What insurance should my builder have Idea

Home » Trending » What insurance should my builder have IdeaYour What insurance should my builder have images are available in this site. What insurance should my builder have are a topic that is being searched for and liked by netizens today. You can Get the What insurance should my builder have files here. Get all royalty-free images.

If you’re looking for what insurance should my builder have pictures information connected with to the what insurance should my builder have topic, you have visit the ideal site. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

What Insurance Should My Builder Have. Finally, you (or your contractor) should carry builder’s risk insurance, which covers damage to the building or materials during construction. Most contractors operate vehicles as a component of the job. This will ensure you are covered against any potential claims for damage to the person and/or their property. A good builder liability insurance coverage can protect against injuries, accidents, or property damage suffered on the job.

What Should Be Included in a Construction Contract Post From feldman.law

What Should Be Included in a Construction Contract Post From feldman.law

What kind of insurance should my builder have? In the unlikely event that something does go wrong with the build, you need to make sure you will be fully covered and protected. Make sure your builder is covered with sufficient public liability insurance to ensure you are not taking unnecessary risk with your building project and your home. If you are building the home yourself, then having regular insurance would protect you against someone stealing your materials or accidentally shooting your hand with the nail gun. Here are five coverages builders should secure in order to properly protect their business. Accidental damage to the building accidental damage to adjoining property any personal injury.

While builder insurance needs can vary from one builder to another, there are some basic coverages to look for when hiring a builder.

Most contractors operate vehicles as a component of the job. Insurance it�s good to have. General liability in most states general liability insurance is. If your builder has any other person working for them who’s not a direct family member, they’re legally required to have this insurance in place. Also he would be changing the radiators with the help of a plumber and adding a ceiling to the kitchen. If they don�t have any, you might want to think about getting your own cover.

Source: equipter.com

Source: equipter.com

General liability insurance should be provided by the builder to protect both the builder and the homeowner. This will ensure you are covered against any potential claims for damage to the person and/or their property. Building surveyor (unlimited) building surveyor (limited) building inspector (unlimited) building inspector (limited). He will be doing just flooring and removing wall paper, skimming, filling and painting the walls. Pl insurance should be renewed every 12 months.

Source: riddlebergerinsurance.com

Source: riddlebergerinsurance.com

General liability in most states general liability insurance is. He will be doing just flooring and removing wall paper, skimming, filling and painting the walls. Pl insurance should be renewed every 12 months. We are hiring a small builder who has no public liability or any kind of insurance. There are three types of insurance every trusted home improvement company should have:

Source: build.saint-gobain.co.uk

Any reputable builder will have public liability insurance and will be happy to show you, so i would ask to see it and let them know your home insurer is requesting the amount of cover. General liability in most states general liability insurance is. In addition, your contractor should require that his subcontractors provide him with their proof of insurance. Make sure your builder is covered with sufficient public liability insurance to ensure you are not taking unnecessary risk with your building project and your home. Builders risk insurance, also known as course of construction (coc) insurance, or sometimes construction all risk insurance, is insurance coverage for buildings and other structures while they are under construction.

Source: tceins.com

Source: tceins.com

Also known as “course of construction” insurance, covered risks typically include fire, storms, theft and vandalism. Builders risk insurance, also known as course of construction (coc) insurance, or sometimes construction all risk insurance, is insurance coverage for buildings and other structures while they are under construction. General liability insurance should be provided by the builder to protect both the builder and the homeowner. Pl insurance should be renewed every 12 months. A good builder liability insurance coverage can protect against injuries, accidents, or property damage suffered on the job.

Source: haggertylaw.com

Source: haggertylaw.com

General liability insurance should be provided by the builder to protect both the builder and the homeowner. Most contractors operate vehicles as a component of the job. In the event of a physical loss caused by electrical, mechanical, pneumatic and hydrostatic testing, builders risk insurance policy can help cover the costs of the loss. If you work near other people and/or their property, which is basically anyone in construction, you should consider having pl insurance. Accidental damage caused by alterations, repairs, maintenance, restoration, dismantling or renovating are not usually covered in your buildings or contents insurance.

Source: builtininsurance.co.nz

Source: builtininsurance.co.nz

This will ensure you are covered against any potential claims for damage to the person and/or their property. Finally, you (or your contractor) should carry builder’s risk insurance, which covers damage to the building or materials during construction. This article presents a thorough understanding of the benefits, limitation. Building surveyor (unlimited) building surveyor (limited) building inspector (unlimited) building inspector (limited). A good builder liability insurance coverage can protect against injuries, accidents, or property damage suffered on the job.

Source: dempseyweiss.com

Source: dempseyweiss.com

Accidental damage caused by alterations, repairs, maintenance, restoration, dismantling or renovating are not usually covered in your buildings or contents insurance. Most building insurance policies, including suncorp’s home building insurance, cover the house itself. In addition, your contractor should require that his subcontractors provide him with their proof of insurance. Who needs public liability insurance? It is very important that your builder has public liability insurance;

Source: farmerbrown.com

Source: farmerbrown.com

Accidental damage caused by alterations, repairs, maintenance, restoration, dismantling or renovating are not usually covered in your buildings or contents insurance. Most building insurance policies, including suncorp’s home building insurance, cover the house itself. In the unlikely event that something does go wrong with the build, you need to make sure you will be fully covered and protected. There are three types of insurance every trusted home improvement company should have: This will ensure you are covered against any potential claims for damage to the person and/or their property.

Source: rftsolutions.com.au

Source: rftsolutions.com.au

If you work near other people and/or their property, which is basically anyone in construction, you should consider having pl insurance. Don�t take any risks when having work done in your home, especially structural work. Most building insurance policies, including suncorp’s home building insurance, cover the house itself. They have liability insurance to cover anything that goes wrong. Most have a large amount of equipment or tools in them.

Source: wbwhite.com

Source: wbwhite.com

Make sure your builder is covered with sufficient public liability insurance to ensure you are not taking unnecessary risk with your building project and your home. For larger scale projects, builders risk insurance is important. Employers’ liability insurance covers your builder if an employee is killed or injured as a result of their work. If you’re considering building insurance, you should organise it as early as possible. Builders risk insurance, also known as course of construction (coc) insurance, or sometimes construction all risk insurance, is insurance coverage for buildings and other structures while they are under construction.

Source: jamisongroup.com

Source: jamisongroup.com

Understand what public liability insurance is and why it is needed. A legal requirement for limited companies. Finally, you (or your contractor) should carry builder’s risk insurance, which covers damage to the building or materials during construction. In the unlikely event that something does go wrong with the build, you need to make sure you will be fully covered and protected. This will ensure you are covered against any potential claims for damage to the person and/or their property.

Source: federated.ca

Source: federated.ca

Building surveyor (unlimited) building surveyor (limited) building inspector (unlimited) building inspector (limited). Don�t take any risks when having work done in your home, especially structural work. Builders risk insurance, also known as course of construction (coc) insurance, or sometimes construction all risk insurance, is insurance coverage for buildings and other structures while they are under construction. Other policies like homeowners insurance or commercial property insurance will typically not cover structures during construction. Also he would be changing the radiators with the help of a plumber and adding a ceiling to the kitchen.

Source: youtube.com

Source: youtube.com

The two forms of coverage you need to be financially protected in a building you’re working on or if your construction materials are damaged during construction are builders risk insurance and construction general liability insurance. Check to see whether subcontractors are covered in your builder�s policy. There are three types of insurance every trusted home improvement company should have: Other policies like homeowners insurance or commercial property insurance will typically not cover structures during construction. What kind of insurance should my builder have?

Source: feldman.law

Source: feldman.law

General liability in most states general liability insurance is. Check to see whether subcontractors are covered in your builder�s policy. Understand what public liability insurance is and why it is needed. Most building insurance policies, including suncorp’s home building insurance, cover the house itself. Who needs public liability insurance?

Source: builderonline.com

General liability insurance should be provided by the builder to protect both the builder and the homeowner. A good builder liability insurance coverage can protect against injuries, accidents, or property damage suffered on the job. Finally, you (or your contractor) should carry builder’s risk insurance, which covers damage to the building or materials during construction. Most contractors operate vehicles as a component of the job. Accidental damage caused by alterations, repairs, maintenance, restoration, dismantling or renovating are not usually covered in your buildings or contents insurance.

Source: plusonesolutions.net

Source: plusonesolutions.net

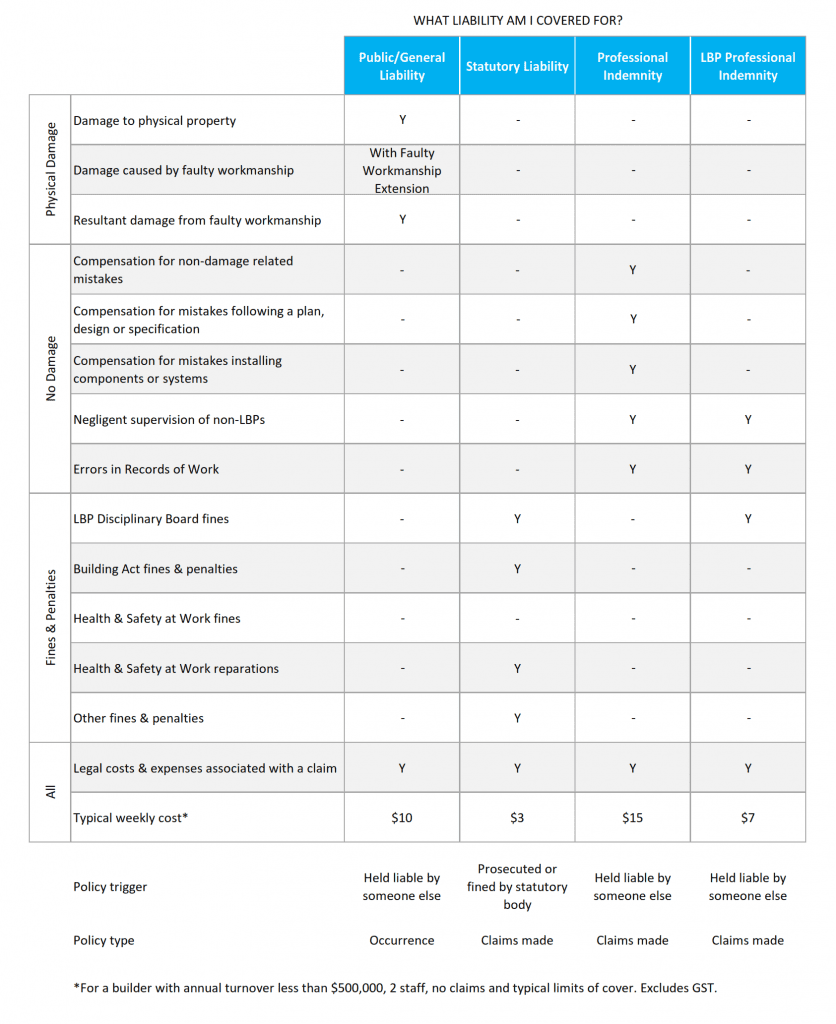

Building surveyor (unlimited) building surveyor (limited) building inspector (unlimited) building inspector (limited). This will ensure you are covered against any potential claims for damage to the person and/or their property. There are three types of insurance every trusted home improvement company should have: You need professional indemnity insurance for registration in any of the following building practitioner categories and classes: We are hiring a small builder who has no public liability or any kind of insurance.

Source: housely.com

Source: housely.com

This will ensure you are covered against any potential claims for damage to the person and/or their property. This article presents a thorough understanding of the benefits, limitation. This covers the structure against the perils named in the policy. It can help provide some protection for the materials, fixtures, and equipment used on the job. Other policies like homeowners insurance or commercial property insurance will typically not cover structures during construction.

Source: harrisclaimsservices.com

Source: harrisclaimsservices.com

Here are five coverages builders should secure in order to properly protect their business. Here are five coverages builders should secure in order to properly protect their business. It is very important that your builder has public liability insurance; Ordinarily, the coverage you need for a home under construction is dwelling and fire coverage. They have liability insurance to cover anything that goes wrong.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what insurance should my builder have by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information