What is an example of insurable interest information

Home » Trending » What is an example of insurable interest informationYour What is an example of insurable interest images are available in this site. What is an example of insurable interest are a topic that is being searched for and liked by netizens now. You can Get the What is an example of insurable interest files here. Download all royalty-free vectors.

If you’re searching for what is an example of insurable interest images information connected with to the what is an example of insurable interest topic, you have visit the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

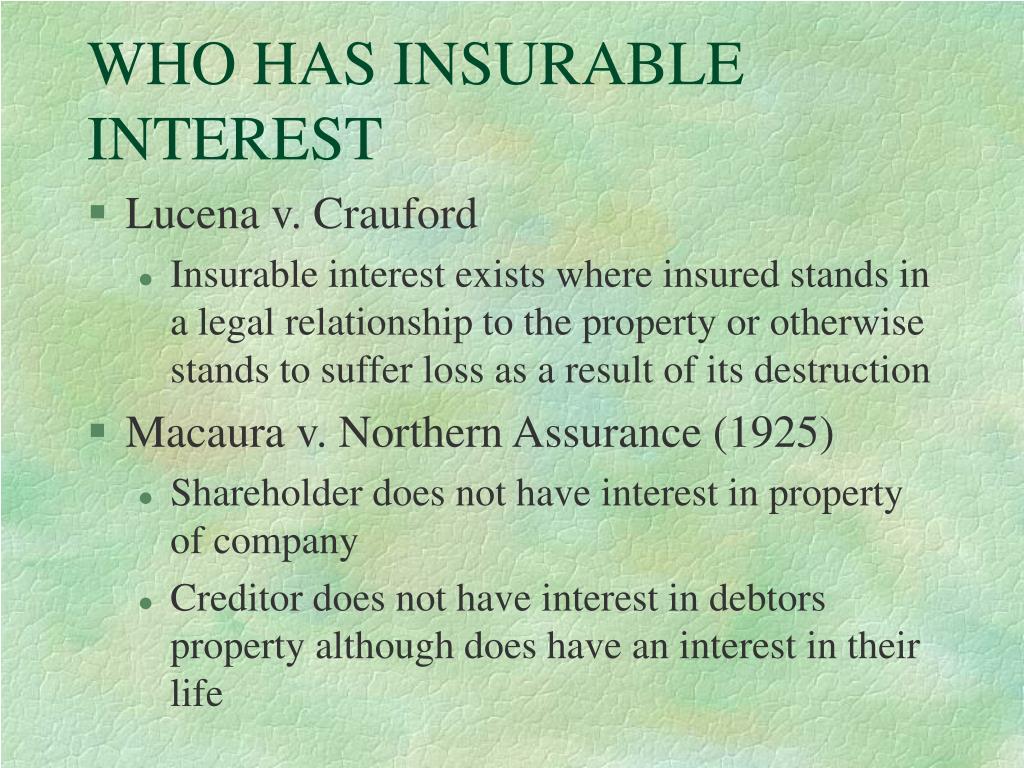

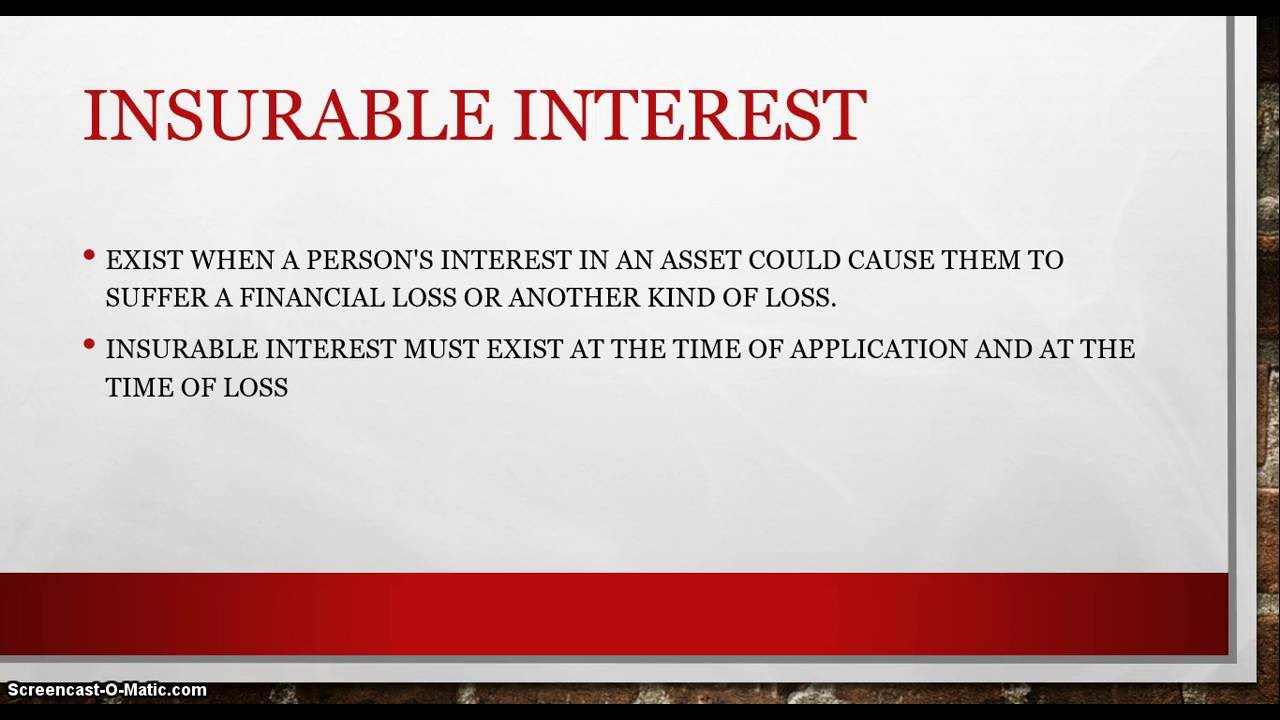

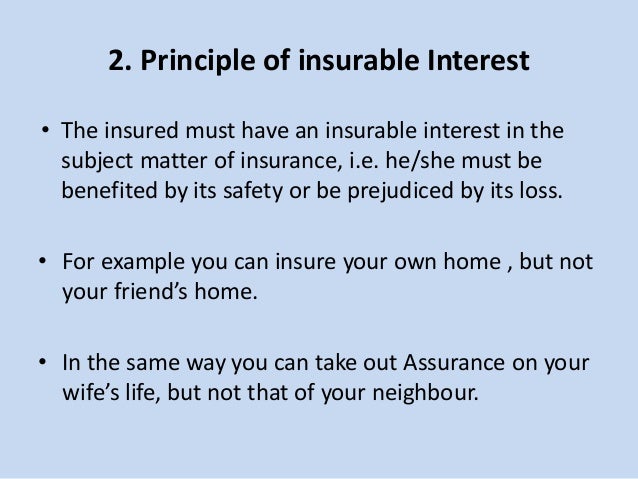

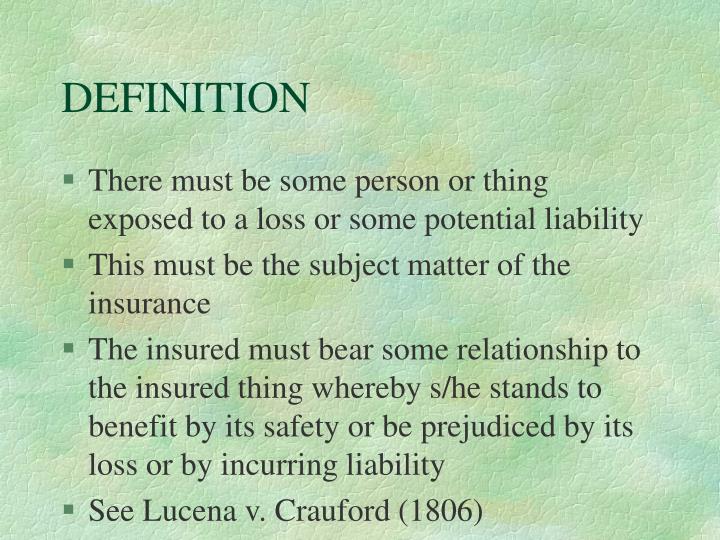

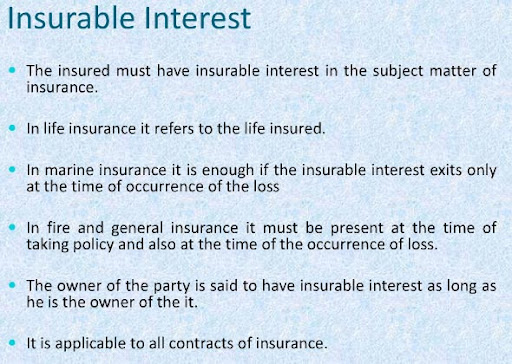

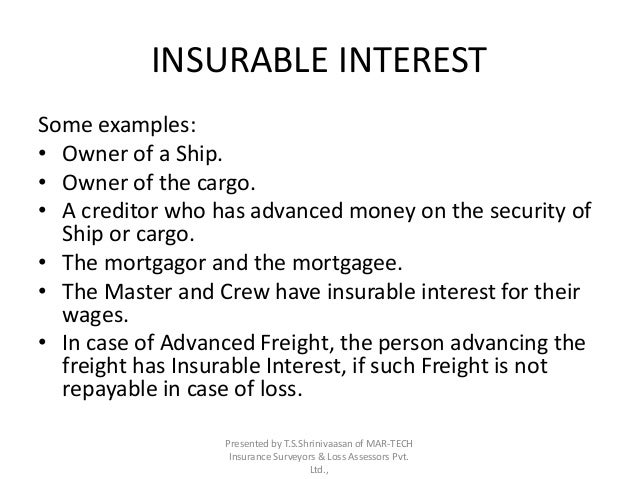

What Is An Example Of Insurable Interest. There are at least five features essential to insurable interest: Insurable interest is almost a legal right to insure. Insurable interest occurs due to the ownership, possession or through direct relationship with the object / individual. Features or essentials of insurable interest.

Insurance Principle of Insurable Interest YouTube From youtube.com

Insurance Principle of Insurable Interest YouTube From youtube.com

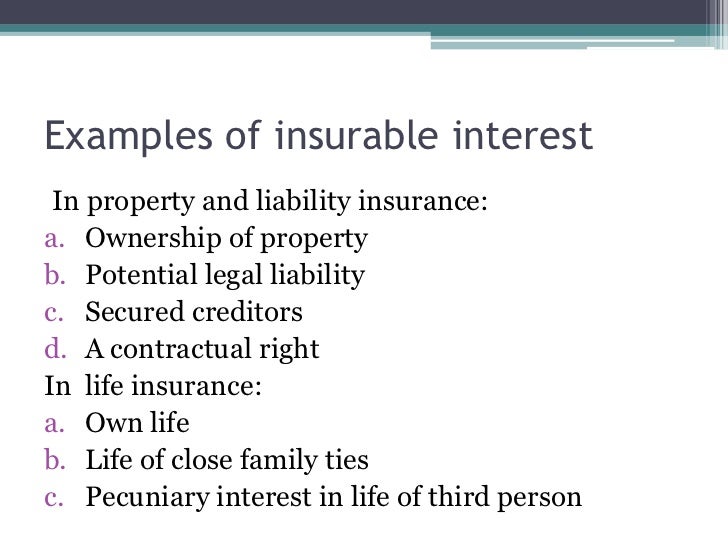

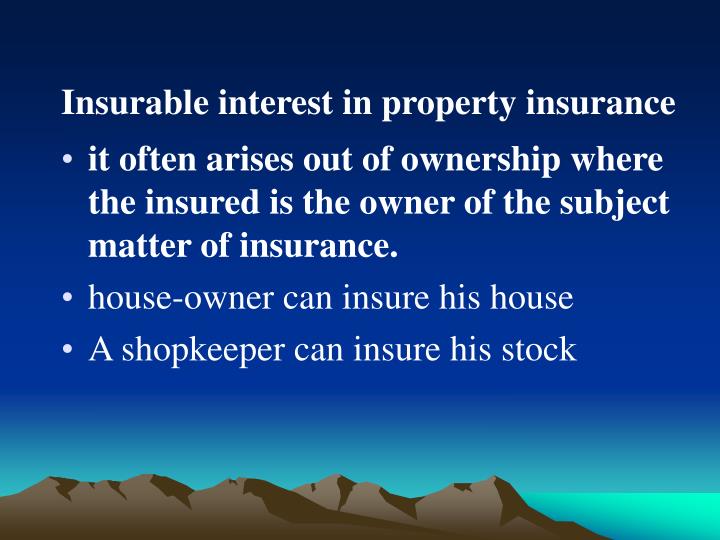

One of the most common examples of an insurable interest is your car. Owners have got insurable interest to the extent of full value. For example, an employer has insurable interest in the lives of his employees, a banker has an insurable interest in the properties mortgaged to it against a loan. Some commonly accepted examples are: Mortgagor, being the owner of the property, has got insurable interest. Fred has two small children and a.

Another example of insurable interest not existing is if someone were to try to buy a life insurance policy on a stranger.

Example of insurable interest if the house you own is damaged by fire, the value of your house has been reduced by the damages sustained in the fire. Example of insurable interest if the house you own is damaged by fire, the value of your house has been reduced by the damages sustained in the fire. Part owners or joint owners: Examples of insurable interest when it comes to life insurance, family members (by blood relation or marriage) are usually considered to constitute interest (considered they are immediate). If your car is totaled, it will be a lot of money for you to replace it. Fred has two small children and a.

Source: slideserve.com

Source: slideserve.com

The extent of the interest only stretches as far as the person’s or entity’s investment reaches. Mortgagor, being the owner of the property, has got insurable interest. This type of insurable interest applies when you’re injured or suffer a loss as the result of an accident or event. Taking receipt of premiums and holding them for the insurance company is an example of. If there is no insurable interest the insurance contract becomes.

Source: youtube.com

Source: youtube.com

As a result, you have insurable interest. Examples of insurable interest which exist in the following cases: The definition of insurable interest varies across national legislations. A company has an insurable interest in a property it owns, such as a warehouse or office building. As a result, you have insurable interest.

Source: youtube.com

Source: youtube.com

A damaged car will cost money and be a hassle to fix. Fred has two small children and a. For example, an employer has insurable interest in the lives of his employees, a banker has an insurable interest in the properties mortgaged to it against a loan. An example of insurable interest is a policyholder buying property insurance for their own house but not for their neighbour�s house. For example, if you own a home and buy fire insurance, your property interest would be the damage or destruction of the home.

Source: slideserve.com

Source: slideserve.com

If there is no insurable interest the insurance contract becomes. A damaged car will cost money and be a hassle to fix. Mortgagor, being the owner of the property, has got insurable interest. Husband or wife (including former spouses) brothers/sisters engaged couples children and grandchildren The person does not have an insurable interest in any financial loss arising from damage to their neighbour�s house.

Source: slideshare.net

Source: slideshare.net

Insurable interest example here’s a simple example: If a fire or other destructive force destroyed that property, it would create an. Insurable interest is almost a legal right to insure. For example, a corporation may have an insurable interest in the chief executive officer (ceo), and an american football team may have an insurable interest in a. As a result, you have insurable interest.

Source: slideshare.net

Source: slideshare.net

Examples of insurable interest which exist in the following cases: For example, an employer has insurable interest in the lives of his employees, a banker has an insurable interest in the properties mortgaged to it against a loan. An example of someone who does not automatically have insurable interest and may need to prove it would be a more distant relative of someone who financially cares for the person. The definition of insurable interest varies across national legislations. Mortgagor, being the owner of the property, has got insurable interest.

Source: slideserve.com

Source: slideserve.com

Whether you pay to have the house rebuilt or you end up selling it at a reduced price, you have suffered a financial loss resulting from the fire. For example, an employer has insurable interest in the lives of his employees, a banker has an insurable interest in the properties mortgaged to it against a loan. The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss. Fred has two small children and a. It can be understood from the following example, that any individual will have an insurable interest in his own home or family and not on some random home or family.

Source: slideserve.com

Source: slideserve.com

This type of insurable interest applies when you’re injured or suffer a loss as the result of an accident or event. Insurable interest example jack has several people who depend on him to survive, so he decides to get life insurance for himself. Taking receipt of premiums and holding them for the insurance company is an example of. After he chooses a package, the insurance company will naturally determine whether the nominees listed on the documents are deserving or. Owners have got insurable interest to the extent of full value.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

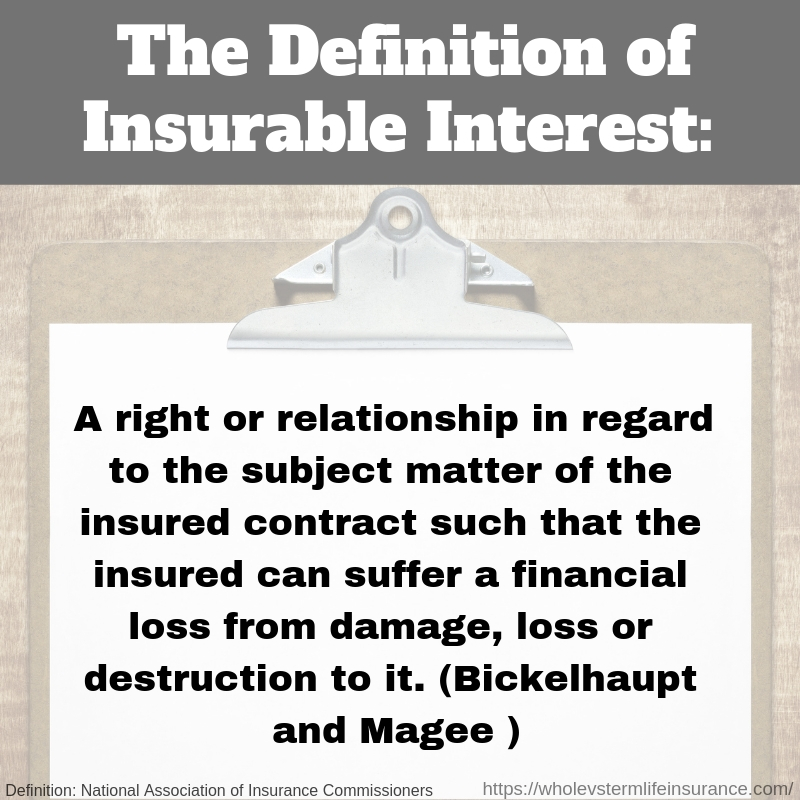

What are some examples of insurable interest. A company has an insurable interest in a property it owns, such as a warehouse or office building. One of the most common examples of an insurable interest is your car. By definition, an insurable interest is an investment by a person or entity to cover the loss or damage of a specific asset. Insurable interest occurs due to the ownership, possession or through direct relationship with the object / individual.

Source: ppt-online.org

Source: ppt-online.org

Mortgagor, being the owner of the property, has got insurable interest. Part owners or joint owners: Insurable interest applies to people and entities where there is an assumption of longevity. They have insurable interest to the extent of their part or financial interest. The definition of insurable interest varies across national legislations.

Source: sleadas.com

Source: sleadas.com

There are at least five features essential to insurable interest: An example of insurable interest is a policyholder buying property insurance for their own house but not for their neighbour�s house. To have an insurable interest, you have to prove that you will suffer financially should the asset be damaged, stolen, or destroyed. Insurable interest example here’s a simple example: An example of someone who does not automatically have insurable interest and may need to prove it would be a more distant relative of someone who financially cares for the person.

Source: youtube.com

Source: youtube.com

For example, people can have an insurable interest in their homes, cars, spouse, and jobs. There are at least five features essential to insurable interest: For example, a corporation may have an insurable interest in the chief executive officer (ceo), and an american football team may have an insurable interest in a. Insurable interest occurs due to the ownership, possession or through direct relationship with the object / individual. If a fire or other destructive force destroyed that property, it would create an.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

To have an insurable interest, you have to prove that you will suffer financially should the asset be damaged, stolen, or destroyed. Another example of insurable interest not existing is if someone were to try to buy a life insurance policy on a stranger. An example of someone who does not automatically have insurable interest and may need to prove it would be a more distant relative of someone who financially cares for the person. Mortgagor, being the owner of the property, has got insurable interest. So, you benefit from your car not being damaged or totaled.

Source: wptechh.com

Source: wptechh.com

Example of insurable interest if the house you own is damaged by fire, the value of your house has been reduced by the damages sustained in the fire. Insurable interest example jack has several people who depend on him to survive, so he decides to get life insurance for himself. What are some examples of insurable interest. There must be some subject matter to insure such as property, life. To have an insurable interest, you have to prove that you will suffer financially should the asset be damaged, stolen, or destroyed.

Source: slideserve.com

Source: slideserve.com

To have an insurable interest, you have to prove that you will suffer financially should the asset be damaged, stolen, or destroyed. Insurance companies use insurable interest to determine whether you or anyone else should be allowed to take out an insurance policy. Part owners or joint owners: Examples of insurable interest which exist in the following cases: An example of someone who does not automatically have insurable interest and may need to prove it would be a more distant relative of someone who financially cares for the person.

Source: slideserve.com

Source: slideserve.com

There are at least five features essential to insurable interest: The definition of insurable interest varies across national legislations. Some commonly accepted examples are: Taking receipt of premiums and holding them for the insurance company is an example of. The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss.

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

Essentially, insurable interest is the evidence that the insured is interested in the preservation of the thing, life or health insured (the subject matter of insurance), and that the insured will suffer loss if the subject matter of insurance is lost or damaged. Owners have got insurable interest to the extent of full value. The person does not have an insurable interest in any financial loss arising from damage to their neighbour�s house. The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss. After he chooses a package, the insurance company will naturally determine whether the nominees listed on the documents are deserving or.

Source: slideshare.net

Source: slideshare.net

Insurable interest applies to people and entities where there is an assumption of longevity. Example of insurable interest if the house you own is damaged by fire, the value of your house has been reduced by the damages sustained in the fire. The rule in texas is that no one without an insurable interest in the life of the insured may be the owner of an insurance policy on the life of a human being, and should such person be made a beneficiary in a policy even by the insured himself, the beneficiary would hold the proceeds as a trustee for the benefit of those entitled by law to receive the same. Some commonly accepted examples are: The policy owner and beneficiary have to have an insurable interest on the property, meaning that if the property is destroyed or damaged, then the policy owner and/or beneficiary will suffer a financial loss.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is an example of insurable interest by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information