What does retention mean in insurance information

Home » Trending » What does retention mean in insurance informationYour What does retention mean in insurance images are available in this site. What does retention mean in insurance are a topic that is being searched for and liked by netizens now. You can Download the What does retention mean in insurance files here. Get all free images.

If you’re searching for what does retention mean in insurance pictures information connected with to the what does retention mean in insurance interest, you have visit the right site. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

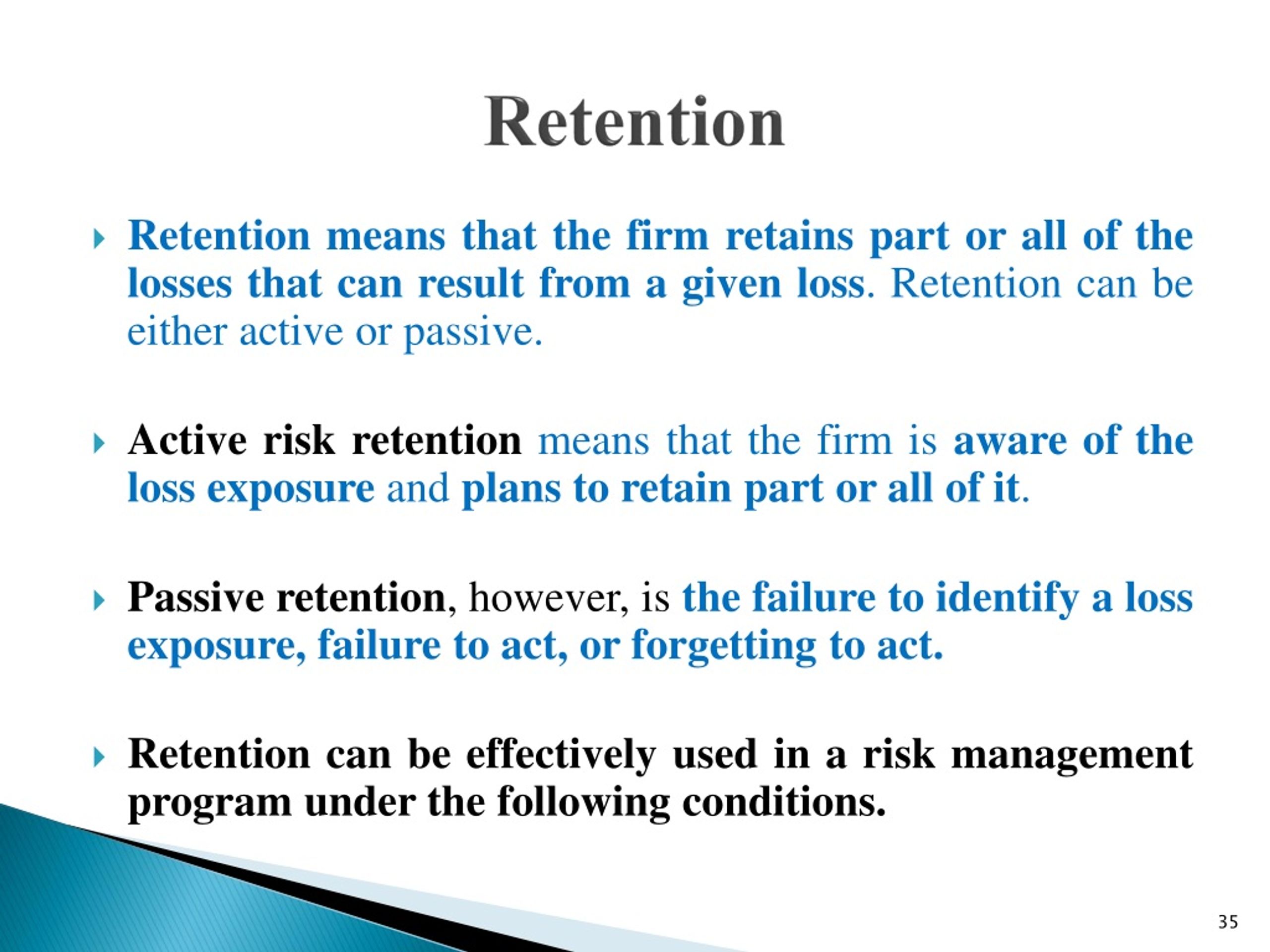

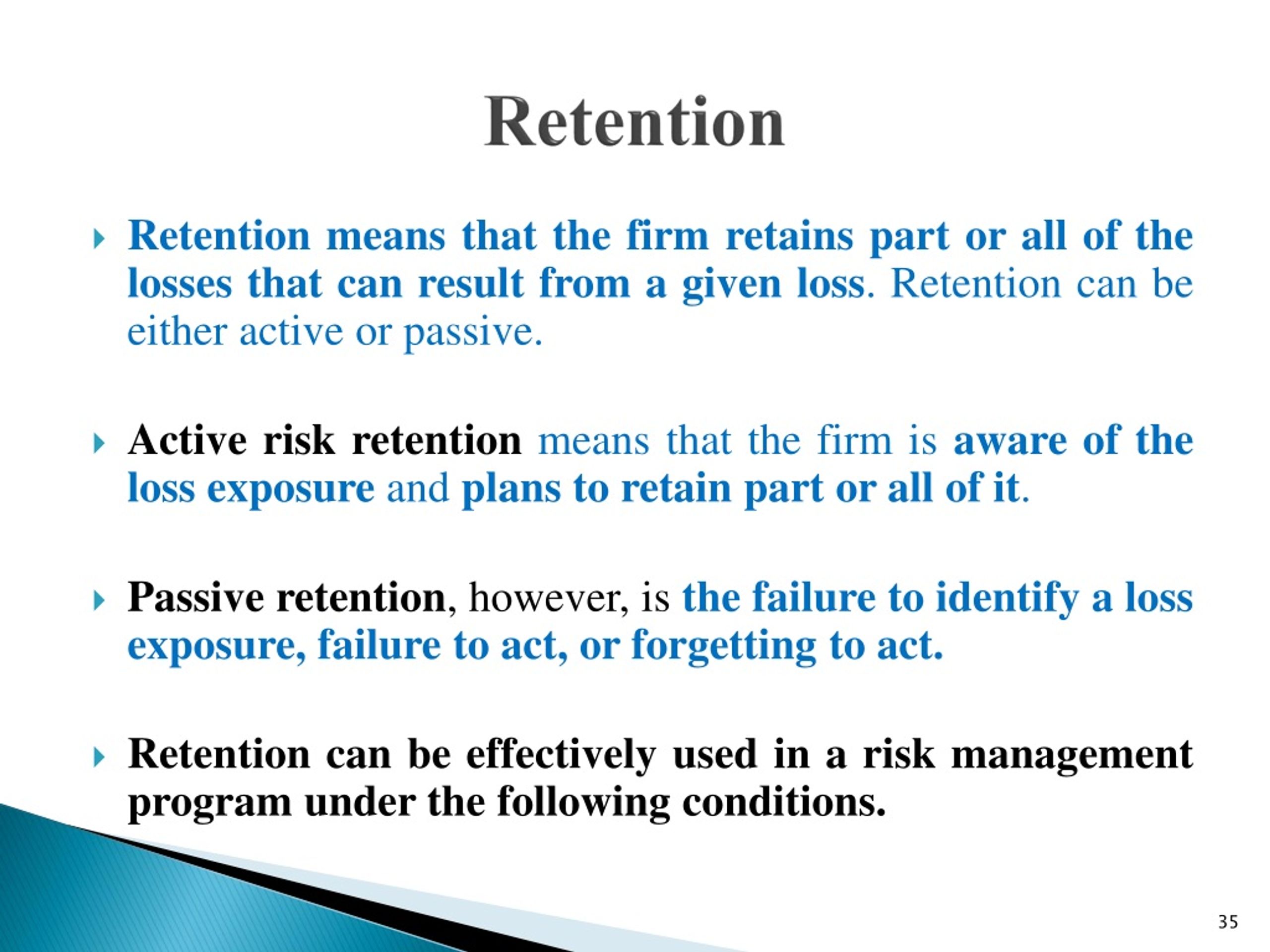

What Does Retention Mean In Insurance. Retention can be intentional or, when exposures are not identified, unintentional. It specifies what portion of any potential claims would be covered by the policyholder and the insurance. These plans reimburse the patient The specific umbrella policy will dictate exactly how much money the policyholder will have to spend on the deductible.

PPT PBBF 303 FIN. RISK MANAGEMENT AND INSURANCE LECTURE From slideserve.com

PPT PBBF 303 FIN. RISK MANAGEMENT AND INSURANCE LECTURE From slideserve.com

When you ask “what does retention mean” in presence of an insurance agency principal or the sales department of an insurance company… * the term speaks to the number of policies, clients or direct written premium that the agency ret. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account. What does retention mean in insurance? It specifies what portion of any potential claims would be covered by the policyholder and the insurance. Retention in normal english literature means to keep or to withhold. In insurance, the word retention is always related to how a company handles its business risk.

(2) in reinsurance, the net amount of risk the ceding company keeps for its own account.

In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. The term retention alone is misleading, suggesting that there is a single way of looking at retention. An application of retention is a declaration commonly included in insurance contracts. Business net retention is a measurement of a company�s growth and strength during a specific period. Technically, you pay a retention upfront and reimburse your insurance company for the deductible after they pay the claim.you can reduce your insurance premium by increasing your retention amount. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account.

Source: infographicszone.com

Source: infographicszone.com

This amount is basically the deductible for that policy. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. And this is how this works: Technically, you pay a retention upfront and reimburse your insurance company for the deductible after they pay the claim.you can reduce your insurance premium by increasing your retention amount. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account.

Source: dreamstime.com

Source: dreamstime.com

In insurance, the word retention is always related to how a company handles its business risk. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account. Insurance retention means that you, as an insured company, will be responsible for paying claims against you up to a certain dollar amount. What is retention in insurance? The specific umbrella policy will dictate exactly how much money the policyholder will have to spend on the deductible.

Source: dreamstime.com

Source: dreamstime.com

A retention deductible is a clause in an umbrella insurance policy which declares that the deductible will apply for losses for which there is no underlying policy that provide coverage for the specific loss. An application of retention is a declaration commonly included in insurance contracts. Retention in normal english literature means to keep or to withhold. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. It specifies what portion of any potential claims would be covered by the policyholder and the insurance.

Source: budgeting.thenest.com

Source: budgeting.thenest.com

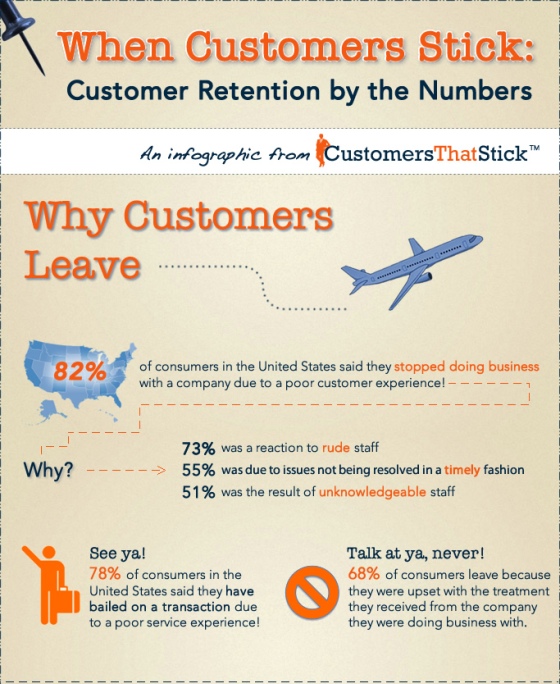

For claims that go beyond that dollar amount, the insurance company handles the claims. The amount of risk retained by an insurance company that is not reinsured. What does retention mean in insurance? Now when most people get their policies although they are advised to read them, like most i assume they don’t. Learn what they are, how to measure them, and how to compare them to get the most accurate read on your growth.

Source: slideserve.com

Source: slideserve.com

In insurance, it is the number of policies remaining after deducting canceled, lapsed, or ceded. Business net retention is an indication of how strong an insurance company is. Plusblog.org a retention deductible is a clause in an umbrella insurance policy which declares that the deductible will apply for losses for which there is no underlying policy that provide coverage for the specific loss. What is retention in insurance? Once the acv is settled upon, you can request the retention value of your vehicle.

Source: acronymsandslang.com

Source: acronymsandslang.com

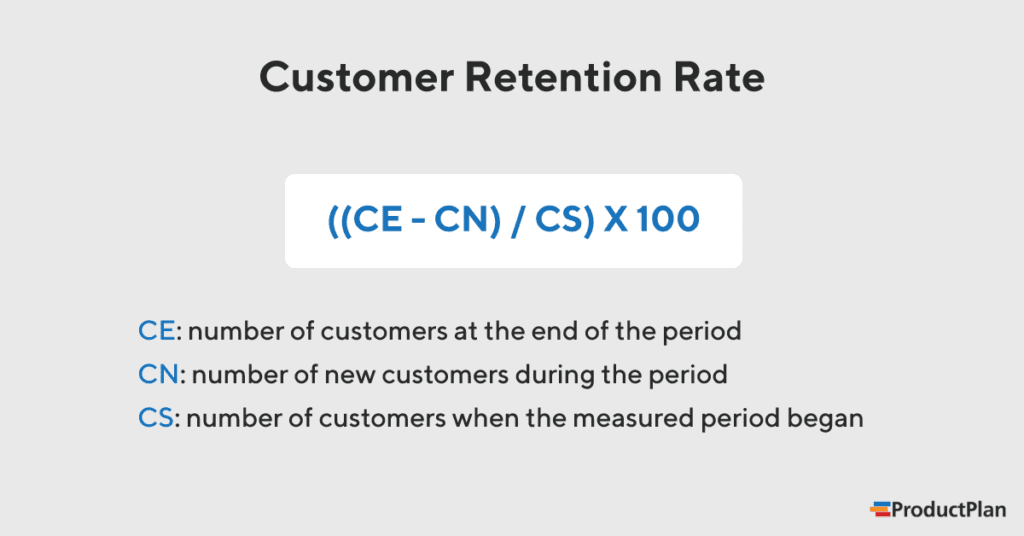

In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. Business net retention is calculated by dividing the number of net premiums by the number of gross written premiums. Retention can be intentional or, when exposures are not identified, unintentional. May be it is done to keep the cost of insurance premium at the minimum level. What is retention in insurance?

Source: attendancebot.com

Source: attendancebot.com

Let’s say acv is $10,000, you request the retention value, the insurance company will contact a salvage auction most likely, insurance auto auction, manheim or copart and get the average salvage value of your vehicle. The common alternative would be to pay an insurance company an annual premium to take that risk off your hands. A retention deductible is a clause in an umbrella insurance policy which declares that the deductible will apply for losses for which there is no underlying policy that provide coverage for the specific loss. Let’s say acv is $10,000, you request the retention value, the insurance company will contact a salvage auction most likely, insurance auto auction, manheim or copart and get the average salvage value of your vehicle. Retention as applied to reinsurance;

Source: familie-techniek.blogspot.com

Retention as applied to reinsurance; And this is how this works: An insurance retention is similar to a deductible, and the two words are often used interchangeably. An application of retention is a declaration commonly included in insurance contracts. The insurance definition of retention is synonymous with this.

Source: plusblog.org

Source: plusblog.org

In insurance, the word retention is always related to how a company handles its business risk. This amount is basically the deductible for that policy. Business net retention is calculated by dividing the number of net premiums by the number of gross written premiums. It specifies what portion of any potential claims would be covered by the policyholder and the insurance. In reality, three different types of retention determine the growth of an insurance agency.

Source: blog.agencyzoom.com

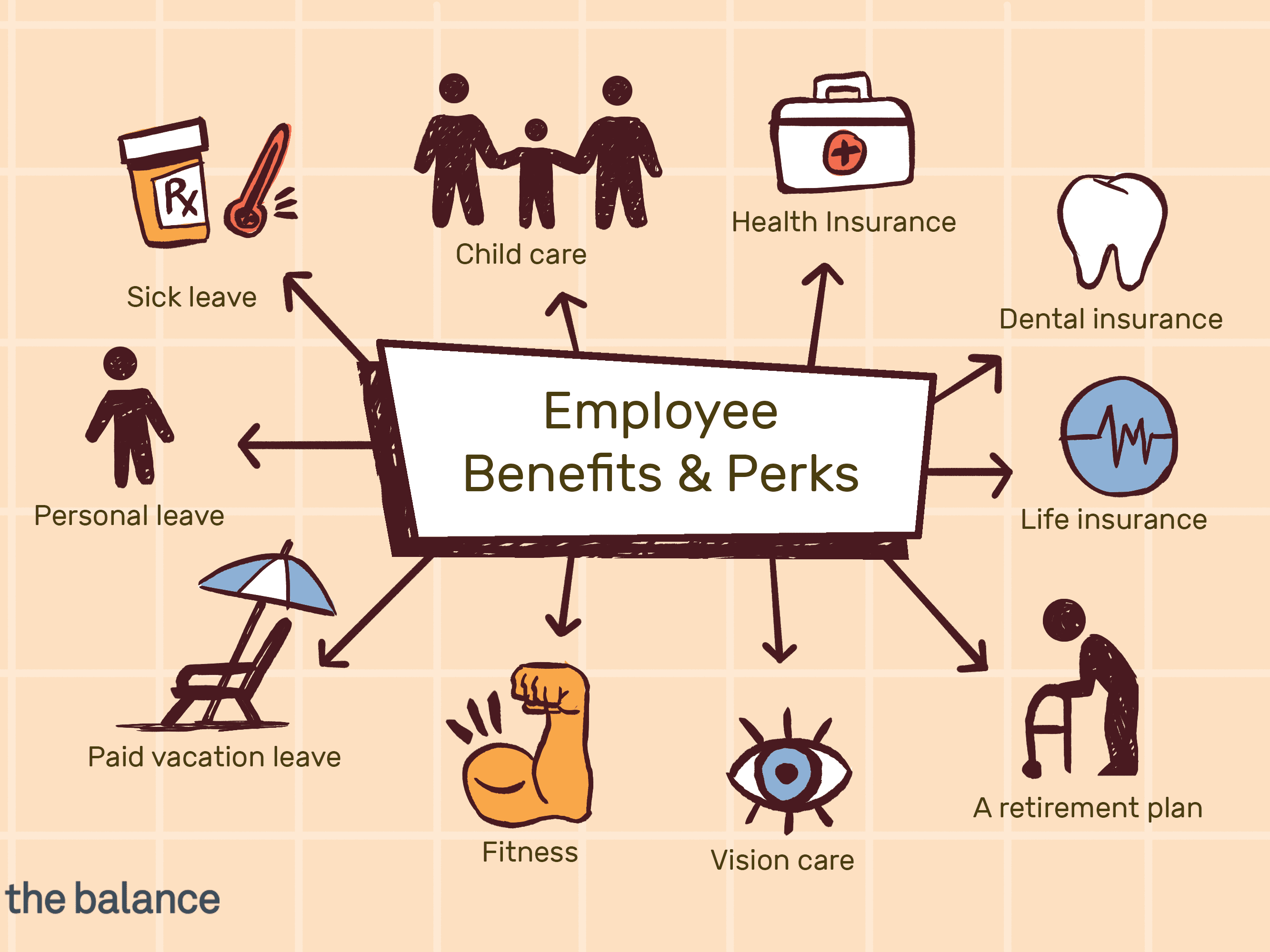

Technically, you pay a retention upfront and reimburse your insurance company for the deductible after they pay the claim.you can reduce your insurance premium by increasing your retention amount. Insurance retention refers to the amount of money an insured person or business becomes responsible for. These plans reimburse the patient In insurance, it is the number of policies remaining after deducting canceled, lapsed, or ceded. An application of retention is a declaration commonly included in insurance contracts.

Source: dreamstime.com

Source: dreamstime.com

In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. Once the acv is settled upon, you can request the retention value of your vehicle. These plans reimburse the patient When you ‘retain’ risk, it usually means you’re not insuring it.

Source: pennockins.com

Source: pennockins.com

Business net retention is a measurement of a company�s growth and strength during a specific period. Insurance retention means that you, as an insured company, will be responsible for paying claims against you up to a certain dollar amount. It specifies what portion of any potential claims would be covered by the policyholder and the insurance. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account. Retention can be intentional or, when exposures are not identified, unintentional.

Source: youtube.com

Source: youtube.com

And this is how this works: Business net retention is calculated by dividing the number of net premiums by the number of gross written premiums. It means it has been able to keep a number of policies in its account while also managing the risks involved in holding them without the aid of reinsurance. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account. Business net retention is an indication of how strong an insurance company is.

Source: productplan.com

Source: productplan.com

It means it has been able to keep a number of policies in its account while also managing the risks involved in holding them without the aid of reinsurance. The common alternative would be to pay an insurance company an annual premium to take that risk off your hands. Business net retention is a measurement of a company�s growth and strength during a specific period. The amount of risk retained by an insurance company that is not reinsured. The insurance definition of retention is synonymous with this.

Source: blog.agencyzoom.com

In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. Insurance retention refers to the amount of money an insured person or business becomes responsible for. Business net retention is an indication of how strong an insurance company is. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. What does retention mean in insurance?

Source: dreamstime.com

Source: dreamstime.com

This amount is basically the deductible for that policy. Plusblog.org a retention deductible is a clause in an umbrella insurance policy which declares that the deductible will apply for losses for which there is no underlying policy that provide coverage for the specific loss. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account. It means it has been able to keep a number of policies in its account while also managing the risks involved in holding them without the aid of reinsurance. Once the acv is settled upon, you can request the retention value of your vehicle.

Source: millionaireacts.com

Source: millionaireacts.com

Insurance retention means that you, as an insured company, will be responsible for paying claims against you up to a certain dollar amount. Insurance retention means that you, as an insured company, will be responsible for paying claims against you up to a certain dollar amount. Plusblog.org a retention deductible is a clause in an umbrella insurance policy which declares that the deductible will apply for losses for which there is no underlying policy that provide coverage for the specific loss. The insurance definition of retention is synonymous with this. The specific umbrella policy will dictate exactly how much money the policyholder will have to spend on the deductible.

Source: plusblog.org

Source: plusblog.org

What is retention in insurance? An insurance retention is similar to a deductible, and the two words are often used interchangeably. When you ‘retain’ risk, it usually means you’re not insuring it. The amount of risk retained by an insurance company that is not reinsured. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does retention mean in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information