What happens when term life insurance expires Idea

Home » Trend » What happens when term life insurance expires IdeaYour What happens when term life insurance expires images are available. What happens when term life insurance expires are a topic that is being searched for and liked by netizens now. You can Get the What happens when term life insurance expires files here. Download all free images.

If you’re looking for what happens when term life insurance expires images information linked to the what happens when term life insurance expires topic, you have pay a visit to the ideal blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

What Happens When Term Life Insurance Expires. Therefore, you’re guaranteed a financial payout in the event of your death. The second option is possible when you buy a term plan with a return of premium option. If your policy’s term is coming to an end, you can just let the coverage expire and go without life insurance. If you outlive your term life insurance policy, the money you have put in, will stay with the insurance company.

What to Do When Your Term Life Insurance Policy Runs Out From lifeinsure.com

What to Do When Your Term Life Insurance Policy Runs Out From lifeinsure.com

Many use life insurance as replacement income in the event of premature or unexpected death. If your term life insurance policy expires without doing anything, most probably it will be gone and you will no longer be covered; A renewable term life insurance policy is automatically renewed upon the expiration of the term. Term life insurance is not a savings or investment plan. Term life insurance doesn’t necessarily expire—what does expire is the rate that you were paying. It’s best to consider your options when you first purchase a policy rather than waiting until the policy expires.

At the end of your term, coverage will end and your payments to the insurance company will be complete.

A renewable term life insurance policy is automatically renewed upon the expiration of the term. Generally, when people buy term life insurance, they rarely give much thought to. When the original term expires, if you don’t do anything, your term life insurance will automatically renew on a yearly basis until its ultimate expiry date. The second option is possible when you buy a term plan with a return of premium option. Your coverage term starting date and expiration date are stated on the declaration page of your. The plan expires without a maturity value, the life cover benefit ends.

Source: lifeinsure.com

Source: lifeinsure.com

The downside is you’ll pay more than a regular term life policy. Options to consider when your policy expires as you approach the end of your policy, you may decide that your life insurance is still valuable. Many use life insurance as replacement income in the event of premature or unexpected death. When the original term expires, if you don’t do anything, your term life insurance will automatically renew on a yearly basis until its ultimate expiry date. Therefore, you’re guaranteed a financial payout in the event of your death.

Source: youtube.com

Source: youtube.com

Your coverage term starting date and expiration date are stated on the declaration page of your. Before your term life insurance expires, you may be able to speak to your insurance provider and convert your term life insurance to a whole life policy. If rop interests you, compare policies with and without that rider to see whether the extra cost is worth it. Remember, the only thing that really “expires” at the end of a term life insurance period is the low rate you’ve been paying. If you outlive your term life policy, you usually don’t get any money.

Source: businesscoverexpert.com

Source: businesscoverexpert.com

Return of premium (rop) term life gives you back the premiums. When your term life insurance comes to an end, you can do one of three things: If your term life insurance policy expires but you still need coverage, you may be able to renew it, convert it or buy another one. A term insurance policy ends at the end of the policy term you choose when you take out your coverage. If your policy’s term is coming to an end, you can just let the coverage expire and go without life insurance.

Source: blogpapi.com

Source: blogpapi.com

When does term life insurance expire? This means you can keep your existing policy in force by continuing to pay the premiums. When your term life insurance comes to an end, you can do one of three things: A term insurance policy ends at the end of the policy term you choose when you take out your coverage. At the end of your term, coverage will end and your payments to the insurance company will be complete.

Source: elisorte.blogspot.com

You can always notify canada life if you don’t want to renew. Generally, when people buy term life insurance, they rarely give much thought to. Renew — simply renew your policy with your existing insurer. A notice is sent by the insurance carrier that the policy is. This means you can keep your existing policy in force by continuing to pay the premiums.

Source: sungateinsurance.com

Source: sungateinsurance.com

Many use life insurance as replacement income in the event of premature or unexpected death. Rarely offered by insurance companies, decreasing term life insurance is usually a cheaper option for term life. When does term life insurance expire? If you outlive your term life insurance policy, the money you have put in, will stay with the insurance company. At the end of your term, coverage will end and your payments to the insurance company will be complete.

Source: drtjmantooth.blogspot.com

Source: drtjmantooth.blogspot.com

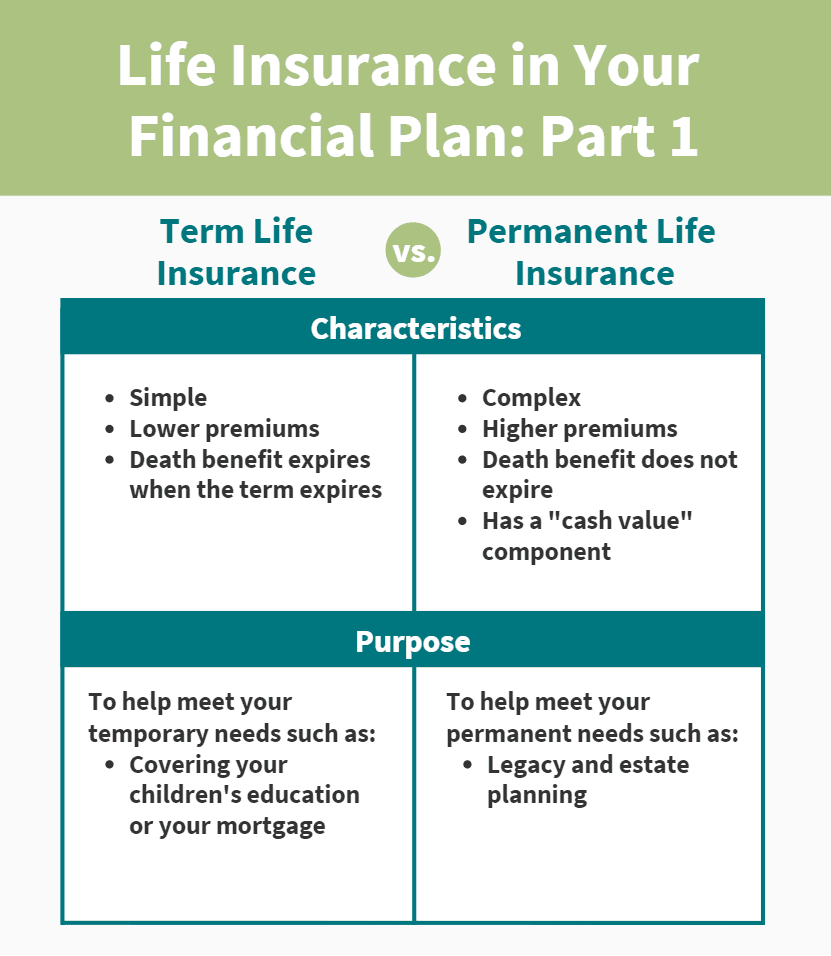

While a universal and whole life insurance policy provide permanent coverage with a cash value component 1, a term policy is a pure life insurance product designed only to give your beneficiaries a payout if you pass away during the term. At the end of your term, coverage will end and your payments to the insurance company will be complete. Mortgage, student loans, car loans, etc.) as well as provide income for families in the event of a premature death so that the surviving family. When your term life insurance comes to an end, you can do one of three things: The most common and affordable type of life insurance available in canada is term life insurance.term life insurance is typically used to cover outstanding debts (e.g.

Source: consumerboomer.com

Source: consumerboomer.com

This may sound like a good option, but in practice, the annual. If you outlive your term life policy, you usually don’t get any money. If your term life insurance policy expires without doing anything, most probably it will be gone and you will no longer be covered; If you outlive your term life insurance policy, the money you have put in, will stay with the insurance company. Here’s what to consider when your term life insurance expires.

Source: drtjmantooth.blogspot.com

Source: drtjmantooth.blogspot.com

What happens to a term life insurance policy when it expires? What happens when you reach the end of term life insurance? When the original term expires, if you don’t do anything, your term life insurance will automatically renew on a yearly basis until its ultimate expiry date. The life insurance company can increase your rate on an annual basis, usually until age 90 or age 95. If your policy’s term is coming to an end, you can just let the coverage expire and go without life insurance.

Source: aspenwealthmgmt.com

Source: aspenwealthmgmt.com

Here’s what to consider when your term life insurance expires. However, if you extend or apply for a new term policy, definitely, you will still enjoy the benefits of the coverage of your insurance company. This may sound like a good option, but in practice, the annual. What happens when my term life insurance policy runs out? Term life insurance doesn’t necessarily expire—what does expire is the rate that you were paying.

Source: lifeinsure.com

Source: lifeinsure.com

Here’s what to consider when your term life insurance expires. This means you can keep your existing policy in force by continuing to pay the premiums. The plan expires without a maturity value, the life cover benefit ends. A whole life insurance policy tends to be more expensive, but it lasts until you die. If you outlive your term life insurance policy, the money you have put in, will stay with the insurance company.

Source: pinterest.com

Source: pinterest.com

Options to consider when your policy expires as you approach the end of your policy, you may decide that your life insurance is still valuable. A term insurance policy ends at the end of the policy term you choose when you take out your coverage. The life insurance company can increase your rate on an annual basis, usually until age 90 or age 95. This may sound like a good option, but in practice, the annual. At the end of your term, coverage will end and your payments to the insurance company will be complete.

Source: coastalwealthmanagement24.com

Source: coastalwealthmanagement24.com

At the end of your term, coverage will end and your payments to the insurance company will be complete. When the original term expires, if you don’t do anything, your term life insurance will automatically renew on a yearly basis until its ultimate expiry date. Before your term life insurance expires, you may be able to speak to your insurance provider and convert your term life insurance to a whole life policy. What happens when my term life insurance policy runs out? If rop interests you, compare policies with and without that rider to see whether the extra cost is worth it.

Source: pinterest.com

Source: pinterest.com

What happens when you reach the end of term life insurance? What happens if your term life insurance ends? If you outlive your term life insurance policy, the money you have put in, will stay with the insurance company. However, your premiums will increase if renewed. However, if you extend or apply for a new term policy, definitely, you will still enjoy the benefits of the coverage of your insurance company.

Source: ennajapan.blogspot.com

Source: ennajapan.blogspot.com

If your term life insurance policy expires without doing anything, most probably it will be gone and you will no longer be covered; Generally, when people buy term life insurance, they rarely give much thought to. If your policy is expiring. A whole life insurance policy tends to be more expensive, but it lasts until you die. Renew — simply renew your policy with your existing insurer.

![]() Source: mybanktracker.com

Source: mybanktracker.com

Many use life insurance as replacement income in the event of premature or unexpected death. Options to consider when your policy expires as you approach the end of your policy, you may decide that your life insurance is still valuable. Although retirees won’t have an income to replace in the traditional sense, there may be other reasons that a policy would make sense. The life insurance company can increase your rate on an annual basis, usually until age 90 or age 95. While a universal and whole life insurance policy provide permanent coverage with a cash value component 1, a term policy is a pure life insurance product designed only to give your beneficiaries a payout if you pass away during the term.

Source: consumerboomer.com

Source: consumerboomer.com

Before your term life insurance expires, you may be able to speak to your insurance provider and convert your term life insurance to a whole life policy. If you outlive your term life policy, you usually don’t get any money. If your policy is expiring. Mortgage, student loans, car loans, etc.) as well as provide income for families in the event of a premature death so that the surviving family. What happens if your term life insurance ends?

Source: canadalife.com

Source: canadalife.com

While a universal and whole life insurance policy provide permanent coverage with a cash value component 1, a term policy is a pure life insurance product designed only to give your beneficiaries a payout if you pass away during the term. A renewable term life insurance policy is automatically renewed upon the expiration of the term. If your term life insurance policy expires but you still need coverage, you may be able to renew it, convert it or buy another one. If your policy is expiring. If your term life insurance policy expires without doing anything, most probably it will be gone and you will no longer be covered;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what happens when term life insurance expires by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information