What is a bond insurer information

Home » Trend » What is a bond insurer informationYour What is a bond insurer images are available in this site. What is a bond insurer are a topic that is being searched for and liked by netizens now. You can Find and Download the What is a bond insurer files here. Find and Download all free photos and vectors.

If you’re searching for what is a bond insurer images information related to the what is a bond insurer topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

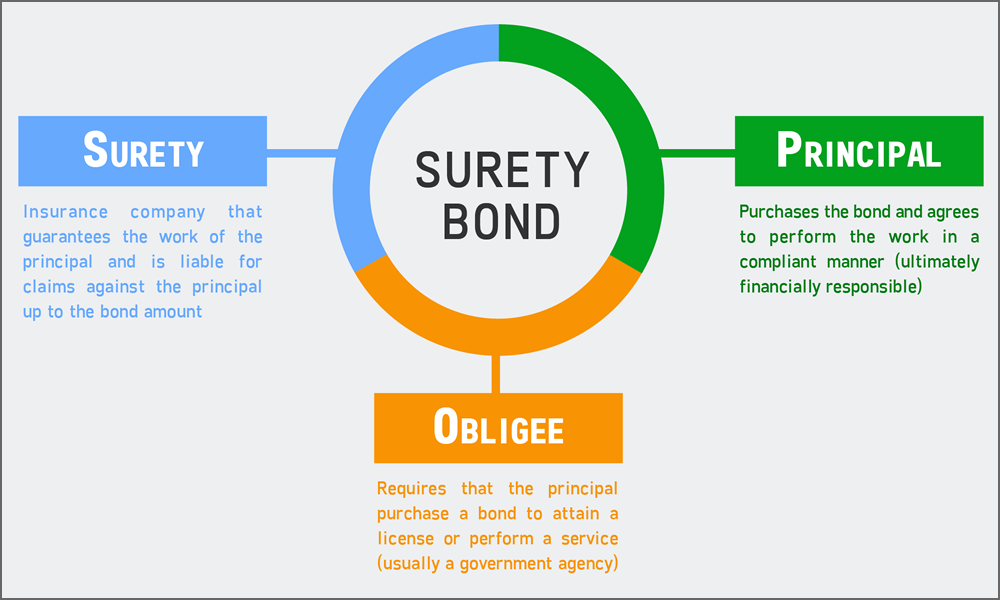

What Is A Bond Insurer. In fact, most governments require licensed contractors to have these bonds for that reason. Once purchased, the issuer�s bond rating is no longer applicable. Should something go wrong, the insurer will pay for the damages up to the policy limit. Definition in the dictionary english.

Insurance Bond Free of Charge Creative Commons Clipboard From picpedia.org

Insurance Bond Free of Charge Creative Commons Clipboard From picpedia.org

Fidelity bond insurance this is (typically) a policy that a company pays for annually. Here�s to george bond, insurance man, father. A road and sewer bond is a form of surety provided on behalf of a property developer or contractor to a local authority under the relevant planning conditions to ensure the roads and sewers can be and are completed to adoptable standards. Definition in the dictionary english. The bonds are also there to ensure that statutory obligations in relation to the construction and maintenance. Stealing funds or investing recklessly.

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity.

A probate surety bond guarantees that the principal will fulfill their duties and obligations under the law and the testator�s will. The courts and often the terms of the trust itself require most trustees to have a. Bond ratings are based on the credit of the insurer rather than the Bond insurer update 2014 bond insurance background. Fidelity bond insurance this is (typically) a policy that a company pays for annually. Bond insurer to heightened losses that could reveal pricing and capital inadequacies, resulting in poor risk/return relationships.

Source: theandrewagency.com

Source: theandrewagency.com

Stealing funds or investing recklessly. Once purchased, the issuer�s bond rating is no longer applicable. Fidelity bond insurance this is (typically) a policy that a company pays for annually. Bond insurance is a type of insurance purchased by a bond issuer to guarantee the repayment of the principal and all associated scheduled interest. Stealing funds or investing recklessly.

Source: 401ktv.com

Source: 401ktv.com

The bonds are also there to ensure that statutory obligations in relation to the construction and maintenance. A road and sewer bond is a form of surety provided on behalf of a property developer or contractor to a local authority under the relevant planning conditions to ensure the roads and sewers can be and are completed to adoptable standards. “bond insurance” is “financial guaranty insurance.” the terms “insured bond” and “wrapped bond” are synonymous. Unlike other p&c insurance companies which require policyholders to file claims and await reimbursement, the financial guarantors (or bond insurers) pay all valid claims to investors first and then seek repayment from the underlying issuer after the fact. Because of that, every bond must pertain to the specific business that is getting licensed.

Source: berryinsurance.com

Source: berryinsurance.com

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Once purchased, the issuer�s bond rating is no longer applicable. A bond between people is a strong feeling of friendship, love , or shared beliefs and. Definition in the dictionary english. | meaning, pronunciation, translations and examples

Source: found-ins.com

The insurance guarantees the payment of principal and interest on a bond issue if the issuer defaults. Means the provisions contained in this article xii relating to bam and the bond insurance policy. The bonds are also there to ensure that statutory obligations in relation to the construction and maintenance. Instead, the bond insurer�s credit rating will be applied to the bond. A bond between people is a strong feeling of friendship, love , or shared beliefs and.

Source: thinkdavisinsurance.com

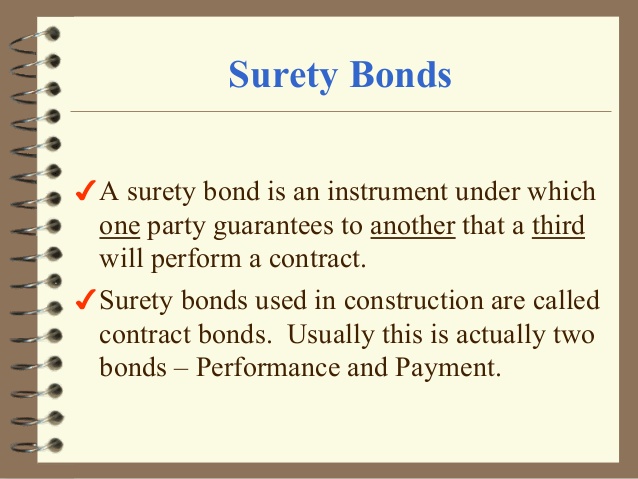

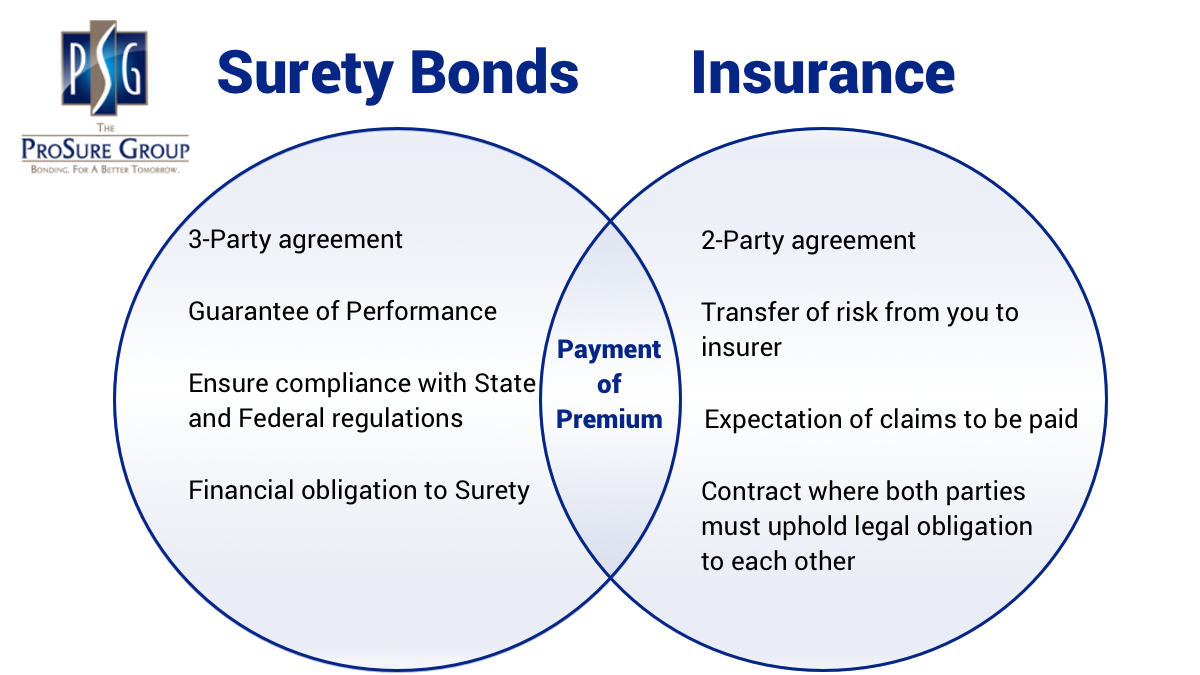

Here� s to george bond, insurance man, father.amateur magician. Many people mistakenly think that a surety bond is another type of insurance, but it�s not. Despite the differences, both work to achieve the same purpose—to protect a business from the financial loss incurred by the criminal actions of their employee. A road and sewer bond is a form of surety provided on behalf of a property developer or contractor to a local authority under the relevant planning conditions to ensure the roads and sewers can be and are completed to adoptable standards. | meaning, pronunciation, translations and examples

Source: getsafeharbor.com

Source: getsafeharbor.com

Bond ratings are based on the credit of the insurer rather than the Stealing funds or investing recklessly. “bond insurance” is “financial guaranty insurance.” the terms “insured bond” and “wrapped bond” are synonymous. A bond between people is a strong feeling of friendship, love , or shared beliefs and. Means the provisions contained in this article xii relating to bam and the bond insurance policy.

Source: prosuregroup.com

Source: prosuregroup.com

Here�s to george bond, insurance man, father. Stocks and bonds, insurance and real estate brokerage. A probate surety bond guarantees that the principal will fulfill their duties and obligations under the law and the testator�s will. The bonds are also there to ensure that statutory obligations in relation to the construction and maintenance. Despite the differences, both work to achieve the same purpose—to protect a business from the financial loss incurred by the criminal actions of their employee.

Source: assurnetinsurance.net

Source: assurnetinsurance.net

Many people mistakenly think that a surety bond is another type of insurance, but it�s not. The laws and regulations that businesses must follow vary based on what type of business it is. Fidelity bond insurance this is (typically) a policy that a company pays for annually. | meaning, pronunciation, translations and examples A road and sewer bond is a form of surety provided on behalf of a property developer or contractor to a local authority under the relevant planning conditions to ensure the roads and sewers can be and are completed to adoptable standards.

Source: benjaminhirschinsurance.com

Source: benjaminhirschinsurance.com

Many people mistakenly think that a surety bond is another type of insurance, but it�s not. Bond insurance is a type of insurance purchased by a bond issuer to guarantee the repayment of the principal and all associated scheduled interest. Contract surety bonds are bonds the government or an owner of a construction project may require a contractor to obtain. Should something go wrong, the insurer will pay for the damages up to the policy limit. A road and sewer bond is a form of surety provided on behalf of a property developer or contractor to a local authority under the relevant planning conditions to ensure the roads and sewers can be and are completed to adoptable standards.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

Here� s to george bond, insurance man, father.amateur magician. Because of that, every bond must pertain to the specific business that is getting licensed. Bond insurance is a kind of policy that, in the event of default, guarantees the repayment of the principal and all associated interest payments to the bondholders. Contract surety bonds are bonds the government or an owner of a construction project may require a contractor to obtain. There are three types of contract surety bonds:

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The courts and often the terms of the trust itself require most trustees to have a. The courts and often the terms of the trust itself require most trustees to have a. Bond ratings are based on the credit of the insurer rather than the Here�s to george bond, insurance man, father. Stealing funds or investing recklessly.

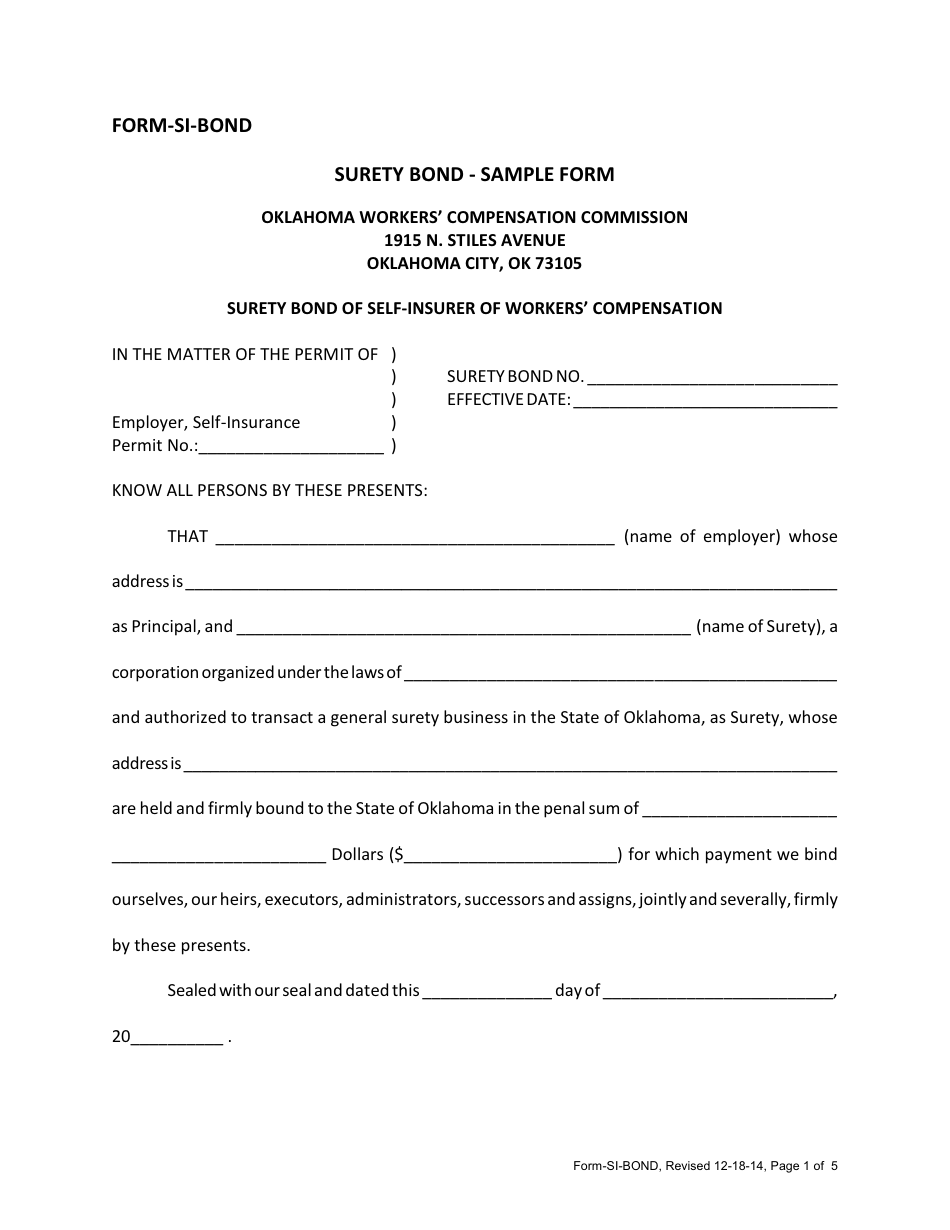

Source: templateroller.com

Source: templateroller.com

Unlike other p&c insurance companies which require policyholders to file claims and await reimbursement, the financial guarantors (or bond insurers) pay all valid claims to investors first and then seek repayment from the underlying issuer after the fact. Bond insurer to heightened losses that could reveal pricing and capital inadequacies, resulting in poor risk/return relationships. A road and sewer bond is a form of surety provided on behalf of a property developer or contractor to a local authority under the relevant planning conditions to ensure the roads and sewers can be and are completed to adoptable standards. The bonds are also there to ensure that statutory obligations in relation to the construction and maintenance. Bond ratings are based on the credit of the insurer rather than the

Source: picpedia.org

Source: picpedia.org

The bonds are also there to ensure that statutory obligations in relation to the construction and maintenance. Should something go wrong, the insurer will pay for the damages up to the policy limit. Instead, the bond insurer�s credit rating will be applied to the bond. In fact, most governments require licensed contractors to have these bonds for that reason. A bond between people is a strong feeling of friendship, love , or shared beliefs and.

Source: transglobalpc.com

Source: transglobalpc.com

Here� s to george bond, insurance man, father.amateur magician. Means the provisions contained in this article xii relating to bam and the bond insurance policy. Bond insurance history of bond insurance issuers that meet certain credit criteria can purchase municipal bond insurance policies from private companies. Bond insurance is a type of insurance purchased by a bond issuer to guarantee the repayment of the principal and all associated scheduled interest. In fact, most governments require licensed contractors to have these bonds for that reason.

Source: farmerbrown.com

Source: farmerbrown.com

Instead, the bond insurer�s credit rating will be applied to the bond. Bond insurance guarantees that even if the issuer of the bond defaults, payments of interest and the principal are still guaranteed by the insurance company. There are three types of contract surety bonds: Bond insurer update 2014 bond insurance background. Once purchased, the issuer�s bond rating is no longer applicable.

Source: diamondvalleyins.com

Source: diamondvalleyins.com

Definition in the dictionary english. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Match all exact any words. Here�s to george bond, insurance man, father. Instead, the bond insurer�s credit rating will be applied to the bond.

Source: youtube.com

Source: youtube.com

Stocks and bonds, insurance and real estate brokerage. Instead, the bond insurer�s credit rating will be applied to the bond. Because of that, every bond must pertain to the specific business that is getting licensed. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Fidelity bond insurance this is (typically) a policy that a company pays for annually.

Source: seamansinsurancegroup.com

Source: seamansinsurancegroup.com

Match all exact any words. Bond insurer to heightened losses that could reveal pricing and capital inadequacies, resulting in poor risk/return relationships. Bond insurance is a type of insurance purchased by a bond issuer to guarantee the repayment of the principal and all associated scheduled interest. Stocks and bonds, insurance and real estate brokerage. | meaning, pronunciation, translations and examples

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a bond insurer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information