What is an admitted insurer Idea

Home » Trending » What is an admitted insurer IdeaYour What is an admitted insurer images are ready in this website. What is an admitted insurer are a topic that is being searched for and liked by netizens today. You can Find and Download the What is an admitted insurer files here. Get all free vectors.

If you’re searching for what is an admitted insurer pictures information related to the what is an admitted insurer interest, you have pay a visit to the ideal blog. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

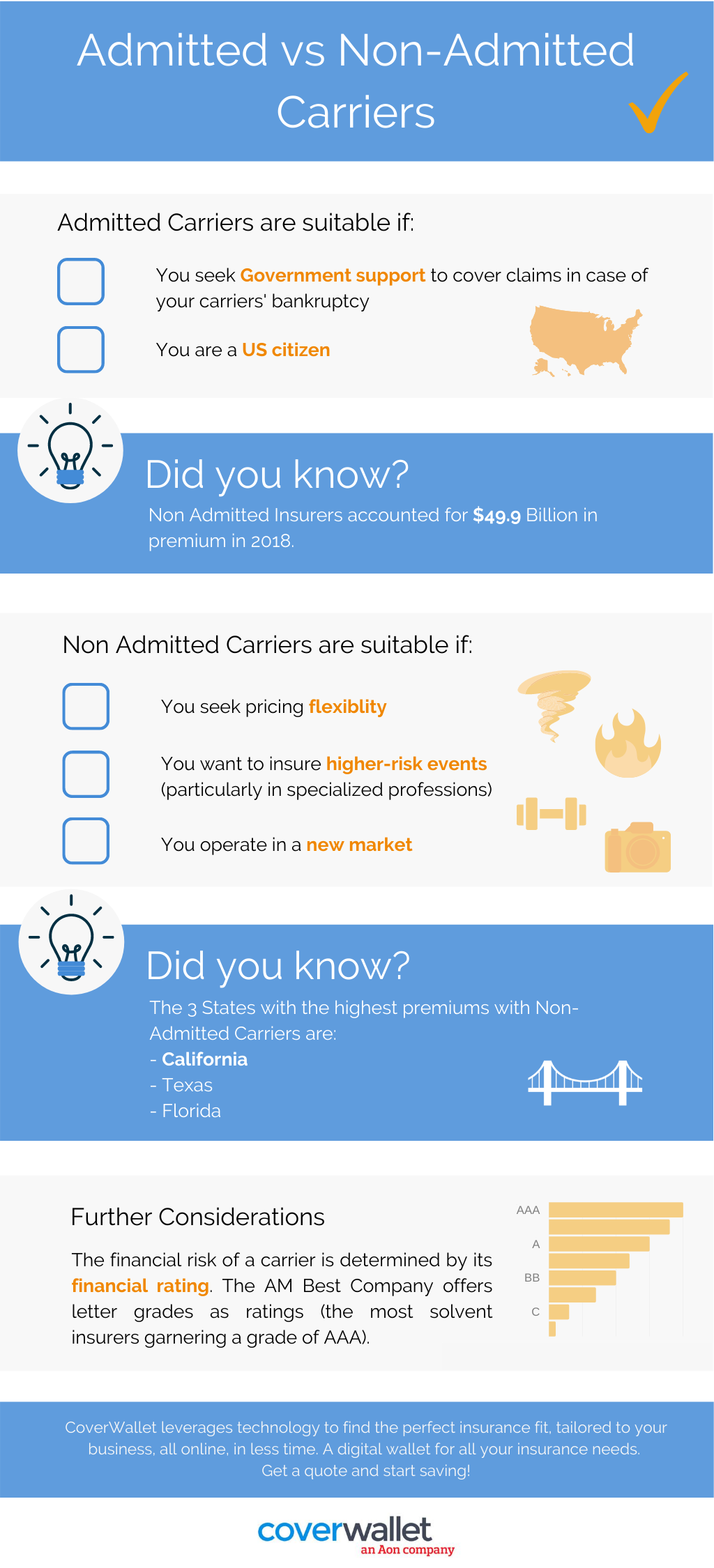

What Is An Admitted Insurer. An admitted insurance carrier is licensed in the states where it does business. Refers to whether or not an insurer is approved or authorized to write business in this state. Also know as authorized insurer, licensed carrier. However, some people need specialized insurance, and these types of.

Admitted Insurance Carrier vs NonAdmitted Insurance From youtube.com

Admitted Insurance Carrier vs NonAdmitted Insurance From youtube.com

Admitted insurance companies must adhere to regulations regarding. The major benefit of an admitted insurance company is that the insured is protected by the state’s guaranty (insolvency) fund should the insurer become insolvent and. The contracts it offers are classified as admitted insurance. This is because of the approval process they undergo to be accepted by the state as an admitted company. At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. This means they are subject to all state regulations, and cannot deviate from their filed rates.

Refers to whether or not an insurer is approved or authorized to write business in this state.

An admitted insurer, which can also be referred to as a standard market, is a term used to classify an insurance carrier that is licensed by a state insurance department to do business in the insured’s state. Admitted carriers also pay a fee to contribute a state reinsurance fund for every insurance policy they write. In simple terms, where a policy and cover provided by an insurer within a territory where it is authorised to transact that class of business then this is known as an “admitted basis!. The non admitted insurance market also referred to as non standard or surplus lines, applies to the group of insurance companies who are not domiciled in the state where you reside. An admitted insurer, which can also be referred to as a standard market, is a term used to classify an insurance carrier that is licensed by a state insurance department to do business in the insured’s state. Refers to whether or not an insurer is approved or authorized to write business in this state.

Source: youtube.com

Source: youtube.com

Customers of admitted companies are covered by the california insurance guarantee association (ciga), in the event the insurance company were to become insolvent. An “admitted carrier” in california is an insurance company that has been filed and approved by the california department of insurance (doi). Insurers licensed in some states or countries, but not others. What is admitted insurer an insurer that is authorized to write insurance business in a particular state or jurisdiction; Refers to whether or not an insurer is approved or authorized to write business in this state.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Admitted insurance companies must adhere to regulations regarding. In practice, admitted insurance is a guarantee for policyholders that their plan will follow standard regulations and they will receive coverage, even if their insurer defaults or is otherwise unable to protect them. Customers of admitted companies are covered by the california insurance guarantee association (ciga), in the event the insurance company were to become insolvent. An admitted insurance carrier is licensed in the states where it does business. Refers to whether or not an insurer is approved or authorized to write business in this state.

Source: campbellriskmanagement.com

Source: campbellriskmanagement.com

At first blush, it would seem more prudent to have an insurance company backed by the state insurance commissioner. A company that has received a license in a u.s. In simple terms, where a policy and cover provided by an insurer within a territory where it is authorised to transact that class of business then this is known as an “admitted basis!. An insurance company operating in multiple states must be an authorized insurer in each state it does business. Admitted carriers also pay a fee to contribute a state reinsurance fund for every insurance policy they write.

Source: mandas-hotspot.blogspot.com

Source: mandas-hotspot.blogspot.com

Admitted insurance companies must adhere to regulations regarding. Admitted insurances are insurance products regulated by states, guaranteed by the state�s guaranty fund, and have the state�s approval for general use. Admitted insurance companies pay into this fund, and. Insurers licensed in some states or countries, but not others. Customers of admitted companies are covered by the california insurance guarantee association (ciga), in the event the insurance company were to become insolvent.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

Admitted insurers also pay into state guaranty funds, which are designed to step in if the insurer becomes insolvent. Insurers licensed in some states or countries, but not others. Consequently, many admitted insurance carriers believe that offering contract liability insurance would not be profitable for them. Admitted insurance companies must adhere to regulations regarding. Admitted carriers agree to follow rating guidelines and submit their rates for state approval.

Source: robertatkinsart.com

Source: robertatkinsart.com

At first glance, it might seem like a risky move to get a policy with an insurer that is not fully approved or has a license in the state you are getting covered in. Customers of admitted companies are covered by the california insurance guarantee association (ciga), in the event the insurance company were to become insolvent. Admitted carriers also pay a fee to contribute a state reinsurance fund for every insurance policy they write. A company that has received a license in a u.s. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located.

Source: finance101.com

Source: finance101.com

Because each state has its own insurance regulations, each has the ability to set standards for authorized insurers. Insurers licensed in some states or countries, but not others. This allows them to issue policies that admitted insurers cannot, but may also come with less security. The major benefit of an admitted insurance company is that the insured is protected by the state’s guaranty (insolvency) fund should the insurer become insolvent and. An admitted insurer, which can also be referred to as a standard market, is a term used to classify an insurance carrier that is licensed by a state insurance department to do business in the insured’s state.

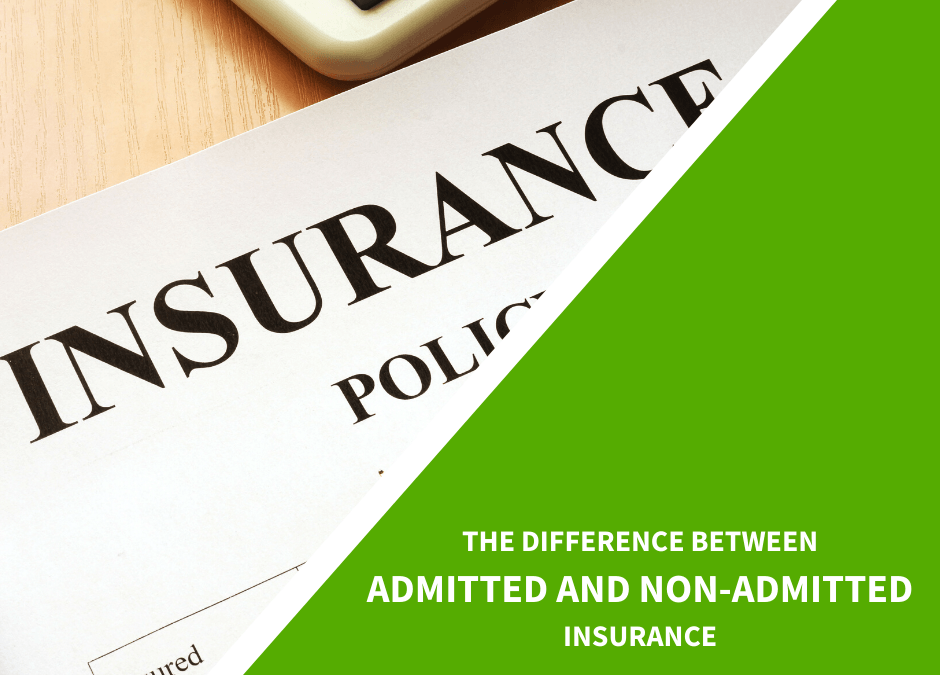

.png “The Difference Between Admitted and NonAdmitted Insurance”) Source: security.naifa.org

What is admitted insurer an insurer that is authorized to write insurance business in a particular state or jurisdiction; Because each state has its own insurance regulations, each has the ability to set standards for authorized insurers. An admitted insurer, which can also be referred to as a standard market, is a term used to classify an insurance carrier that is licensed by a state insurance department to do business in the insured’s state. Admitted carriers also pay a fee to contribute a state reinsurance fund for every insurance policy they write. An “admitted carrier” in california is an insurance company that has been filed and approved by the california department of insurance (doi).

Source: suzannebrownagency.com

Source: suzannebrownagency.com

This allows them to issue policies that admitted insurers cannot, but may also come with less security. The major benefit of an admitted insurance company is that the insured is protected by the state’s guaranty (insolvency) fund should the insurer become insolvent and. The contracts it offers are classified as admitted insurance. Insurers licensed in some states or countries, but not others. The non admitted insurance market also referred to as non standard or surplus lines, applies to the group of insurance companies who are not domiciled in the state where you reside.

Source: youtube.com

Source: youtube.com

Admitted insurance refers to coverage offered by insurance providers who are licensed to operate by state insurance agencies. Admitted insurances are insurance products regulated by states, guaranteed by the state�s guaranty fund, and have the state�s approval for general use. The contracts it offers are classified as admitted insurance. An admitted insurance carrier is licensed in the states where it does business. However, some people need specialized insurance, and these types of.

Source: floridainsuranceguy.com

Source: floridainsuranceguy.com

Also know as authorized insurer, licensed carrier. Admitted insurers also pay into state guaranty funds, which are designed to step in if the insurer becomes insolvent. However, some people need specialized insurance, and these types of. Consequently, many admitted insurance carriers believe that offering contract liability insurance would not be profitable for them. In practice, admitted insurance is a guarantee for policyholders that their plan will follow standard regulations and they will receive coverage, even if their insurer defaults or is otherwise unable to protect them.

Source: elliotwhittier.com

Source: elliotwhittier.com

The contracts it offers are classified as admitted insurance. This allows them to issue policies that admitted insurers cannot, but may also come with less security. Links for irmi online subscribers only:pli iv.j; This means they are subject to all state regulations, and cannot deviate from their filed rates. The contracts it offers are classified as admitted insurance.

Source: insurance.ohio.gov

Source: insurance.ohio.gov

Because each state has its own insurance regulations, each has the ability to set standards for authorized insurers. As a result, these insurance agencies tend to offer stable pricing options. Insurers licensed in some states or countries, but not others. An admitted insurance carrier is licensed in the states where it does business. Insurers licensed in some states or countries, but not others.

Source: youtube.com

Source: youtube.com

Admitted carriers agree to follow rating guidelines and submit their rates for state approval. As a result, these insurance agencies tend to offer stable pricing options. At first blush, it would seem more prudent to have an insurance company backed by the state insurance commissioner. Admitted insurers also pay into state guaranty funds, which are designed to step in if the insurer becomes insolvent. This means they are subject to all state regulations, and cannot deviate from their filed rates.

Source: coverwallet.com

Source: coverwallet.com

An insurance company operating in multiple states must be an authorized insurer in each state it does business. Consequently, many admitted insurance carriers believe that offering contract liability insurance would not be profitable for them. State to sell insurance in that state. Admitted carriers agree to follow rating guidelines and submit their rates for state approval. Admitted carriers also pay a fee to contribute a state reinsurance fund for every insurance policy they write.

Source: myempro.com

Source: myempro.com

An admitted insurance carrier is licensed in the states where it does business. An “admitted carrier” in california is an insurance company that has been filed and approved by the california department of insurance (doi). An admitted insurer, which can also be referred to as a standard market, is a term used to classify an insurance carrier that is licensed by a state insurance department to do business in the insured’s state. A company that has received a license in a u.s. However, some people need specialized insurance, and these types of.

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

Admitted insurance companies must adhere to regulations regarding. An admitted insurer, which can also be referred to as a standard market, is a term used to classify an insurance carrier that is licensed by a state insurance department to do business in the insured’s state. A company that has received a license in a u.s. This allows them to issue policies that admitted insurers cannot, but may also come with less security. This is because of the approval process they undergo to be accepted by the state as an admitted company.

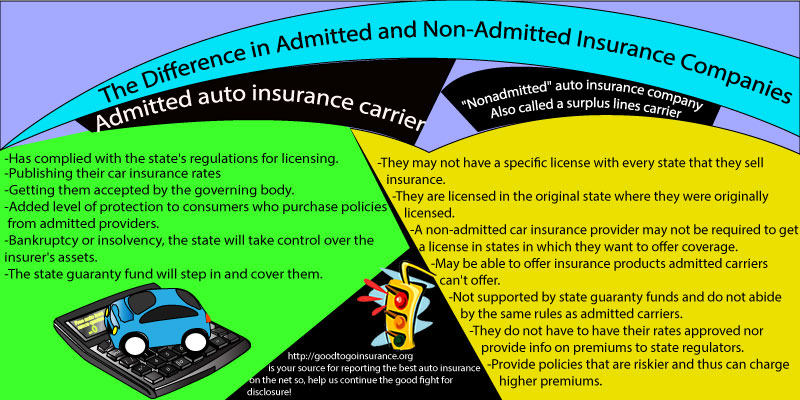

.png#keepProtocol “Admitted vs. NonAdmitted Insurance Carriers”) Source: blog.protexurelawyers.com

Consequently, many admitted insurance carriers believe that offering contract liability insurance would not be profitable for them. Admitted insurance companies pay into this fund, and. Admitted insurer — an insurer licensed to do business in the state or country in which the insured exposure is located. This means they are subject to all state regulations, and cannot deviate from their filed rates. Admitted insurance companies must adhere to regulations regarding.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is an admitted insurer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information