What is a warranty in insurance Idea

Home » Trending » What is a warranty in insurance IdeaYour What is a warranty in insurance images are available in this site. What is a warranty in insurance are a topic that is being searched for and liked by netizens now. You can Download the What is a warranty in insurance files here. Find and Download all free vectors.

If you’re looking for what is a warranty in insurance pictures information related to the what is a warranty in insurance interest, you have come to the right blog. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

What Is A Warranty In Insurance. A thing providing protection against a possible eventuality. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Insurers that use warranties must, therefore, include the warranty in the policy and state that it is material to the decision of the insurer to insure or not insure the insured, that the warranty is material to the risk and that breach of the warranty shall cause the policy to be void.de campos v. Warranties may be either express or implied.

What is Homeowners Insurance and How is it Different from From northernvirginiahomepro.com

What is Homeowners Insurance and How is it Different from From northernvirginiahomepro.com

What is product warranty insurance? It is sold for things like appliances, vehicles, and electronics as an extra assurance for consumers. The overall reps and warranties insurance cost is made up of the insurer�s premium, the broker�s commission, and counsel�s underwriting fee. Warranties are statements of fact about the target business which protect a buyer in two primary ways: What does home warranty insurance. A warranty, manufacturer’s warranty, mechanical breakdown insurance, appliance warranty, you name it — is a type of guarantee that a manufacturer or warranty company makes regarding the condition of its product that you purchased.

The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured.

Product warranties are included within the definition of the named insured�s product in general liability policies. Most insurance contracts require the insured to make certain warranties. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. What does home warranty insurance. Warranties may be either express or implied. A thing providing protection against a possible eventuality.

Source: issuu.com

Source: issuu.com

A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. It is sold for things like appliances, vehicles, and electronics as an extra assurance for consumers. Home warranty insurance is s a type of insurance which protects you if the builder does not finish building the house, or if you discover defects after settlement which the builder will not fix. According to jrank, a warranty in an insurance policy states that something the insured person says is true. Warranties are like statements according to which an insured promises to do or not to do some particular things.

Source: wqcorp.com

Source: wqcorp.com

Most insurance contracts require the insured to make certain warranties. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A warranty is a promise (assurance) that must be met by the insured in regards to the risks to: Home warranty insurance is s a type of insurance which protects you if the builder does not finish building the house, or if you discover defects after settlement which the builder will not fix. In addition, depending on how the law classifies the product, states heavily dictate what laws, regulations, and rules govern the development and sale of that product.

Source: homefinderorangecounty.com

Source: homefinderorangecounty.com

An insurance contract is written on the principle of utmost good faith, meaning each party must trust that the other is being completely truthful. In addition, depending on how the law classifies the product, states heavily dictate what laws, regulations, and rules govern the development and sale of that product. A warranty, manufacturer’s warranty, mechanical breakdown insurance, appliance warranty, you name it — is a type of guarantee that a manufacturer or warranty company makes regarding the condition of its product that you purchased. The overall reps and warranties insurance cost is made up of the insurer�s premium, the broker�s commission, and counsel�s underwriting fee. What does home warranty insurance.

Source: essentialhomeandgarden.com

Source: essentialhomeandgarden.com

A warranty, manufacturer’s warranty, mechanical breakdown insurance, appliance warranty, you name it — is a type of guarantee that a manufacturer or warranty company makes regarding the condition of its product that you purchased. Failure to comply to your warranty could void your coverage regardless of the cause of the loss and the coverages and exclusions in your policy. Warranties are statements of fact about the target business which protect a buyer in two primary ways: Warranties are like statements according to which an insured promises to do or not to do some particular things. Warranty — (1) a guarantee of the performance of a product.

Source: sweephoenixazhomes.com

Source: sweephoenixazhomes.com

That no content, object, person, or any condition, attached to the insurance policy undertaking is illegal. The overall reps and warranties insurance cost is made up of the insurer�s premium, the broker�s commission, and counsel�s underwriting fee. A warranty, manufacturer’s warranty, mechanical breakdown insurance, appliance warranty, you name it — is a type of guarantee that a manufacturer or warranty company makes regarding the condition of its product that you purchased. It means, he affirms or negates the existence of particular facts. Most insurance contracts require the insured to make certain warranties.

Source: brashearsinsurance.com

Source: brashearsinsurance.com

A thing providing protection against a possible eventuality. Warranties are like statements according to which an insured promises to do or not to do some particular things. Warranty insurance is an insurance product designed to provide coverage for expenses associated with repair or replacement of the items covered by the insurance. Warranties may be either express or implied. A thing providing protection against a possible eventuality.

Source: youtube.com

Source: youtube.com

This warranty implies that the matter (voyage) insured conducts in a lawful manner. A clause in an insurance contract that requires certain conditions, circumstances, or facts to be tr That no content, object, person, or any condition, attached to the insurance policy undertaking is illegal. It means, he affirms or negates the existence of particular facts. The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured.

Source: youtube.com

Source: youtube.com

It means, he affirms or negates the existence of particular facts. An insurance contract is written on the principle of utmost good faith, meaning each party must trust that the other is being completely truthful. (2) a statement of fact given to an insurer by the insured concerning the insured risk which, if. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Warranties are statements of fact about the target business which protect a buyer in two primary ways:

Source: pierceinsgroup.com

Source: pierceinsgroup.com

This warranty implies that the matter (voyage) insured conducts in a lawful manner. Warranty insurance is an insurance product designed to provide coverage for expenses associated with repair or replacement of the items covered by the insurance. A warranty is a promise (assurance) that must be met by the insured in regards to the risks to: 1 to 1.5% of the limit of insurance is typically the rep and warranty insurance premium that can be negotiated on average across global jurisdictions. What does home warranty insurance.

Source: northernvirginiahomepro.com

Source: northernvirginiahomepro.com

This warranty implies that the matter (voyage) insured conducts in a lawful manner. In an insurance policy, a warranty is a promise. (2) a statement of fact given to an insurer by the insured concerning the insured risk which, if. A warranty, on the other hand, is an undertaking by the insured to the effect that he shall or shall not do a certain thing or that some conditions shall be fulfilled or whereby he affirms or negatives the existence of a particular state of affairs. Home warranty insurance is s a type of insurance which protects you if the builder does not finish building the house, or if you discover defects after settlement which the builder will not fix.

![]() Source: strategicclaimconsultants.com

Source: strategicclaimconsultants.com

In terms of the premium, pricing varies based on the insurer’s risk assessment, coverage limit, length of. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A warranty is a promise (assurance) that must be met by the insured in regards to the risks to: Insurers that use warranties must, therefore, include the warranty in the policy and state that it is material to the decision of the insurer to insure or not insure the insured, that the warranty is material to the risk and that breach of the warranty shall cause the policy to be void.de campos v. (2) a statement of fact given to an insurer by the insured concerning the insured risk which, if.

Source: insurance-advocate.com

Source: insurance-advocate.com

In terms of the premium, pricing varies based on the insurer’s risk assessment, coverage limit, length of. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Your warranty coverage is essentially a “promise” the manufacturer makes to repair or replace the items (if. A clause in an insurance contract that requires certain conditions, circumstances, or facts to be tr Only misrepresentations on conditions and warranties in.

Source: hwahomewarranty.com

Source: hwahomewarranty.com

What does home warranty insurance. The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured. A thing providing protection against a possible eventuality. Failure to comply to your warranty could void your coverage regardless of the cause of the loss and the coverages and exclusions in your policy. Product warranty insurance may offer a solution to increase the warranty while transferring the risk to an insurance company.

Source: rockriverrealty.com

Source: rockriverrealty.com

The overall reps and warranties insurance cost is made up of the insurer�s premium, the broker�s commission, and counsel�s underwriting fee. While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price. A warranty is a promise (assurance) that must be met by the insured in regards to the risks to: A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A clause in an insurance contract that requires certain conditions, circumstances, or facts to be tr

Source: totalprotect.com

Warranty insurance is an insurance product designed to provide coverage for expenses associated with repair or replacement of the items covered by the insurance. A warranty is a form of guarantee that a manufacturer offers to repair or replace a faulty product within a window of time after purchase. An insurance contract is written on the principle of utmost good faith, meaning each party must trust that the other is being completely truthful. A warranty is a promise (assurance) that must be met by the insured in regards to the risks to: A warranty is something by which the policyholder undertakes that some things shall or shall not be done during the tenure of the policy.

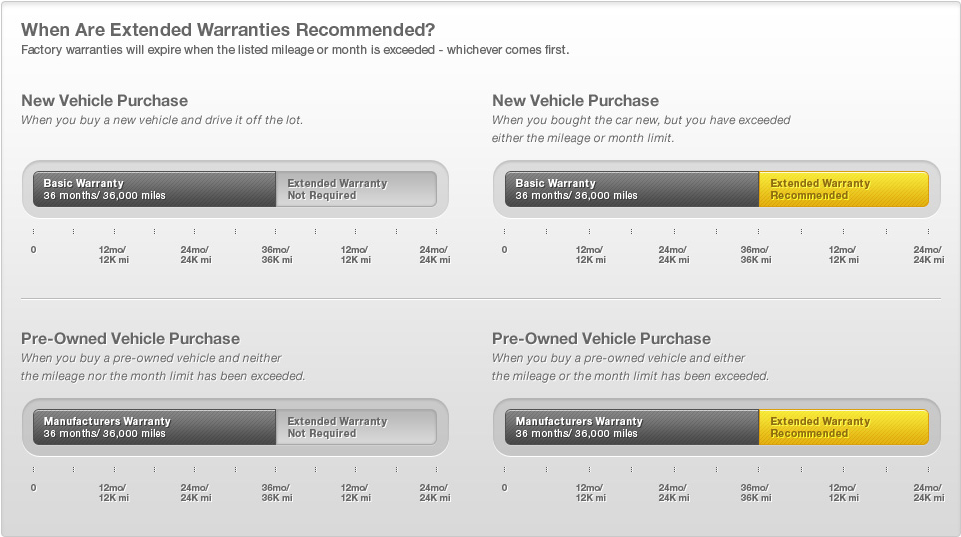

Source: carinsurancerates.com

Source: carinsurancerates.com

What does home warranty insurance. The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured. Product warranty insurance may offer a solution to increase the warranty while transferring the risk to an insurance company. While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price. In an insurance policy, a warranty is a promise.

Source: issuu.com

Source: issuu.com

Warranties, service contracts, and insurance policies have many similar components, but their dissimilarities are important under the eyes of the law. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A warranty, manufacturer’s warranty, mechanical breakdown insurance, appliance warranty, you name it — is a type of guarantee that a manufacturer or warranty company makes regarding the condition of its product that you purchased. Warranty insurance is an insurance product designed to provide coverage for expenses associated with repair or replacement of the items covered by the insurance. It is sold for things like appliances, vehicles, and electronics as an extra assurance for consumers.

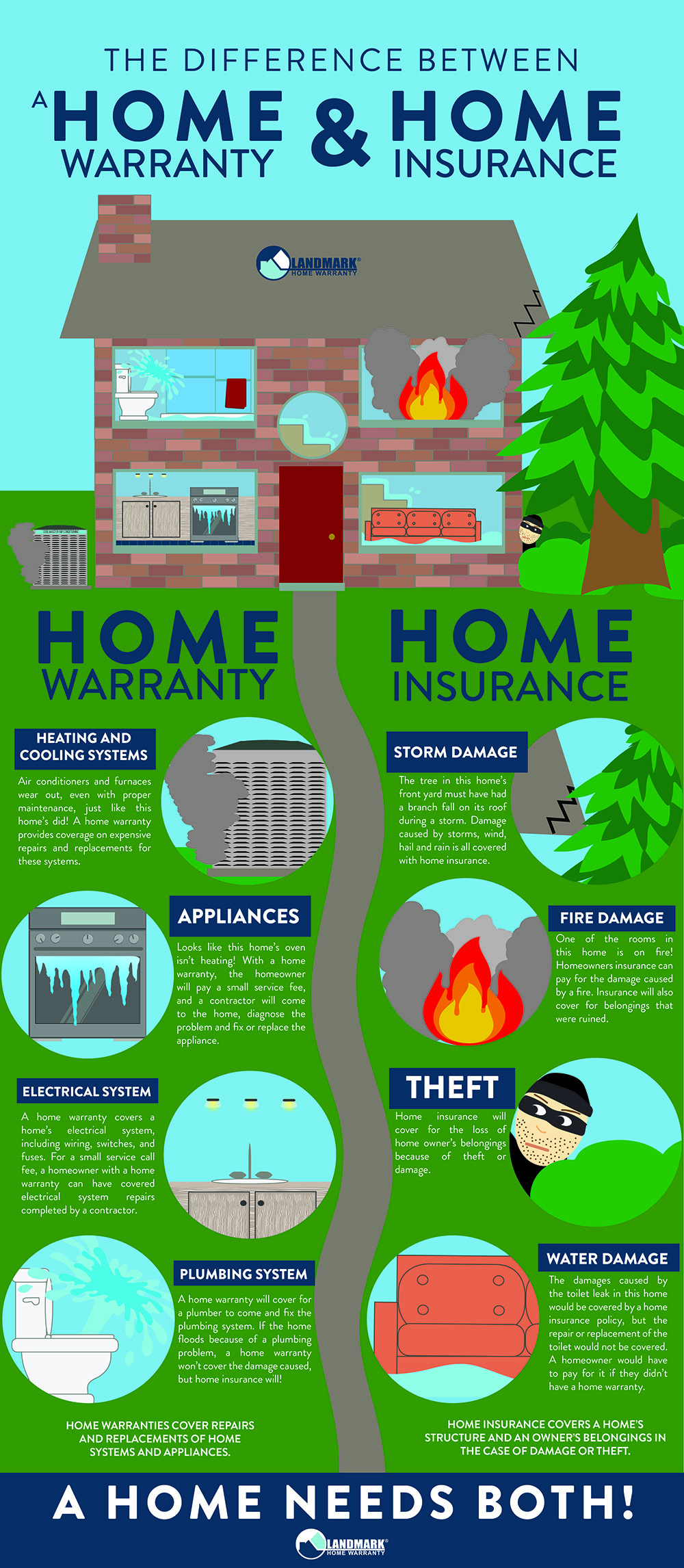

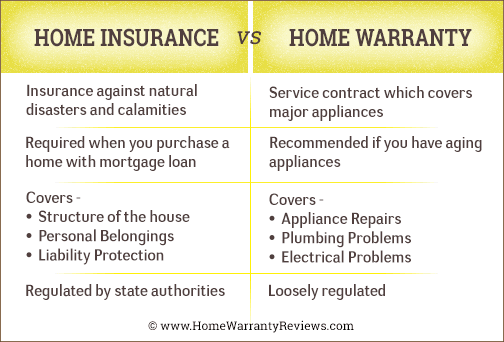

Source: homewarrantyreviews.com

Source: homewarrantyreviews.com

1 to 1.5% of the limit of insurance is typically the rep and warranty insurance premium that can be negotiated on average across global jurisdictions. Most insurance contracts require the insured to make certain warranties. Warranties are statements of fact about the target business which protect a buyer in two primary ways: A thing providing protection against a possible eventuality. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is a warranty in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information