What insurance do i need in singapore Idea

Home » Trending » What insurance do i need in singapore IdeaYour What insurance do i need in singapore images are available in this site. What insurance do i need in singapore are a topic that is being searched for and liked by netizens today. You can Download the What insurance do i need in singapore files here. Download all royalty-free photos and vectors.

If you’re looking for what insurance do i need in singapore images information related to the what insurance do i need in singapore interest, you have pay a visit to the right site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

What Insurance Do I Need In Singapore. The main medical expense insurance plans pay a portion of hospital and surgical costs if you�re ill or suffering from injuries due to an accident. Here�s a basic guide to the insurance policies you need in singapore, including how long do you need insurance for, how much insurance coverage you need, and what type of insurance policies should you purchase. Pay an additional premium either from your medisave account or in cash, and you’ll be covered for. It’s designed to cover any and all damage to your car (assuming it’s within any policy limits).

Car Insurance in Singapore All You Need to Know to Get From blog.moneysmart.sg

Car Insurance in Singapore All You Need to Know to Get From blog.moneysmart.sg

The short answer is yes. Your property is a big investment, buying a fire insurance policy brings you peace of mind as it covers you for losses or damages resulting from a fire. With hdb flats protected by mandatory fire insurance, and condominiums units insured by the management corporation (mc), is home insurance necessary in singapore? The insurance must be at least €30,000 and valid in all 26 schengen countries. According to life insurance association singapore, you should aim to have approximately 11 times your. Personal accident insurance the personal accident insurance purchased for your helper must meet all of these requirements:

A fire insurance policy can be bought by anyone who is a legal owner of a residential landed property or an apartment.

In this guide, we’ll cover everything you need to know about term life insurance plans in singapore. This is a national annuity scheme that will give you monthly payouts for as long as you live. Whether you visit bangkok or fly back home to see your relatives, you can trust your health cover 24/7. You may enhance your medishield coverage by purchasing an integrated shield plan, which is offered by some private insurers in singapore. Personal accident insurance the personal accident insurance purchased for your helper must meet all of these requirements: Health insurance helps pay for health care costs in the event of an injury, illness or disability.

Source: pacificprime.sg

Source: pacificprime.sg

Apart from medical expense insurance, there are other types of health insurance plans. With hdb flats protected by mandatory fire insurance, and condominiums units insured by the management corporation (mc), is home insurance necessary in singapore? (you must be not able to do some of the basic routines, eg walking, bathing, eating etc) In this guide, we’ll cover everything you need to know about term life insurance plans in singapore. All singaporeans are covered under medishield life, a basic government health plan to cover large medical expenses.

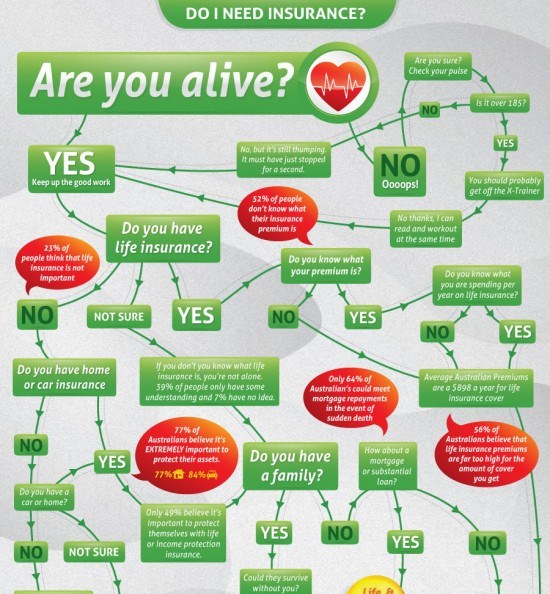

Source: visual.ly

Source: visual.ly

Medishield life (compulsory for singapore citizens and prs), integrated shield plans, other hospital and medical plans and riders. The main medical expense insurance plans pay a portion of hospital and surgical costs if you�re ill or suffering from injuries due to an accident. A fire insurance policy can be bought by anyone who is a legal owner of a residential landed property or an apartment. All singaporeans are covered under medishield life, a basic government health plan to cover large medical expenses. This is a national annuity scheme that will give you monthly payouts for as long as you live.

Source: blog.moneysmart.sg

Source: blog.moneysmart.sg

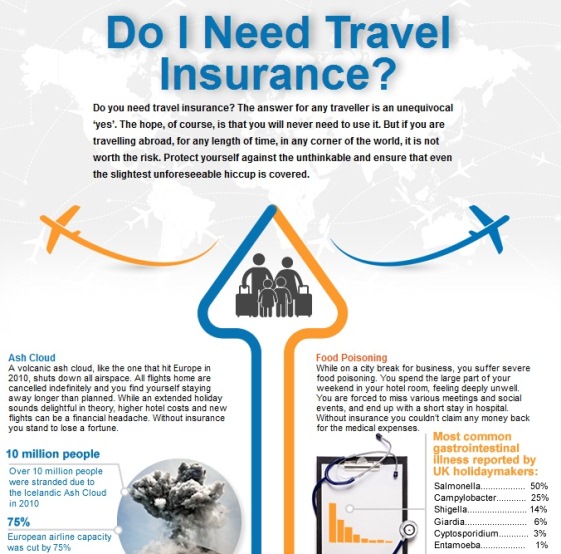

Whether you visit bangkok or fly back home to see your relatives, you can trust your health cover 24/7. You may enhance your medishield coverage by purchasing an integrated shield plan, which is offered by some private insurers in singapore. Fire insurance makes good sense. Especially for young professionals who have just started working in their early 20s, insurance is usually not one of their priorities. Apart from medical expense insurance, there are other types of health insurance plans.

Source: noclutter.cloud

Source: noclutter.cloud

According to life insurance association singapore, you should aim to have approximately 11 times your. This is a national annuity scheme that will give you monthly payouts for as long as you live. In this guide, we’ll cover everything you need to know about term life insurance plans in singapore. Health insurance protect us against the possibility of falling ill and incurring high healthcare cost. Health insurance helps pay for health care costs in the event of an injury, illness or disability.

Source: iselect.com.au

Source: iselect.com.au

It is a compulsory requirement to have car insurance in singapore. Any health condition(s) you have at the time of your insurance application may be excluded, which means that the policy will not pay on your claim related to the health. You may enhance your medishield coverage by purchasing an integrated shield plan, which is offered by some private insurers in singapore. The 4 types of coverage you need 1. Hospitalisation insurance help to cover the cost of medical bills in the event of injury/illness with hospital admission.

Source: kwiksure.sg

Source: kwiksure.sg

While health insurance is meant to cover our healthcare cost. Your personal advisor is always here to advise you This is because they are simply not aware of how much coverage they need. Different types of car insurance comprehensive car insurance comprehensive car insurance gives the highest level of protection for your vehicle. This is a national annuity scheme that will give you monthly payouts for as long as you live.

Source: dbs.com.sg

Source: dbs.com.sg

By subscribing to our myhealth , our international health insurance plan designed for people in singapore, you are covered anywhere in the world and know that you are safe. Whether you visit bangkok or fly back home to see your relatives, you can trust your health cover 24/7. While health insurance is meant to cover our healthcare cost. Why do i need fire insurance? In this guide, we’ll cover everything you need to know about term life insurance plans in singapore.

Source: fwd.com.sg

Source: fwd.com.sg

Get a free schengen visa insurance quote now! While health insurance is meant to cover our healthcare cost. A fire insurance policy can be bought by anyone who is a legal owner of a residential landed property or an apartment. Medishield is a mandatory national insurance that all singaporeans and prs need to purchase. You may enhance your medishield coverage by purchasing an integrated shield plan, which is offered by some private insurers in singapore.

Source: visual.ly

Source: visual.ly

Health insurance helps pay for health care costs in the event of an injury, illness or disability. To add on, insurance companies are aggressively competing with each other, which meant even more affordable rates for the consumer. Personal accident insurance the personal accident insurance purchased for your helper must meet all of these requirements: It is a compulsory requirement to have car insurance in singapore. Here�s a basic guide to the insurance policies you need in singapore, including how long do you need insurance for, how much insurance coverage you need, and what type of insurance policies should you purchase.

Source: blog.moneysmart.sg

Source: blog.moneysmart.sg

Pay an additional premium either from your medisave account or in cash, and you’ll be covered for. This is because they are simply not aware of how much coverage they need. The short answer is yes. All singaporeans are covered under medishield life, a basic government health plan to cover large medical expenses. Hospitalisation insurance help to cover the cost of medical bills in the event of injury/illness with hospital admission.

Source: infographicszone.com

Source: infographicszone.com

Have a sum assured of at least $60,000 per year. Pay an additional premium either from your medisave account or in cash, and you’ll be covered for. Medishield life (compulsory for singapore citizens and prs), integrated shield plans, other hospital and medical plans and riders. The main medical expense insurance plans pay a portion of hospital and surgical costs if you�re ill or suffering from injuries due to an accident. Singapore has one of the best healthcare systems in the world.

While health insurance is meant to cover our healthcare cost. Especially for young professionals who have just started working in their early 20s, insurance is usually not one of their priorities. This is because they are simply not aware of how much coverage they need. Medical insurance you need to buy medical insurance with a coverage of at least $15,000 per year for inpatient care and day surgery during your helper’s stay in singapore. Medishield life (compulsory for singapore citizens and prs), integrated shield plans, other hospital and medical plans and riders.

Medical insurance you need to buy medical insurance with a coverage of at least $15,000 per year for inpatient care and day surgery during your helper’s stay in singapore. The short answer is yes. Health insurance protect us against the possibility of falling ill and incurring high healthcare cost. According to life insurance association singapore, you should aim to have approximately 11 times your. It’s designed to cover any and all damage to your car (assuming it’s within any policy limits).

Source: infographicszone.com

Source: infographicszone.com

Personal accident insurance the personal accident insurance purchased for your helper must meet all of these requirements: In this guide, we’ll cover everything you need to know about term life insurance plans in singapore. Hospitalisation insurance help to cover the cost of medical bills in the event of injury/illness with hospital admission. The insurance must be at least €30,000 and valid in all 26 schengen countries. Medishield life (compulsory for singapore citizens and prs), integrated shield plans, other hospital and medical plans and riders.

Source: youtube.com

Source: youtube.com

(you must be not able to do some of the basic routines, eg walking, bathing, eating etc) Personal accident insurance the personal accident insurance purchased for your helper must meet all of these requirements: Singapore has one of the best healthcare systems in the world. In this guide, we’ll cover everything you need to know about term life insurance plans in singapore. Foreigners don�t qualify for it.

![What Type of Life Insurance Do I Need? [INFOGRAPHIC] What Type of Life Insurance Do I Need? [INFOGRAPHIC]](http://infographicplaza.com/wp-content/uploads/Life-Insurance-Infographic-plaza.jpg) Source: infographicplaza.com

Source: infographicplaza.com

Medishield life (compulsory for singapore citizens and prs), integrated shield plans, other hospital and medical plans and riders. It is a compulsory requirement to have car insurance in singapore. Pay an additional premium either from your medisave account or in cash, and you’ll be covered for. Different types of car insurance comprehensive car insurance comprehensive car insurance gives the highest level of protection for your vehicle. Why do i need fire insurance?

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

You may enhance your medishield coverage by purchasing an integrated shield plan, which is offered by some private insurers in singapore. This is a requirement regardless. Especially for young professionals who have just started working in their early 20s, insurance is usually not one of their priorities. A fire insurance policy can be bought by anyone who is a legal owner of a residential landed property or an apartment. Get a free schengen visa insurance quote now!

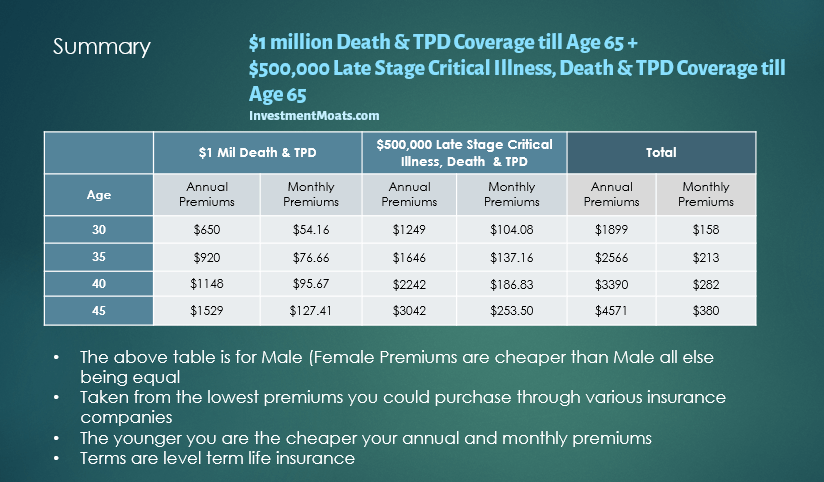

Source: investmentmoats.com

Source: investmentmoats.com

Especially for young professionals who have just started working in their early 20s, insurance is usually not one of their priorities. It makes sense to protect the biggest asset you own, yet many singaporeans overlook buying home insurance. Any health condition(s) you have at the time of your insurance application may be excluded, which means that the policy will not pay on your claim related to the health. Singapore has one of the best healthcare systems in the world. Have a sum assured of at least $60,000 per year.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what insurance do i need in singapore by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information