What is a homeowners insurance binder Idea

Home » Trend » What is a homeowners insurance binder IdeaYour What is a homeowners insurance binder images are available. What is a homeowners insurance binder are a topic that is being searched for and liked by netizens today. You can Find and Download the What is a homeowners insurance binder files here. Find and Download all free photos.

If you’re looking for what is a homeowners insurance binder pictures information related to the what is a homeowners insurance binder keyword, you have visit the ideal site. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

What Is A Homeowners Insurance Binder. Often referred to as bind coverage, a home insurance binder is a set of legal papers establishing the agreement between you and your insurer and. Insurance binders are contracts of temporary insurance pending the issuance of a formal policy or proper rejection of the application by the insurer. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. Once a formal policy is issued, the binder is no longer in effect, and therefore it is the lender�s decision of whether or not to accept a binder as evidence of insurance. if the homeowners policy is already in force, offer an acord 27 to evidence the coverage for the second mortgagee, pending revised declarations or an endorsement to add the.

Usaa Homeowners Insurance Binder Request Review Home Co From reviewhome.co

Usaa Homeowners Insurance Binder Request Review Home Co From reviewhome.co

The insured uses the binder to serve as proof of coverage until your formal policy is officially issued. For auto insurance, the insurer must give 5 days prior notice, unless the binder is replaced by a policy or another binder in the same company. It can provide you with full coverage while you await a more formal issuance. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. It�s a temporary legal placeholder until your official insurance policy is issued. A homeowners insurance binder is a document that is prepared and completed once the policy / coverage has been purchased.

What is a homeowners insurance binder?

An insurance binder is a temporary oral or written contract that provides evidence that a particular policy is active. It can provide you with full coverage while you await a more formal issuance. An insurance binder is a temporary oral or written contract that provides evidence that a particular policy is active. The insured uses the binder to serve as proof of coverage until your formal policy is officially issued. Definition of a homeowners insurance binder. An insurance binder is a temporary proof of homeowners insurance provided by your insurance company you may need an insurance binder to close on a home mortgage the binder will include information about your insurance.

Source: zadishqr.blogspot.com

What is an insurance binder? It�s most commonly used when you�re closing on a new property so you can prove to the lender or mortgage company that the home is insured. An insurance binder is very simple. Once the underwriting process is underway, your insurer will give you a homeowners insurance binder that serves as proof of coverage. A homeowners or fire insurance hazard binder assures your lender or mortgage holder that there is insurance on the home in case it is damaged or destroyed by fire or other disaster situations.

Source: reviewhome.co

Source: reviewhome.co

An insurance binder basically proves that there’s a formal agreement in place between you and the insurance company. A homeowners or fire insurance hazard binder assures your lender or mortgage holder that there is insurance on the home in case it is damaged or destroyed by fire or other disaster situations. An insurance binder is very simple. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. Applicable in florida except for auto insurance coverage, no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.

Source: viefgaufsiaxy4zw.25u.com

Source: viefgaufsiaxy4zw.25u.com

For auto insurance, the insurer must give 5 days prior notice, unless the binder is replaced by a policy or another binder in the same company. Who needs a homeowners insurance binder? It binds them to provide you insurance through the binder�s expiration date. All it is is a few pages of paperwork that serves as temporary evidence of insurance. An insurance binder is a temporary proof of homeowners insurance provided by your insurance company you may need an insurance binder to close on a home mortgage the binder will include information about your insurance.

Source: formsbirds.com

Source: formsbirds.com

A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. All it is is a few pages of paperwork that serves as temporary evidence of insurance. It�s issued before the underwriting process is complete largely for homeowners policies. The insured uses the binder to serve as proof of coverage until your formal policy is officially issued. Applicable in florida except for auto insurance coverage, no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.

Source: reviewhome.co

Source: reviewhome.co

This is important, as a lender will usually ask for proof of insurance when you go to purchase a home. All it is is a few pages of paperwork that serves as temporary evidence of insurance. The insurance binder specifies all the protections for which you are covered while you wait for a new policy, as well as any coverage limits, deductibles, fees, terms and conditions. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. A home insurance binder is used to prove that you have coverage on your home.

Source: applevalleyagency.com

Source: applevalleyagency.com

An insurance binder is very simple. An insurance binder is a temporary proof of homeowners insurance provided by your insurance company you may need an insurance binder to close on a home mortgage the binder will include information about your insurance. A homeowners or fire insurance hazard binder assures your lender or mortgage holder that there is insurance on the home in case it is damaged or destroyed by fire or other disaster situations. Anyone who gets homeowners insurance should ask for a binder. Insurance binders are contracts of temporary insurance pending the issuance of a formal policy or proper rejection of the application by the insurer.

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

That way, you’ll have proof of your. An insurance binder is a temporary contract between you and your insurer that proves you’ve purchased insurance coverage. What is an insurance binder? It�s issued before the underwriting process is complete largely for homeowners policies. For auto insurance, the insurer must give 5 days prior notice, unless the binder is replaced by a policy or another binder in the same company.

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

An insurance binder is a temporary proof of homeowners insurance provided by your insurance company you may need an insurance binder to close on a home mortgage the binder will include information about your insurance. A home insurance binder is used to prove that you have coverage on your home. A homeowners’ insurance binder is a document between you and your insurance agent that proves you have purchased homeowners’ insurance. This is important, as a lender will usually ask for proof of insurance when you go to purchase a home. An insurance binder is a temporary oral or written contract that provides evidence that a particular policy is active.

Source: pinterest.com

Source: pinterest.com

That way, you’ll have proof of your. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. This is important, as a lender will usually ask for proof of insurance when you go to purchase a home. A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. A homeowners insurance binder is a temporary legal insurance contract that furnishes coverage and evidence of insurance.

Source: thebalance.com

Source: thebalance.com

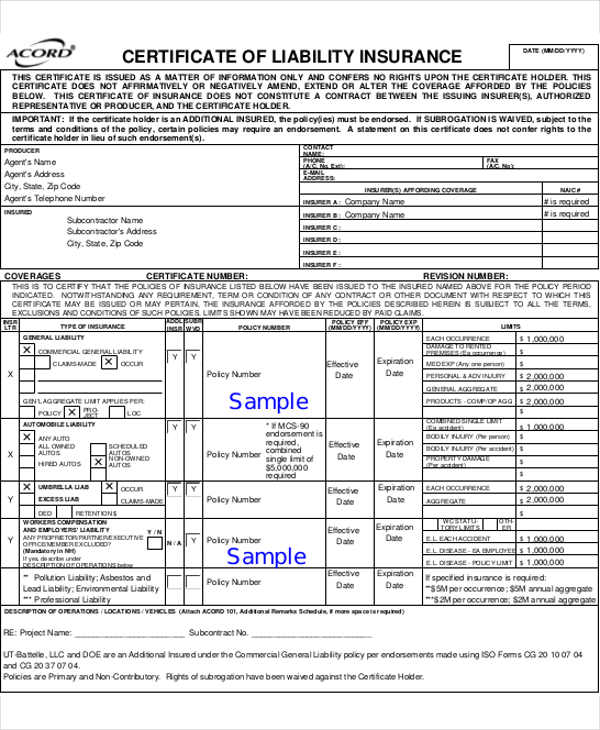

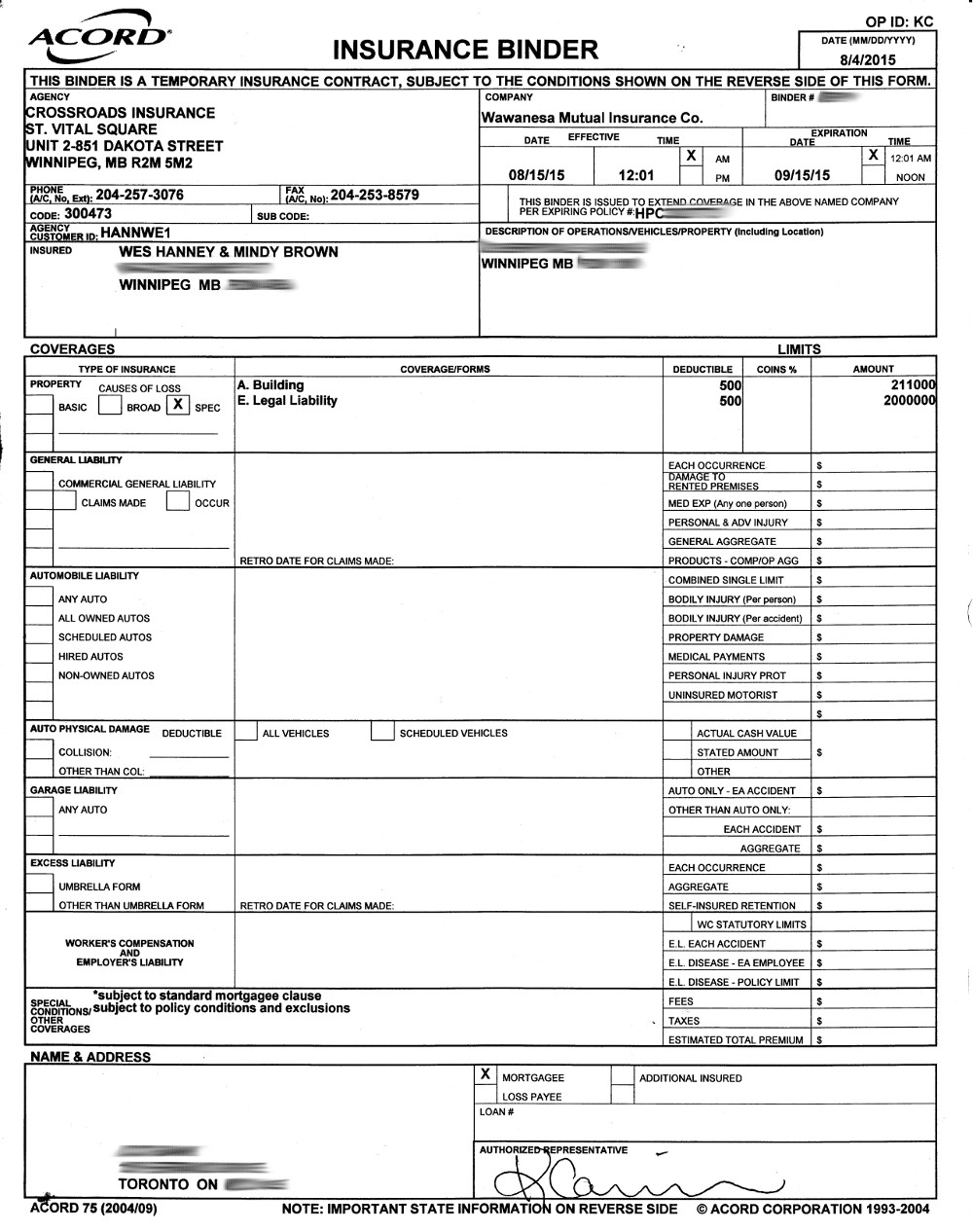

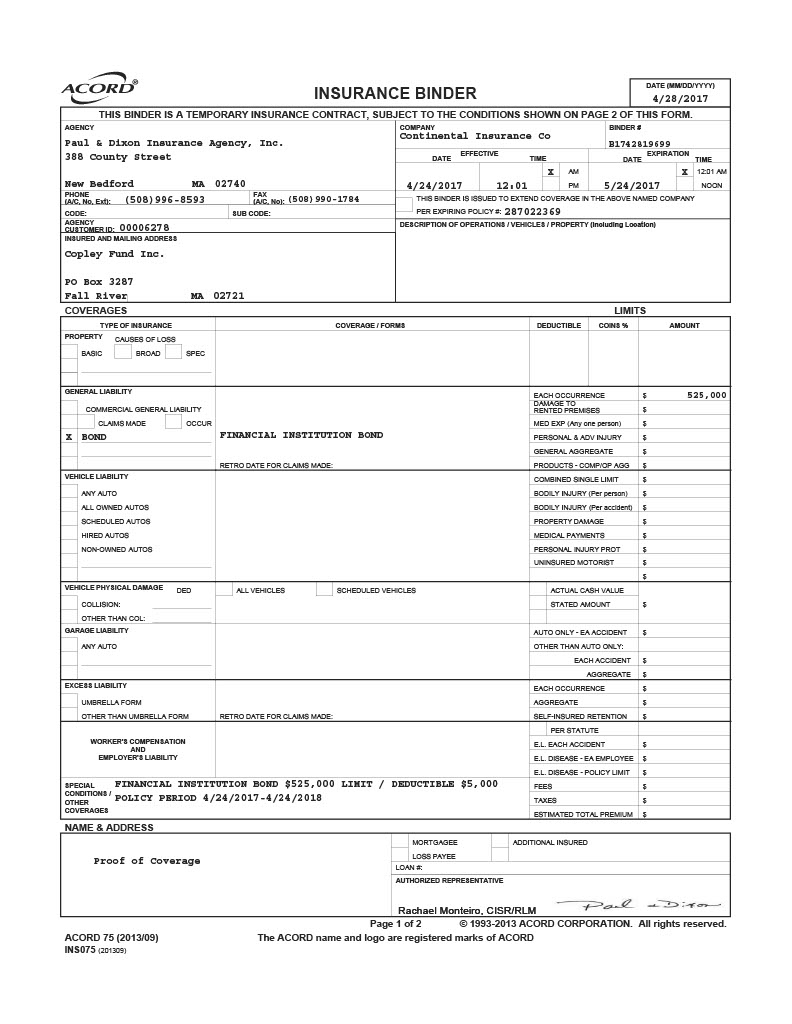

The binder serves only as a temporary or. A homeowners or fire insurance hazard binder assures your lender or mortgage holder that there is insurance on the home in case it is damaged or destroyed by fire or other disaster situations. Applicable in florida except for auto insurance coverage, no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days. Homeowner insurance binder what is an insurance binder ethan s blog certificate of liability insurance homeowners insurance binder form. A homeowners insurance binder ensures that you have proof of insurance for your home.

Source: homeownerinsurancekamimodo.blogspot.com

Source: homeownerinsurancekamimodo.blogspot.com

People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. In comparison, an insurance binder is proof of insurance and an actual temporary legal document. Insurance binders are contracts of temporary insurance pending the issuance of a formal policy or proper rejection of the application by the insurer. The insured uses the binder to serve as proof of coverage until your formal policy is officially issued. For auto insurance, the insurer must give 5 days prior notice, unless the binder is replaced by a policy or another binder in the same company.

Source: enmimundoviolettasiempre.blogspot.com

An insurance binder is a temporary proof of homeowners insurance provided by your insurance company you may need an insurance binder to close on a home mortgage the binder will include information about your insurance. The binder serves only as a temporary or. When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. In comparison, an insurance binder is proof of insurance and an actual temporary legal document. Applicable in florida except for auto insurance coverage, no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.

Source: reviewhome.co

Source: reviewhome.co

It binds them to provide you insurance through the binder�s expiration date. It can be a prepared document that demonstrates the basics of coverage or even a verbal, “you’re covered” from an insurance agent. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. A homeowners insurance binder is a document that is prepared and completed once the policy / coverage has been purchased. A home insurance binder is used to prove that you have coverage on your home.

Source: lopriore.com

Source: lopriore.com

What is a homeowners insurance binder? When you purchase an insurance policy, whether it’s homeowners insurance or car insurance, you’ll agree to terms with an insurance agent on everything about your policy. The insured uses the binder to serve as proof of coverage until your formal policy is officially issued. It�s most commonly used when you�re closing on a new property so you can prove to the lender or mortgage company that the home is insured. It�s a temporary legal placeholder until your official insurance policy is issued.

Source: honestpolicy.com

Source: honestpolicy.com

The insurance binder specifies all the protections for which you are covered while you wait for a new policy, as well as any coverage limits, deductibles, fees, terms and conditions. Your homeowners insurance binder will contain all of the policy details of your homeowners insurance, and act as your proof of insurance for a. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. What is an insurance binder? A homeowners’ insurance binder is a document between you and your insurance agent that proves you have purchased homeowners’ insurance.

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

Homeowner insurance binder what is an insurance binder ethan s blog certificate of liability insurance homeowners insurance binder form. Most lenders require that the insured amount is equal to the amount of your loan or at least equal to the replacement… An insurance binder basically proves that there’s a formal agreement in place between you and the insurance company. Anyone who gets homeowners insurance should ask for a binder. A home insurance binder is used to prove that you have coverage on your home.

An insurance binder is a temporary oral or written contract that provides evidence that a particular policy is active. It�s issued before the underwriting process is complete largely for homeowners policies. Your homeowners insurance binder will contain all of the policy details of your homeowners insurance, and act as your proof of insurance for a. A homeowners or fire insurance hazard binder assures your lender or mortgage holder that there is insurance on the home in case it is damaged or destroyed by fire or other disaster situations. What is a homeowners insurance binder?

Source: youngalfred.com

Source: youngalfred.com

The insured uses the binder to serve as proof of coverage until your formal policy is officially issued. When you purchase an insurance policy, whether it’s homeowners insurance or car insurance, you’ll agree to terms with an insurance agent on everything about your policy. Most lenders require that the insured amount is equal to the amount of your loan or at least equal to the replacement… When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. Applicable in florida except for auto insurance coverage, no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a homeowners insurance binder by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information