What happens if the property is under insured information

Home » Trend » What happens if the property is under insured informationYour What happens if the property is under insured images are ready in this website. What happens if the property is under insured are a topic that is being searched for and liked by netizens today. You can Download the What happens if the property is under insured files here. Download all royalty-free vectors.

If you’re searching for what happens if the property is under insured images information linked to the what happens if the property is under insured topic, you have pay a visit to the right site. Our website always provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

What Happens If The Property Is Under Insured. Most people understand that if you are underinsured it means you may not have enough insurance money to rebuild and replace back to the same standard you are at right now. It is often caused by miscalculating the value of your property and its contents. What happens if my home is under insured? What happens if the property is underinsured.

PostFlood Advice for UnderInsured Homeowners Virani Law From viranilaw.ca

PostFlood Advice for UnderInsured Homeowners Virani Law From viranilaw.ca

For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000. In this case, that’s £15,000 worth of equipment cover minus 25% (£5,000) underinsured, so a total payout of only £11,250….£8,750 shy of the true replacement cost. The insurance policies where underinsurance commonly occurs are: Structural damage when thinking of damages, it’s not always an entire house that gets destroyed. What happens if my home is under insured? When you come to make a claim, if the sums insured are not sufficient to pay the full cost of rebuilding your property, your claim may not be met in full.

Failure to insure for the correct sum could result in a claim being reduced or even, in extreme circumstances your insurance policy being voided.

Simply put, being underinsured means you have a policy that only covers a portion of your losses in a claim, often because of exclusions or coverage limits. A lot of people are underinsured without knowing it. For example, you might insure your home for $300,000, only to find out that rebuilding it after a total loss costs $400,000. Underinsurance refers to an insufficient insurance policy. Mlfpllc.com this would mean that in the event of a claim, insurers will not pay the full amount, they will apply what is known as ‘average’. In the event of a claim, the amount will be reduced, giving the property owner less to work with in order to reinstate the property.

Source: riskheads.org

Source: riskheads.org

Although a good insurance policy won’t prevent any of life’s calamities, it should. In some cases there will be a discrepancy between the value of the property and the value of the sum insured. Because in the event of a total loss, the sum insured will not pay for the full value of the claim. The average clause is typically found in commercial property insurance clauses. For example, you might insure your home for $300,000, only to find out that rebuilding it after a total loss costs $400,000.

Source: mlfpllc.com

Source: mlfpllc.com

People don’t understand how much they could lose by being underinsured. Structural damage when thinking of damages, it’s not always an entire house that gets destroyed. If an item or property is underinsured, the insured must bear a rateable proportion of each and every loss. In the case of underinsured property, claims will be calculated subject to an average, proportionally reduced by the amount that the property is underinsured. Being underinsured could also mean losing your house if you get sued.

Source: higginsrealestatelismore.com.au

Source: higginsrealestatelismore.com.au

What happens if the property is underinsured. Although a good insurance policy won’t prevent any of life’s calamities, it should. In some cases there will be a discrepancy between the value of the property and the value of the sum insured. What happens if the property is underinsured. If an item or property is underinsured, the insured must bear a rateable proportion of each and every loss.

Source: ginsure.co.nz

Source: ginsure.co.nz

In the case of underinsured property, claims will be calculated subject to an average, proportionally reduced by the amount that the property is underinsured. The danger of being underinsured is that it could lead to major financial implications for you in a time when you are already stressed out. In the case of underinsured property, claims will be calculated subject to an average, proportionally reduced by the amount that the property is underinsured. What happens if my home is under insured? In this case, that’s £15,000 worth of equipment cover minus 25% (£5,000) underinsured, so a total payout of only £11,250….£8,750 shy of the true replacement cost.

Source: svmcleaningspecialists.com

Source: svmcleaningspecialists.com

But it will also hamper your insurer’s ability to help you in the rebuild and replacement process, causing more stress and uncertainty for you and your family. Mlfpllc.com this would mean that in the event of a claim, insurers will not pay the full amount, they will apply what is known as ‘average’. When you come to make a claim, if the sums insured are not sufficient to pay the full cost of rebuilding your property, your claim may not be met in full. A lot of people are underinsured without knowing it. For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000.

Source: mozo.com.au

Source: mozo.com.au

The average clause states that if your property is underinsured, your insurer is only liable to pay for a percentage of the value of items lost. The danger of being underinsured is that it could lead to major financial implications for you in a time when you are already stressed out. The insurance policies where underinsurance commonly occurs are: The consequence of under insured values would be compounded if the sum insured is set too low at the outset. Underinsurance comes from having wrong coverage or insufficient coverage for your small business.

Source: 727injury.com

Source: 727injury.com

A lot of people are underinsured without knowing it. The danger of being underinsured is that it could lead to major financial implications for you in a time when you are already stressed out. People also ask, are there. Mlfpllc.com this would mean that in the event of a claim, insurers will not pay the full amount, they will apply what is known as ‘average’. The average clause is typically found in commercial property insurance clauses.

Source: thehub.nrma.com.au

When you come to make a claim, if the sums insured are not sufficient to pay the full cost of rebuilding your property, your claim may not be met in full. Underinsurance is when homeowners have a home and contents insurance policy, but don’t have an adequate level of cover to fund repairs if their home is damaged. In the case of underinsured property, claims will be calculated subject to an average, proportionally reduced by the amount that the property is underinsured. For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000. For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000.

Source: phoenixins.com.au

Source: phoenixins.com.au

Underinsurance is when homeowners have a home and contents insurance policy, but don’t have an adequate level of cover to fund repairs if their home is damaged. What happens if my home is under insured? Buildings insurance contents insurance business interruption cyber liability underinsurance summary underinsurance occurs when your property is insured for less than its true value. For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000. The average clause is typically found in commercial property insurance clauses.

Source: talmadgeconstruction.com

Source: talmadgeconstruction.com

According to mozo data manager peter marshall, being underinsured can deliver a big blow to aussies’ wallets, right when they need help the most. In this case, that’s £15,000 worth of equipment cover minus 25% (£5,000) underinsured, so a total payout of only £11,250….£8,750 shy of the true replacement cost. Simply put, being underinsured means you have a policy that only covers a portion of your losses in a claim, often because of exclusions or coverage limits. When you come to make a claim, if the sums insured are not sufficient to pay the full cost of rebuilding your property, your claim may not be met in full. In the event of a claim, being underinsured may result in economic losses for the policyholder, since the claim could exceed the maximum amount that could be paid out by the insurance policy.

Source: morningstarinsurance.com

Source: morningstarinsurance.com

Failure to insure for the correct sum could result in a claim being reduced or even, in extreme circumstances your insurance policy being voided. What happens when a property is underinsured? In the event of a claim, being underinsured may result in economic losses for the policyholder, since the claim could exceed the maximum amount that could be paid out by the insurance policy. Being underinsured could also mean losing your house if you get sued. Determined by the percentage your property is under insured.

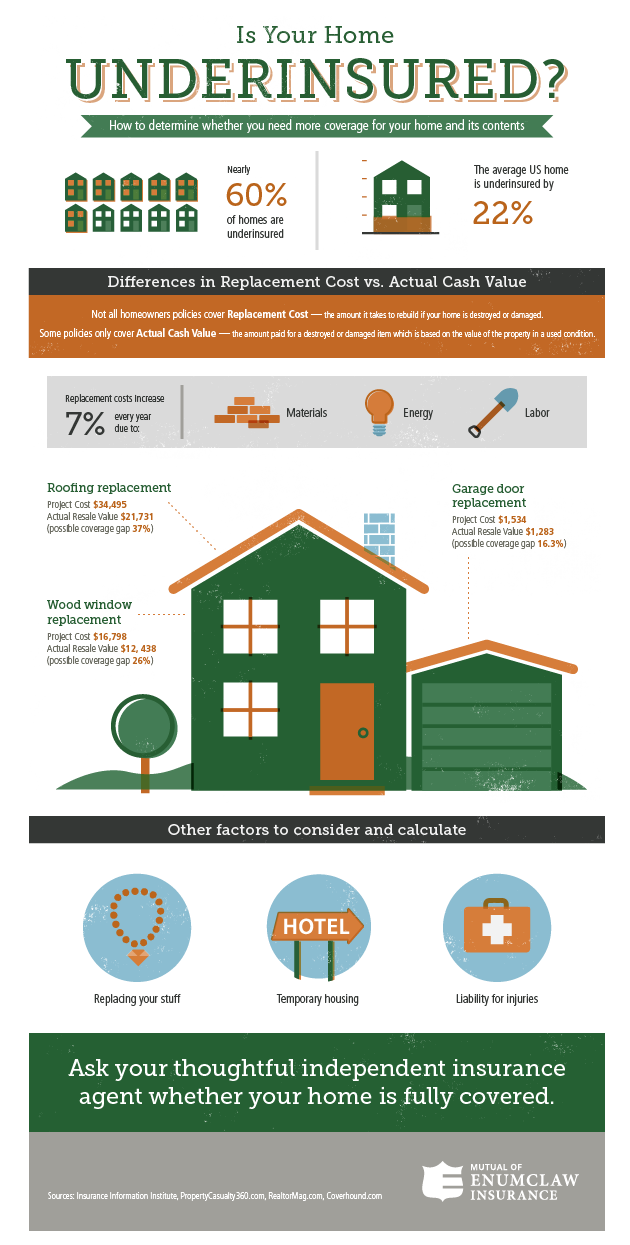

Source: mutualofenumclaw.com

Source: mutualofenumclaw.com

In some cases there will be a discrepancy between the value of the property and the value of the sum insured. Failure to insure for the correct sum could result in a claim being reduced or even, in extreme circumstances your insurance policy being voided. Most people understand that if you are underinsured it means you may not have enough insurance money to rebuild and replace back to the same standard you are at right now. In the event of a claim, being underinsured may result in economic losses for the policyholder, since the claim could exceed the maximum amount that could be paid out by the insurance policy. In this case, that’s £15,000 worth of equipment cover minus 25% (£5,000) underinsured, so a total payout of only £11,250….£8,750 shy of the true replacement cost.

Source: focusmanifesto.com

Source: focusmanifesto.com

The consequence of under insured values would be compounded if the sum insured is set too low at the outset. The average clause states that if your property is underinsured, your insurer is only liable to pay for a percentage of the value of items lost. For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000. People don’t understand how much they could lose by being underinsured. It means if you’re underinsured, they can reduce the amount they pay you by the same proportion you�re underinsured.

Source: krasneylaw.net

Source: krasneylaw.net

Underinsurance refers to an insufficient insurance policy. Underinsurance refers to an insufficient insurance policy. The consequence of under insured values would be compounded if the sum insured is set too low at the outset. A lot of people are underinsured without knowing it. Leaving you the policyholder, to pay for the remaining cost;

Source: viranilaw.ca

Source: viranilaw.ca

Underinsurance comes from having wrong coverage or insufficient coverage for your small business. What happens if the property is underinsured. Buildings insurance contents insurance business interruption cyber liability underinsurance summary underinsurance occurs when your property is insured for less than its true value. Most people understand that if you are underinsured it means you may not have enough insurance money to rebuild and replace back to the same standard you are at right now. The truth is, homeowners today pay more than they need to insure their homes.

Source: ddf.com.au

Source: ddf.com.au

What happens if the property is under insured? When you come to make a claim, if the sums insured are not sufficient to pay the full cost of rebuilding your property, your claim may not be met in full. In this case, that’s £15,000 worth of equipment cover minus 25% (£5,000) underinsured, so a total payout of only £11,250….£8,750 shy of the true replacement cost. What happens if my home is under insured? Mlfpllc.com this would mean that in the event of a claim, insurers will not pay the full amount, they will apply what is known as ‘average’.

Source: aesthetecurator.com

Source: aesthetecurator.com

The insurance policies where underinsurance commonly occurs are: The truth is, homeowners today pay more than they need to insure their homes. In the event of a claim, being underinsured may result in economic losses for the policyholder, since the claim could exceed the maximum amount that could be paid out by the insurance policy. The average clause states that if your property is underinsured, your insurer is only liable to pay for a percentage of the value of items lost. Simply put, being underinsured means you have a policy that only covers a portion of your losses in a claim, often because of exclusions or coverage limits.

Source: grlittle.com

Source: grlittle.com

Determined by the percentage your property is under insured. For example, if you�re underinsured by 20 perecent, and your house costs $200,000 to replace, you’d be short by $40,000. What happens if the property is under insured? According to mozo data manager peter marshall, being underinsured can deliver a big blow to aussies’ wallets, right when they need help the most. Leaving you the policyholder, to pay for the remaining cost;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what happens if the property is under insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information