What is a non admitted insurer Idea

Home » Trending » What is a non admitted insurer IdeaYour What is a non admitted insurer images are ready in this website. What is a non admitted insurer are a topic that is being searched for and liked by netizens now. You can Download the What is a non admitted insurer files here. Download all free images.

If you’re looking for what is a non admitted insurer images information related to the what is a non admitted insurer interest, you have come to the ideal blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

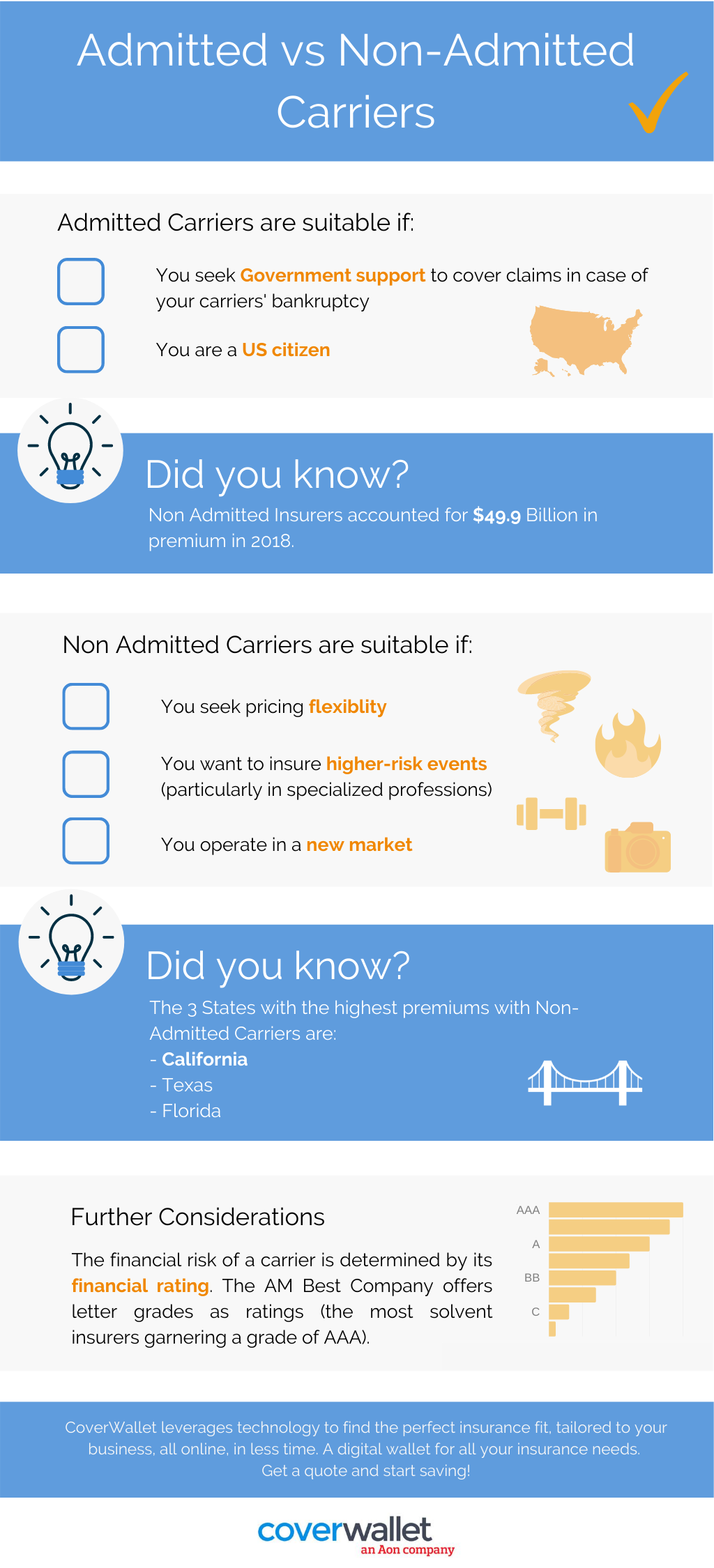

What Is A Non Admitted Insurer. Admitted insurers also pay into state guaranty funds, which are designed to step in if the insurer becomes insolvent. However, some people need specialized insurance, and these types of. This allows them to issue policies that admitted insurers cannot, but may also come with less security. You may also be able to negotiate a reduced rate for your policy.

What is the difference between an Admitted or NonAdmitted From grbminc.com

What is the difference between an Admitted or NonAdmitted From grbminc.com

It protects policyholders from the potential bankruptcy of their insurer. They can be more flexible and meet consumers� needs. Jurisdictions, such insurers can nevertheless write coverage through an excess and surplus lines broker licensed in that jurisdiction. Insurance purchased from a company that is admitted (or licensed) in the state in which the policy was sold. Admitted insurance must also be sold by an agent who is licensed in. Rates must be approved by the state.

They can be more flexible and meet consumers� needs.

An item on an insurer’s balance sheet that represents reinsured liabilities for which the reinsurer has not provided collateral. You may also be able to negotiate a reduced rate for your policy. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as. It just doesn’t have the same licensing, regulation, or backing. But, they are better able to offer coverage if an admitted company cannot. They sell coverage that is unavailable from licensed insurers within the country or state.

Source: slideshare.net

Source: slideshare.net

Admitted insurance must also be sold by an agent who is licensed in. It protects policyholders from the potential bankruptcy of their insurer. Insurance purchased from a company that is admitted (or licensed) in the state in which the policy was sold. Admitted insurance must also be sold by an agent who is licensed in. Nonadmitted balance entries reduce the.

Source: coverwallet.com

Source: coverwallet.com

Admitted insurance must also be sold by an agent who is licensed in. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. Nonadmitted balance entries reduce the. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located. Insurance purchased from a company that is admitted (or licensed) in the state in which the policy was sold.

Source: slideserve.com

Source: slideserve.com

However, some people need specialized insurance, and these types of. Looking at the bigger picture, the main issue for concern is not “admitted v. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. Some may even allow you to create a customized policy. Admitted insurers also pay into state guaranty funds, which are designed to step in if the insurer becomes insolvent.

Source: youtube.com

Source: youtube.com

It also doesn’t mean the insurance is illegal, nor does it mean it’s bad. It protects policyholders from the potential bankruptcy of their insurer. An item on an insurer’s balance sheet that represents reinsured liabilities for which the reinsurer has not provided collateral. They sell coverage that is unavailable from licensed insurers within the country or state. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as.

Source: presidioinsurance.com

Source: presidioinsurance.com

They can be more flexible and meet consumers� needs. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located. However, some people need specialized insurance, and these types of. Looking at the bigger picture, the main issue for concern is not “admitted v. Nonadmitted balance entries reduce the.

Source: youtube.com

Source: youtube.com

Looking at the bigger picture, the main issue for concern is not “admitted v. You may also be able to negotiate a reduced rate for your policy. This allows them to issue policies that admitted insurers cannot, but may also come with less security. But, that does not mean that the insurer is not allowed to work in the state. These terms generally refer to the type of regulation an insurance company must follow.

.png “The Difference Between Admitted and NonAdmitted Insurance”) Source: security.naifa.org

They can be more flexible and meet consumers� needs. Admitted insurance must also be sold by an agent who is licensed in. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located. Rates must be approved by the state. But, that does not mean that the insurer is not allowed to work in the state.

Source: embroker.com

Source: embroker.com

Rates must be approved by the state. At first blush, it would seem more prudent to have an insurance company backed by the state insurance commissioner. Admitted insurance must also be sold by an agent who is licensed in. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located. It just doesn’t have the same licensing, regulation, or backing.

Source: elliotwhittier.com

Jurisdictions, such insurers can nevertheless write coverage through an excess and surplus lines broker licensed in that jurisdiction. But, that does not mean that the insurer is not allowed to work in the state. It also doesn’t mean the insurance is illegal, nor does it mean it’s bad. At first blush, it would seem more prudent to have an insurance company backed by the state insurance commissioner. They can be more flexible and meet consumers� needs.

Source: suzannebrownagency.com

Source: suzannebrownagency.com

These terms generally refer to the type of regulation an insurance company must follow. Rates must be approved by the state. At first blush, it would seem more prudent to have an insurance company backed by the state insurance commissioner. You may also be able to negotiate a reduced rate for your policy. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as.

Source: falveyinsurancegroup.com

Source: falveyinsurancegroup.com

Admitted insurance must also be sold by an agent who is licensed in. It just doesn’t have the same licensing, regulation, or backing. Some may even allow you to create a customized policy. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. You may also be able to negotiate a reduced rate for your policy.

Source: insurdinary.ca

Source: insurdinary.ca

This allows them to issue policies that admitted insurers cannot, but may also come with less security. Links for irmi online subscribers only: An item on an insurer’s balance sheet that represents reinsured liabilities for which the reinsurer has not provided collateral. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. Requiring that rates be approved by the state’s office of insurance regulation prevents huge swings in insurance rates.

Source: americanheritagegapinsurancephonenumb.blogspot.com

Source: americanheritagegapinsurancephonenumb.blogspot.com

At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. Links for irmi online subscribers only: Looking at the bigger picture, the main issue for concern is not “admitted v. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as.

Source: revisi.net

Source: revisi.net

Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located. Admitted insurance must also be sold by an agent who is licensed in. They sell coverage that is unavailable from licensed insurers within the country or state. Nonadmitted insurer — an insurance company not licensed to do business in a certain state or country. It also doesn’t mean the insurance is illegal, nor does it mean it’s bad.

Source: grbminc.com

Source: grbminc.com

They can be more flexible and meet consumers� needs. But, that does not mean that the insurer is not allowed to work in the state. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as. Rates must be approved by the state. Insurance purchased from a company that is admitted (or licensed) in the state in which the policy was sold.

Source: campbellriskmanagement.com

Source: campbellriskmanagement.com

Requiring that rates be approved by the state’s office of insurance regulation prevents huge swings in insurance rates. Insurance purchased from a company that is admitted (or licensed) in the state in which the policy was sold. These terms generally refer to the type of regulation an insurance company must follow. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as. But, they are better able to offer coverage if an admitted company cannot.

Source: insurancethoughtleadership.com

Source: insurancethoughtleadership.com

But, that does not mean that the insurer is not allowed to work in the state. Admitted insurance must also be sold by an agent who is licensed in. Requiring that rates be approved by the state’s office of insurance regulation prevents huge swings in insurance rates. But, that does not mean that the insurer is not allowed to work in the state. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located.

Source: nextinsurance.com

Source: nextinsurance.com

These terms generally refer to the type of regulation an insurance company must follow. Non admitted insurer in the state of new york because they dont have the license to transact insurance businesses in that state an agent of first financial secuirty can use a surplus line broker who can write coverage if the broker is licensed in the state where coverage is being written the non admitted insurance market also referred to as. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. Requiring that rates be approved by the state’s office of insurance regulation prevents huge swings in insurance rates. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a non admitted insurer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information