What is a contingent beneficiary on a life insurance policy Idea

Home » Trend » What is a contingent beneficiary on a life insurance policy IdeaYour What is a contingent beneficiary on a life insurance policy images are available in this site. What is a contingent beneficiary on a life insurance policy are a topic that is being searched for and liked by netizens today. You can Find and Download the What is a contingent beneficiary on a life insurance policy files here. Find and Download all royalty-free photos.

If you’re looking for what is a contingent beneficiary on a life insurance policy pictures information linked to the what is a contingent beneficiary on a life insurance policy topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

What Is A Contingent Beneficiary On A Life Insurance Policy. A) receive the policy proceeds if the. A contingent beneficiary on a life insurance policy is a person or entity that receives the plan’s death benefit if the primary beneficiary or beneficiaries can’t be located, refuse the payout or die before the insured individual does. Contingent beneficiaries can be assigned to life insurance policies, retirement plans, and annuities. Whatever life insurance you choose, whether it be term life or whole life, there is guaranteed death benefit that is paid out to your beneficiaries.

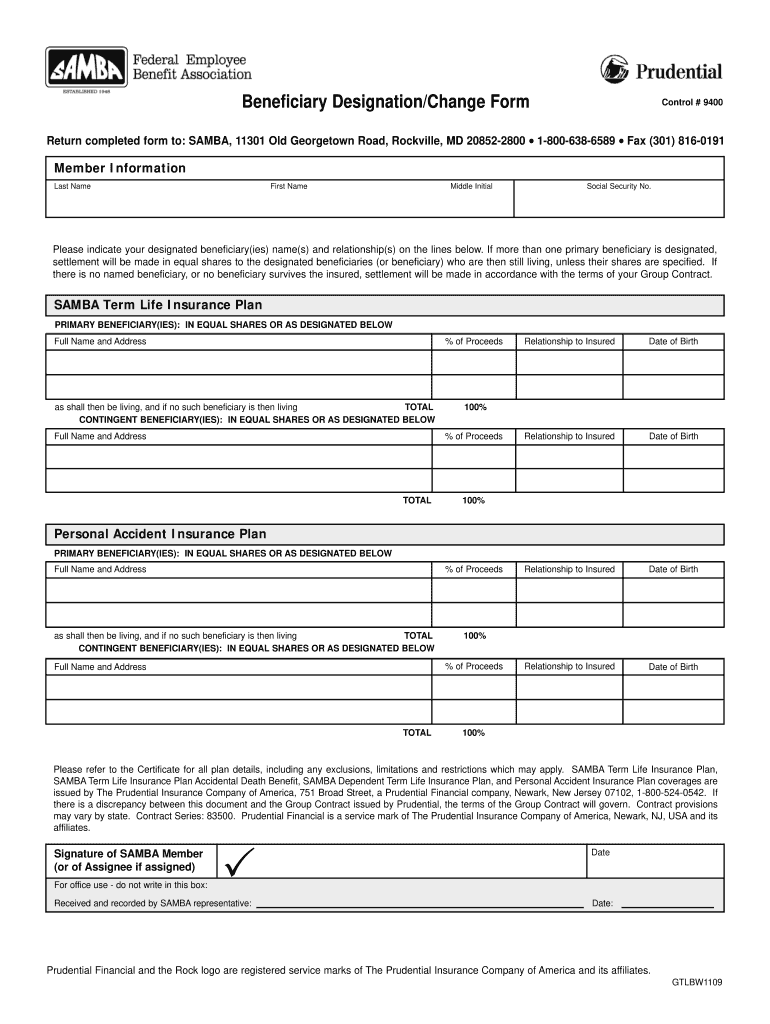

Changing The Beneficiary On A Life Insurance Policy How From voleyball-games.blogspot.com

Changing The Beneficiary On A Life Insurance Policy How From voleyball-games.blogspot.com

A contingent beneficiary on a life insurance policy is a person or entity that receives the plan’s death benefit if the primary beneficiary or beneficiaries can’t be located, refuse the payout or die before the insured individual does. A contingent beneficiary is sometimes known as a “secondary beneficiary.”. If alive, they’ll receive life insurance proceeds before a contingent beneficiary. Naming a contingent beneficiary helps ensure that the funds left behind are distributed as per your final wishes. Typically, the spouse or partner is assigned as the primary beneficiary of your policy. 9) a contingent beneficiary in a life insurance policy has the right to.

(there’s no way to sugar coat these things sometimes.) your contingent beneficiary would be your backup — this is the person who will receive those death.

The primary beneficiary is the intended recipient of your policy benefits. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust.in insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit. The name of the beneficiary is mandatorily mentioned in the policy documents by the insured person. How to assign and assist your contingent beneficiaries. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout. At the point when you buy your life insurance strategy, you’ll have to name a primary beneficiary and a contingent beneficiary on the beneficiary assignment form.

Source: meanoin.blogspot.com

Source: meanoin.blogspot.com

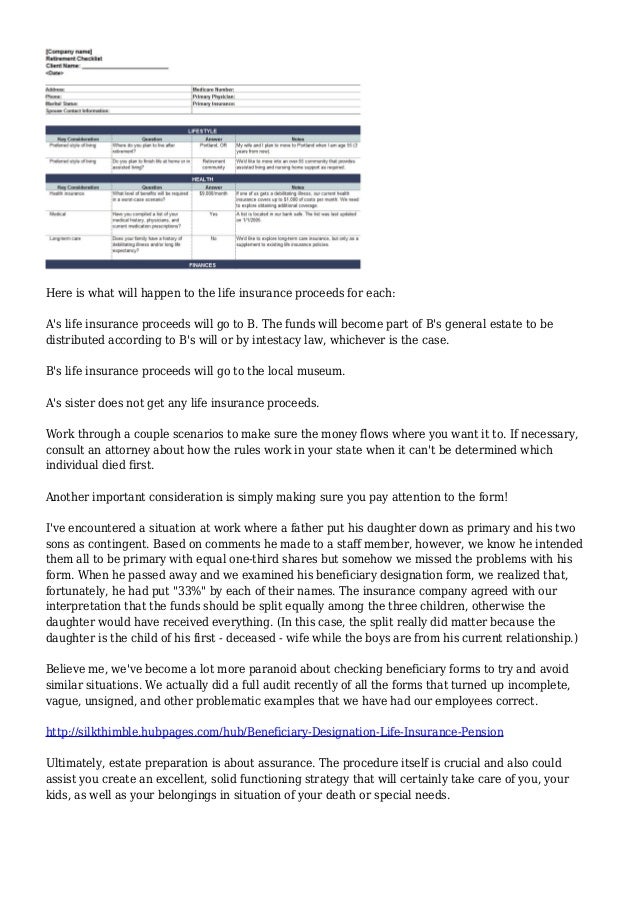

The primary beneficiary is the intended recipient of your policy benefits. John has a $500,000 life insurance policy and a home valued at $800,000. A contingent beneficiary on a life insurance policy receives the death benefit if the primary beneficiary becomes impaired and passes away. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy. His will states that his son and daughter are the primary beneficiaries, and his current spouse is the contingent beneficiary.

Source: businesspromotionstore.com

Source: businesspromotionstore.com

Payout to a secondary beneficiary may be governed by specific terms or conditions established in the life. In insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit.in texas, if a beneficiary of a life insurance forfeits one’s interest in the policy, the contingent beneficiary named. A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. He also has a small coin collection and one car. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Essentially, when setting up your life insurance policy, you’ll designate a primary beneficiary (typically your spouse or partner), who will receive all death benefits if you, well, die. In insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit.in texas, if a beneficiary of a life insurance forfeits one’s interest in the policy, the contingent beneficiary named. A contingent beneficiary is a person(s), organization, trust, or other entity named by the policyholder to receive their life insurance death benefit if the primary beneficiary is deceased, unable to be found, legally unqualified to accept it, or refuses the benefit at the time the monies are to be paid out. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust.in insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit. Naming a contingent beneficiary helps ensure that the funds left behind are distributed as per your final wishes.

Source: signnow.com

Source: signnow.com

Typically, the spouse or partner is assigned as the primary beneficiary of your policy. Essentially, when setting up your life insurance policy, you’ll designate a primary beneficiary (typically your spouse or partner), who will receive all death benefits if you, well, die. (there’s no way to sugar coat these things sometimes.) your contingent beneficiary would be your backup — this is the person who will receive those death. The primary beneficiary is the intended recipient of your policy benefits. For example, it’s possible that your primary beneficiary may die before receiving the death.

Source: blogpapi.com

Source: blogpapi.com

Naming a contingent beneficiary helps ensure that the funds left behind are distributed as per your final wishes. When you’re buying the policy, you are required to name your primary beneficiaries and contingent (secondary). Siblings and favorite charities are great secondary life. Whatever life insurance you choose, whether it be term life or whole life, there is guaranteed death benefit that is paid out to your beneficiaries. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason.

Source: eho-pirmadienanaujinamai.blogspot.com

When purchasing life insurance, you�ll be asked to designate at least one. Your spouse and adult children are typical primary life insurance beneficiaries. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. Payout to a secondary beneficiary may be governed by specific terms or conditions established in the life. Typically, the spouse or partner is assigned as the primary beneficiary of your policy.

Source: industrial-mechanical-teach.blogspot.com

Source: industrial-mechanical-teach.blogspot.com

A contingent beneficiary is a person, organization, or entity that receives your life insurance policy’s death benefit if your primary beneficiary dies. For example, it’s possible that your primary beneficiary may die before receiving the death. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy. Essentially, when setting up your life insurance policy, you’ll designate a primary beneficiary (typically your spouse or partner), who will receive all death benefits if you, well, die. A) receive the policy proceeds if the.

Source: americanqualityassurancegroup.com

Source: americanqualityassurancegroup.com

When purchasing life insurance, you�ll be asked to designate at least one. This is your primary life insurance beneficiary. There are two types of beneficiaries — primary and contingent: The primary beneficiary is the intended recipient of your policy benefits. His will states that his son and daughter are the primary beneficiaries, and his current spouse is the contingent beneficiary.

Source: thestreet.com

Source: thestreet.com

A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. At the point when you buy your life insurance strategy, you’ll have to name a primary beneficiary and a contingent beneficiary on the beneficiary assignment form. His will states that his son and daughter are the primary beneficiaries, and his current spouse is the contingent beneficiary. In insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit. A contingent beneficiary is a person(s), organization, trust, or other entity named by the policyholder to receive their life insurance death benefit if the primary beneficiary is deceased, unable to be found, legally unqualified to accept it, or refuses the benefit at the time the monies are to be paid out.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

When you’re buying the policy, you are required to name your primary beneficiaries and contingent (secondary). An insurance beneficiary is a person who receives the benefits or money from a life insurance policy only on the demise of the insured person. At the point when you buy your life insurance strategy, you’ll have to name a primary beneficiary and a contingent beneficiary on the beneficiary assignment form. When someone buys a life insurance policy , they get to choose both the primary and contingent beneficiaries. There are two essential types of insurance beneficiaries:

Source: simple-memorial.blogspot.com

Source: simple-memorial.blogspot.com

Essentially, when setting up your life insurance policy, you’ll designate a primary beneficiary (typically your spouse or partner), who will receive all death benefits if you, well, die. An insurance beneficiary is a person who receives the benefits or money from a life insurance policy only on the demise of the insured person. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. Typically, the spouse or partner is assigned as the primary beneficiary of your policy. A contingent beneficiary on a life insurance policy is a person or entity that receives the plan’s death benefit if the primary beneficiary or beneficiaries can’t be located, refuse the payout or die before the insured individual does.

Source: youtube.com

Source: youtube.com

There are two types of beneficiaries — primary and contingent: His will states that his son and daughter are the primary beneficiaries, and his current spouse is the contingent beneficiary. Whatever life insurance you choose, whether it be term life or whole life, there is guaranteed death benefit that is paid out to your beneficiaries. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason. (there’s no way to sugar coat these things sometimes.) your contingent beneficiary would be your backup — this is the person who will receive those death.

Source: blogpapi.com

Source: blogpapi.com

This is your primary life insurance beneficiary. Essentially, when setting up your life insurance policy, you’ll designate a primary beneficiary (typically your spouse or partner), who will receive all death benefits if you, well, die. In the event that the primary beneficiary is unable to receive your proceeds, then. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

This is your primary life insurance beneficiary. Typically, the spouse or partner is assigned as the primary beneficiary of your policy. They will receive any proceeds from the policy at the time of your death. A contingent or secondary beneficiary is the person who collects your insurance payout if none of your primary life insurance beneficiaries can accept the money. There are two essential types of insurance beneficiaries:

Source: revisi.net

Source: revisi.net

Typically, the spouse or partner is assigned as the primary beneficiary of your policy. A contingent beneficiary is sometimes known as a “secondary beneficiary.”. When you assign contingent beneficiaries for your life insurance policy, make sure they are specified clearly in all paperwork.typically, this will involve providing each beneficiary�s full name and social security number (or tax id number in the case of an organization). A contingent beneficiary is the person, people, or entity that receives a life insurance policy’s payout if the primary beneficiary is unable to do so. A contingent beneficiary on a life insurance policy is a person or entity that receives the plan’s death benefit if the primary beneficiary or beneficiaries can’t be located, refuse the payout or die before the insured individual does.

Source: slideshare.net

Source: slideshare.net

When someone buys a life insurance policy , they get to choose both the primary and contingent beneficiaries. An insurance beneficiary is a person who receives the benefits or money from a life insurance policy only on the demise of the insured person. If alive, they’ll receive life insurance proceeds before a contingent beneficiary. In insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit.in texas, if a beneficiary of a life insurance forfeits one’s interest in the policy, the contingent beneficiary named. When someone buys a life insurance policy , they get to choose both the primary and contingent beneficiaries.

Source: elsa-ita.blogspot.com

Source: elsa-ita.blogspot.com

The name of the beneficiary is mandatorily mentioned in the policy documents by the insured person. Naming a contingent beneficiary helps ensure that the funds left behind are distributed as per your final wishes. A contingent beneficiary receives the death benefit only if all of your primary beneficiaries are unable to. A contingent beneficiary on a life insurance policy receives the death benefit if the primary beneficiary becomes impaired and passes away. In insurance contracts, a contingent beneficiary is one who benefits when the prior beneficiary of the policy is unable receive the benefit.in texas, if a beneficiary of a life insurance forfeits one’s interest in the policy, the contingent beneficiary named.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

For example, it’s possible that your primary beneficiary may die before receiving the death. A contingent beneficiary on a life insurance policy receives the death benefit if the primary beneficiary becomes impaired and passes away. Sometimes relationships change, which is why life insurance companies encourage you to name at least one contingent beneficiary in your policy. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout. In the event that the primary beneficiary is unable to receive your proceeds, then.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a contingent beneficiary on a life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information