What is a tax qualified long term care insurance policy information

Home » Trending » What is a tax qualified long term care insurance policy informationYour What is a tax qualified long term care insurance policy images are available in this site. What is a tax qualified long term care insurance policy are a topic that is being searched for and liked by netizens today. You can Download the What is a tax qualified long term care insurance policy files here. Download all free photos.

If you’re looking for what is a tax qualified long term care insurance policy images information connected with to the what is a tax qualified long term care insurance policy topic, you have come to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

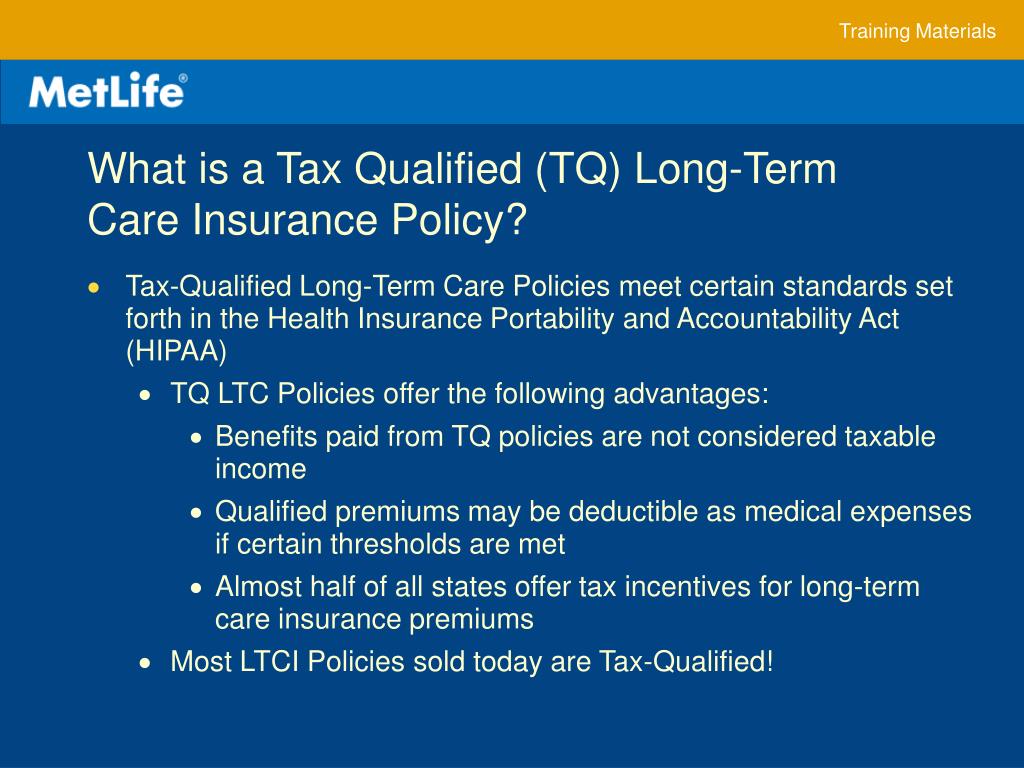

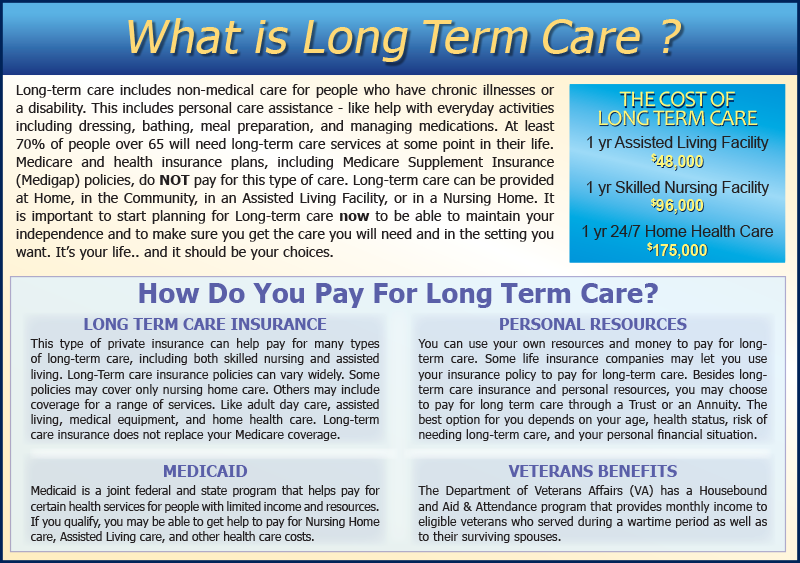

What Is A Tax Qualified Long Term Care Insurance Policy. For example, if you receive $450 a day and your expenses are only $400 a day, the extra $50 is taxable. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium. Benefits paid under this type of policy are not considered taxable income. You add your total policy premium to your other deductible.

Pension Investors Corporation of Orlando. Business Planning From pensioninvestorscorp.com

Pension Investors Corporation of Orlando. Business Planning From pensioninvestorscorp.com

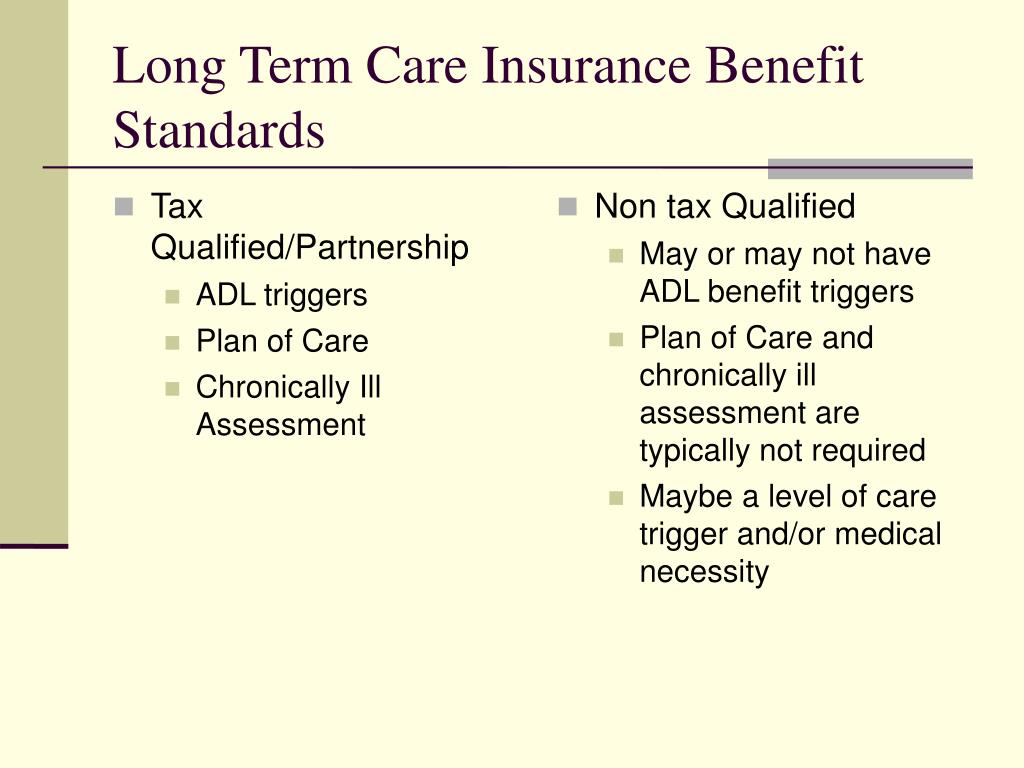

As of august 2018, all states have enacted some form of long term care partnership program except alaska, hawaii, illinois, massachusetts, mississippi, utah and vermont. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration. A qualified policy must meet certain requirements, including: Tq long term care insurance premiums are considered to be a medical expense and qualify as an itemized deduction up to a defined limit, based on the age of the policyholder and inflation. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income.

Adjusted gross income for the purpose of this income tax is 5 percent.

Before the health insurance portability and accountability act of 1996, it was unclear whether benefits received under a ltci policy would be treated as taxable income. Similar tax advantages exist at the state level, but. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. Adjusted gross income for the purpose of this income tax is 5 percent. As of 2021, the maximum is up to $400 per day. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

As of august 2018, all states have enacted some form of long term care partnership program except alaska, hawaii, illinois, massachusetts, mississippi, utah and vermont. Benefits paid under this type of policy are not considered taxable income. As of 2021, the maximum is up to $400 per day. Similar tax advantages exist at the state level, but. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium.

Source: livemoneyadvisor.com

Source: livemoneyadvisor.com

A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. Adjusted gross income for the purpose of this income tax is 5 percent. However, these premiums can be expensive. You add your total policy premium to your other deductible. As of 2021, the maximum is up to $400 per day.

Source: mccannltc.net

Source: mccannltc.net

Before the health insurance portability and accountability act of 1996, it was unclear whether benefits received under a ltci policy would be treated as taxable income. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. Medical expenses that exceed 7 have a choice of allowing or denying tax deductions. Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration. Adjusted gross income for the purpose of this income tax is 5 percent.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

A qualified policy must meet certain requirements, including: If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. Before the health insurance portability and accountability act of 1996, it was unclear whether benefits received under a ltci policy would be treated as taxable income. Adjusted gross income for the purpose of this income tax is 5 percent.

Source: slideserve.com

Source: slideserve.com

Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration. However, these premiums can be expensive. For example, if you receive $450 a day and your expenses are only $400 a day, the extra $50 is taxable. Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium.

Source: slideserve.com

Source: slideserve.com

You add your total policy premium to your other deductible. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium. A qualified policy must meet certain requirements, including: Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration.

Source: prepsmart.com

Source: prepsmart.com

A qualified policy must meet certain requirements, including: Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration. Similar tax advantages exist at the state level, but. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. Benefits paid under this type of policy are not considered taxable income.

Source: pensioninvestorscorp.com

Source: pensioninvestorscorp.com

For example, if you receive $450 a day and your expenses are only $400 a day, the extra $50 is taxable. Similar tax advantages exist at the state level, but. You add your total policy premium to your other deductible. Medical expenses that exceed 7 have a choice of allowing or denying tax deductions. A qualified policy must meet certain requirements, including:

Source: npa1.org

Source: npa1.org

Medical expenses that exceed 7 have a choice of allowing or denying tax deductions. Adjusted gross income for the purpose of this income tax is 5 percent. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. Medical expenses that exceed 7 have a choice of allowing or denying tax deductions. As of august 2018, all states have enacted some form of long term care partnership program except alaska, hawaii, illinois, massachusetts, mississippi, utah and vermont.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

As of 2021, the maximum is up to $400 per day. Similar tax advantages exist at the state level, but. However, these premiums can be expensive. Benefits paid under this type of policy are not considered taxable income. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income.

Source: kiplinger.com

Source: kiplinger.com

If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. As of 2021, the maximum is up to $400 per day. Tq long term care insurance premiums are considered to be a medical expense and qualify as an itemized deduction up to a defined limit, based on the age of the policyholder and inflation. Adjusted gross income for the purpose of this income tax is 5 percent.

Source: skloff.com

Source: skloff.com

However, these premiums can be expensive. Adjusted gross income for the purpose of this income tax is 5 percent. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium. For example, if you receive $450 a day and your expenses are only $400 a day, the extra $50 is taxable. Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration.

Source: theuslawoffices.com

Source: theuslawoffices.com

A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. As of 2021, the maximum is up to $400 per day. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. However, these premiums can be expensive. Medical expenses that exceed 7 have a choice of allowing or denying tax deductions.

Source: thebenefitblog.com

Source: thebenefitblog.com

Similar tax advantages exist at the state level, but. Medical expenses that exceed 7 have a choice of allowing or denying tax deductions. You add your total policy premium to your other deductible. Similar tax advantages exist at the state level, but. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and.

Source: slideserve.com

Source: slideserve.com

If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. Before the health insurance portability and accountability act of 1996, it was unclear whether benefits received under a ltci policy would be treated as taxable income. If you have a qualified long term care policy, and you itemize deductions, you may be able to deduct part, or all, of the premium. Part of the law stipulated that long term care policies that meet certain standards will receive favorable tax consideration. As of 2021, the maximum is up to $400 per day.

Source: lifelawfirm.com

Source: lifelawfirm.com

For example, if you receive $450 a day and your expenses are only $400 a day, the extra $50 is taxable. Tq long term care insurance premiums are considered to be a medical expense and qualify as an itemized deduction up to a defined limit, based on the age of the policyholder and inflation. A long term care insurance classified as qualified is taken as an itemized deduction until “certain limits”, provided that premiums and. As of august 2018, all states have enacted some form of long term care partnership program except alaska, hawaii, illinois, massachusetts, mississippi, utah and vermont. Benefits paid under this type of policy are not considered taxable income.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

For example, if you receive $450 a day and your expenses are only $400 a day, the extra $50 is taxable. A qualified policy must meet certain requirements, including: As of august 2018, all states have enacted some form of long term care partnership program except alaska, hawaii, illinois, massachusetts, mississippi, utah and vermont. Adjusted gross income for the purpose of this income tax is 5 percent. Before the health insurance portability and accountability act of 1996, it was unclear whether benefits received under a ltci policy would be treated as taxable income.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information