What is an insurance demand letter information

Home » Trending » What is an insurance demand letter informationYour What is an insurance demand letter images are ready in this website. What is an insurance demand letter are a topic that is being searched for and liked by netizens today. You can Find and Download the What is an insurance demand letter files here. Find and Download all royalty-free vectors.

If you’re searching for what is an insurance demand letter images information linked to the what is an insurance demand letter topic, you have come to the ideal site. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

What Is An Insurance Demand Letter. Insurance companies can take weeks to respond to demand letters and, in some cases, may ignore them altogether. The need arises based on the other party’s alleged breach of contract, trademark infringement, or if they committed a legal wrong. August 11, 2021 after drafting and sending a demand letter, waiting for the insurance company to respond can be one of the hardest parts of an injury claims process. However, other carriers may only offer a minimal amount that could lead to the victim hiring a lawyer and sending a demand letter.

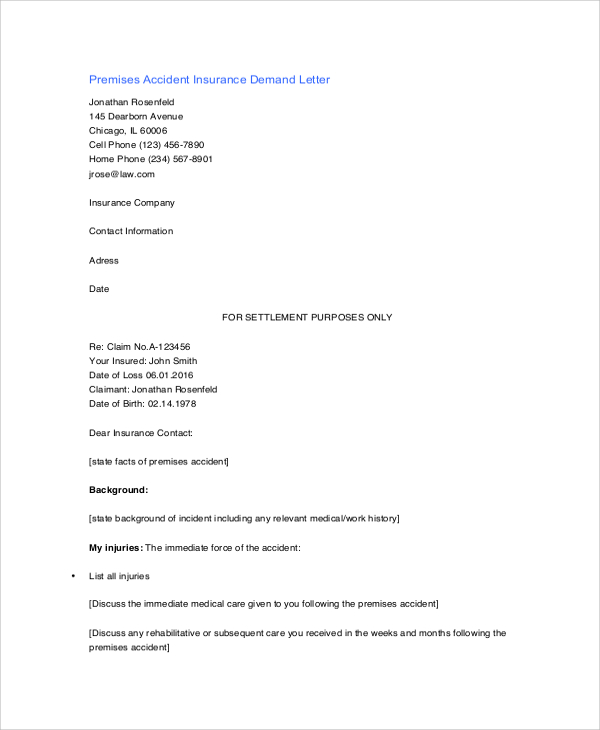

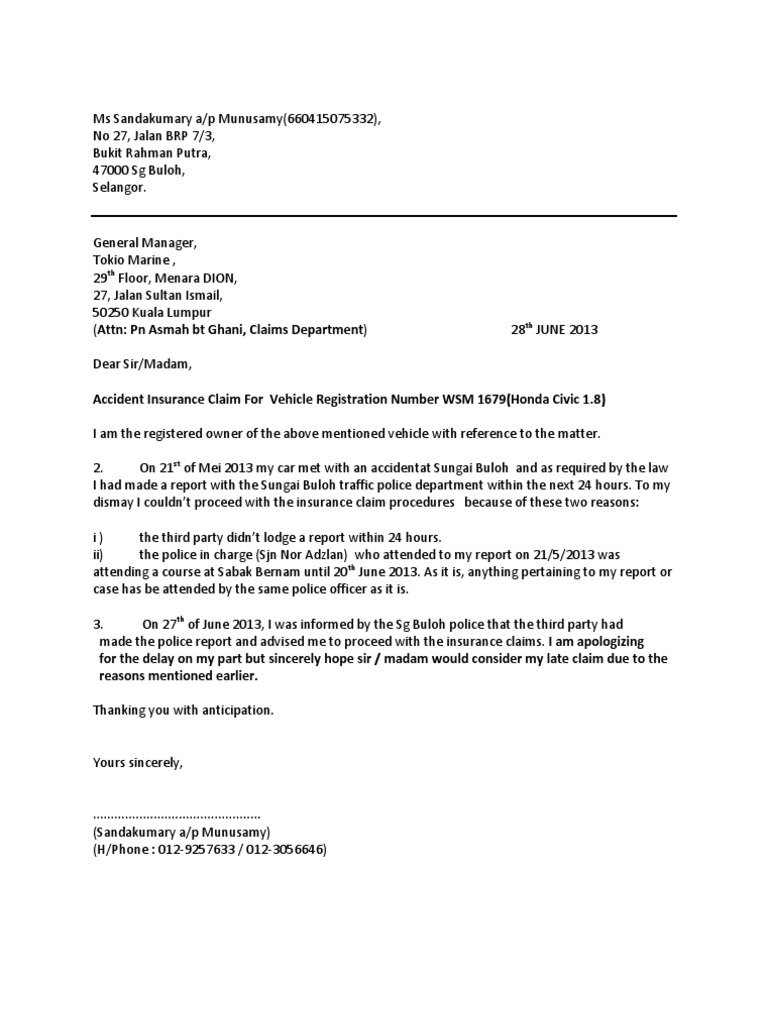

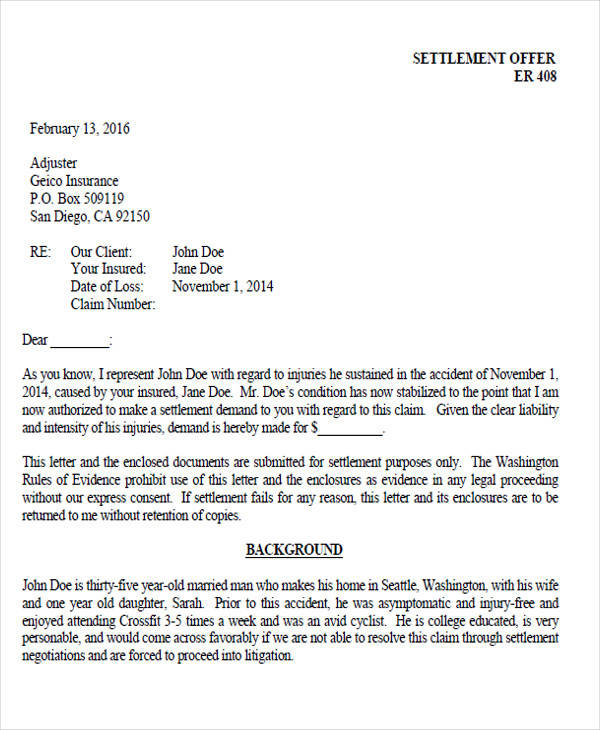

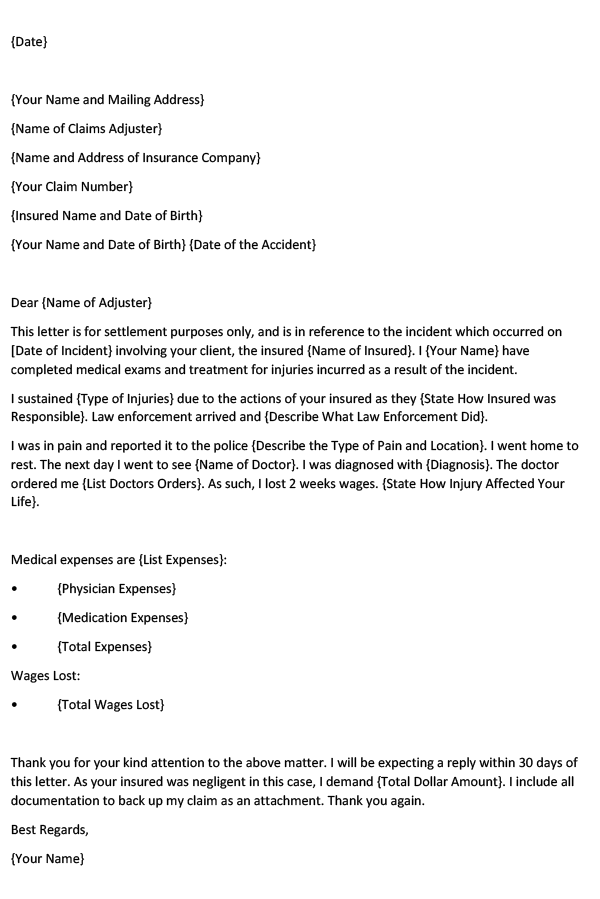

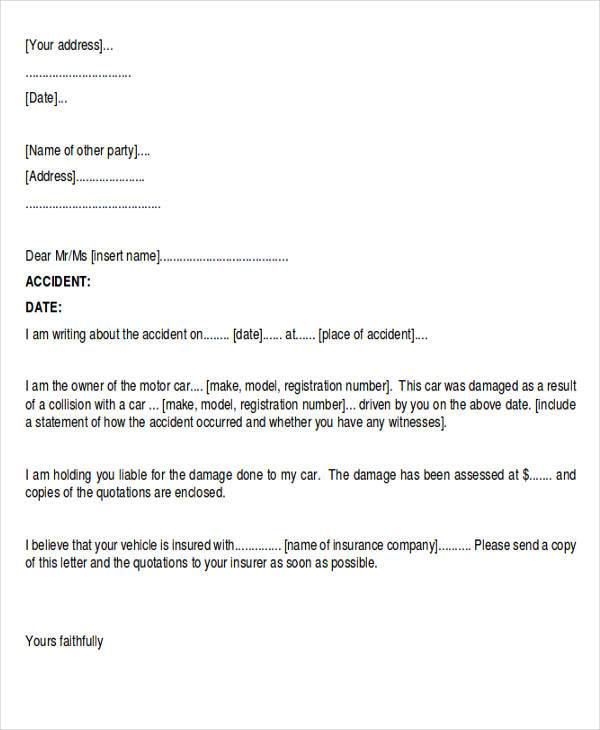

If you get into a car accident, for example, texas’s fault law holds the driver who caused the collision financially responsible for your losses. Prior to drafting a demand letter. The purpose of the demand letter is. Make copies of all your evidence and proof of losses to send with your demand letter. A typical demand letter is structured in the following manner: In the case of a settlement demand letter, it is sent by a claimant or their lawyer to an insurance company asking to demand compensation by way of a settlement offer.

A letter from your employer confirming your lost wages the police crash report witness statements photographs and video of the collision and your injuries you’ll need all your bills, receipts, and wage loss statements to calculate the value of your injury claim.

If you have any questions, please call us. A demand letter to an insurance company is a formal demand for compensation. Demand letters are best used when you first realize you are having difficulty collecting payment or there is a delay in payment from your customer. A demand letter, which is a summary of your claim and damages, is a crucial step toward settling a car accident claim. The demand letter contains the facts about your problem and the way you want it resolved. If you have any questions, please call us.

If you get into a car accident, for example, texas’s fault law holds the driver who caused the collision financially responsible for your losses. You write an insurance company demand letter when you need to make a claim on your insurance or another person’s insurance. You see, insurance adjusters evaluate a case based upon evidence, not by what someone argues in a demand letter, whether it’s written well or not. Insurance company demand letters are formal documents in which a claimant demands money from an insurance company. Never ignore a demand letter.

Source: sampletemplates.com

Source: sampletemplates.com

In personal injury claims, the settlement negotiation process begins with the victim submitting a demand letter to the insurance companies. If someone owes you money, then the letter will contain the amount that is due to you and the date that you want it paid. Make copies of all your evidence and proof of losses to send with your demand letter. The demand letter contains the facts about your problem and the way you want it resolved. A demand letter is the starting point of the settlement process.

The insurance demand letter is the written statement you submit to the insurance provider of the person or party you believe caused your accident. A demand letter is a factual summary of your claim, which includes all injuries (major or minor), loss of wages, emotional trauma (if applicable), and property damage. What is a demand letter? Demand letters are best used when you first realize you are having difficulty collecting payment or there is a delay in payment from your customer. If you are chasing compensation for either of these factors, then demand letters are a dependable way to ensure a fair settlement.

Your letter outlines the incident that caused your loss and demands payment to cover it. What is a demand letter? The insurance demand letter is the written statement you submit to the insurance provider of the person or party you believe caused your accident. You write an insurance company demand letter when you need to make a claim on your insurance or another person’s insurance. In personal injury claims, the settlement negotiation process begins by the victim submitting a demand letter to the insurance companies.

Source: sampletemplates.com

Source: sampletemplates.com

If you are chasing compensation for either of these factors, then demand letters are a dependable way to ensure a fair settlement. Prior to drafting a demand letter. The letter also makes a specific demand, a dollar amount that the injured person will accept in order to resolve the case and. A demand letter is a document drafted by your attorney and sent to the insurance company in an effort to resolve the case. A demand letter is the starting point of the settlement process.

Source: thedemandletters.com

Source: thedemandletters.com

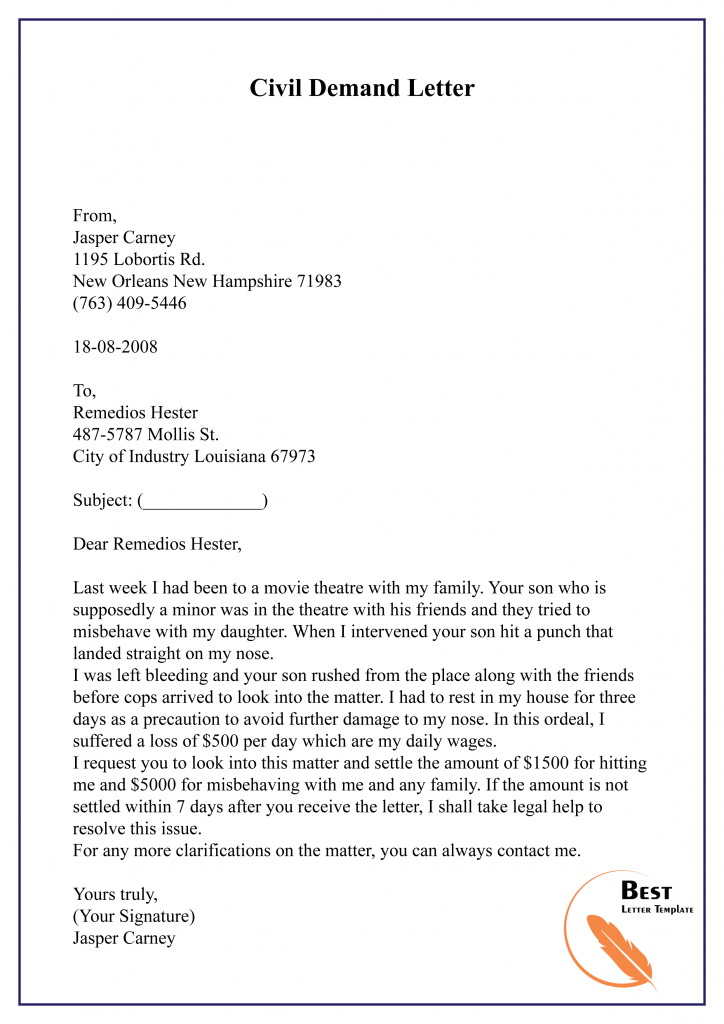

A demand letter, which is a summary of your claim and damages, is a crucial step toward settling a car accident claim. The demand letter lays out a number of details, especially presenting the injured person�s side of the case—how the injuries happened and what those injuries are, including specifics of medical treatment and how the injuries have impacted the claimant�s life. The information in a demand letter may be used against you. What is a demand letter to insurance company? Never ignore a demand letter.

The need arises based on the other party’s alleged breach of contract, trademark infringement, or if they committed a legal wrong. The letter also makes a specific demand, a dollar amount that the injured person will accept in order to resolve the case and. You should include in the demand letter: If you are chasing compensation for either of these factors, then demand letters are a dependable way to ensure a fair settlement. The demand letter lays out a number of details, especially presenting the injured person�s side of the case—how the injuries happened and what those injuries are, including specifics of medical treatment and how the injuries have impacted the claimant�s life.

Source: sampletemplates.com

Source: sampletemplates.com

A demand letter is generally seen by the court as a sign of good faith. A demand letter is a document drafted by your attorney and sent to the insurance company in an effort to resolve the case. If you get into a car accident, for example, texas’s fault law holds the driver who caused the collision financially responsible for your losses. Sending a demand letter can save you money and time in the long run. The purpose of the demand letter is to present facts about the accident in order to persuade the insurance companies to provide adequate compensation.

The insurance company’s liability or exactly why they owe you money. The information in a demand letter may be used against you. The purpose of the demand letter is. The letter also makes a specific demand, a dollar amount that the injured person will accept in order to resolve the case and. A demand letter is the starting point of the settlement process.

Source: bestlittlebookshop.com

Source: bestlittlebookshop.com

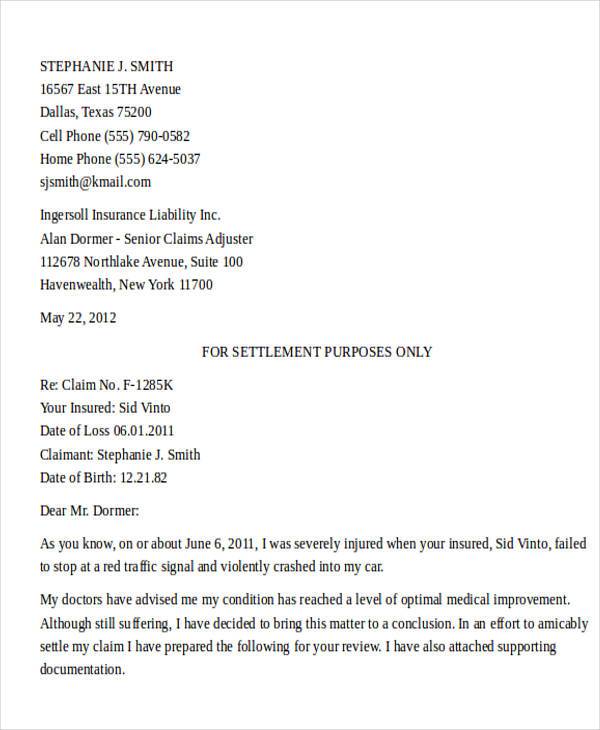

Your medical treatment or other costs, an exact amount. A demand letter is a document drafted by your attorney and sent to the insurance company in an effort to resolve the case. Insurance companies can take weeks to respond to demand letters and, in some cases, may ignore them altogether. In personal injury claims, the settlement negotiation process begins by the victim submitting a demand letter to the insurance companies. The need arises based on the other party’s alleged breach of contract, trademark infringement, or if they committed a legal wrong.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

August 11, 2021 after drafting and sending a demand letter, waiting for the insurance company to respond can be one of the hardest parts of an injury claims process. August 11, 2021 after drafting and sending a demand letter, waiting for the insurance company to respond can be one of the hardest parts of an injury claims process. The insurance company’s liability or exactly why they owe you money. A demand letter is a letter sent to the insurance company. A demand letter is an official document sent between two parties.

Source: mamiihondenk.org

Source: mamiihondenk.org

What is a demand letter? When an insurance company is part of a settlement for an incident, there are certain offers that are reasonable that the policyholder should receive. A demand letter is a document drafted by your attorney and sent to the insurance company in an effort to resolve the case. Since the insurance will be the party paying your compensation, they will need the details of the accident. The need arises based on the other party’s alleged breach of contract, trademark infringement, or if they committed a legal wrong.

Source: diminishedvaluemethod.com

Source: diminishedvaluemethod.com

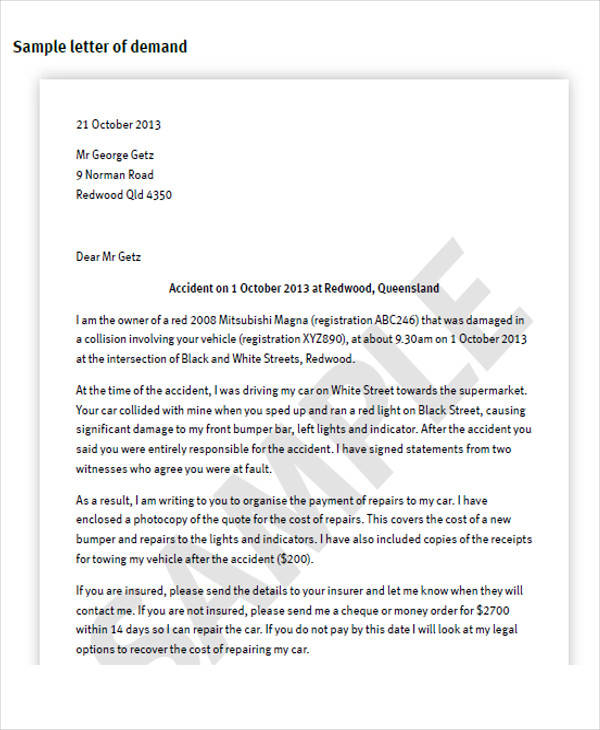

Never ignore a demand letter. You write an insurance company demand letter when you need to make a claim on your insurance or another person’s insurance. A demand letter shows the other party you’re serious. You, as the claimant or the person writing the letter, must inform the insurance company of how your property was damaged, the value of your losses, and the. You see, insurance adjusters evaluate a case based upon evidence, not by what someone argues in a demand letter, whether it’s written well or not.

Source: simpleartifact.com

Source: simpleartifact.com

The insurance demand letter is the written statement you submit to the insurance provider of the person or party you believe caused your accident. The individual or attorney writing the letter, the ‘claimant’, informs the insurance company that they intend to seek monetary repayment to satisfy their claimed damages. If someone owes you money, then the letter will contain the amount that is due to you and the date that you want it paid. The demand letter is an important piece of your case, as it marks the first formal demand for settlement sent from your attorney to the insurance company involved in your case. A typical demand letter is structured in the following manner:

Source: pinterest.com

Source: pinterest.com

Your letter outlines the incident that caused your loss and demands payment to cover it. The demand letter contains the facts about your problem and the way you want it resolved. The demand letter is an important piece of your case, as it marks the first formal demand for settlement sent from your attorney to the insurance company involved in your case. What is the insurance demand letter response time? What is the insurance demand letter?

Source: sampletemplates.com

Source: sampletemplates.com

A demand letter is also written when making insurance claims. Never ignore a demand letter. The insurance demand letter is the written statement you submit to the insurance provider of the person or party you believe caused your accident. A demand letter shows the other party you’re serious. An insurance company demand letter is a letter written to an insurance company seeking money for a claim related to personal injury or property damage.

Source: peterainsworth.com

Source: peterainsworth.com

The demand letter lays out a number of details, especially presenting the injured person�s side of the case—how the injuries happened and what those injuries are, including specifics of medical treatment and how the injuries have impacted the claimant�s life. The need arises based on the other party’s alleged breach of contract, trademark infringement, or if they committed a legal wrong. Make copies of all your evidence and proof of losses to send with your demand letter. A demand letter is generally seen by the court as a sign of good faith. If you have any questions, please call us.

Source: sampletemplates.com

Source: sampletemplates.com

If you get into a car accident, for example, texas’s fault law holds the driver who caused the collision financially responsible for your losses. Prior to drafting a demand letter. You see, insurance adjusters evaluate a case based upon evidence, not by what someone argues in a demand letter, whether it’s written well or not. Your medical treatment or other costs, an exact amount. What is the insurance demand letter response time?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is an insurance demand letter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information