What does twisting mean in insurance Idea

Home » Trend » What does twisting mean in insurance IdeaYour What does twisting mean in insurance images are available in this site. What does twisting mean in insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What does twisting mean in insurance files here. Find and Download all free photos.

If you’re searching for what does twisting mean in insurance images information linked to the what does twisting mean in insurance keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

What Does Twisting Mean In Insurance. Each morning he spends an hour loading his van requiring him to load a dolly, and unload it into a delivery van. In the brokerage business, twisting is usually called churning. One constituent state of the us, new york, has established insurance laws that will prevent such cases. As a general principle, insurance agents are fiduciaries responsible for acting on behalf of their clients and the insurance carriers they represent and placing their interests above their own in all situations.

what is twisting in insurance? Common Kola for long From commonkola.com

what is twisting in insurance? Common Kola for long From commonkola.com

One constituent state of the us, new york, has established insurance laws that will prevent such cases. Most insurance policies, including home and auto, require a deductible. Twisting, the more general term, applies to the sale of other products as well, such as insurance policies. Rebating is defined as giving a customer something of monetary value in exchange for making a purchase. Churning is mostly attributed to insurance agents, and most states have laws that will punish those who engage in the practice. Life insurance twisting occurs when an agent misrepresents the facts to replace a life policy the customer owns with a policy from another life insurance company.

Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage.

This is usually conceived of as cash discounts, but can include expensive gifts, free trips or concert tickets, prizes, anything of significant value. This is usually conceived of as cash discounts, but can include expensive gifts, free trips or concert tickets, prizes, anything of significant value. Additional value can differ but in most cases mean financial benefits for the customer (as paybacks), expensive gifts, tickets, etc. Some states specifically exclude token gifts, such as calendars and christmas cards. Also know, what is a twisting in insurance? Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).

Source: pinterest.com

Source: pinterest.com

Twisting hurts clients financially, but it�s a sweet deal for the agent who pulls it off. In simple terms, twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). The sole aim is to generate extra profits for the insurance agent, who makes commissions by selling new policies to existing clients. But before they contribute, your deductible is subtracted from the payout amount. Twisting occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from a different insurer.

Source: us.dujuz.com

Source: us.dujuz.com

Twisting is essentially the same practice but conducted with different parties involved. Twisting is essentially the same practice but conducted with different parties involved. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations. The act of twisting when life insurance is. Twisting occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from a different insurer.

Source: sapling.com

Source: sapling.com

Churning is in effect �twisting� of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a). Our insurance terms glossary is divided alphabetically by insurance terms in a quick reference guide to assist understanding the language commonly used by insurance companies. Sliding is to imply coverage or another policy is required bylaw and its not or not telling someone of a charge and their reallyis! Twisting, the more general term, applies to the sale of other products as well, such as insurance policies. One constituent state of the us, new york, has established insurance laws that will prevent such cases.

For example, if an employee is precluded from repetitive bending and twisting and he works as a delivery driver. But before they contribute, your deductible is subtracted from the payout amount. Twisting hurts clients financially, but it�s a sweet deal for the agent who pulls it off. Although he acts as the agent of his client, he is normally remunerated by a commission (brokerage) from the insurer. The law says that churning is to be prohibited.

Source: insurancereviews911.com

Source: insurancereviews911.com

In the brokerage business, twisting is usually called churning. The act of twisting when life insurance is. An insurance intermediary who advises his clients and arranges their insurances. When you file an insurance claim, your insurance company pays for most of the cost. But before they contribute, your deductible is subtracted from the payout amount.

Source: wweddingringsets.blogspot.com

The sole aim is to generate extra profits for the insurance agent, who makes commissions by selling new policies to existing clients. The other problem is that the key above, does not take into account, duration. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Twisting hurts clients financially, but it�s a sweet deal for the agent who pulls it off. Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage.

![]() Source: gallfingervirh.blogspot.com

Source: gallfingervirh.blogspot.com

This is usually conceived of as cash discounts, but can include expensive gifts, free trips or concert tickets, prizes, anything of significant value. Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage. For example, if an employee is precluded from repetitive bending and twisting and he works as a delivery driver. Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).

Source: esurance.com

Source: esurance.com

They are tricking you into buying that policy when you don’t need it, telling you that it’s better when it’s only going to benefit them. Twisting, the more general term, applies to the sale of other products as well, such as insurance policies. Twisting hurts clients financially, but it�s a sweet deal for the agent who pulls it off. Although he acts as the agent of his client, he is normally remunerated by a commission (brokerage) from the insurer. When you file an insurance claim, your insurance company pays for most of the cost.

Source: b.aisnicaragua.org

Source: b.aisnicaragua.org

In simple terms, twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). The law says that churning is to be prohibited. Rebating is defined as giving a customer something of monetary value in exchange for making a purchase. Insurance twisting is an unscrupulous practice of insurance agents trying hard to convince you to shift to another insurance policy.

Source: agentsync.io

Source: agentsync.io

Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations. Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage. One constituent state of the us, new york, has established insurance laws that will prevent such cases. The law says that churning is to be prohibited.

Source: commonkola.com

Source: commonkola.com

Twisting is essentially the same practice but conducted with different parties involved. Our insurance terms glossary is divided alphabetically by insurance terms in a quick reference guide to assist understanding the language commonly used by insurance companies. They have enumerated certain rubrics applicable for the insurance company personnel that are constructed to lessen churning cases. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Life insurance twisting occurs when an agent misrepresents the facts to replace a life policy the customer owns with a policy from another life insurance company.

Source: b.aisnicaragua.org

Source: b.aisnicaragua.org

Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage. Twisting, the more general term, applies to the sale of other products as well, such as insurance policies. An insurance intermediary who advises his clients and arranges their insurances. The sole aim is to generate extra profits for the insurance agent, who makes commissions by selling new policies to existing clients. Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage.

Source: ebraces.org

Source: ebraces.org

Twisting is essentially the same practice but conducted with different parties involved. Some states specifically exclude token gifts, such as calendars and christmas cards. Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Twisting, the more general term, applies to the sale of other products as well, such as insurance policies. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations.

Source: mcclarroninsurance.com

Source: mcclarroninsurance.com

Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage. In the brokerage business, twisting is usually called churning. But before they contribute, your deductible is subtracted from the payout amount. When you file an insurance claim, your insurance company pays for most of the cost. Churning is in effect twisting of policies by an existing insurer.

Source: farrin.com

Source: farrin.com

Twisting definition, the practice of an insurance agent of tricking the holder of a life insurance policy into letting it lapse so that the insured will replace it with one of a company represented by the agent. Twisting is essentially the same practice but conducted with different parties involved. But before they contribute, your deductible is subtracted from the payout amount. Churning is mostly attributed to insurance agents, and most states have laws that will punish those who engage in the practice. The act of twisting when life insurance is.

Source: bayoralsurgery.com

Source: bayoralsurgery.com

Twisting is essentially the same practice but conducted with different parties involved. Churning is in effect �twisting� of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a). Rebating is defined as giving a customer something of monetary value in exchange for making a purchase. Life insurance twisting occurs when an agent misrepresents the facts to replace a life policy the customer owns with a policy from another life insurance company. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).

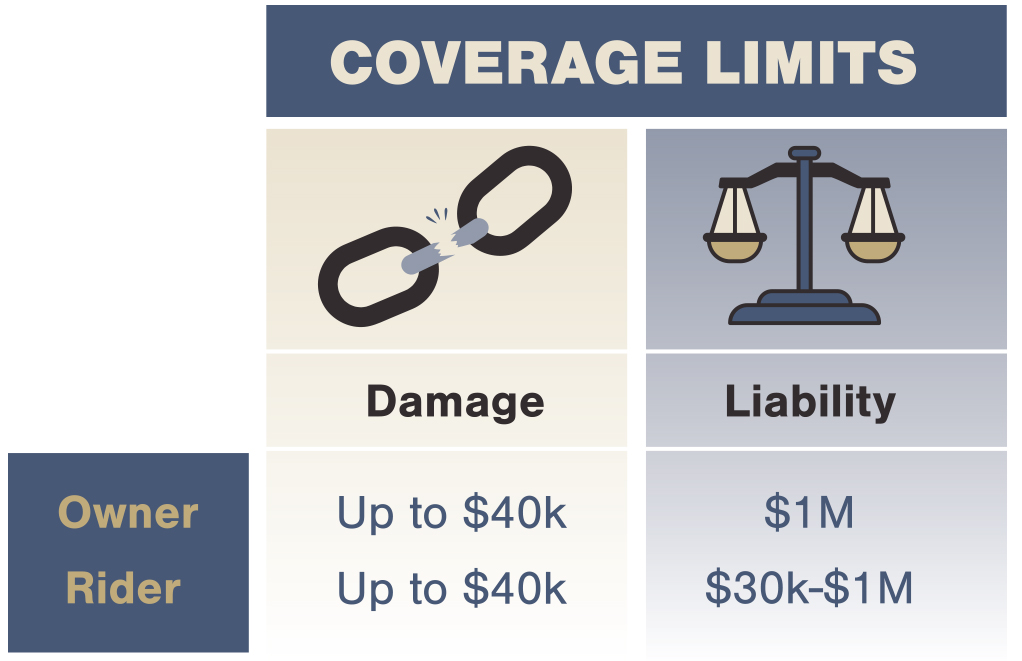

Source: support.twistedroad.com

Source: support.twistedroad.com

One constituent state of the us, new york, has established insurance laws that will prevent such cases. Each morning he spends an hour loading his van requiring him to load a dolly, and unload it into a delivery van. Most states have enacted legislation making twisting. This is usually conceived of as cash discounts, but can include expensive gifts, free trips or concert tickets, prizes, anything of significant value. Also know, what is a twisting in insurance?

Source: zempk.net

Source: zempk.net

These plans reimburse the patient The law says that churning is to be prohibited. Anyone who does churning may be liable to certain sanctions. In simple terms, twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Most insurance policies, including home and auto, require a deductible.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what does twisting mean in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information