What does taxi insurance cover information

Home » Trend » What does taxi insurance cover informationYour What does taxi insurance cover images are ready. What does taxi insurance cover are a topic that is being searched for and liked by netizens today. You can Download the What does taxi insurance cover files here. Get all royalty-free photos.

If you’re looking for what does taxi insurance cover pictures information connected with to the what does taxi insurance cover interest, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

What Does Taxi Insurance Cover. This is especially important for taxi drivers who regularly take. This protects you if a customer suffers a personal injury or property damage while either. This covers damage to your taxi after a collision. Taxi insurance policies come with a range of different options including:

Cheap Taxi Insurance Quotes Online Blue Angel From blueangeltech.com

Cheap Taxi Insurance Quotes Online Blue Angel From blueangeltech.com

Personal harm to the insured car ; Seasoned drivers may very well be familiar with the three main types of car insurance available, and these types are the same for taxis. Taxi companies are not required by law to take out public liability insurance, however some local authorities do insist upon it and many taxi drivers choose to take it out to protect themselves against claims from members of the public. These advantages you possibly can obtain in case you have axa insurance coverage for taxis: You can apply for taxi insurance if you have a taxi license and have had a full driving licence for over 12 months. Taxi insurance does exactly what is says on the tin;

What does axa taxi insurance coverage cowl?

It covers any vehicles used as a public or private hire taxi. Taxi services differ from limo, black car and ridesharing businesses because their fares and pickup locations are often random and unscheduled, and they don’t use luxury vehicles. Before you can start working as a taxi driver, you will first need to ensure you have the correct insurance in place. If you have liberty mutual auto insurance, you are also covered for rental cars. This ensures that you and your passengers are protected should anything happen whilst you are working. You need to have a $125,000 per person policy for bodily injury liability, $50,000 to cover property damage liability, and $250,000 for each occurrence.

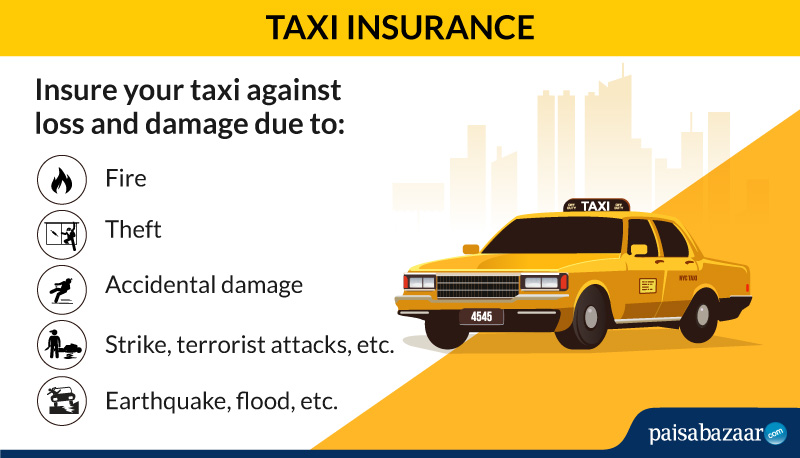

Source: paisabazaar.com

Source: paisabazaar.com

This covers damage to your taxi not caused by a collision, like storm damage, fire damage and theft. This can cover damage to accessories in your cab, like your mileage meter, communication equipment and gps device. Taxi insurance does exactly what is says on the tin; However, there are other cover options specific to taxi insurance you should also consider, including: Public hire taxi insurance, also known as ‘black cab’ insurance, is a type of policy specifically designed to cover taxi cabs licensed to be flagged down by the public.

Source: echoinsurance.co.uk

Source: echoinsurance.co.uk

But if you own a chevy spark with 230,000 miles on it and rent an. If you have liberty mutual auto insurance, you are also covered for rental cars. It covers any vehicles used as a public or private hire taxi. Taxi insurance includes motor insurance and passenger liability insurance as standard in every policy. What does taxi insurance cover?

Source: gtins.com.au

Source: gtins.com.au

What does axa taxi insurance coverage cowl? Some of the things that can be included on a taxi insurance policy are: The caveat is that the coverage extends to the same limits of your personal auto policy. Taxi insurance includes motor insurance and passenger liability insurance as standard in every policy. With comprehensive cover, you may also include demurrage cover (loss of income while your vehicle is off the road due to loss), and residual value cover, which protects you against any gap between the value of your taxi, and the level of finance owed on the vehicle.

Source: alternativeinsurancebrokers.co.uk

Source: alternativeinsurancebrokers.co.uk

This coverage is mandatory if you want to protect your taxi cab from all kinds of accidents and unexpected events such as fire, theft or vandalism. Your liberty mutual auto insurance should cover your rental as long as the vehicle is of similar value to the one you already own. Well, don’t worry, we are here to help from insurance blog. Public hire taxi insurance, also known as ‘black cab’ insurance, is a type of policy specifically designed to cover taxi cabs licensed to be flagged down by the public. Almost all small water taxi services business should have enough professional liability insurance to cover a single claim of $25,000, with annual cover of $50,000.

Source: patonsinsurance.co.uk

Source: patonsinsurance.co.uk

Compare commercial car insurance for taxis Taxi insurance is different from standard car insurance because you will cover substantially more mileage than the average motorist, as well as deal with members of the public. Public and private hire insurance will cover you when carrying passengers in exchange for payment. Third party or third party, fire and theft. Personal harm to the insured car ;

Source: focusinsurance.co.uk

Source: focusinsurance.co.uk

This can cover damage to accessories in your cab, like your mileage meter, communication equipment and gps device. With comprehensive cover, you may also include demurrage cover (loss of income while your vehicle is off the road due to loss), and residual value cover, which protects you against any gap between the value of your taxi, and the level of finance owed on the vehicle. Seasoned drivers may very well be familiar with the three main types of car insurance available, and these types are the same for taxis. The caveat is that the coverage extends to the same limits of your personal auto policy. You need to have a $125,000 per person policy for bodily injury liability, $50,000 to cover property damage liability, and $250,000 for each occurrence.

Source: youtube.com

Source: youtube.com

Public hire taxi insurance, also known as ‘black cab’ insurance, is a type of policy specifically designed to cover taxi cabs licensed to be flagged down by the public. Taxi insurance policies come with a range of different options including: A typical comprehensive taxi insurance policy will cover you for : Seasoned drivers may very well be familiar with the three main types of car insurance available, and these types are the same for taxis. You will need this in place if you plan to use your taxi.

Source: blueangeltech.com

Source: blueangeltech.com

Does taxi insurance cover personal use? If you decide to switch from a private hire taxi job to food delivery courier work, you’ll need to make sure you have the right insurance in place to protect yourself from the risks you’ll face. Almost all small water taxi services business should have enough professional liability insurance to cover a single claim of $25,000, with annual cover of $50,000. This is a legal requirement and attempting to complete taxi work without it can have some serious consequences. With comprehensive cover, you may also include demurrage cover (loss of income while your vehicle is off the road due to loss), and residual value cover, which protects you against any gap between the value of your taxi, and the level of finance owed on the vehicle.

Source: youtube.com

Source: youtube.com

Taxi companies are not required by law to take out public liability insurance, however some local authorities do insist upon it and many taxi drivers choose to take it out to protect themselves against claims from members of the public. Taxi insurance is different from standard car insurance because you will cover substantially more mileage than the average motorist, as well as deal with members of the public. Taxi services differ from limo, black car and ridesharing businesses because their fares and pickup locations are often random and unscheduled, and they don’t use luxury vehicles. It covers any vehicles used as a public or private hire taxi. Taxi insurance includes motor insurance and passenger liability insurance as standard in every policy.

Source: completecar.ca

Source: completecar.ca

If you have liberty mutual auto insurance, you are also covered for rental cars. With comprehensive cover, you may also include demurrage cover (loss of income while your vehicle is off the road due to loss), and residual value cover, which protects you against any gap between the value of your taxi, and the level of finance owed on the vehicle. Taxi companies are not required by law to take out public liability insurance, however some local authorities do insist upon it and many taxi drivers choose to take it out to protect themselves against claims from members of the public. Third party or third party, fire and theft. Your liberty mutual auto insurance should cover your rental as long as the vehicle is of similar value to the one you already own.

Source: theworldbeast.com

Source: theworldbeast.com

This covers damage to your taxi after a collision. A typical comprehensive taxi insurance policy will cover you for : Taxi insurance includes motor insurance and passenger liability insurance as standard in every policy. However, there are other cover options specific to taxi insurance you should also consider, including: This coverage is mandatory if you want to protect your taxi cab from all kinds of accidents and unexpected events such as fire, theft or vandalism.

Source: moneybeach.co.uk

Source: moneybeach.co.uk

This is a legal requirement and attempting to complete taxi work without it can have some serious consequences. If you decide to switch from a private hire taxi job to food delivery courier work, you’ll need to make sure you have the right insurance in place to protect yourself from the risks you’ll face. This can cover damage to accessories in your cab, like your mileage meter, communication equipment and gps device. You need to have a $125,000 per person policy for bodily injury liability, $50,000 to cover property damage liability, and $250,000 for each occurrence. It varies slightly from private hire taxi insurance because there are different risks for public hire cab drivers.

Source: insuretaxi.com

Source: insuretaxi.com

Public hire taxi insurance, also known as ‘black cab’ insurance, is a type of policy specifically designed to cover taxi cabs licensed to be flagged down by the public. These advantages you possibly can obtain in case you have axa insurance coverage for taxis: This ensures that you and your passengers are protected should anything happen whilst you are working. This insurer targeted on the details to cowl for taxi drivers and their items, however has added different extras. Well, don’t worry, we are here to help from insurance blog.

Source: revisi.net

Source: revisi.net

Your insurance company with insurance marketing will ask for “proof of ownership” if you need to file a homeowner’s insurance claim from insurance agents. But if you own a chevy spark with 230,000 miles on it and rent an. Compare commercial car insurance for taxis With comprehensive cover, you may also include demurrage cover (loss of income while your vehicle is off the road due to loss), and residual value cover, which protects you against any gap between the value of your taxi, and the level of finance owed on the vehicle. This covers damage to your taxi after a collision.

Source: insurancemarketing.club

Source: insurancemarketing.club

Unlike private hire insurance, courier insurance covers goods in transit coverage up to a predetermined sum, protecting the items you deliver if they are lost, damaged (food spoilage),. Public hire taxi insurance, also known as ‘black cab’ insurance, is a type of policy specifically designed to cover taxi cabs licensed to be flagged down by the public. If you have liberty mutual auto insurance, you are also covered for rental cars. These advantages you possibly can obtain in case you have axa insurance coverage for taxis: Taxi services differ from limo, black car and ridesharing businesses because their fares and pickup locations are often random and unscheduled, and they don’t use luxury vehicles.

Source: mega-search.net

Source: mega-search.net

This is especially important for taxi drivers who regularly take. A typical comprehensive taxi insurance policy will cover you for : But if you own a chevy spark with 230,000 miles on it and rent an. Almost all small water taxi services business should have enough professional liability insurance to cover a single claim of $25,000, with annual cover of $50,000. Public and private hire insurance will cover you when carrying passengers in exchange for payment.

Source: fashionstance.blogspot.com

Source: fashionstance.blogspot.com

A typical comprehensive taxi insurance policy will cover you for : Well, don’t worry, we are here to help from insurance blog. But if you own a chevy spark with 230,000 miles on it and rent an. Before you can start working as a taxi driver, you will first need to ensure you have the correct insurance in place. If you have liberty mutual auto insurance, you are also covered for rental cars.

Source: fashionstance.blogspot.com

Source: fashionstance.blogspot.com

Some of the things that can be included on a taxi insurance policy are: This insurer targeted on the details to cowl for taxi drivers and their items, however has added different extras. Almost all small water taxi services business should have enough professional liability insurance to cover a single claim of $25,000, with annual cover of $50,000. Does taxi insurance cover personal use? Some of the things that can be included on a taxi insurance policy are:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does taxi insurance cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information