What is adjustable life insurance Idea

Home » Trending » What is adjustable life insurance IdeaYour What is adjustable life insurance images are ready in this website. What is adjustable life insurance are a topic that is being searched for and liked by netizens now. You can Get the What is adjustable life insurance files here. Find and Download all free vectors.

If you’re looking for what is adjustable life insurance pictures information connected with to the what is adjustable life insurance interest, you have visit the ideal site. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

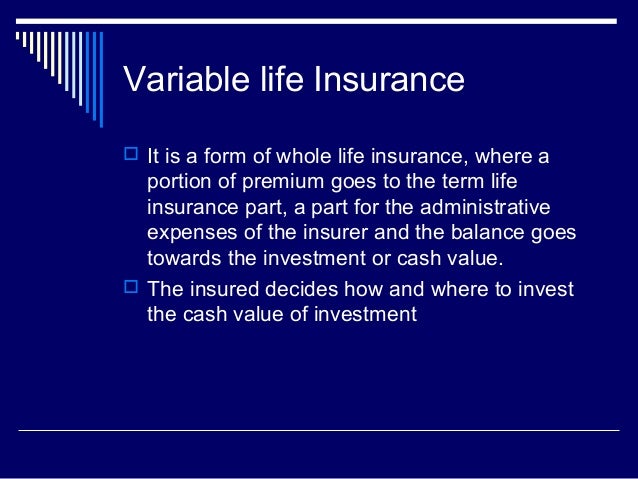

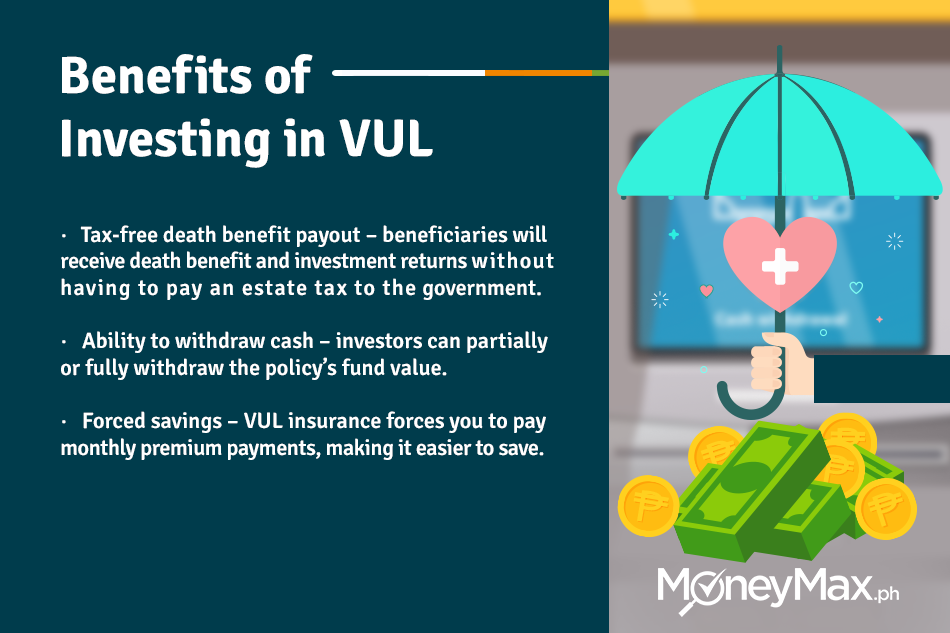

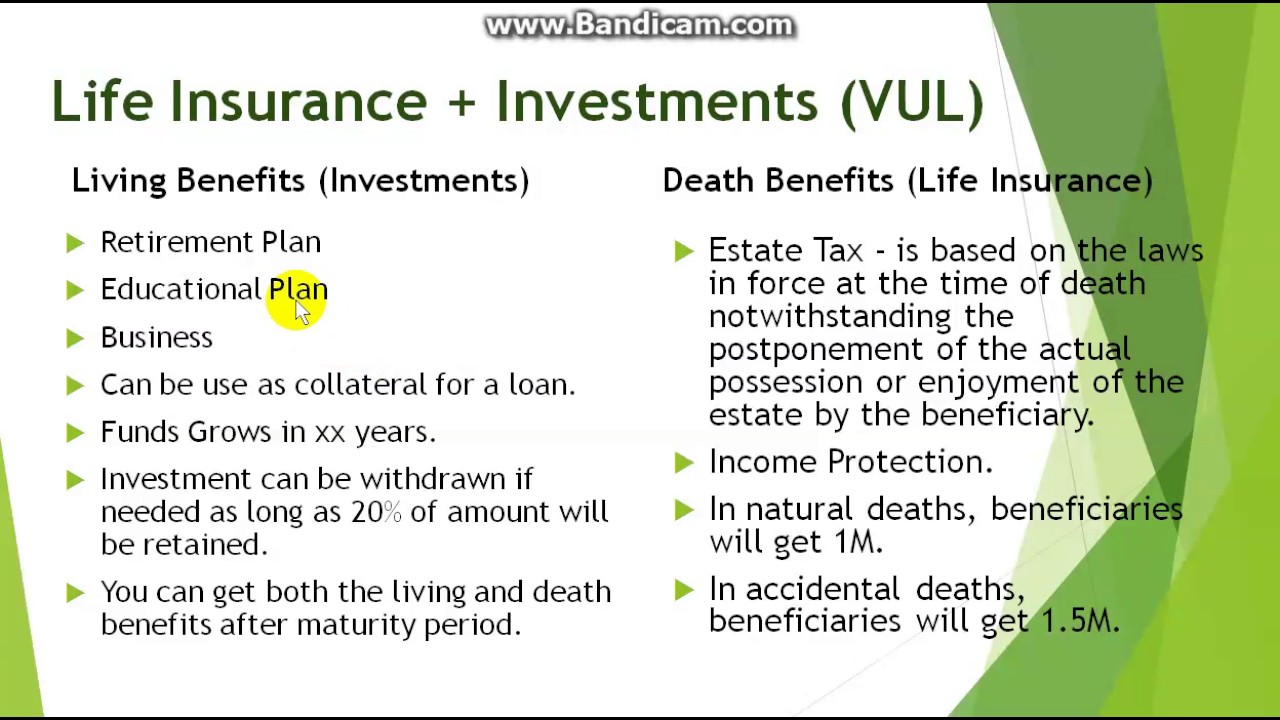

What Is Adjustable Life Insurance. Permanent life insurance lasts for the duration of the insured’s life, (2). Also known as flexible premium adjustable life insurance, the policy has a cash value component that grows with the insurer’s financial performance but has a guaranteed minimum interest rate. Adjustable life insurance is a permanent life insurance policy that offers lifetime coverage and a cash value account, and also has premiums and coverage amounts that can be changed. What is adjustable life insurance?

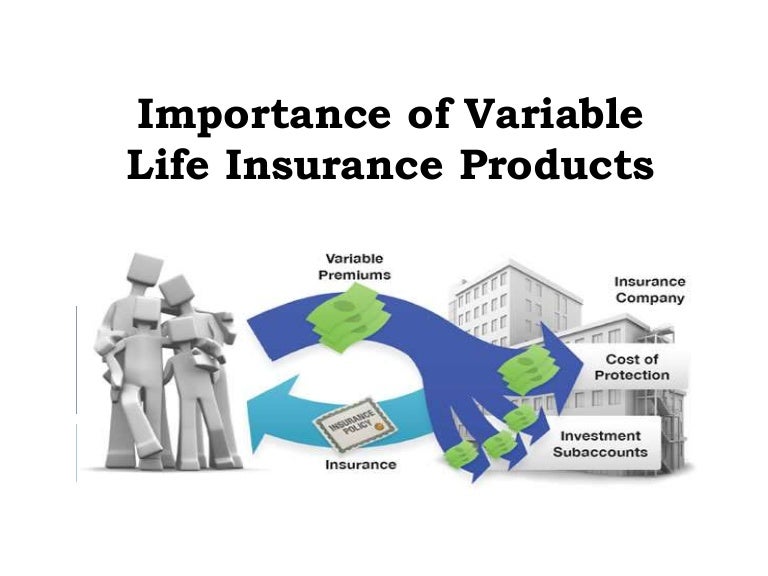

Randy Becker Bellevue Importance of Variable Life From slideshare.net

Randy Becker Bellevue Importance of Variable Life From slideshare.net

An adjustable life (1) adjustable life insurance is a type of permanent life insurance. There are three key elements you can change in an adjustable life insurance policy: Permanent life insurance lasts for the duration of the insured’s life, (2). Adjustable life insurance is a permanent life insurance policy that gives policyholders the flexibility to change the premiums and death benefits. A flexible premium adjustable life insurance policy is an alternative fixed rate policy that gives investors greater freedom. Adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance.

Adjustable life insurance is a permanent life insurance policy that offers lifetime coverage and a cash value account, and also has premiums and coverage amounts that can be changed.

Adjustable life insurance is a type of life insurance that allows policyholders to adjust features of the policy as time goes on. A hybrid policy that incorporates features of term life and whole life insurance is adjustable life insurance. Flexible premium adjustable life insurance policies were popular in the 1980s and 1990s, but it is still sold by some companies today. Adjustable life insurance is an insurance option that makes it simple for policy holders to change the amount and scope of coverage offered by the policy, while also modifying the monthly premium. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of. Often referred to as a universal life insurance or ul, adjustable life insurance is often described as a hybrid of a term and participating whole life insurance policy.

Source: youtube.com

Source: youtube.com

Adjustable life insurance is a permanent life insurance policy that offers lifetime coverage and a cash value account, and also has premiums and coverage amounts that can be changed. An adjustable life (1) adjustable life insurance is a type of permanent life insurance. Adjustable life insurance is the name given to older universal life insurance policies. Generally, life insurance of this type allows adjustments in premiums, the period of protection, and the face amount associated with the policy. Adjustable life insurance is an insurance option that makes it simple for policy holders to change the amount and scope of coverage offered by the policy, while also modifying the monthly premium.

Source: moneylogue.com

Source: moneylogue.com

Features that can be adjusted include the face value of the policy, the premium amount, the benefits, the. Nov 13, 2019 — what is adjustable life insurance? These types of insurances are designed to have flexible premiums, as well as, benefits in the case of death. It provides coverage for your entire life, like a whole life insurance plan, but it also has some of the flexibility that term life insurance typically provides. The policy owner may increase or lower the.

Source: slideshare.net

Source: slideshare.net

Nov 13, 2019 — what is adjustable life insurance? There are three key elements you can change in an adjustable life insurance policy: All this means is that within your life insurance contract, a permanent plan, you can adjust the premium, increase/lower the death benefit and may be able to remove some riders as needed. A hybrid policy that incorporates features of term life and whole life insurance is adjustable life insurance. If interest rates changed, the risk fell on the insured to make up the difference in premium.

Source: insurancenoon.com

Source: insurancenoon.com

Nov 13, 2019 — what is adjustable life insurance? There are three key elements you can change in an adjustable life insurance policy: The policy owner may increase or lower the. The amount he pays in ultimately affects how much income he will earn from the life insurance policy. One example for needing an adjustable whole life insurance policy is when a child is born into the family.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of protection, face amount, premiums, and length of the premium payment period. The amount he pays in ultimately affects how much income he will earn from the life insurance policy. Adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance. Adjustable life insurance is a permanent life insurance policy that gives policyholders the flexibility to change the premiums and death benefits. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The term adjustable refers to the way that your insurance policy can be modified over time. Policy owners are presented with many options during the contract period with adjustable life insurance. Dec 11, 2020 — adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance. Features that can be adjusted include the face value of the policy, the premium amount, the benefits, the.

Source: insurancenoon.com

Source: insurancenoon.com

These types of insurances are designed to have flexible premiums, as well as, benefits in the case of death. Adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance. An adjustable life policy is a (1). Instead of paying the same premiums every month, the insured can choose to pay within a range. What is adjustable life insurance?

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

The policy owner may increase or lower the. I can�t say i have heard of adjustable life insurance however i think you might be referring to flexible premium life insurance. As adjustable life insurance became more popular and policy designs changed, life insurers started referring to this policy as universal life insurance or flexible. A facility allowing a life insurance policy owner to change the insurance plan, increase or decrease It provides coverage for your entire life, like a whole life insurance plan, but it also has some of the flexibility that term life insurance typically provides.

Source: analysiswiki.blogspot.com

Source: analysiswiki.blogspot.com

If interest rates changed, the risk fell on the insured to make up the difference in premium. All this means is that within your life insurance contract, a permanent plan, you can adjust the premium, increase/lower the death benefit and may be able to remove some riders as needed. Dec 11, 2020 — adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance. Flexible premium adjustable life insurance policies were popular in the 1980s and 1990s, but it is still sold by some companies today. Policy owners are presented with many options during the contract period with adjustable life insurance.

Source: slideshare.net

Source: slideshare.net

These policies were the first universal life insurance policies designed in the 1980s. Generally, life insurance of this type allows adjustments in premiums, the period of protection, and the face amount associated with the policy. If interest rates changed, the risk fell on the insured to make up the difference in premium. An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan. The amount he pays in ultimately affects how much income he will earn from the life insurance policy.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

It provides coverage for your entire life, like a whole life insurance plan, but it also has some of the flexibility that term life insurance typically provides. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Adjustable life insurance is a permanent life insurance policy that offers lifetime coverage and a cash value account, and also has premiums and coverage amounts that can be changed. There are three key elements you can change in an adjustable life insurance policy: Generally, life insurance of this type allows adjustments in premiums, the period of protection, and the face amount associated with the policy.

Source: easyquotes4you.com

Source: easyquotes4you.com

Features that can be adjusted include the face value of the policy, the premium amount, the benefits, the. So, adjustable life insurance isn�t the right product for all, but for those that seek flexibility, or know their situation is likely to change, adjustable life insurance is the desired product. Features that can be adjusted include the face value of the policy, the premium amount, the benefits, the. Adjustable life insurance is a type of life insurance that allows policyholders to adjust features of the. Adjustable life insurance is often thought of as a hybrid of term life insurance and whole life insurance.

Source: pinterest.com

Source: pinterest.com

Often referred to as a universal life insurance or ul, adjustable life insurance is often described as a hybrid of a term and participating whole life insurance policy. These types of insurances are designed to have flexible premiums, as well as, benefits in the case of death. Often referred to as a universal life insurance or ul, adjustable life insurance is often described as a hybrid of a term and participating whole life insurance policy. Adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of protection, face amount, premiums, and length of the premium payment period.

Source: youtube.com

Source: youtube.com

Adjustable life insurance is the name given to older universal life insurance policies. Nov 13, 2019 — what is adjustable life insurance? An adjustable life (1) adjustable life insurance is a type of permanent life insurance. Adjustable life insurance is a type of life insurance that allows policyholders to adjust features of the policy as time goes on. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of protection, face amount, premiums, and length of the premium payment period.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What is adjustable life insurance? Flexible premium adjustable life insurance policies were popular in the 1980s and 1990s, but it is still sold by some companies today. Adjustable life insurance is the name given to older universal life insurance policies. Adjustable life insurance is a type of life insurance that allows policyholders to adjust features of the. An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan.

Source: taufanrestu.com

Source: taufanrestu.com

These types of permanent life insurance policies are designed to have “flexible premiums” and an “adjustable death benefit.” One example for needing an adjustable whole life insurance policy is when a child is born into the family. Adjustable life insurance is a permanent life insurance policy that offers lifetime coverage and a cash value account, and also has premiums and coverage amounts that can be changed. Adjustable life insurance is often thought of as a hybrid of term life insurance and whole life insurance. Adjustable life insurance is the name given to older universal life insurance policies.

Source: youtube.com

Source: youtube.com

Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of protection, face amount, premiums, and length of the premium payment period. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of. Dec 11, 2020 — adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance. Adjustable life insurance is a permanent life insurance policy that gives policyholders the flexibility to change the premiums and death benefits. One example for needing an adjustable whole life insurance policy is when a child is born into the family.

Source: insuranceandestates.com

Source: insuranceandestates.com

A facility allowing a life insurance policy owner to change the insurance plan, increase or decrease Often referred to as a universal life insurance or ul, adjustable life insurance is often described as a hybrid of a term and participating whole life insurance policy. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of. What is adjustable life insurance? Adjustable life insurance is the name given to older universal life insurance policies.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is adjustable life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information