What happens when car accident claim exceeds insurance limits Idea

Home » Trending » What happens when car accident claim exceeds insurance limits IdeaYour What happens when car accident claim exceeds insurance limits images are ready in this website. What happens when car accident claim exceeds insurance limits are a topic that is being searched for and liked by netizens now. You can Find and Download the What happens when car accident claim exceeds insurance limits files here. Get all free photos and vectors.

If you’re searching for what happens when car accident claim exceeds insurance limits images information related to the what happens when car accident claim exceeds insurance limits keyword, you have visit the ideal site. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

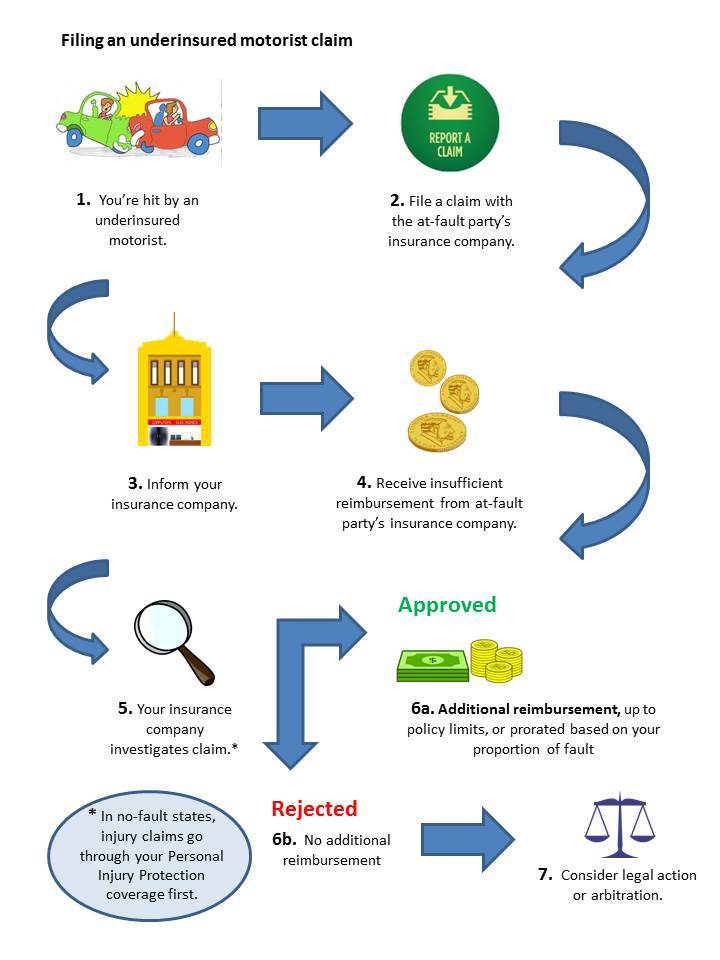

What Happens When Car Accident Claim Exceeds Insurance Limits. Statistically it is most improbable they will go after you in excess of the policy limit. You have many legal options available to you following a car accident in which your claim exceeds the negligent party’s insurance limits. If you or a loved one has recently been involved in an auto accident, you might be unsure of how insurance policy limits work. When a car accident claim exceeds insurance limits, you can file an uninsured/underinsured motorist (um/uim) claim, or you may need to take legal action.

What Happens When Car Accident Claim Exceeds Insurance From morning-news-live12.blogspot.com

What Happens When Car Accident Claim Exceeds Insurance From morning-news-live12.blogspot.com

When a car accident claim exceeds the insurance limits, the driver may be held liable for the damages. In many personal injury cases, the claim exceeds the policy limits. Also, if they make a policy limit demand to your insurance carrier and your insurance carrier rejects it then your insurance carrier will be on. But what happens when your car accident claim exceeds insurance policy limits? This can be a costly mistake, especially if the driver is not wealthy. We bring kentucky courage to your claim.

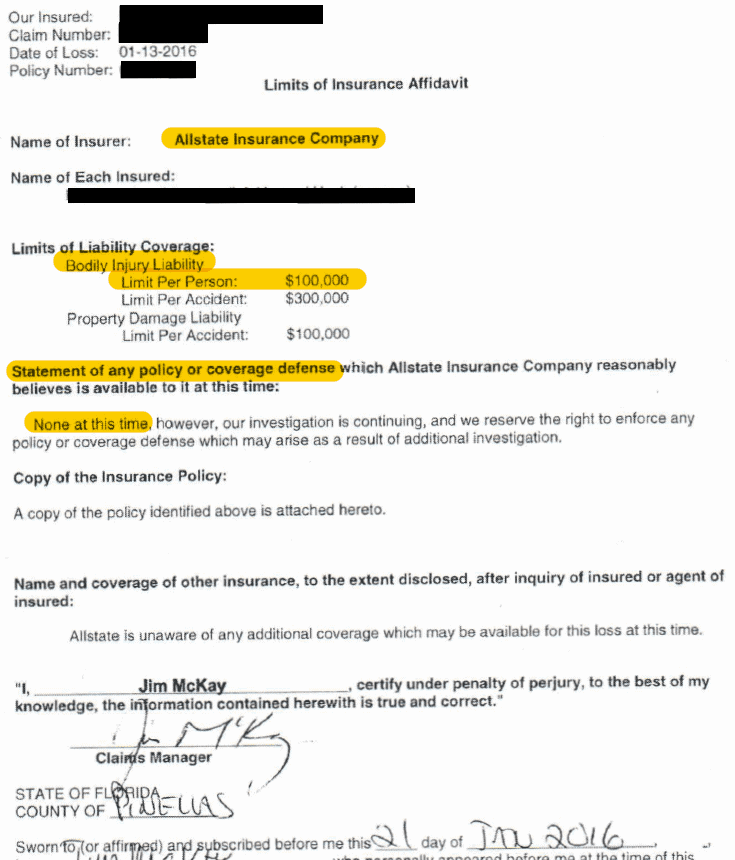

As an example, if an individual obtains an insurance policy with a $60,000 limit, the insurance provider will pay upwards of this amount but not in excess of it in the event of personal injury litigation.

If you or a loved one has recently been involved in an auto accident, you might be unsure of how insurance policy limits work. Time is of the essence following a catastrophic accident and what happens when a car accident claim exceeds insurance limits can depend on your specific actions after an accident. However, what happens if your damages exceed the insurance policy’s claim limits? The state has a mandatory minimum for the coverages to help protect the citizens. This can be a costly mistake, especially if the driver is not wealthy. When this happens, the victim may be left wondering how to pay their remaining medical bills and lost wages.

Source: 3000insurancegroup.com

Source: 3000insurancegroup.com

Obviously, uninsured drivers will exceed the settlement limit, but underinsured drivers present a financial danger after the accident. Obviously, uninsured drivers will exceed the settlement limit, but underinsured drivers present a financial danger after the accident. Here are your three basic options for seeking compensation in excess of an insurance policy limit after an auto accident: You can get compensation directly from them, by filing suit against them or from an umbrella insurance policy if they have. In many personal injury cases, the claim exceeds the policy limits.

Source: georgiaautolaw.com

Source: georgiaautolaw.com

The post what happens when a car accident claim exceeds insurance limits? After a car accident , motorcycle accident , truck collision, or other accident in georgia, contact a lawyer at the graham firm as soon as possible to discuss your legal rights and options to file a claim. Our carlsbad car accident lawyers provide you with a free consultation where we can discuss your options. No matter the costs of your injuries, if the accident was the fault of the other driver, they have the legal obligation to cover the costs. The post what happens when a car accident claim exceeds insurance limits?

Source: motorera.com

Source: motorera.com

An excess judgment in florida is when the judgment in the case exceeds the policy limit. Obviously, uninsured drivers will exceed the settlement limit, but underinsured drivers present a financial danger after the accident. No matter the costs of your injuries, if the accident was the fault of the other driver, they have the legal obligation to cover the costs. “probably 85 to 90 percent of the people nationally involved in accidents have insurance and most claims are well under their limits,” hunter estimates. Appeared first on morgan, collins, yeast & salyer.

Source: justicecounts.com

Source: justicecounts.com

Most states, including north carolina law allows driver’s to purchase extra auto insurance call underinsured motorist coverage. “probably 85 to 90 percent of the people nationally involved in accidents have insurance and most claims are well under their limits,” hunter estimates. This can be hard to do if the defendant does not have cash or assets to pay you. If the value of your insurance claim potentially exceeds the amount of liability coverage available under the other (driver�s) insurance, you have the option of filing a insurance claim under your own policy for. It’s the big disasters that you really need to insure against.

Source: toronto9design.blogspot.com

Source: toronto9design.blogspot.com

If the value of your insurance claim potentially exceeds the amount of liability coverage available under the other (driver�s) insurance, you have the option of filing a insurance claim under your own policy for. After a car accident , motorcycle accident , truck collision, or other accident in georgia, contact a lawyer at the graham firm as soon as possible to discuss your legal rights and options to file a claim. What happens when a car accident claim exceeds the insurance limits? When the judgment in the case is for a higher amount than the insured party has as. We bring kentucky courage to your claim.

Source: mahmudinsurance.blogspot.com

Source: mahmudinsurance.blogspot.com

It’s the big disasters that you really need to insure against. If you or a loved one has recently been involved in an auto accident, you might be unsure of how insurance policy limits work. But what happens when your car accident claim exceeds insurance policy limits? Statistically it is most improbable they will go after you in excess of the policy limit. Florida’s required auto insurance policy limits florida state law requires all drivers to carry insurance on their vehicles.

Source: justicecounts.com

Source: justicecounts.com

Learn more about your options by contacting an experienced car accident attorney at the law office of daniel h. 2 found this answer helpful. Find out how to proceed if your car accident claim exceeds an insurance policy’s limits in arizona. Victims can turn to their own insurer for some additional coverage. When a car accident claim happens to exceed the insurance limits usually one of three things result:

Source: patrickmalonelaw.com

Source: patrickmalonelaw.com

If you or a loved one has recently been involved in an auto accident, you might be unsure of how insurance policy limits work. When this happens, the victim may be left wondering how to pay their remaining medical bills and lost wages. Obviously, uninsured drivers will exceed the settlement limit, but underinsured drivers present a financial danger after the accident. If medical needs exceed available insurance, the insurer for the driver who caused the accident will still not pay more than policy limits. Find out how to proceed if your car accident claim exceeds an insurance policy’s limits in arizona.

Source: justinziegler.net

Source: justinziegler.net

Appeared first on morgan, collins, yeast & salyer. Our carlsbad car accident lawyers provide you with a free consultation where we can discuss your options. If the value of your insurance claim potentially exceeds the amount of liability coverage available under the other (driver�s) insurance, you have the option of filing a insurance claim under your own policy for. (2) a jury will return an “over limits” verdict against a collectible defendant; The insurance policy will also cover no more than $25,000 for damages to any claimant’s vehicle, such as repair or replacement value of their vehicle.

Source: michiganautolaw.com

Source: michiganautolaw.com

It’s the big disasters that you really need to insure against. When the judgment in the case is for a higher amount than the insured party has as. In many personal injury cases, the claim exceeds the policy limits. If medical needs exceed available insurance, the insurer for the driver who caused the accident will still not pay more than policy limits. If your medical bills exceed the defendant’s car insurance policy limit, the defendant is still legally liable to pay the full amount of your damages.

Source: justicecounts.com

Source: justicecounts.com

In many personal injury cases, the claim exceeds the policy limits. When a car accident claim exceeds insurance limits, you can file an uninsured/underinsured motorist (um/uim) claim, or you may need to take legal action. If the damage from your car accident exceeds policy limits, you could be left with staggering medical bills, a totaled vehicle, and the inability to return to work due to your injuries. No matter the costs of your injuries, if the accident was the fault of the other driver, they have the legal obligation to cover the costs. After a car accident , motorcycle accident , truck collision, or other accident in georgia, contact a lawyer at the graham firm as soon as possible to discuss your legal rights and options to file a claim.

Source: morning-news-live12.blogspot.com

Source: morning-news-live12.blogspot.com

This can be a costly mistake, especially if the driver is not wealthy. Find out how to proceed if your car accident claim exceeds an insurance policy’s limits in arizona. In many personal injury cases, the claim exceeds the policy limits. But what happens when your car accident claim exceeds insurance policy limits? When the judgment in the case is for a higher amount than the insured party has as.

Source: reducemyexcess.co.uk

Source: reducemyexcess.co.uk

The insurance policy will also cover no more than $25,000 for damages to any claimant’s vehicle, such as repair or replacement value of their vehicle. No matter the costs of your injuries, if the accident was the fault of the other driver, they have the legal obligation to cover the costs. If the accident victim endured subsequent damages that amount to $100,000, $60,000 can be obtained from the insurance provider. When a car accident claim exceeds the insurance limits, the driver may be held liable for the damages. Florida’s required auto insurance policy limits florida state law requires all drivers to carry insurance on their vehicles.

Source: megeredchianlaw.com

Source: megeredchianlaw.com

Florida’s required auto insurance policy limits florida state law requires all drivers to carry insurance on their vehicles. When a car accident claim exceeds insurance limits, you can file an uninsured/underinsured motorist (um/uim) claim, or you may need to take legal action. When the judgment in the case is for a higher amount than the insured party has as. After a car accident , motorcycle accident , truck collision, or other accident in georgia, contact a lawyer at the graham firm as soon as possible to discuss your legal rights and options to file a claim. Find out how to proceed if your car accident claim exceeds an insurance policy’s limits in arizona.

Source: toronto9design.blogspot.com

Source: toronto9design.blogspot.com

We bring kentucky courage to your claim. If the driver is found liable, they may be required to pay the damages out of their own pocket. We bring kentucky courage to your claim. When a car accident claim happens to exceed the insurance limits usually one of three things result: What happens when a car accident claim exceeds the from www.rcslawfirm.com.

Source: michiganautolaw.com

Source: michiganautolaw.com

We bring kentucky courage to your claim. Our carlsbad car accident lawyers provide you with a free consultation where we can discuss your options. Learn more about your options by contacting an experienced car accident attorney at the law office of daniel h. If the damage from your car accident exceeds policy limits, you could be left with staggering medical bills, a totaled vehicle, and the inability to return to work due to your injuries. Also, if they make a policy limit demand to your insurance carrier and your insurance carrier rejects it then your insurance carrier will be on.

Source: rcslawfirm.com

Source: rcslawfirm.com

No matter the costs of your injuries, if the accident was the fault of the other driver, they have the legal obligation to cover the costs. No matter the costs of your injuries, if the accident was the fault of the other driver, they have the legal obligation to cover the costs. If your medical bills exceed the defendant’s car insurance policy limit, the defendant is still legally liable to pay the full amount of your damages. In many personal injury cases, the claim exceeds the policy limits. This can be a costly mistake, especially if the driver is not wealthy.

Source: hauglawgroup.com

Source: hauglawgroup.com

It’s the big disasters that you really need to insure against. If the damage from your car accident exceeds policy limits, you could be left with staggering medical bills, a totaled vehicle, and the inability to return to work due to your injuries. When a car accident claim exceeds insurance limits, you can file an uninsured/underinsured motorist (um/uim) claim, or you may need to take legal action. It’s the big disasters that you really need to insure against. Most states, including north carolina law allows driver’s to purchase extra auto insurance call underinsured motorist coverage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what happens when car accident claim exceeds insurance limits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information