What is a house person on car insurance information

Home » Trending » What is a house person on car insurance informationYour What is a house person on car insurance images are ready. What is a house person on car insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is a house person on car insurance files here. Download all free vectors.

If you’re searching for what is a house person on car insurance pictures information connected with to the what is a house person on car insurance keyword, you have pay a visit to the right blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

What Is A House Person On Car Insurance. Comprehensive and collision coverage are coverages that protect the value of your own car. Liability, which covers damage you may do to someone else and their property, and everything else, which covers damage that happens to your property. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. It mainly depends on the value of your car.

Car Insurance PIC Insurance Brokers From pic.co.nz

Car Insurance PIC Insurance Brokers From pic.co.nz

Car insurance is for sudden accidental occurrences, not auto maintenance. Most standard homeowner�s policies protect the owners for damage to their dwelling and connected structures, such as a garage, that is caused by hazards such as fire, smoke, theft, vandalism, windstorm, and other things—like autos. Homeowners policies—like farmers smart plan home. Liability, which covers damage you may do to someone else and their property, and everything else, which covers damage that happens to your property. —that provide “all perils” coverage typically would cover the damage to your pool and fence caused in this scenario. You�ll need both types of liability insurance to protect yourself.

These are the most common types of car insurance, though many insurance companies sell other types of coverage as well, like gap insurance and rental reimbursement.

Car insurance is for sudden accidental occurrences, not auto maintenance. Forms of property insurance include auto insurance,. Most insurance companies give at least 30 days to the family to inform about the policy holder’s death to the insurer. Collision coverage will pay to repair or replace your car if you are at fault in an accident. If your car is hit by someone else�s car while parked, for instance, then you can file a property damage claim. Car insurance is for sudden accidental occurrences, not auto maintenance.

Source: dreamstime.com

Source: dreamstime.com

Because insurance is applied to the vehicle, every car in france needs to be separately insured. Car insurance is for sudden accidental occurrences, not auto maintenance. Most insurers offer one coverage or the other only. For those of you who feel that you have paid into your car insurance way more than you will ever get out of it, consider yourself lucky. You can also file a claim in other cases, such as when a car slides off the road and damages your mailbox, lawn, or home.

Source: dreamstime.com

Source: dreamstime.com

Most standard homeowner�s policies protect the owners for damage to their dwelling and connected structures, such as a garage, that is caused by hazards such as fire, smoke, theft, vandalism, windstorm, and other things—like autos. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. Many auto policies stop at a maximum of $300,000 or $500,000 per accident for liability coverage. Comprehensive coverage will pay to repair or replace your car if it is damaged outside of an accident or stolen. Most standard homeowner�s policies protect the owners for damage to their dwelling and connected structures, such as a garage, that is caused by hazards such as fire, smoke, theft, vandalism, windstorm, and other things—like autos.

Source: dreamstime.com

Source: dreamstime.com

What is property damage car insurance and what does it cover? —that provide “all perils” coverage typically would cover the damage to your pool and fence caused in this scenario. Claims are filed after a covered event has occurred, such as a natural disaster, house fire, or car crash. Many auto policies stop at a maximum of $300,000 or $500,000 per accident for liability coverage. Property damage liability insurance covers damage to the other person�s property, usually their car, but it can include items inside the vehicle.

Source: dreamstime.com

Source: dreamstime.com

The 5 types of car insurance 1. Following that reasoning, property insurance protects you against damage to—or loss of—expensive personal property, such as a dwelling or a car. Costs $136 per month, on average, but your rate may be very different. An insurance claim is a request from a policyholder to receive compensation from the policy provider. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

Source: dreamstime.com

Source: dreamstime.com

Car insurance is for sudden accidental occurrences, not auto maintenance. New car replacement insurance works similarly to gap insurance and will pay for the value of a new car if yours is totaled in an accident. Costs $136 per month, on average, but your rate may be very different. Your own homeowners policy may cover the damages to your property subject to policy terms and limits. —that provide “all perils” coverage typically would cover the damage to your pool and fence caused in this scenario.

Source: dreamstime.com

Source: dreamstime.com

Liability, which covers damage you may do to someone else and their property, and everything else, which covers damage that happens to your property. When it comes to car insurance, there are two major types of coverage: Coverage for your own property falls under comprehensive and collision coverage, which you pay for separately. Car insurance is for sudden accidental occurrences, not auto maintenance. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

Source: dreamstime.com

Source: dreamstime.com

When it comes to car insurance, there are two major types of coverage: Homeowners policies—like farmers smart plan home. When it comes to car insurance, there are two major types of coverage: Personal insurance for car, home and rv | intact insurance. 2 most standard homeowner�s policies cite vehicles among the hazards covered that might cause damage.

Source: dreamstime.com

Source: dreamstime.com

Forms of property insurance include auto insurance,. Car insurance is for sudden accidental occurrences, not auto maintenance. 2 most standard homeowner�s policies cite vehicles among the hazards covered that might cause damage. The 5 types of car insurance 1. An insurance claim is a request from a policyholder to receive compensation from the policy provider.

Source: dreamstime.com

Source: dreamstime.com

Car insurance in france covers the vehicle rather than the driver, meaning that other licensed drivers can driver your car if the policy allows it. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. Car insurance details of the other driver (and car owner if different) names and addresses of other passengers in both cars or other involved/injured people names and contact details of any witnesses Comprehensive and collision coverage are coverages that protect the value of your own car. In general, a personal auto insurance policy will cover the policyholder and any family members listed as drivers on the policy.

Source: thebalance.com

Source: thebalance.com

An insurance claim is a request from a policyholder to receive compensation from the policy provider. Car insurance is for sudden accidental occurrences, not auto maintenance. Claims, especially severe claims, are always best avoided. Property damage liability insurance is a main component of car insurance, homeowners insurance, and business liability insurance. If you drive into a building, property damage liability will cover the damage to the building up to the policy�s limit.

Source: dreamstime.com

Source: dreamstime.com

Liability, which covers damage you may do to someone else and their property, and everything else, which covers damage that happens to your property. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. For those of you who feel that you have paid into your car insurance way more than you will ever get out of it, consider yourself lucky. Each state has its own laws governing claims. Coverage for your own property falls under comprehensive and collision coverage, which you pay for separately.

Source: pic.co.nz

Source: pic.co.nz

Liability, which covers damage you may do to someone else and their property, and everything else, which covers damage that happens to your property. Many auto policies stop at a maximum of $300,000 or $500,000 per accident for liability coverage. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. An insurance claim is a request from a policyholder to receive compensation from the policy provider. Property damage liability insurance is a main component of car insurance, homeowners insurance, and business liability insurance.

![How To Shop For Car Insurance In 2021 [Full Guide] How To Shop For Car Insurance In 2021 [Full Guide]](https://cdn.motor1.com/images/mgl/BMxEj/s1/shop-car-insurance-photo.jpg) Source: motor1.com

Source: motor1.com

New car replacement insurance works similarly to gap insurance and will pay for the value of a new car if yours is totaled in an accident. 2 most standard homeowner�s policies cite vehicles among the hazards covered that might cause damage. Property damage insurance covers you for any financial liability that occurs should you get into an accident and cause damage to someone else�s property. If your car is hit by someone else�s car while parked, for instance, then you can file a property damage claim. Comprehensive and collision coverage are coverages that protect the value of your own car.

Source: aami.com.au

Source: aami.com.au

Costs $136 per month, on average, but your rate may be very different. You�ll need both types of liability insurance to protect yourself. The five types of car insurance are liability, comprehensive, collision, uninsured/underinsured motorist, and personal injury protection/medical payments. Property damage insurance covers you for any financial liability that occurs should you get into an accident and cause damage to someone else�s property. Car insurance is for sudden accidental occurrences, not auto maintenance.

Source: bankrate.com

Source: bankrate.com

This link will open in a new window. Car insurance in the u.s. The five types of car insurance are liability, comprehensive, collision, uninsured/underinsured motorist, and personal injury protection/medical payments. If the family of the policyholder decides to take possession of the car after their death, then they will have to change the title at the local dmv and buy a new insurance policy. If you drive into a building, property damage liability will cover the damage to the building up to the policy�s limit.

Source: dreamstime.com

Source: dreamstime.com

Failure to insure a vehicle can lead to fines of up to €3,750. Most insurance companies give at least 30 days to the family to inform about the policy holder’s death to the insurer. It mainly depends on the value of your car. Homeowners insurance protects your home’s structure and the belongings inside against loss or damage caused by a covered peril. Costs $136 per month, on average, but your rate may be very different.

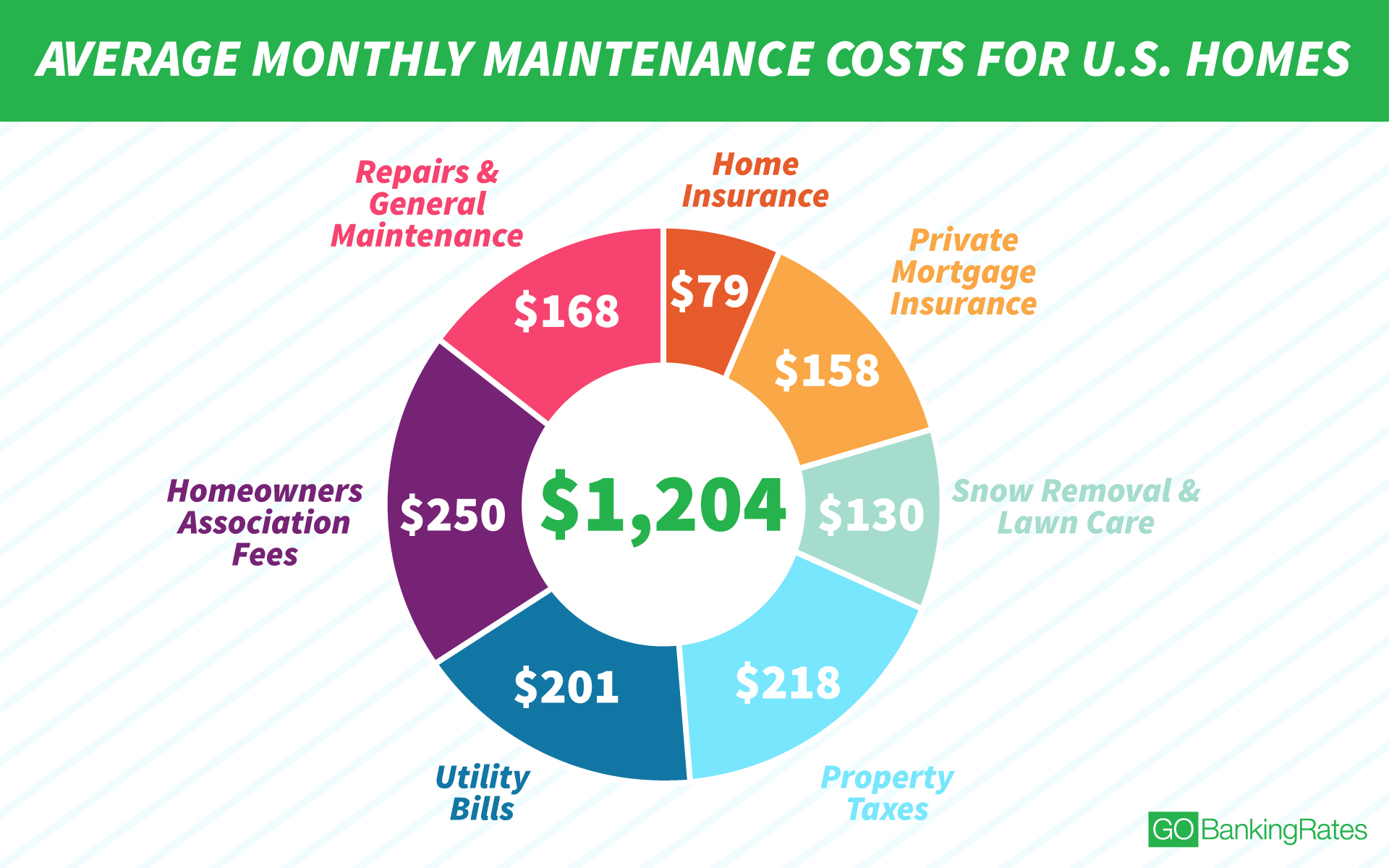

Source: gobankingrates.com

Source: gobankingrates.com

Comprehensive coverage will pay to repair or replace your car if it is damaged outside of an accident or stolen. Failure to insure a vehicle can lead to fines of up to €3,750. The 5 types of car insurance 1. Many or all of the products featured here are. If you drive into a building, property damage liability will cover the damage to the building up to the policy�s limit.

Source: mabeyinsurance.com

Source: mabeyinsurance.com

Car insurance in the u.s. Car insurance details of the other driver (and car owner if different) names and addresses of other passengers in both cars or other involved/injured people names and contact details of any witnesses Car insurance in france covers the vehicle rather than the driver, meaning that other licensed drivers can driver your car if the policy allows it. Your own homeowners policy may cover the damages to your property subject to policy terms and limits. Comprehensive coverage will pay to repair or replace your car if it is damaged outside of an accident or stolen.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is a house person on car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information