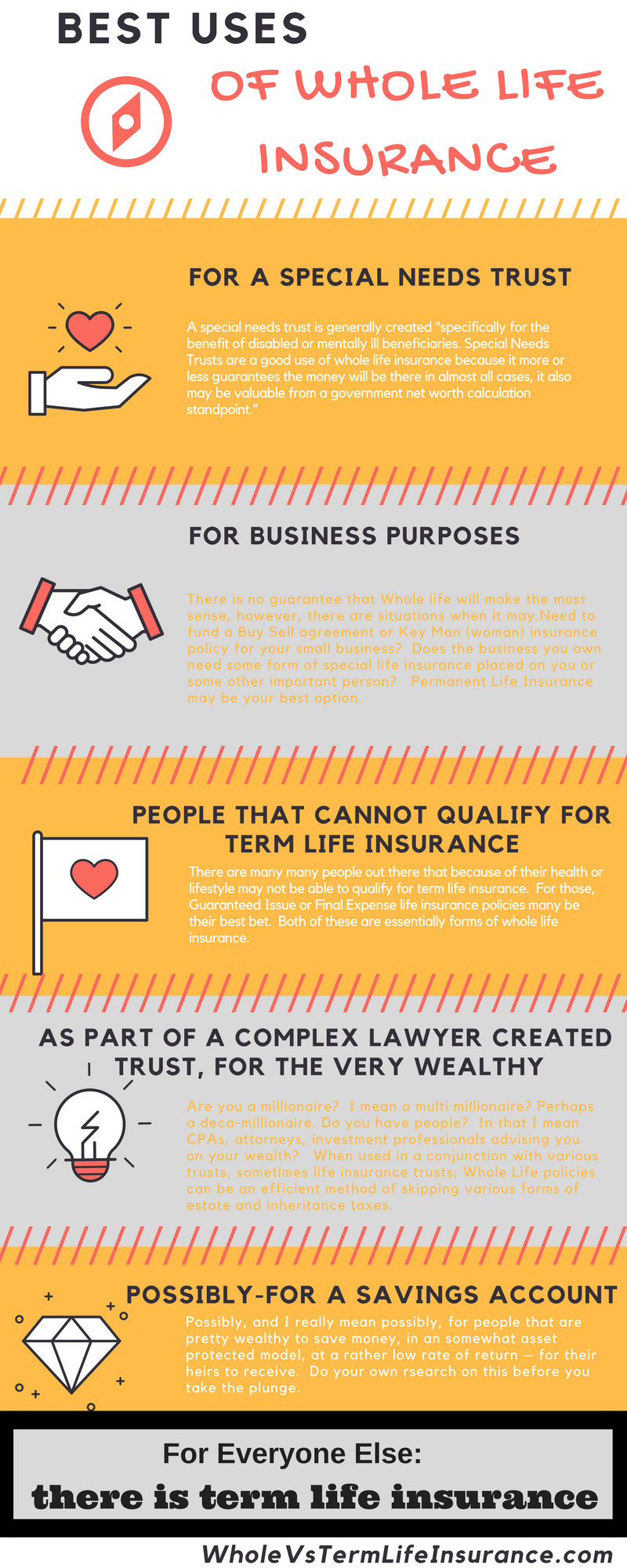

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

These life insurance plans provide death benefit along with maturity and survival benefit to the. Whole life insurance works as a permanent policy that builds cash value over time. This comes from california state law protection under common law. first, you must realize if you have a health. You�re going to need to hire a lawyer in order to get results. To indemnify someone means to “make someone whole.” the principle of indemnity is one of the fundamental principles of insurance because it is the part of an insurance contract that ensures the insured has the right to compensation and sets limits on how much they can get.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

The made whole doctrine is a common law principle in insurance subrogation law that a policyholder must be made whole before the insurance company may take any money from the person (or the settlement) to reimburse itself for the payments it has already made. Make whole is a term used in reference to compensating a party for a loss sustained. Premiums are level and the death benefit is guaranteed as long as you continue to pay the policy premiums. (set phrase) to repair or restore (something). What is whole life insurance?

Source: in.pinterest.com

Source: in.pinterest.com

The make whole doctrine means you, the injured person, have to be made whole before any private or public health lien interest (any private or public health insurance plan) can take reimbursement from your gross settlement from a personal injury case. (finance, law) to provide (someone), especially under the terms of a legal judgment or an agreement, with financial compensation for lost money or other lost assets. As long as the premiums are current, the policy remains active for the entire life of the policyholder, and beneficiaries will receive a set death benefit upon the insured�s death. A make whole call provision, also sometimes known as a doomsday call, is a type of call provision attached to a bond that allows the borrower, or bond issuer, to pay off the remaining debt to the lender, or investor before the bond matures. Whole life insurance premiums never increase as a condition of continued coverage.

Source: investopedia.com

Source: investopedia.com

As long as the premiums are current, the policy remains active for the entire life of the policyholder, and beneficiaries will receive a set death benefit upon the insured�s death. Make whole is a term used in reference to compensating a party for a loss sustained. When you die, your named beneficiaries will get a payout based on the policy value plus interest. (finance, law) to provide (someone), especially under the terms of a legal judgment or an agreement, with financial compensation for lost money or other lost assets. The policy has cash value, which can be used.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

As long as the premiums are current, the policy remains active for the entire life of the policyholder, and beneficiaries will receive a set death benefit upon the insured�s death. (set phrase) to repair or restore (something). Whole life insurance is a specifically designed life insurance plan which aims to provide whole life cover to the insured so that they can live a financially secured life and create a financial cushion for the future, in case of accidental death. These life insurance plans provide death benefit along with maturity and survival benefit to the. A whole life insurance policy will cover you as long as you live.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

You are entitled to have your property damage, medical bills and future medical expenses paid for by the other party�s insurance. What does the insurance term made whole mean? As long as the premiums are current, the policy remains active for the entire life of the policyholder, and beneficiaries will receive a set death benefit upon the insured�s death. You�re going to need to hire a lawyer in order to get results. The insured pays fixed level premiums, which are allotted between several portions:

Source: foxstylo.com

Source: foxstylo.com

How does a make whole call (provision) work? What is a make whole call (provision)? Make whole is a term used in reference to compensating a party for a loss sustained. The policy has cash value, which can be used. The insured pays fixed level premiums, which are allotted between several portions:

Source: icaagencyalliance.com

Source: icaagencyalliance.com

What is a make whole call (provision)? Modified whole life insurance is permanent life insurance in which premiums increase after a specific period. A whole life insurance policy will cover you as long as you live. A make whole call provision, also sometimes known as a doomsday call, is a type of call provision attached to a bond that allows the borrower, or bond issuer, to pay off the remaining debt to the lender, or investor before the bond matures. Make whole is a term used in reference to compensating a party for a loss sustained.

![]() Source: madepossiblept.com

Source: madepossiblept.com

Premiums are level and the death benefit is guaranteed as long as you continue to pay the policy premiums. Whole life insurance is a type of permanent life insurance contract that covers the insured individual — usually the policy owner — until they die or reach 100 years of age, whichever occurs first. The presise definition varies, according to contract terms and local laws. The concept of made whole in an insurance settlement made whole doctrine. (finance, law) to provide (someone), especially under the terms of a legal judgment or an agreement, with financial compensation for lost money or other lost assets.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does made whole mean in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information