What does personal accident car insurance cover Idea

Home » Trending » What does personal accident car insurance cover IdeaYour What does personal accident car insurance cover images are ready in this website. What does personal accident car insurance cover are a topic that is being searched for and liked by netizens now. You can Find and Download the What does personal accident car insurance cover files here. Get all royalty-free vectors.

If you’re looking for what does personal accident car insurance cover pictures information connected with to the what does personal accident car insurance cover interest, you have visit the ideal site. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

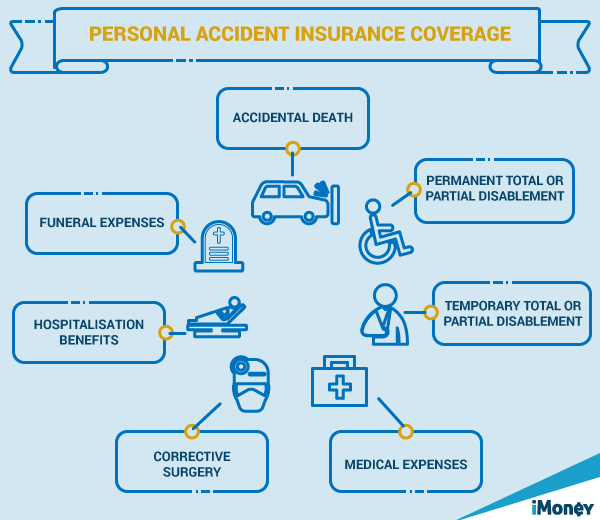

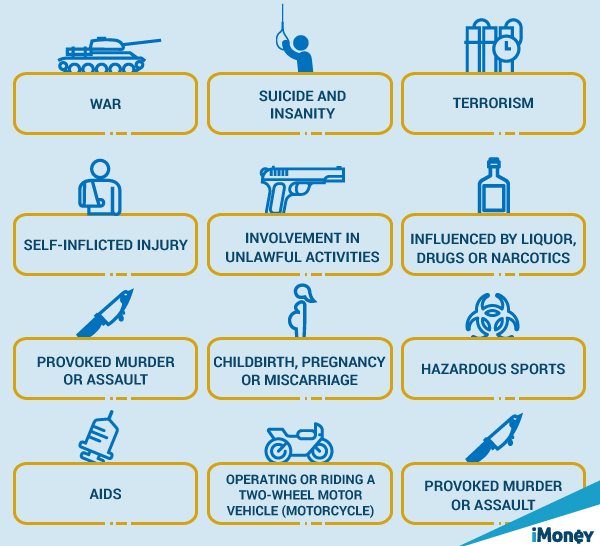

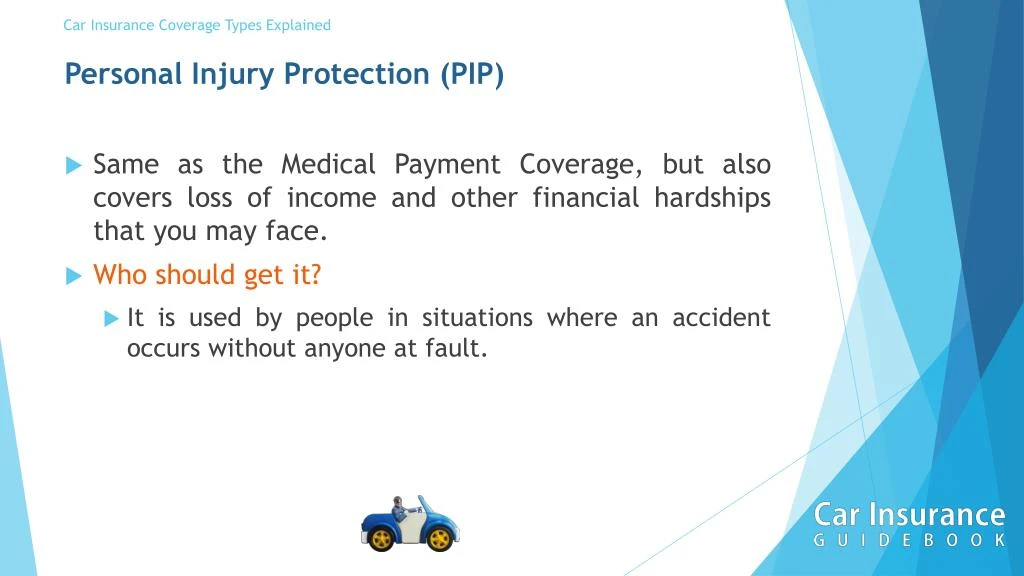

What Does Personal Accident Car Insurance Cover. Here is the percentage of compensation paid in different circumstances: Personal accident cover personal accident cover could provide compensation to the policy holder or their partner if either are injured or killed as a result of a car accident. Medical payments or personal injury protection (pip) this coverage pays for the treatment of injuries to the driver and passengers of the policyholder�s car. A pa cover under the motor insurance policy will pay for the compensation in case of bodily injuries, death or any permanent disability resulting due to an accident.

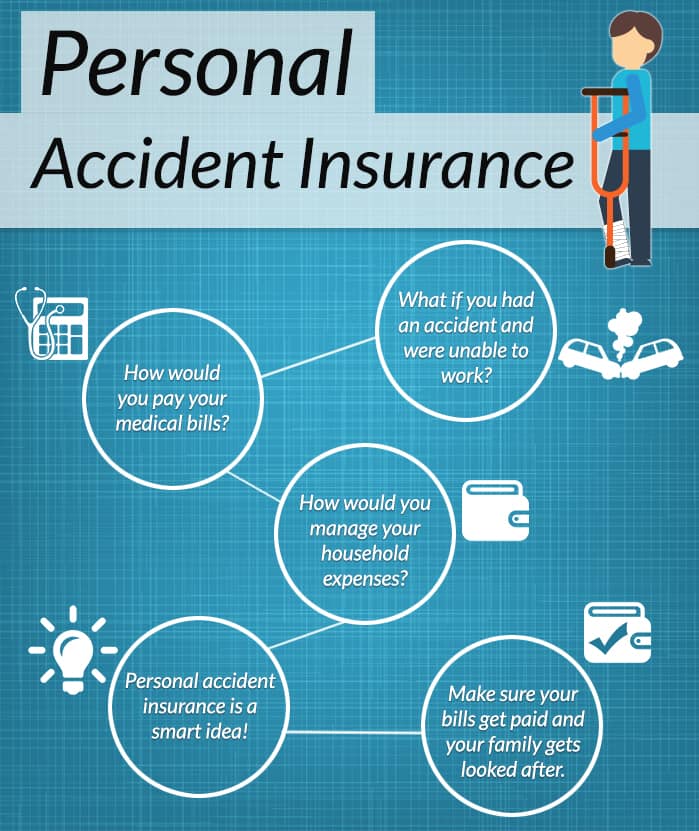

Why You Should Get A Personal Accident Insurance From imoney.my

Why You Should Get A Personal Accident Insurance From imoney.my

Car insurance is divided into three main categories: This includes reimbursement for damage to your vehicle, lost personal belonging, and more. Liability insurance covers medical costs and damages for the person whose car or property you hit during a collision. It’ll help pay out for medical costs if you’re injured, and it’ll compensate you if you’re temporarily or permanently disabled. Here is the percentage of compensation paid in different circumstances: Here’s what you can expect to be covered in a standard accident insurance policy:

While liability coverage covers other people�s property damage and injuries in an accident, personal accident coverage includes medical, ambulance and death benefits for you (the rental car driver) and your passengers.

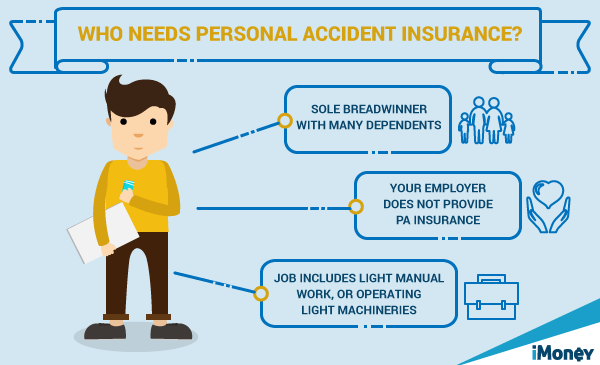

Do you need personal accident insurance? Damages and injuries are covered by various insurance policies, such as: What is personal accident cover? What is covered in personal accident cover? Do you need personal accident insurance? Although accident insurance doesn’t cover health issues like sickness or disease, it does cover many different injury and.

Source: kei18kun-smartinvestment.blogspot.com

Source: kei18kun-smartinvestment.blogspot.com

A pa cover under the motor insurance policy will pay for the compensation in case of bodily injuries, death or any permanent disability resulting due to an accident. A pa cover under the motor insurance policy will pay for the compensation in case of bodily injuries, death or any permanent disability resulting due to an accident. Personal injury insurance policies usually pay a fixed amount of money for specific injuries, depending on the level of cover, according to the financial ombudsman service. Here is the percentage of compensation paid in different circumstances: Requirements for this coverage vary from state to state.

Source: thepointinsurance.com

Source: thepointinsurance.com

A personal accident insurance policy is a type of general insurance that provides benefits in the case of accidental death, disability and injury. Liability insurance protects everyone on the road from each other. What does liability insurance not cover in the event of a car accident? In missouri, you aren’t required to get auto coverage for medical bills you incur from a car accident outside of standard liability insurance. Missouri requires motorists to have liability coverage, which pays the other driver if you were at fault in the accident, and uninsured coverage, from which you can claim your injuries and damages if.

Source: hometeamns.sg

Source: hometeamns.sg

Here’s what you can expect to be covered in a standard accident insurance policy: The limit of the coverage is defined as rs.15 lakhs by irdai. What is personal accident cover? It means that if an accident leads to any of the conditions within six months from the date of the accident, the insured individual or beneficiary will be eligible for compensation or reimbursement. While liability coverage covers other people�s property damage and injuries in an accident, personal accident coverage includes medical, ambulance and death benefits for you (the rental car driver) and your passengers.

Source: allstate.com

Source: allstate.com

While liability coverage covers other people�s property damage and injuries in an accident, personal accident coverage includes medical, ambulance and death benefits for you (the rental car driver) and your passengers. The benefits usually cover all phases of suffering an accident, from evacuation to hospitalisation and treatment, rehabilitation and. Although accident insurance doesn’t cover health issues like sickness or disease, it does cover many different injury and. Personal accident insurance provides financial coverage against unforeseen events such as accidents causing bodily injury, permanent partial disability or permanent total disability and accidental death. You’ll also get compensation if you lose some or all of your income as a result of the accident.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

A pa cover under the motor insurance policy will pay for the compensation in case of bodily injuries, death or any permanent disability resulting due to an accident. Some level of personal accident cover is usually included in comprehensive car insurance. Car insurance is divided into three main categories: The cost of repairing your vehicle. Personal accident insurance pays out if you suffer a serious injury, die as a result of an accident, or become totally and permanently disabled.

Source: insurance.com

It’ll help pay out for medical costs if you’re injured, and it’ll compensate you if you’re temporarily or permanently disabled. It’ll help pay out for medical costs if you’re injured, and it’ll compensate you if you’re temporarily or permanently disabled. It may also cover funeral costs. It means that if an accident leads to any of the conditions within six months from the date of the accident, the insured individual or beneficiary will be eligible for compensation or reimbursement. Car insurance is divided into three main categories:

Source: shriramgi.com

Source: shriramgi.com

A personal accident insurance policy is a type of general insurance that provides benefits in the case of accidental death, disability and injury. Personal accident insurance pays out if you suffer a serious injury, die as a result of an accident, or become totally and permanently disabled. Damages and injuries are covered by various insurance policies, such as: It may also cover funeral costs. Liability insurance helps pay for harm you cause to another person as a result of an accident.

Source: allianz.co.ke

Source: allianz.co.ke

This compensation is provided to cover injuries that arise only from the road accident that too within the subsequent six months. You’ll also get compensation if you lose some or all of your income as a result of the accident. What is personal accident cover? Here’s what you can expect to be covered in a standard accident insurance policy: Personal injury insurance policies usually pay a fixed amount of money for specific injuries, depending on the level of cover, according to the financial ombudsman service.

Source: imoney.my

Source: imoney.my

What does liability insurance not cover in the event of a car accident? The limit of the coverage is defined as rs.15 lakhs by irdai. Some level of personal accident cover is usually included in comprehensive car insurance. Personal accident cover protects you and your family in case of loss of earnings brought about by serious injury. It means that if an accident leads to any of the conditions within six months from the date of the accident, the insured individual or beneficiary will be eligible for compensation or reimbursement.

Source: 20milesnorth.com

Source: 20milesnorth.com

Let’s take a closer look at the personal injury protection definition. You’ll also get compensation if you lose some or all of your income as a result of the accident. Car insurance is divided into three main categories: What is personal accident cover? Requirements for this coverage vary from state to state.

Source: ringgitplus.com

Source: ringgitplus.com

Here’s what you can expect to be covered in a standard accident insurance policy: Personal accident insurance provides financial coverage against unforeseen events such as accidents causing bodily injury, permanent partial disability or permanent total disability and accidental death. What is covered in personal accident cover? Personal accident insurance pays out if you suffer a serious injury, die as a result of an accident, or become totally and permanently disabled. What is personal accident cover?

Source: slideserve.com

Source: slideserve.com

In missouri, you aren’t required to get auto coverage for medical bills you incur from a car accident outside of standard liability insurance. It may also cover funeral costs. The cost of repairing your vehicle. This compensation is provided to cover injuries that arise only from the road accident that too within the subsequent six months. What is personal accident insurance?

Source: automoblog.net

Source: automoblog.net

This covers the expenses of. Here’s what you can expect to be covered in a standard accident insurance policy: It means that if an accident leads to any of the conditions within six months from the date of the accident, the insured individual or beneficiary will be eligible for compensation or reimbursement. The benefits usually cover all phases of suffering an accident, from evacuation to hospitalisation and treatment, rehabilitation and. Liability insurance protects everyone on the road from each other.

Source: goodfundsadvisor.blogspot.com

Source: goodfundsadvisor.blogspot.com

It may also cover funeral costs. Car insurance is divided into three main categories: Personal accident insurance pays out if you suffer a serious injury, die as a result of an accident, or become totally and permanently disabled. Liability insurance protects everyone on the road from each other. A pa cover under the motor insurance policy will pay for the compensation in case of bodily injuries, death or any permanent disability resulting due to an accident.

Source: policybazaar.com

Source: policybazaar.com

Check your individual policy for how payout works. Personal accident insurance provides financial coverage against unforeseen events such as accidents causing bodily injury, permanent partial disability or permanent total disability and accidental death. Personal accident cover personal accident cover could provide compensation to the policy holder or their partner if either are injured or killed as a result of a car accident. A pa cover under the motor insurance policy will pay for the compensation in case of bodily injuries, death or any permanent disability resulting due to an accident. What does liability insurance not cover in the event of a car accident?

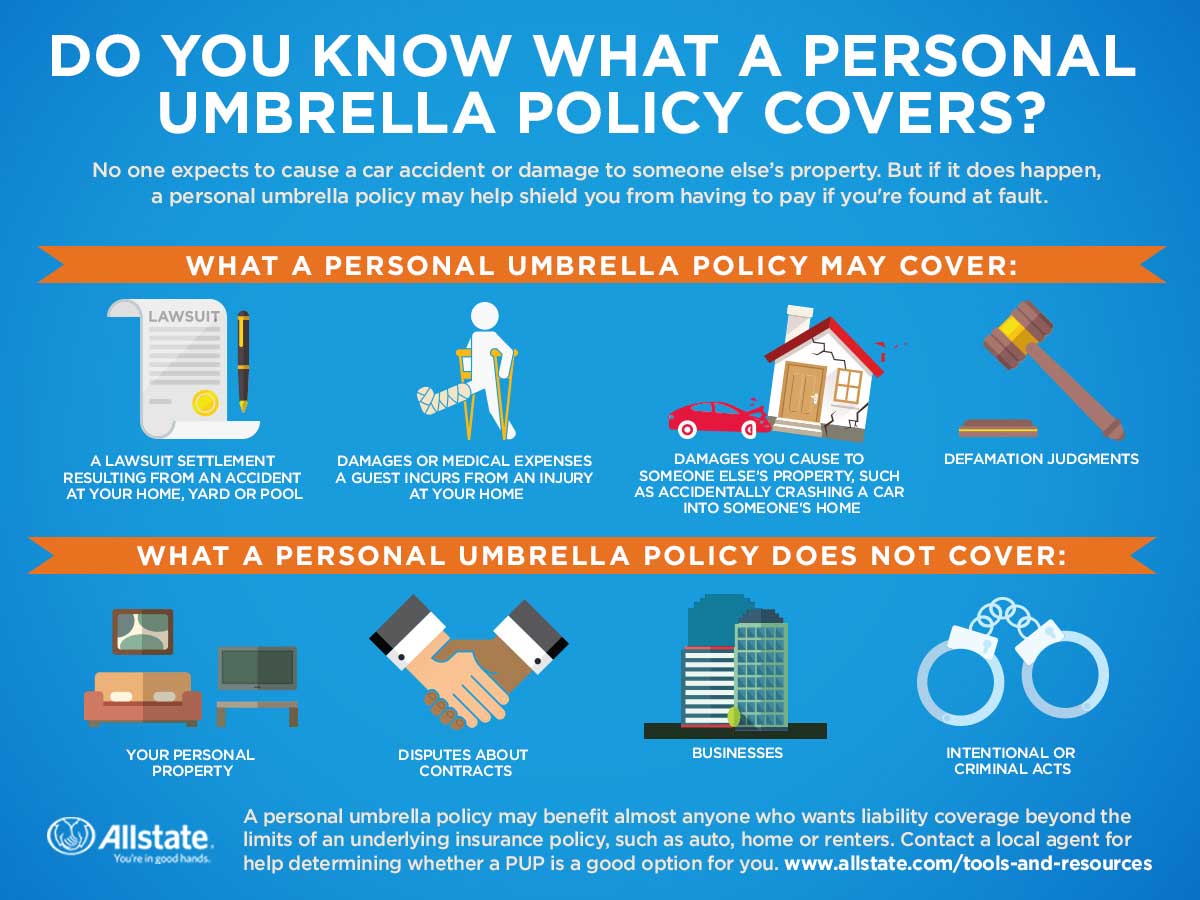

Source: allstate.com

Source: allstate.com

Within these three are further subdivisions, which include the following: The benefits usually cover all phases of suffering an accident, from evacuation to hospitalisation and treatment, rehabilitation and. The three main categories of auto insurance. Requirements for this coverage vary from state to state. Do you need personal accident insurance?

Source: carsurance.net

Source: carsurance.net

This compensation is provided to cover injuries that arise only from the road accident that too within the subsequent six months. You need liability insurance, and you want other people to have liability insurance too. Individual accident insurance is insurance that helps cover your out of pocket needs in the event that you are injured in an unforeseen accident. The benefits usually cover all phases of suffering an accident, from evacuation to hospitalisation and treatment, rehabilitation and. Personal injury protection and medical payments coverage pay your own medical expenses after a car accident, no matter who was at fault.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

Check your individual policy for how payout works. The limit of the coverage is defined as rs.15 lakhs by irdai. Personal injury protection and medical payments coverage pay your own medical expenses after a car accident, no matter who was at fault. Within these three are further subdivisions, which include the following: In missouri, you aren’t required to get auto coverage for medical bills you incur from a car accident outside of standard liability insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does personal accident car insurance cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information