What is a contingent beneficiary for life insurance information

Home » Trend » What is a contingent beneficiary for life insurance informationYour What is a contingent beneficiary for life insurance images are available in this site. What is a contingent beneficiary for life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is a contingent beneficiary for life insurance files here. Find and Download all royalty-free photos.

If you’re looking for what is a contingent beneficiary for life insurance images information linked to the what is a contingent beneficiary for life insurance interest, you have come to the ideal blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

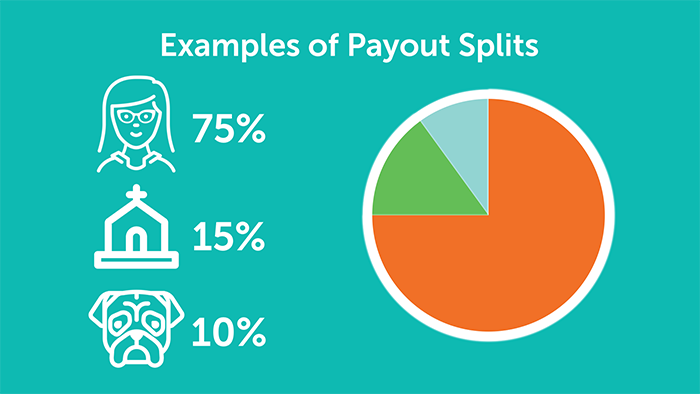

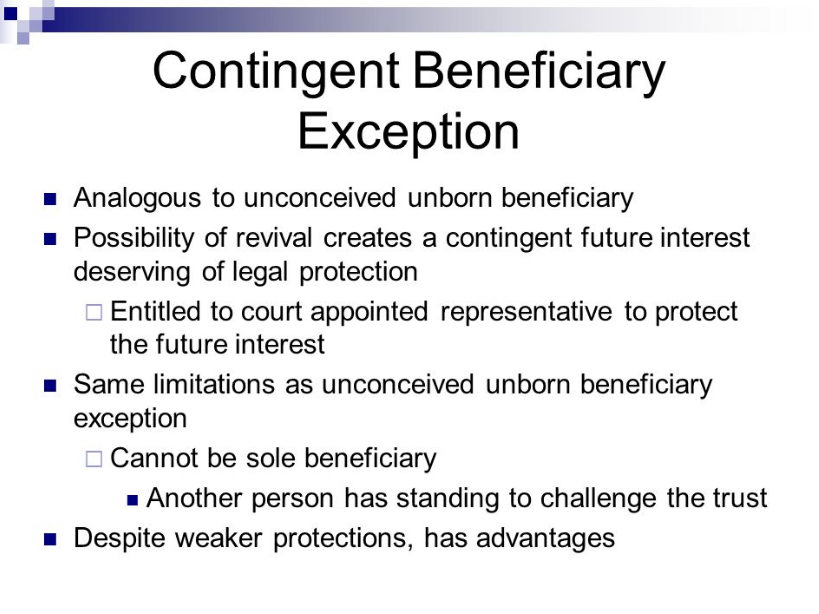

What Is A Contingent Beneficiary For Life Insurance. This person will only inherit the named assets if the primary beneficiary does not. A contingent beneficiary is a beneficiary of proceeds or a payout if the primary beneficiary is deceased or unable to be located.a contingent beneficiary can be named in an insurance contract or a retirement account. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust. A contingent beneficiary is a person chosen by the policyholder to receive their insurance policy payout if the primary beneficiary has already (14).

The Life Insurance Beneficiary Review Why it is important From mgkrum.com

The Life Insurance Beneficiary Review Why it is important From mgkrum.com

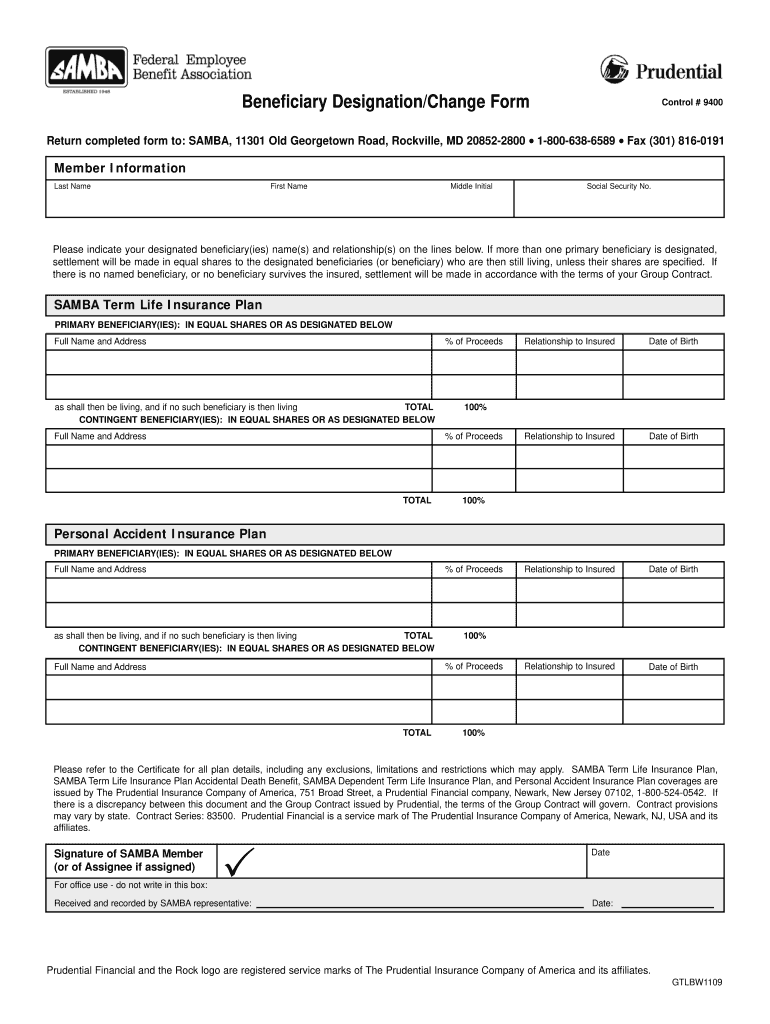

When you’re buying the policy, you are required to name your primary beneficiaries and contingent (secondary). When you pass away, if all of your primary beneficiaries have also passed. Beneficiaries are an essential step in making a life insurance policy, retirement account, or living trust. When someone buys a life insurance policy , they get to choose both the primary and contingent beneficiaries. A contingent beneficiary is sometimes known as a “secondary beneficiary.” Every life insurance policy should name both a primary beneficiary and contingent beneficiaries.

A contingent beneficiary is a beneficiary of proceeds or a payout if the primary beneficiary is deceased or unable to be located.a contingent beneficiary can be named in an insurance contract or a retirement account.

Whatever life insurance you choose, whether it be term life or whole life, there is guaranteed death benefit that is paid out to your beneficiaries. If you have a life insurance plan, make sure to name both primary and contingent beneficiaries on the policy. When you’re buying the policy, you are required to name your primary beneficiaries and contingent (secondary). A contingent beneficiary is a person(s), organization, trust, or other entity named by the policyholder to receive their life insurance death benefit if the primary beneficiary is deceased, unable to be found, legally unqualified to accept it, or refuses the benefit at the time the monies are to be paid out. A contingent designee is not someone who will share the benefits, but instead someone who is only entitled to payment if the primary person named cannot make a claim. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

For a life insurance beneficiary minor, a legal guardian is assigned or named in the will. A contingent beneficiary is a person chosen by the policyholder to receive their insurance policy payout if the primary beneficiary has already (14). The contingent beneficiary is granted the benefits or money in turn. What does contingent mean on life insurance? For example, you might choose your spouse as your primary beneficiary at the time that you prepare your estate, and then name your child as the contingent beneficiary.

Source: healthassociation.ns.ca

Source: healthassociation.ns.ca

A contingent or secondary beneficiary is the person who collects your insurance payout if none of your primary life insurance beneficiaries can accept the money. A contingent beneficiary is a person, organization, or entity that receives your life insurance policy’s death benefit if your primary beneficiary dies. If you have a life insurance plan, make sure to name both primary and contingent beneficiaries on the policy. Contingent beneficiaries, also known as will substitutes, serve as “backups” for estates and life insurance policies.they’re different from primary. In the event that the entirety of your primary beneficiaries pass away before you do, the death benefit is disseminated.

Source: simplyinsurance.com

Source: simplyinsurance.com

What is a contingent beneficiary? Naming a contingent beneficiary guarantees that you control where your life insurance proceeds go when you die. There are two essential types of insurance beneficiaries: A contingent beneficiary is a person, organization, or entity that receives your life insurance policy’s death benefit if your primary beneficiary dies. Siblings and favorite charities are great contingent life insurance beneficiary options.

Source: simple-memorial.blogspot.com

Source: simple-memorial.blogspot.com

A contingent beneficiary is a beneficiary of proceeds or a payout if the primary beneficiary is deceased or unable to be located.a contingent beneficiary can be named in an insurance contract or a retirement account. A contingent or secondary beneficiary is the person who collects your insurance payout if none of your primary life insurance beneficiaries can accept the money. When someone buys a life insurance policy , they get to choose both the primary and contingent beneficiaries. Typically, primary life insurance beneficiaries are your spouse and adult children. It is the situation in which both the insured and primary beneficiary ceases to exist due to death or demise.

Source: insuranceandquotes.info

Source: insuranceandquotes.info

Typically used for an insurance policy, retirement account or will, a contingent beneficiary is a person or entity a policyholder names to receive their account’s benefits if. You can also name a contingent beneficiary, who could receive the death benefit if something happened to the primary beneficiary. When you’re buying the policy, you are required to name your primary beneficiaries and contingent (secondary). What is a contingent beneficiary? What is a contingent beneficiary?

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

Siblings and favorite charities are great contingent life insurance beneficiary options. There are two essential types of insurance beneficiaries: A contingent designee is not someone who will share the benefits, but instead someone who is only entitled to payment if the primary person named cannot make a claim. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust. If you have a life insurance plan, make sure to name both primary and contingent beneficiaries on the policy.

Source: fotorise.com

Source: fotorise.com

What does contingent mean on life insurance? The contingent beneficiary is granted the benefits or money in turn. Long story short, your contingent life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. For example, you might choose your spouse as your primary beneficiary at the time that you prepare your estate, and then name your child as the contingent beneficiary. A contingent beneficiary is a person chosen by the policyholder to receive their insurance policy payout if the primary beneficiary has already (14).

Source: millennialfinancialgroup.com

Source: millennialfinancialgroup.com

Siblings and favorite charities are great contingent life insurance beneficiary options. Whatever life insurance you choose, whether it be term life or whole life, there is guaranteed death benefit that is paid out to your beneficiaries. What’s a contingent beneficiary for life insurance? A contingent beneficiary receives your life insurance payout if your primary beneficiary has already died, is ineligible, or decides to not take the payout, helping make sure your policy supports your loved ones financially. For a life insurance beneficiary minor, a legal guardian is assigned or named in the will.

Source: mgkrum.com

Source: mgkrum.com

When you’re buying the policy, you are required to name your primary beneficiaries and contingent (secondary). Beneficiaries are an essential step in making a life insurance policy, retirement account, or living trust. A contingent beneficiary is one who is entitled to the death benefit if the primary beneficiary has already died or cannot receive the benefit for another reason. When you pass away, if all of your primary beneficiaries have also passed. A contingent or secondary beneficiary is the person who collects your insurance payout if none of your primary life insurance beneficiaries can accept the money.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. When someone buys a life insurance policy , they get to choose both the primary and contingent beneficiaries. A contingent beneficiary is a person who can claim a payout for the proceeds if the primary beneficiary has passed or if they are ineligible for payout for some reason. The account you designate to be given to a primary beneficiary will be released to your second beneficiary if your first beneficiary can�t be found, declines the gift, isn�t legally able to accept it,. In insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit.

Source: signnow.com

Source: signnow.com

That’s what does contingent means for beneficiaries. Naming a contingent beneficiary guarantees that you control where your life insurance proceeds go when you die. Siblings and favorite charities are great contingent life insurance beneficiary options. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy. The party designated to receive proceeds of a life irrevocable beneficiary:

Source: businesspromotionstore.com

Source: businesspromotionstore.com

Contingent beneficiaries, also known as will substitutes, serve as “backups” for estates and life insurance policies.they’re different from primary. Contingent beneficiaries are basically the backup that would receive your life insurance death benefit if all of your primary beneficiaries were deceased. A contingent beneficiary is one who is entitled to the death benefit if the primary beneficiary has already died or cannot receive the benefit for another reason. A contingent or secondary beneficiary is the person who collects your insurance payout if none of your primary life insurance beneficiaries can accept the money. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy.

Source: slideshare.net

Source: slideshare.net

The contingent beneficiary is granted the benefits or money in turn. Siblings and favorite charities are great contingent life insurance beneficiary options. That’s what does contingent means for beneficiaries. A life insurance policy beneficiary who has a vested (13). When you pass away, if all of your primary beneficiaries have also passed.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

A contingent beneficiary is a person(s), organization, trust, or other entity named by the policyholder to receive their life insurance death benefit if the primary beneficiary is deceased, unable to be found, legally unqualified to accept it, or refuses the benefit at the time the monies are to be paid out. There are two essential types of insurance beneficiaries: What is a contingent beneficiary? A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. Naming a contingent beneficiary guarantees that you control where your life insurance proceeds go when you die.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

The contingent beneficiary is granted the benefits or money in turn. Typically, primary life insurance beneficiaries are your spouse and adult children. What does contingent mean on life insurance? Concerning your benefits, a contingent beneficiary is someone who becomes the beneficiary if your primary choice is unable to fulfill the role. Think of a contingent beneficiary as your “alternate.” with most life insurance policies, you can change your beneficiary designation at.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

This person will only inherit the named assets if the primary beneficiary does not. They only receive the benefits if the primary beneficiary passes away before the policyholder. Naming at least one contingent beneficiary protects your insurance proceeds from paying into your estate and entering a lengthy legal process or being taken by creditors. Learn about the differences between primary and contingent beneficiaries, as well as how to make sure your death benefit gets to the right family members. A contingent beneficiary is the person, people, or entity that receives a life insurance policy’s payout if the primary beneficiary is unable to do so.

Source: elsa-ita.blogspot.com

Source: elsa-ita.blogspot.com

If you have a life insurance plan, make sure to name both primary and contingent beneficiaries on the policy. Whatever life insurance you choose, whether it be term life or whole life, there is guaranteed death benefit that is paid out to your beneficiaries. A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy. A contingent beneficiary is a person who can claim a payout for the proceeds if the primary beneficiary has passed or if they are ineligible for payout for some reason.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is a contingent beneficiary for life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information