What is an insurance binder for a car information

Home » Trend » What is an insurance binder for a car informationYour What is an insurance binder for a car images are ready in this website. What is an insurance binder for a car are a topic that is being searched for and liked by netizens now. You can Download the What is an insurance binder for a car files here. Download all free images.

If you’re searching for what is an insurance binder for a car pictures information related to the what is an insurance binder for a car topic, you have visit the ideal site. Our site frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

What Is An Insurance Binder For A Car. Car insurance binders provide a description of coverages (liability, collision and comprehensive), along with the associated deductibles. An insurance binder summarizes the details of your insurance policy, such as the coverage, deductible amount, and listed drivers. What is an insurance binder? An insurance binder may also be called an insurance policy binder, title binder, interim binder, insurance card, or certificate of insurance.

Car insurance binders provide a description of coverages (liability, collision and comprehensive), along with the associated deductibles. Auto insurance companies use an underwriting process to verify a person’s information before selling them a full car insurance policy. An insurance binder is just meant to allow for temporary insurance for a few days as someone transitions a new car or adds insurance to their policy. You should see coverages such as liability, collision, or comprehensive coverage, along with each of their deductibles. An insurance binder basically proves that there’s a formal agreement in place between you and the insurance company. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan.

An insurance binder only covers the key liability, bodily injury, and property damage amounts in most cases.

In comparison, a home insurance binder identifies the amount of insurance on the building, the. An insurance binder is a legal document that provides proof of temporary coverage. What is an insurance binder? What is an insurance binder? You should see coverages such as liability, collision, or comprehensive coverage, along with each of their deductibles. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued.

Source: niftymom.com

Source: niftymom.com

It serves as proof of insurance, but only for a given period. A car insurance binder serves as a temporary form of insurance as your policy is being processed. A car insurance binder or an auto insurance binder will provide proof of an insurance policy purchased of your car. Your insurance policy is an official contract between you and your insurer — and breaks down all the terms and conditions of your insurance. What is an auto insurance binder for a car?

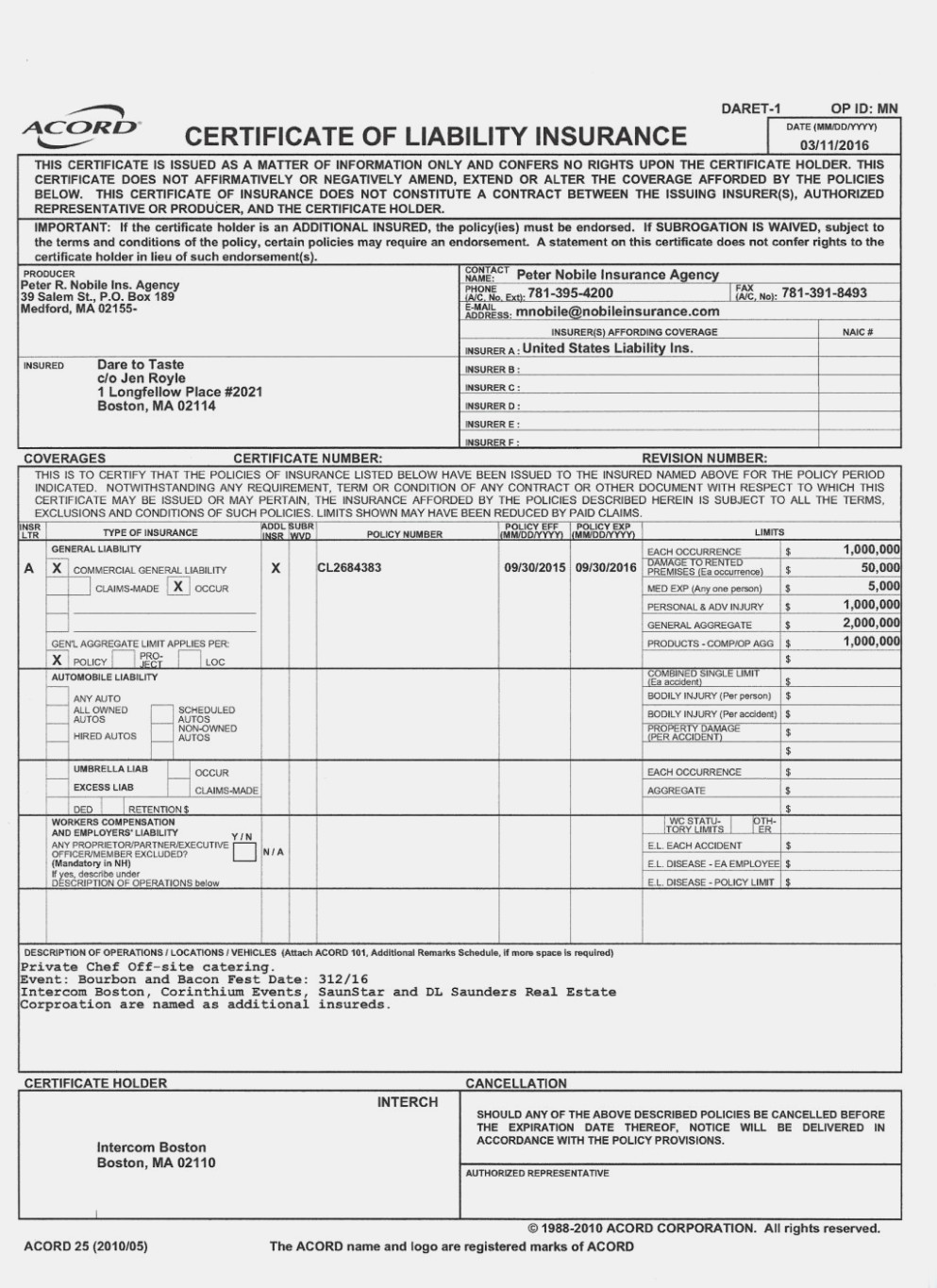

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

An insurance binder summarizes the details of your insurance policy, such as the coverage, deductible amount, and listed drivers. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. Car insurance binders provide a description of coverages (liability, collision and comprehensive), along with the associated deductibles. An insurance binder is a temporary insurance policy. It incorporates all the terms and limitations in the policy, including the conditions.

Source: thebalancesmb.com

Source: thebalancesmb.com

When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. At its simplest definition, a car insurance binder is temporary car insurance. What is an insurance binder? An insurance binder is a temporary policy document given when official policy documents are not being issued yet.

Source: insurancecompanies20.blogspot.com

Source: insurancecompanies20.blogspot.com

The same terms that are specified in your policy are also legally enforceable as part of an insurance binder. An insurance binder is a legal document that provides proof of temporary coverage. Only a certified insurance professional may prepare an insurance binder, and you can receive it upon request within one to two days. It serves as proof of insurance, but only for a given period. An insurance binder basically proves that there’s a formal agreement in place between you and the insurance company.

Source: autoinsuranceape.com

Source: autoinsuranceape.com

A binder will act as your insurance until the underwriting process is through and your car insurance company issues you your actual policy. Car insurance binders provide a description of coverages (liability, collision and comprehensive), along with the associated deductibles. A car insurance binder is temporary proof of insurance that allows you to provide the evidence of coverage required by law that may allow you to legally drive your car if your policy is still being processed. You should see coverages such as liability, collision, or comprehensive coverage, along with each of their deductibles. Keep in mind that the terms of the auto insurance binder letter are not necessarily the same as what your policy will be.

Source: thebalancesmb.com

Source: thebalancesmb.com

In other words, when you obtain a binder, you have proof of coverage that your proper insurance is being prepared. For auto insurance, the insurer must give 5 days prior notice, unless the binder is replaced by a. It may be required by a dealership, a leasing firm, or a finance company when you�re purchasing a new car. An insurance binder summarizes the details of your insurance policy, such as the coverage, deductible amount, and listed drivers. What is a car insurance binder?

Source: signnow.com

Source: signnow.com

A car insurance binder serves as a temporary form of insurance as your policy is being processed. An auto insurance binder is not an insurance policy. While your policy will contain all the details of your insurance, your binder will provide an overview of the important points. Even though the binder is only an interim certificate of insurance, it is a fully enforceable contract of insurance. It provides you with a document showing evidence of insurance(link).

Source: zazzle.com

Source: zazzle.com

A car insurance binder is a temporary form of insurance. In other words, when you obtain a binder, you have proof of coverage that your proper insurance is being prepared. While your policy will contain all the details of your insurance, your binder will provide an overview of the important points. What is an insurance binder? The insurance binder specifies all the protections for which you are covered while you wait for a new policy, as well as any coverage limits, deductibles, fees, terms and conditions.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. Even though the binder is only an interim certificate of insurance, it is a fully enforceable contract of insurance. Except for auto insurance coverage, no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days. It provides you with a document showing evidence of insurance(link). An insurance binder is a legal document that provides proof of temporary coverage.

It may be required by a dealership, a leasing firm, or a finance company when you�re purchasing a new car. Only a certified insurance professional may prepare an insurance binder, and you can receive it upon request within one to two days. In some cases, an insurance company may need to give you an auto insurance binder so that you can drive while they await the completion of the underwriting process. It is needed when providing proof of insurance for car financing and is provided by the insurance company. An insurance binder is just meant to allow for temporary insurance for a few days as someone transitions a new car or adds insurance to their policy.

Source: pdffiller.com

Source: pdffiller.com

An insurance binder may also be called an insurance policy binder, title binder, interim binder, insurance card, or certificate of insurance. An insurance binder is a temporary insurance policy. A car insurance policy is an official contract between a driver and insurer and includes all the terms and conditions of your insurance. An insurance binder is a legal document that provides proof of temporary coverage. It binds them to provide you insurance through the binder�s expiration date.

Source: pinterest.com

Source: pinterest.com

Keep in mind that the terms of the auto insurance binder letter are not necessarily the same as what your policy will be. A binder will act as your insurance until the underwriting process is through and your car insurance company issues you your actual policy. When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. It provides you with a document showing evidence of insurance(link). A typical binder consists of just a page or two of information, but it�s a valid insurance contract.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What�s the difference between an insurance binder and a policy? It is needed when providing proof of insurance for car financing and is provided by the insurance company. An insurance binder is a legal document that provides proof of temporary coverage. In comparison, a home insurance binder identifies the amount of insurance on the building, the. A car insurance binder or an auto insurance binder will provide proof of an insurance policy purchased of your car.

Source: albanord.com

Source: albanord.com

What is an insurance binder? When purchasing a new home or car, you�ll typically need insurance that begins the day you assume ownership. It may be required by a dealership, a leasing firm, or a finance company when you�re purchasing a new car. Only a certified insurance professional may prepare an insurance binder, and you can receive it upon request within one to two days. An insurance binder is a temporary insurance policy.

Source: sayinsurance.com

Source: sayinsurance.com

Car insurance binders provide a description of coverages (liability, collision and comprehensive), along with the associated deductibles. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. In other words, when you obtain a binder, you have proof of coverage that your proper insurance is being prepared. An insurance binder basically proves that there’s a formal agreement in place between you and the insurance company. It is needed when providing proof of insurance for car financing and is provided by the insurance company.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

While your policy will contain all the details of your insurance, your binder will provide an overview of the important points. A binder will act as your insurance until the underwriting process is through and your car insurance company issues you your actual policy. An insurance binder is just meant to allow for temporary insurance for a few days as someone transitions a new car or adds insurance to their policy. A car insurance policy is an official contract between a driver and insurer and includes all the terms and conditions of your insurance. It�s a temporary legal placeholder until your official insurance policy is issued.

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

While your policy will contain all the details of your insurance, your binder will provide an overview of the important points. It�s usually replaced by a policy within 30 to 90 days and dissolves once the policy has been issued. It may be required by a dealership, a leasing firm, or a finance company when you�re purchasing a new car. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. It�s a temporary legal placeholder until your official insurance policy is issued.

Source: lopriore.com

Source: lopriore.com

It binds them to provide you insurance through the binder�s expiration date. A car insurance binder is often used to prove that you�ve insured your car. The time it takes to finish underwriting policies varies, but generally it should take around 10 days. In comparison, a home insurance binder identifies the amount of insurance on the building, the. A car insurance binder is a temporary form of insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is an insurance binder for a car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information