What is a good loss ratio for insurance companies information

Home » Trend » What is a good loss ratio for insurance companies informationYour What is a good loss ratio for insurance companies images are ready. What is a good loss ratio for insurance companies are a topic that is being searched for and liked by netizens today. You can Get the What is a good loss ratio for insurance companies files here. Get all royalty-free photos and vectors.

If you’re looking for what is a good loss ratio for insurance companies images information connected with to the what is a good loss ratio for insurance companies keyword, you have come to the ideal blog. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

What Is A Good Loss Ratio For Insurance Companies. As a result, life insurance providers in india are expected to maintain a solvency ratio of 1.5 (or a solvency margin of 150%). Farmers insurance posted a loss ratio of 155% while allstate corp posted a ratio of 257%. Such companies are collecting premiums more than the amount paid in claims.conversely, insurers that consistently experience high loss ratios may be. What is a good expense ratio in insurance?

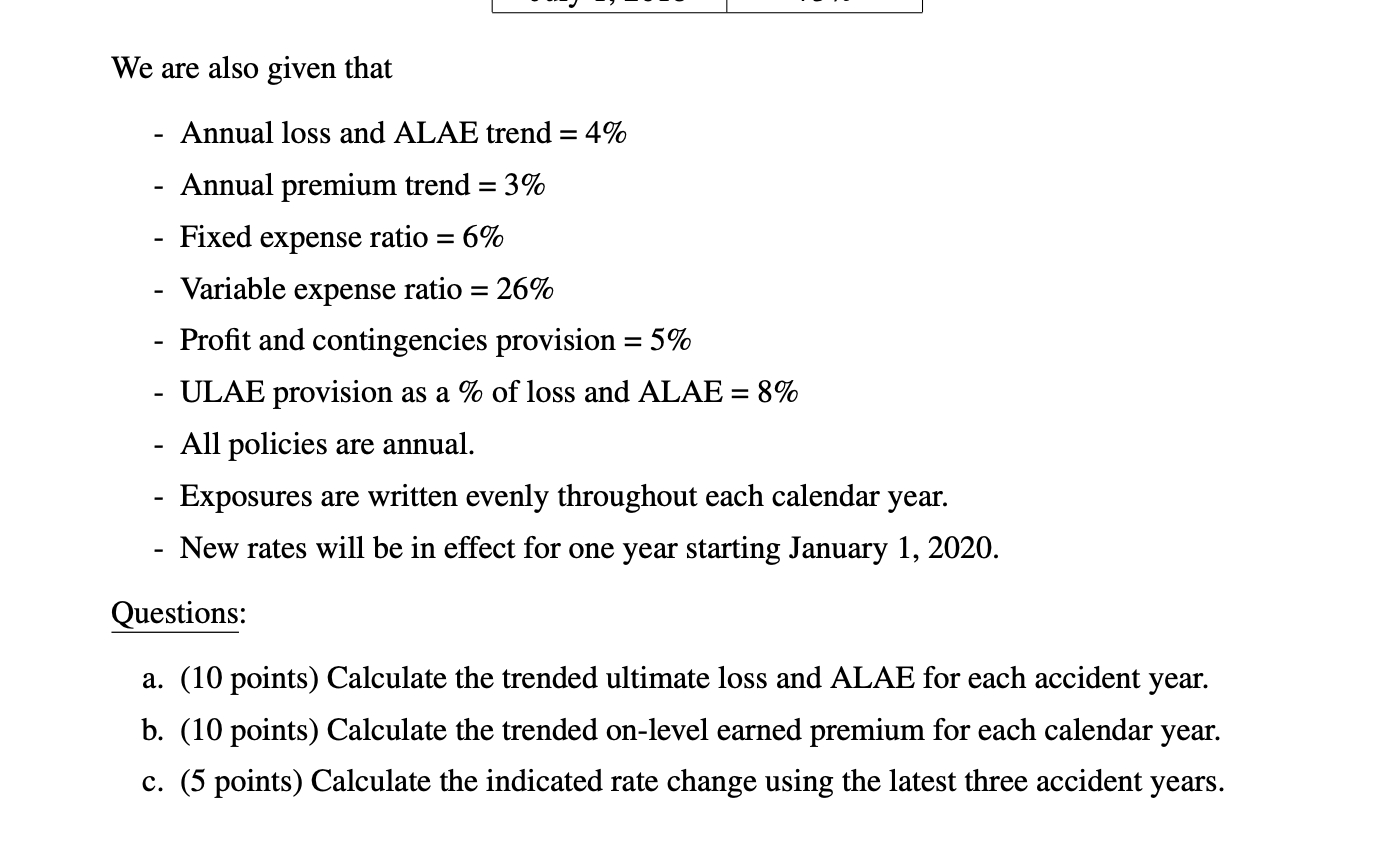

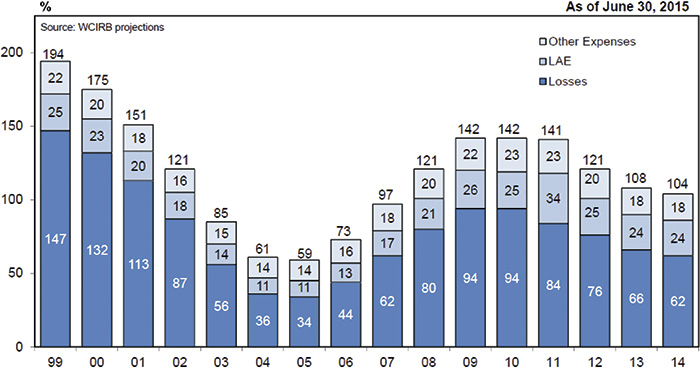

Insurance Ratemaking and premium data analysis From slideshare.net

Insurance Ratemaking and premium data analysis From slideshare.net

For example, a company with a very low expense ratio can afford a higher target loss ratio. Motor car insurance) typically range from 40% to 60%. It is a good idea to review what the loss ratio is for the type of insurance you want to purchase. Loss ratios among health insurance companies, for instance, can be between 60 percent and 110 percent. What does a high loss ratio mean for an insurance company? Usbr calculates the loss ratio by dividing loss adjustments expenses by premiums earned.the loss ratio shows what percentage of payouts are being settled with recipients.

What is a good rbc ratio for an insurance company?

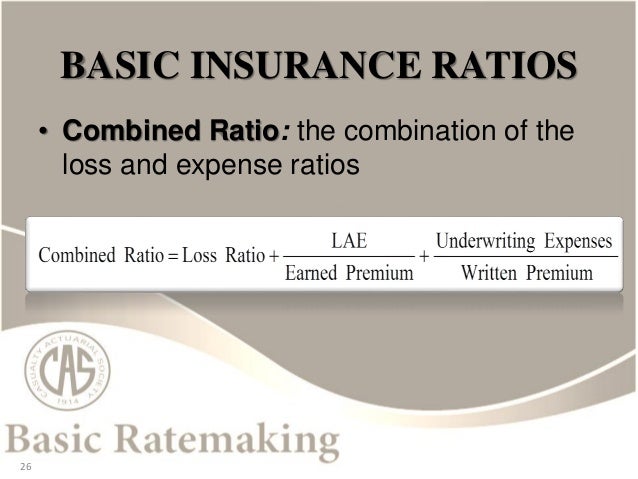

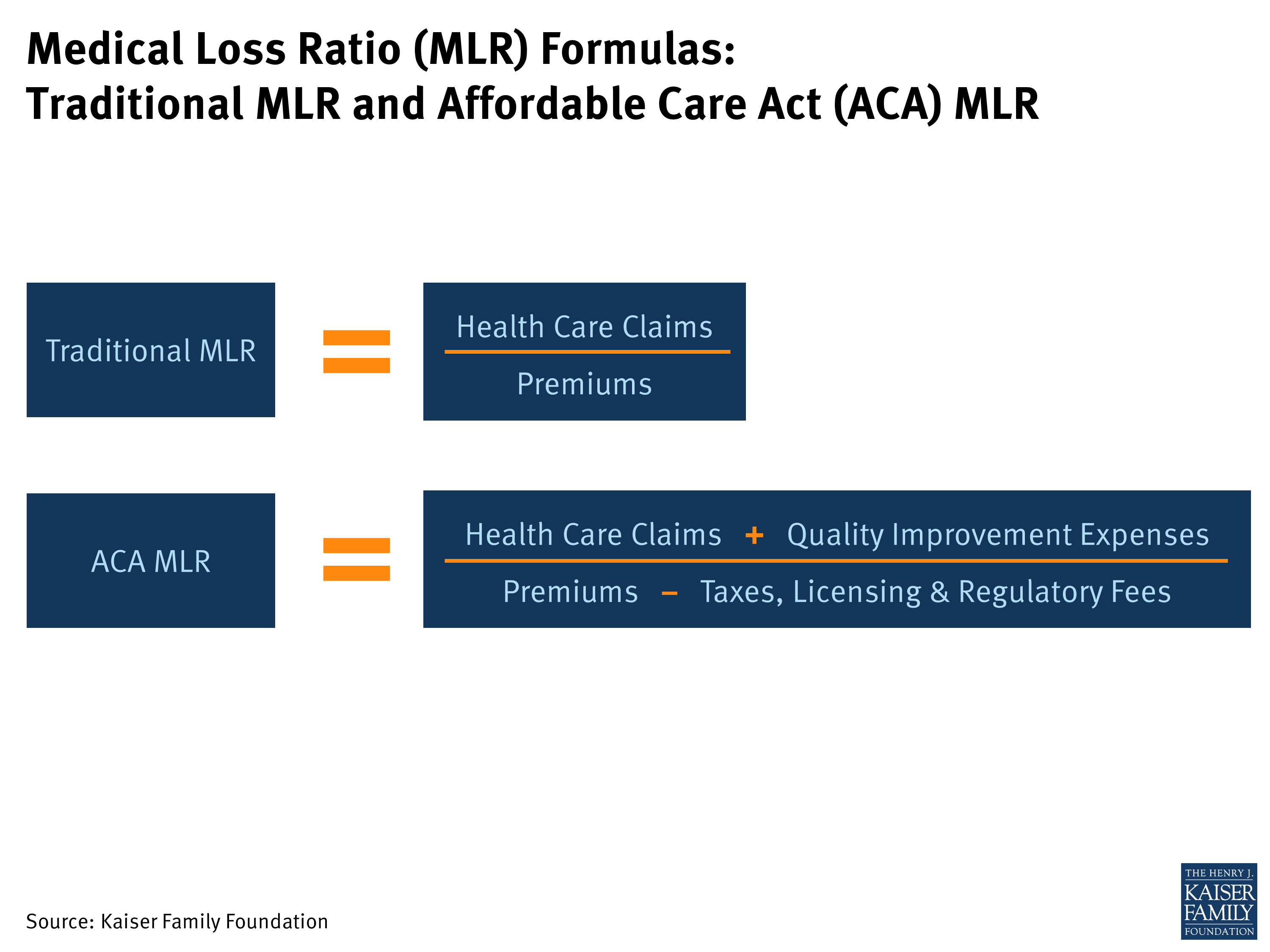

A loss ratio or “claims ratio,” is simply the ratio of incurred losses from claims plus the cost of settling claims to earned premiums: A quantitative score based on factors like the insurer�s balance sheet, its company profile and risk management strategies for instance, if a company had $100,000 in rates and paid out $50,000 in claims, its loss ratio would be 50%. Some insurance companies post loss ratios on company websites for current and previous years. Insurance loss ratiois the loss to the insurance company for claims that were paid out, divided by the premiums paid by those insured. Insurance companies in the large group market must spend at least 85 percent of premium dollars on medical care and quality improvement. The loss ratio is a mathematical calculation that takes the total claims that have been reported to the carrier, plus the carrier’s costs to administer the claim handling, divided by the total premiums earned (this refers to a portion of policy premium that has been used up during the term of the policy).

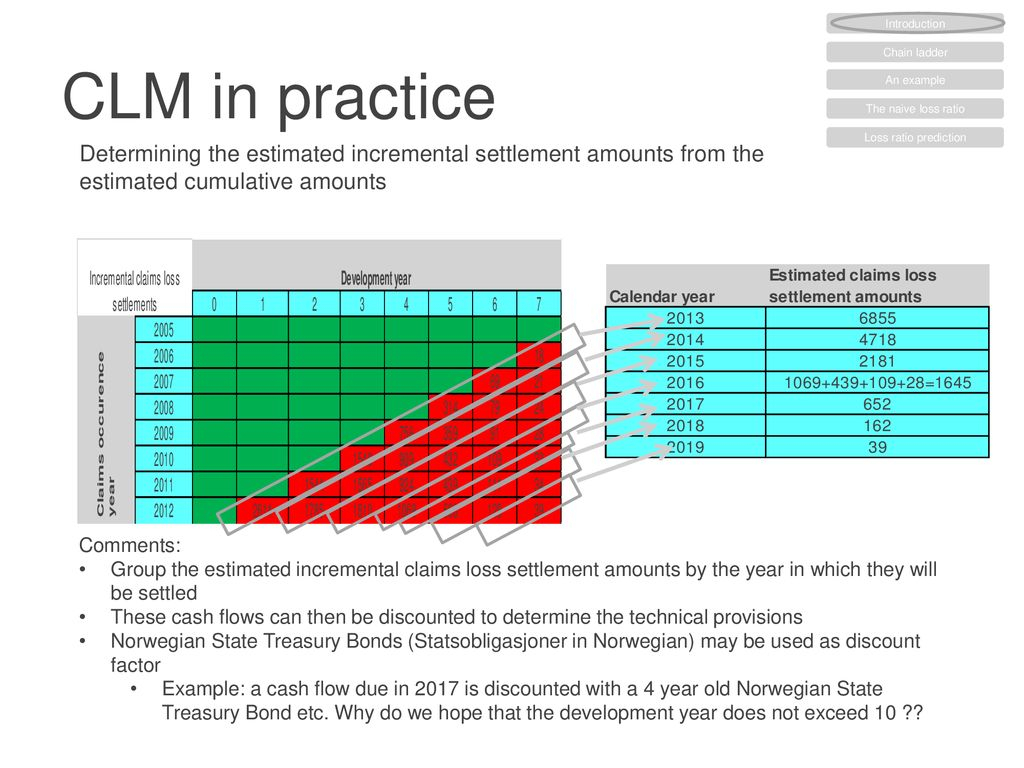

Source: slideshare.net

Source: slideshare.net

Insurance companies in the large group market must spend at least 85 percent of premium dollars on medical care and quality improvement. Let’s look at a live example spreadsheet. The loss ratio formula is insurance claims paid plus adjustment expenses divided by total earned premiums. Such companies are collecting premiums more than the amount paid in claims.conversely, insurers that consistently experience high loss ratios may be. For example, a company with a very low expense ratio can afford a higher target loss ratio.

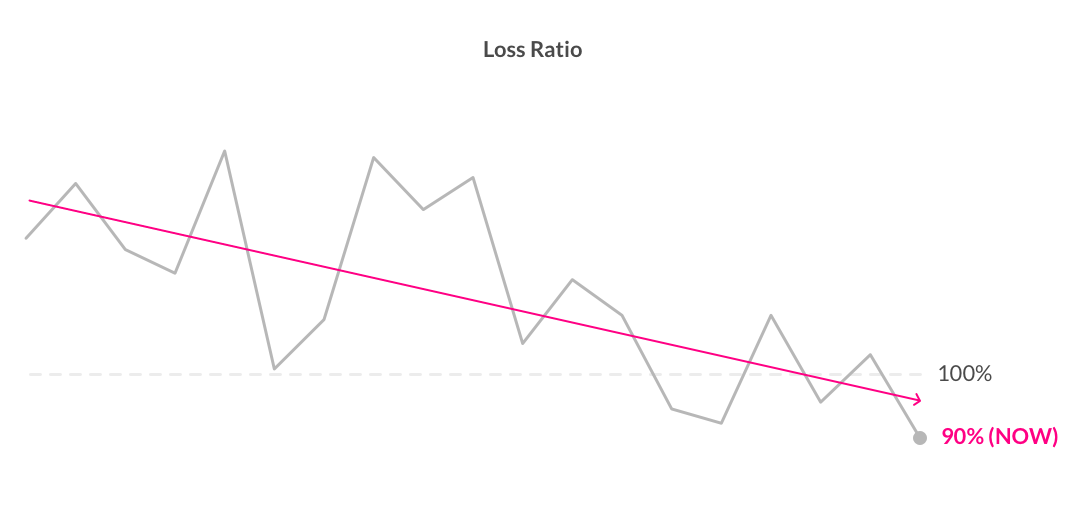

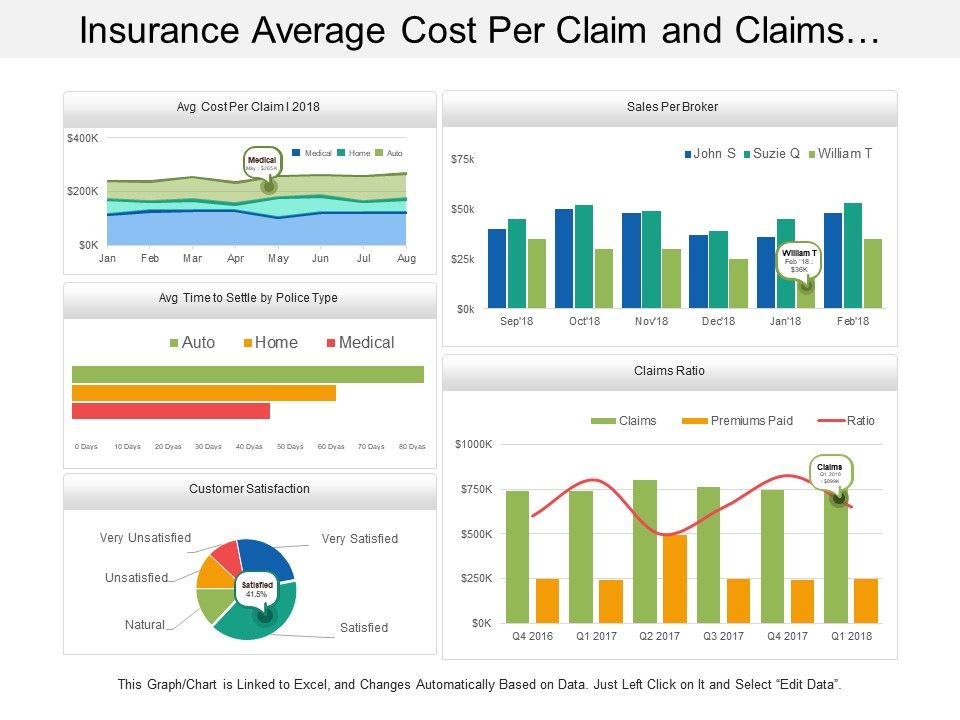

Source: lemonade.com

Source: lemonade.com

Each insurance company formulates its own target loss ratio, which depends on the expense ratio. This ratio provides insight into the quality of the policies an insurance company writes and the rates it charges. Insurance companies always keep a reserve on hand to pay claims that their actuaries know statistically are coming soon. If the loss ratio is above 1, or 100%, the insurance company is unprofitable and maybe in poor financial health because it is paying out more in claims than it is receiving in premiums. The remaining 40% of your premium dollar is spent on “expenses” such as claims handling, insurance company filing fees, taxes, overhead, agent commissions, and attorney fees.

Source: slideshare.net

Source: slideshare.net

The remaining 40% of your premium dollar is spent on “expenses” such as claims handling, insurance company filing fees, taxes, overhead, agent commissions, and attorney fees. A healthy combined ratio in the field of insurance sectors is generally considered to be in the range of 75% to 90%. Loss ratios among health insurance companies, for instance, can be between 60 percent and 110 percent. What is a good rbc ratio for an insurance company? If the loss ratio is above 1, or 100%, the insurance company is unprofitable and maybe in poor financial health because it is paying out more in claims than it is receiving in premiums.

Source: calendarinspirationdesign.com

Source: calendarinspirationdesign.com

Loss ratios for property and casualty insurance (e.g. Loss ratio is calculated using the formula given below loss ratio = (losses due to claims + adjustment expenses) / total premium earned loss ratio = ($45.5 million + $4.5 million) / $65.0 million loss ratio = 76.9% therefore, the loss ratio of the insurance company was 76.9% for the year 2019. Insurance loss ratiois the loss to the insurance company for claims that were paid out, divided by the premiums paid by those insured. Loss ratios for property and casualty insurance (e.g. Why loss ratio is useful?

Source: kff.org

Source: kff.org

Motor car insurance) typically range from 40% to 60%. The remaining 40% of your premium dollar is spent on “expenses” such as claims handling, insurance company filing fees, taxes, overhead, agent commissions, and attorney fees. What does a high loss ratio mean for an insurance company? Let’s look at a live example spreadsheet. The lower the loss ratio the better.

Source: calendarlocal.us

Source: calendarlocal.us

A quantitative score based on factors like the insurer�s balance sheet, its company profile and risk management strategies for instance, if a company had $100,000 in rates and paid out $50,000 in claims, its loss ratio would be 50%. Such companies are collecting premiums more than the amount paid in claims.conversely, insurers that consistently experience high loss ratios may be. What does a high loss ratio mean for an insurance company? Conclusion to conclude, we can tell that calculating the combined ratio is easy once we know where to get the numbers from. What is an insurance company loss ratio?

Source: calendarinspirationdesign.com

Source: calendarinspirationdesign.com

What is a good expense ratio in insurance? The lower the ratio, the more profitable the insurance company, and vice versa. That gives them enough leftover to. What is a good rbc ratio for an insurance company? This ratio provides insight into the quality of the policies an insurance company writes and the rates it charges.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

It is a good idea to review what the loss ratio is for the type of insurance you want to purchase. Such “risk capital” may be required in a captive insurance company for payment of losses, in the event that premium collected is insufficient to pay losses and expenses. The loss ratio is a mathematical calculation that takes the total claims that have been reported to the carrier, plus the carrier’s costs to administer the claim handling, divided by the total premiums earned (this refers to a portion of policy premium that has been used up during the term of the policy). The lower the loss ratio the better. As a result, life insurance providers in india are expected to maintain a solvency ratio of 1.5 (or a solvency margin of 150%).

Source: medium.com

An rbc ratio of 200% is the minimum surplus level needed for a health insurer to avoid regulatory action. Farmers insurance posted a loss ratio of 155% while allstate corp posted a ratio of 257%. Each insurance company formulates its own target loss ratio, which depends on the expense ratio. For example, if a company pays $80 in claims for every $160 in collected premiums, the. Loss ratios among health insurance companies, for instance, can be between 60 percent and 110 percent.

Source: relakhs.com

Source: relakhs.com

It indicates a large part of premium earned is used to cover up the actual risk. Insurance loss ratiois the loss to the insurance company for claims that were paid out, divided by the premiums paid by those insured. Motor car insurance) typically range from 40% to 60%. Such “risk capital” may be required in a captive insurance company for payment of losses, in the event that premium collected is insufficient to pay losses and expenses. An rbc ratio of 200% is the minimum surplus level needed for a health insurer to avoid regulatory action.

Source: 1investing.in

Source: 1investing.in

Such “risk capital” may be required in a captive insurance company for payment of losses, in the event that premium collected is insufficient to pay losses and expenses. Usbr calculates the loss ratio by dividing loss adjustments expenses by premiums earned.the loss ratio shows what percentage of payouts are being settled with recipients. Insurance loss ratiois the loss to the insurance company for claims that were paid out, divided by the premiums paid by those insured. Conclusion to conclude, we can tell that calculating the combined ratio is easy once we know where to get the numbers from. Why loss ratio is useful?

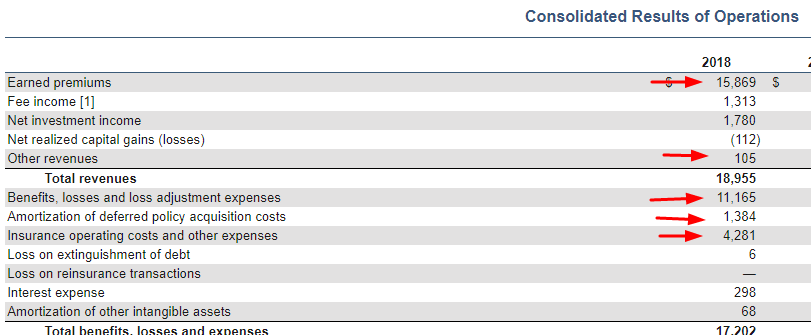

Source: einvestingforbeginners.com

Source: einvestingforbeginners.com

A loss ratio or “claims ratio,” is simply the ratio of incurred losses from claims plus the cost of settling claims to earned premiums: Insurance companies in the large group market must spend at least 85 percent of premium dollars on medical care and quality improvement. The lower the ratio, the more profitable the insurance company, and vice versa. For example, if a company pays $80 in claims for every $160 in collected premiums, the. Some insurance companies post loss ratios on company websites for current and previous years.

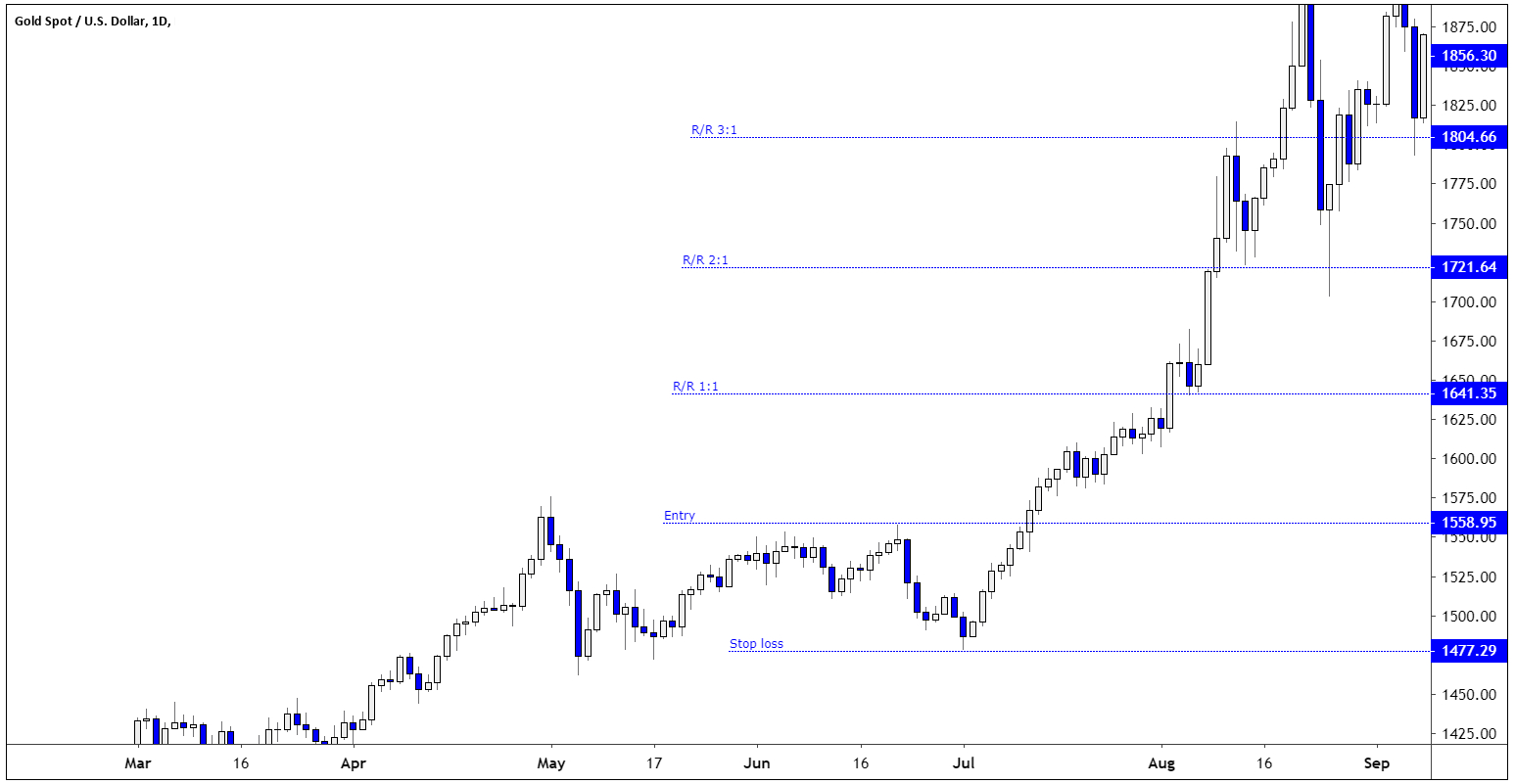

Source: warriortrading.com

Source: warriortrading.com

The loss ratio formula is insurance claims paid plus adjustment expenses divided by total earned premiums. The loss ratio is a mathematical calculation that takes the total claims that have been reported to the carrier, plus the carrier’s costs to administer the claim handling, divided by the total premiums earned (this refers to a portion of policy premium that has been used up during the term of the policy). A healthy combined ratio in the field of insurance sectors is generally considered to be in the range of 75% to 90%. If the insurer�s acceptable loss ratio is 65 percent, this prospect must understand that, in order for it to be considered for coverage (at a reasonable premium), it must find a way to. Each insurance company formulates its own target loss ratio, which depends on the expense ratio.

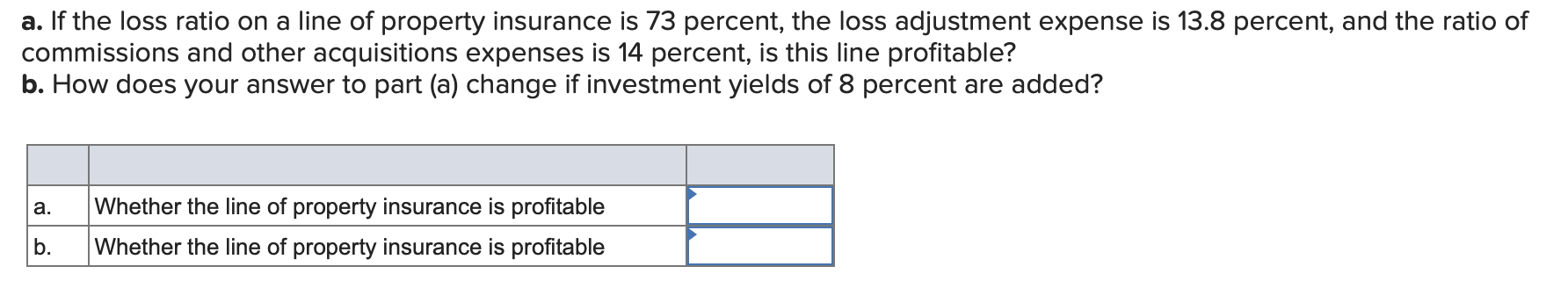

Source: chegg.com

Source: chegg.com

It indicates a large part of premium earned is used to cover up the actual risk. Each insurance company formulates its own target loss ratio, which depends on the expense ratio. The lower the ratio, the more profitable the insurance company, and vice versa. Such “risk capital” may be required in a captive insurance company for payment of losses, in the event that premium collected is insufficient to pay losses and expenses. Income earned during the year.

Source: constructionbusinessowner.com

Source: constructionbusinessowner.com

Such “risk capital” may be required in a captive insurance company for payment of losses, in the event that premium collected is insufficient to pay losses and expenses. For example, a company with a very low expense ratio can afford a higher target loss ratio. A quantitative score based on factors like the insurer�s balance sheet, its company profile and risk management strategies for instance, if a company had $100,000 in rates and paid out $50,000 in claims, its loss ratio would be 50%. Each insurance company formulates its own target loss ratio, which depends on the expense ratio. Higher loss ratios may indicate that an insurance company may need better risk management policies to guard against future possible insurance payouts.

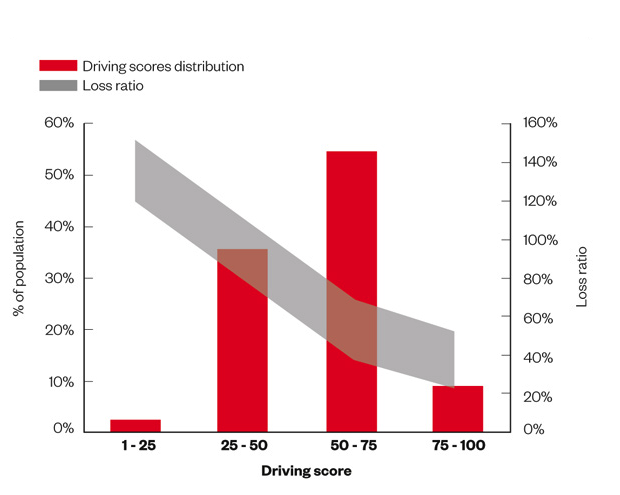

Source: dashroad.com

Source: dashroad.com

The lower the ratio, the more profitable the insurance company, and vice versa. Motor car insurance) typically range from 40% to 60%. What is a good rbc ratio for an insurance company? Some insurance companies post loss ratios on company websites for current and previous years. What is an insurance company loss ratio?

Source: chegg.com

Source: chegg.com

Motor car insurance) typically range from 40% to 60%. For example, if a company pays $80 in claims for every $160 in collected premiums, the. It indicates a large part of premium earned is used to cover up the actual risk. For example, a company with a very low expense ratio can afford a higher target loss ratio. A quantitative score based on factors like the insurer�s balance sheet, its company profile and risk management strategies for instance, if a company had $100,000 in rates and paid out $50,000 in claims, its loss ratio would be 50%.

Source: relakhs.com

Source: relakhs.com

As a result, life insurance providers in india are expected to maintain a solvency ratio of 1.5 (or a solvency margin of 150%). If the loss ratio is above 1, or 100%, the insurance company is unprofitable and maybe in poor financial health because it is paying out more in claims than it is receiving in premiums. Insurance loss ratiois the loss to the insurance company for claims that were paid out, divided by the premiums paid by those insured. A healthy combined ratio in the field of insurance sectors is generally considered to be in the range of 75% to 90%. So, let�s get back to our prospective client with the 95 percent loss ratio.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is a good loss ratio for insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information