What is aleatory in insurance information

Home » Trend » What is aleatory in insurance informationYour What is aleatory in insurance images are available in this site. What is aleatory in insurance are a topic that is being searched for and liked by netizens today. You can Get the What is aleatory in insurance files here. Download all royalty-free photos.

If you’re searching for what is aleatory in insurance pictures information connected with to the what is aleatory in insurance topic, you have come to the ideal site. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

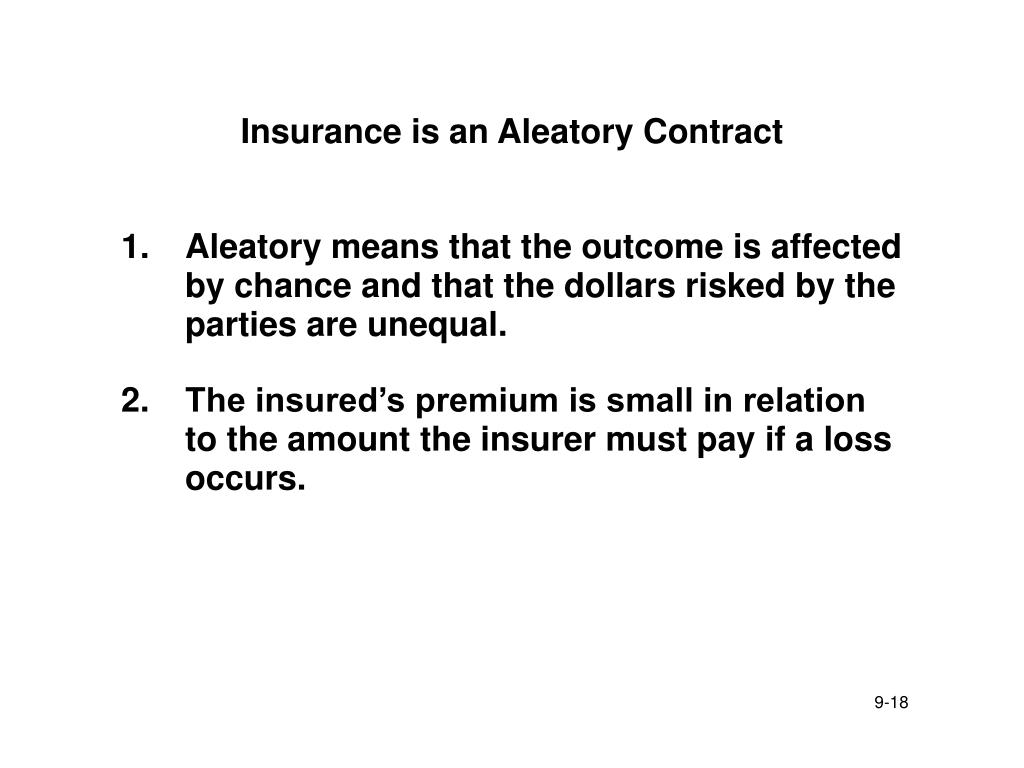

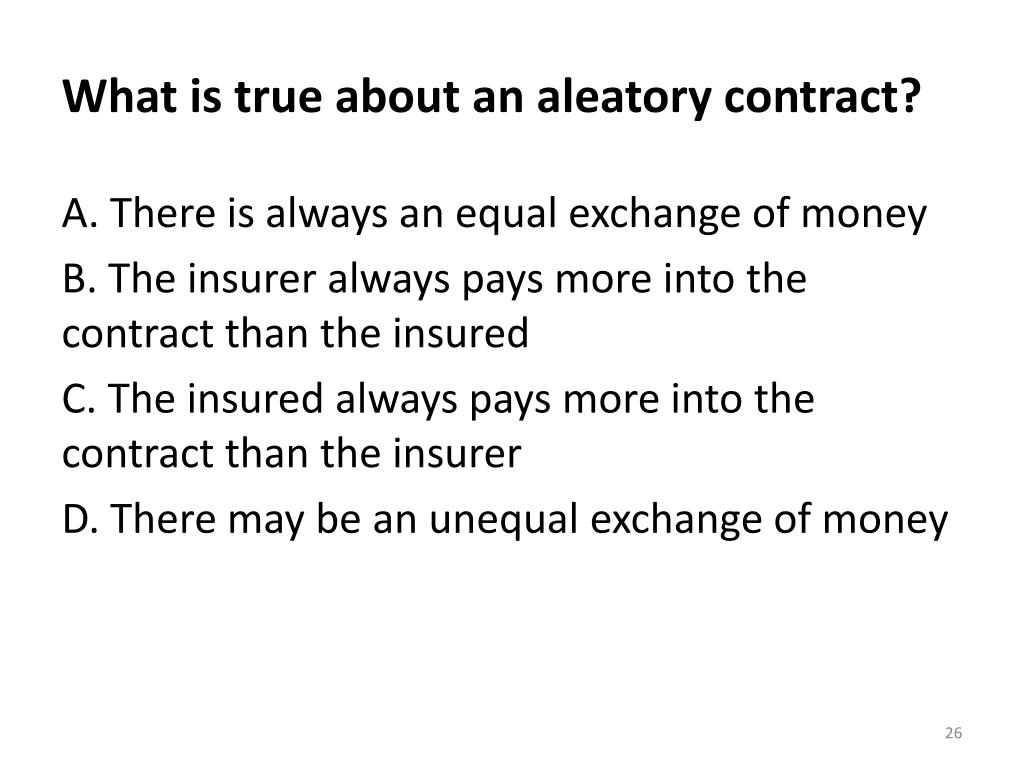

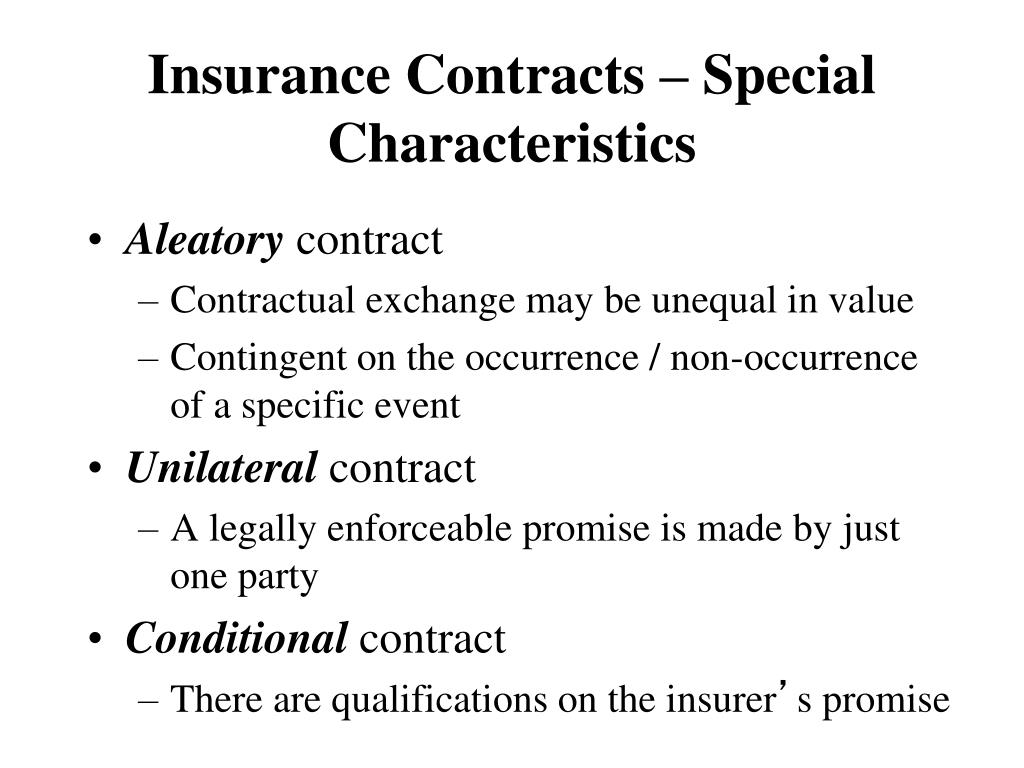

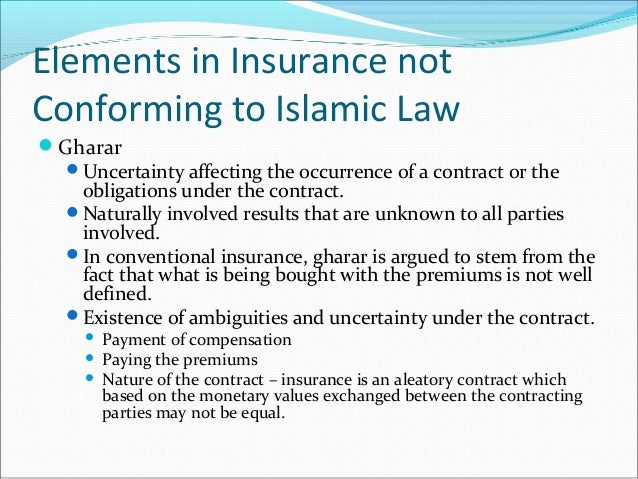

What Is Aleatory In Insurance. Additionally, another very common type of aleatory contract is an insurance policy. The word aleatory derives from the latin word aleator, meaning “a gambler,” which itself comes from alea (a die used in gaming). Insurance policies are considered aleatory contracts because. For example, gambling, wagering, or betting typically use aleatory contracts.

Aleatory Insurance Meaning / What Is An Aleatory Contract From voleyball-games.blogspot.com

Aleatory Insurance Meaning / What Is An Aleatory Contract From voleyball-games.blogspot.com

Insurance contracts are aleatory in nature. An aleatory contract is conditioned upon the occurrence of an event. Why are insurance policies called aleatory contracts? Additionally, another very common type of aleatory contract is an insurance policy. What is an example of an aleatory contract? For example, insurance policies are considered aleatory contracts, because the policy does not go to work for the.

An aleatory contract is conditioned upon the occurrence of an event.

For example, gambling, wagering, or betting typically use aleatory contracts. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. The word aleatory derives from the latin word aleator, meaning “a gambler,” which itself comes from alea (a die used in gaming). For example, gambling, wagering, or betting typically use aleatory contracts. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss. Insurance policy is a fitting example of an aleatory contract.

Source: slideserve.com

Source: slideserve.com

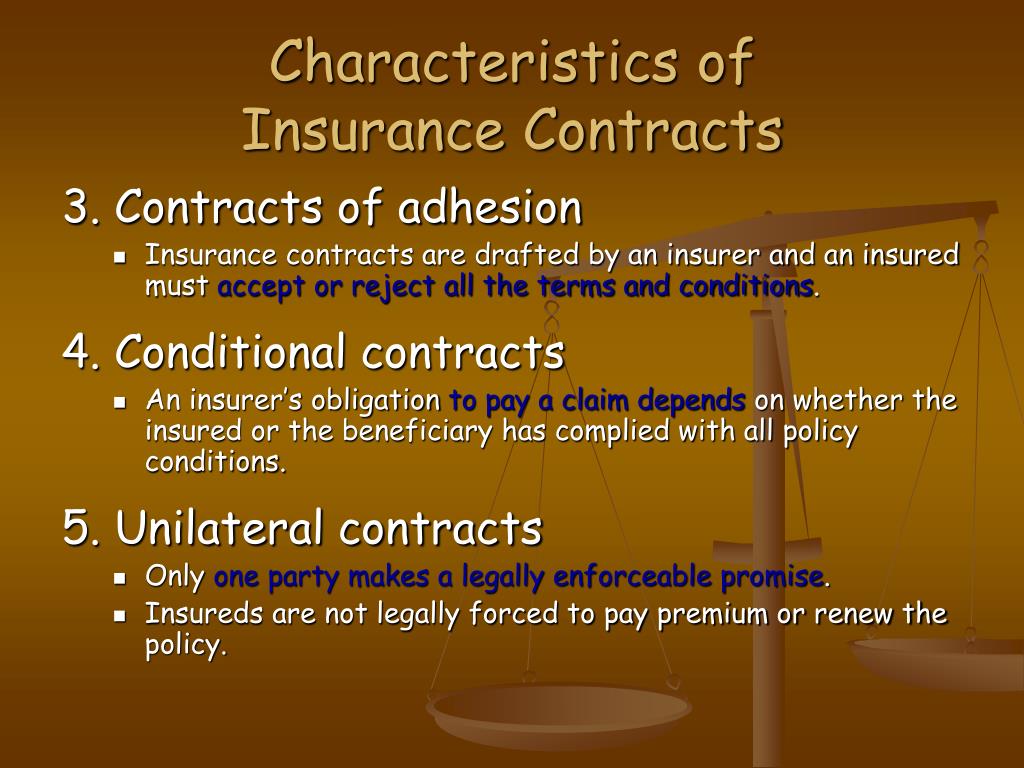

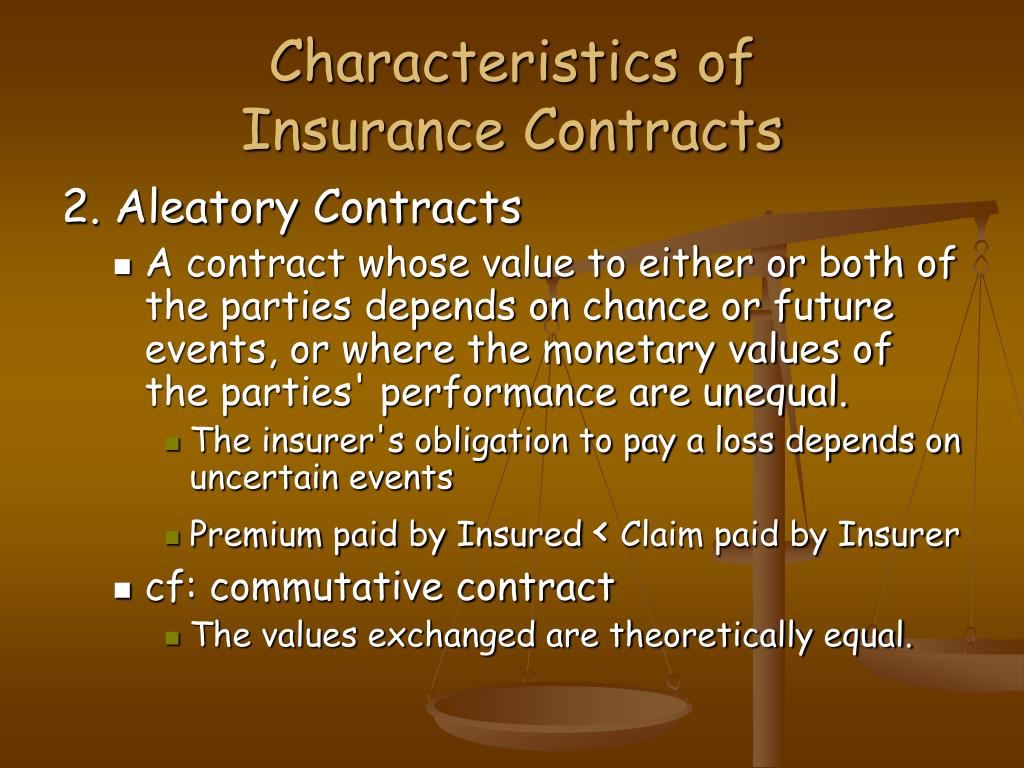

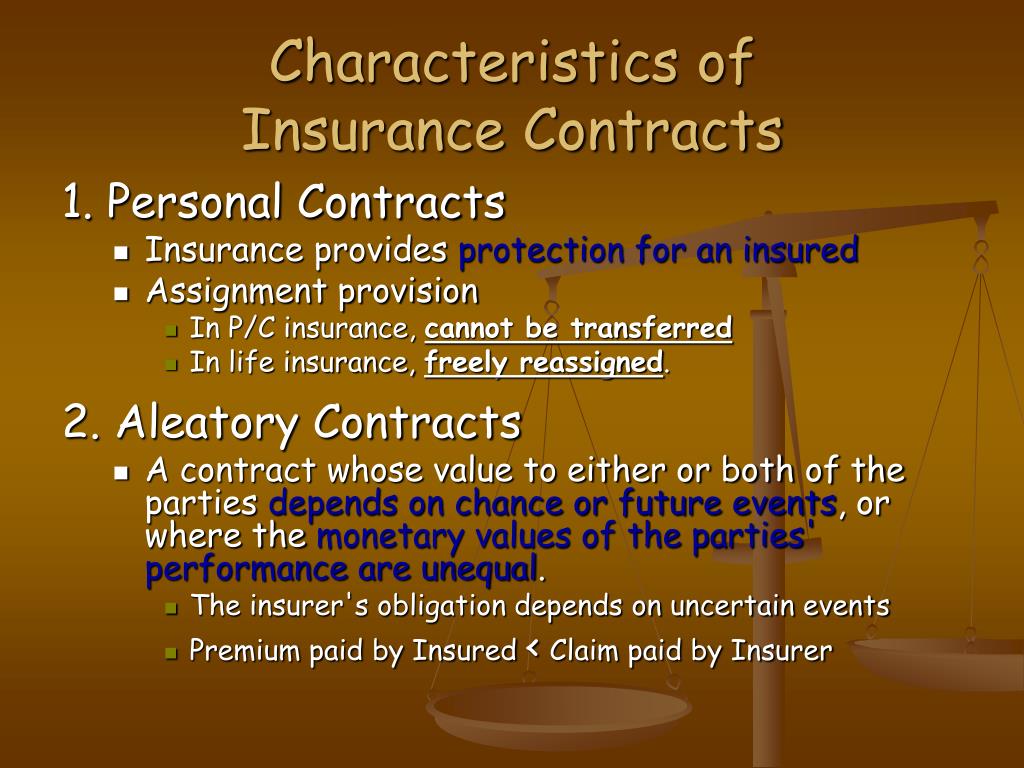

With an insurance policy or contract, the risk is insured but nothing happens until a specific event occurs. Insurance contracts are aleatory in nature. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss. Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Sep 30, 2021 — in legal terms, an aleatory contract is a contract that depends on an uncertain event;

Source: slideserve.com

Source: slideserve.com

Additionally, another very common type of aleatory contract is an insurance policy. What is an example of aleatory contract? An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. Aleatory contract — an agreement concerned with an uncertain event that provides for unequal transfer of value between the parties. An aleatory contract is a type of insurance contract in which the reimbursements to the insured are not evenly distributed.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. A mutual agreement between two parties in which the performance of the contractual obligations of one or both parties depends upon a fortuitous event. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. Only after the fortuitous event occurs will the insurer grant the policyholder the agreed amount or services specified in the aleatory contract. For example, gambling, wagering, or betting typically use aleatory contracts.

Source: laisberion.blogspot.com

Source: laisberion.blogspot.com

Insurance contracts are aleatory, which means there is an unequal exchange. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered. Saxon myrcnalag] the law of the mercians. Additionally, another very common type of aleatory contract is an insurance policy.

Source: slideserve.com

Source: slideserve.com

Aleatory contracts have existed for hundreds (and. An aleatory contract is a contract where an uncertain event determines the parties’ rights and obligations. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. A mutual agreement between two parties in which the performance of the contractual obligations of one or both parties depends upon a fortuitous event. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

The word aleatory derives from the latin word aleator, meaning “a gambler,” which itself comes from alea (a die used in gaming). Today, they are most commonly seen in insurance contracts. Additionally, another very common type of aleatory contract is an insurance policy. Aleatory contracts have existed for hundreds (and possibly thousands) of years, first showing up in roman law in relation to gambling and other uncontrollable chance events. An aleatory contract is a type of insurance contract in which the reimbursements to the insured are not evenly distributed.

Source: slideserve.com

Source: slideserve.com

Conversely, insureds sometimes pay relatively small premiums for a short period and. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. An aleatory contract is conditioned upon the occurrence of an event. Conversely, insureds sometimes pay relatively small premiums for a short period and. For example, gambling, wagering, or betting typically use aleatory contracts.

Source: laisberion.blogspot.com

Source: laisberion.blogspot.com

Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. This means there is an element of chance and potential for unequal exchange of value or consideration for both parties. Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered loss. An aleatory contract is a contract where an uncertain event determines the parties’ rights and obligations. Why are insurance policies called aleatory contracts?

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

The word aleatory derives from the latin word aleator, meaning “a gambler,” which itself comes from alea (a die used in gaming). An aleatory contract is a contract where an uncertain event determines the parties’ rights and obligations. What is an example of aleatory contract? A mutual agreement between two parties in which the performance of the contractual obligations of one or both parties depends upon a fortuitous event. [adjective] depending on an uncertain event or contingency as to both profit and loss.

Source: slideserve.com

Source: slideserve.com

With an insurance policy or contract, the risk is insured but nothing happens until a specific event occurs. Aleatory contracts have existed for hundreds (and possibly thousands) of years, first showing up in roman law in relation to gambling and other uncontrollable chance events. For example, gambling, wagering, or betting typically use aleatory contracts. For example, gambling, wagering, or betting typically use aleatory contracts. For example, insurance policies are considered aleatory contracts, because the policy does not go to work for the.

Source: taylorsphotopeace.blogspot.com

Source: taylorsphotopeace.blogspot.com

Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Insurance policies are considered aleatory contracts because. For example, insurance policies are considered aleatory contracts, because the policy does not go to work for the. In insurance, an aleatory contract refers to an insurance arrangement in which the payouts to the insured are unbalanced. Only after the fortuitous event occurs will the insurer grant the policyholder the agreed amount or services specified in the aleatory contract.

Source: majoradjusters.com

Source: majoradjusters.com

An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. The aleatory nature of an insurance contract is also beneficial to the insurance company as it can collect a set amount of premium on a regular basis and will only have to make payment should the triggering event take place. Why are insurance policies called aleatory contracts? The word aleatory derives from the latin word aleator, meaning “a gambler,” which itself comes from alea (a die used in gaming). Performance is conditioned upon a future occurrence.

Source: slideserve.com

Source: slideserve.com

Aleatory contract — an agreement. Today, they are most commonly seen in insurance contracts. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. An aleatory contract is a type of insurance contract in which the reimbursements to the insured are not evenly distributed. Additionally, another very common type of aleatory contract is an insurance policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The insured pays premiums without obtaining anything in return other than coverage until the insurance policy pays off. A legal contract in which the outcome depends on an uncertain event. For example, insurance policies are considered aleatory contracts, because the policy does not go to work for the. An aleatory contract is a type of insurance contract in which the reimbursements to the insured are not evenly distributed. Insurance contracts are aleatory , which means there is an unequal exchange.

Source: educadoresparasempre.blogspot.com

Why are insurance policies called aleatory contracts? Insurance policies are aleatory contracts because an insured can pay premiums for many years without sustaining a covered. Additionally, another very common type of aleatory contract is an insurance policy. In other words, it is a contract in which there is no (4). Aleatory contracts have existed for hundreds (and possibly thousands) of years, first showing up in roman law in relation to gambling and other uncontrollable chance events.

Source: slideshare.net

Source: slideshare.net

In other words, it is a contract in which there is no (4). Insurance contracts are aleatory in nature. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations. For example, gambling, wagering, or betting typically use aleatory contracts. One may also ask, what kind of contract is an insurance policy?

Source: slideserve.com

Source: slideserve.com

In other words, it is a contract in which there is no (4). An aleatory contract is conditioned upon the occurrence of an event. One may also ask, what kind of contract is an insurance policy? An aleatory contract is a contract where an uncertain event determines the parties’ rights and obligations. An aleatory contract is a contract where an uncertain event determines the parties� rights and obligations.

Source: slideserve.com

Source: slideserve.com

The most common type of aleatory contract is an insurance policy in which an insured pays a premium in exchange for an insurance company�s promise to pay damages up to the. The aleatory nature of an insurance contract is also beneficial to the insurance company as it can collect a set amount of premium on a regular basis and will only have to make payment should the triggering event take place. What is the aleatory nature of an insurance contract? The most common type of aleatory contract is an insurance policy in which an insured pays a premium in exchange for an insurance company’s promise to. Insurance contracts are aleatory in nature.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is aleatory in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information