What is an insured retirement plan Idea

Home » Trending » What is an insured retirement plan IdeaYour What is an insured retirement plan images are available. What is an insured retirement plan are a topic that is being searched for and liked by netizens today. You can Download the What is an insured retirement plan files here. Download all free photos.

If you’re searching for what is an insured retirement plan pictures information related to the what is an insured retirement plan topic, you have pay a visit to the ideal site. Our site always gives you hints for viewing the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

What Is An Insured Retirement Plan. Business owners or key shareholders who have a corporate surplus and. However, an insured annuity should not make up your entire retirement plan. When you retire, instead of withdrawing these funds directly from the life insurance policy, you use the policy as collateral on a loan. It’s more likely that employers will offer a defined contribution plan.

Retirement Planning From slideshare.net

Retirement Planning From slideshare.net

This policy will serve two objectives: The corporate insured retirement plan: More specifically, it’s a line of credit that allows one to access the cash value inside of their permanent policy. Instead, you should consider it as part of a larger diversified plan that includes other types of investments. First steps • assess insurance needs • determine deposit stream • select a ul policy from bmo life assurance company including an investment portfolio best suited to the client’s risk tolerance over 400 investment options visit investmentpro at www.bmoinvestpro.ca But at least the clients have insurance coverage immediately, they can always lower their contribution momentarily while establishing their economic stability in canada, then later on increased the contribution once.

The insured retirement plan provides a corporation with valuable life insurance.

In fact, 64% of private industry workers had access to a defined contribution plan in 2020. Business owners or key shareholders who have a corporate surplus and. Who should consider insured retirement plan? This policy will serve two objectives: What affects the size of the insured retirement plan? Instead, you should consider it as part of a larger diversified plan that includes other types of investments.

Source: insurancenoon.com

Source: insurancenoon.com

What is insured retirement plan? While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. First steps • assess insurance needs • determine deposit stream • select a ul policy from bmo life assurance company including an investment portfolio best suited to the client’s risk tolerance over 400 investment options visit investmentpro at www.bmoinvestpro.ca What is an insured retirement plan (irp)? More specifically, it’s a line of credit that allows one to access the cash value inside of their permanent policy.

![4 Major Benefits of a Personal Retirement Plan [Infographic] 4 Major Benefits of a Personal Retirement Plan [Infographic]](https://blog.highlandbrokerage.com/wp-content/uploads/2015/08/4-Major-Benefits-of-a-Personal-Retirement-Plan-Infographic-Revised.png) Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

First steps • assess insurance needs • determine deposit stream • select a ul policy from bmo life assurance company including an investment portfolio best suited to the client’s risk tolerance over 400 investment options visit investmentpro at www.bmoinvestpro.ca The insured retirement plan provides a corporation with valuable life insurance. It’s more likely that employers will offer a defined contribution plan. You are looking for a conservative investment strategy requiring little or no management. The monthly payment is flexible anyways.

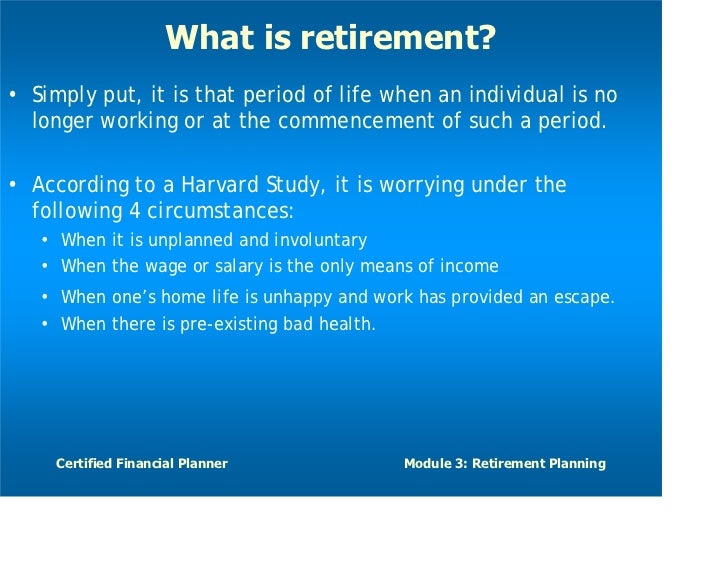

Source: slideshare.net

Source: slideshare.net

- need to replace income or protect the value of an estate*; It’s more likely that employers will offer a defined contribution plan. However, an insured annuity should not make up your entire retirement plan. Instead, you should consider it as part of a larger diversified plan that includes other types of investments. A client must be 50 years of age to apply.

Source: slideshare.net

Source: slideshare.net

Let’s talk about…presenting an insured retirement strategy to your client an insured retirement strategy works with an ivari universal life insurance policy. An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. The age of the insured (older owner means higher cost of pure net insurance) the health of the insured (less healthy individuals means a higher cost of net pure insurance) the size of the policy (the larger the. The monthly payment is flexible anyways. N if you are at least 10 to 15 years away from retirement, you are maximizing your annual rsp contributions and

Source: locallifeagents.com

Source: locallifeagents.com

N if you are at least 10 to 15 years away from retirement, you are maximizing your annual rsp contributions and The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value. Who should consider insured retirement plan? Let’s talk about…presenting an insured retirement strategy to your client an insured retirement strategy works with an ivari universal life insurance policy. Instead, you should consider it as part of a larger diversified plan that includes other types of investments.

Source: samivalue.com.my

Source: samivalue.com.my

- need to replace income or protect the value of an estate*; Instead, you should consider it as part of a larger diversified plan that includes other types of investments. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges,. The corporate insured retirement plan: What is insured retirement plan?

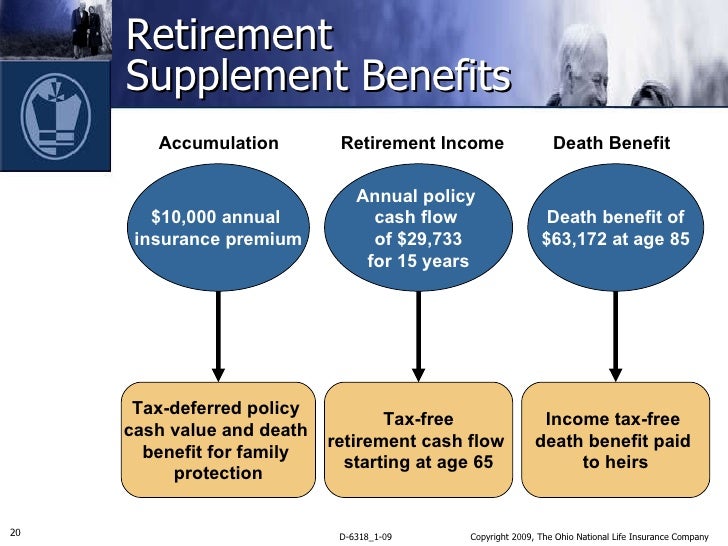

Source: harvest-financial.ca

Source: harvest-financial.ca

An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges,. Business owners or key shareholders who have a corporate surplus and. What is an insured retirement plan 10 ways to build wealth in your business to fund your exit strategy tips for business wealth management business owners work hard at perfecting their business to make a living, earn a profit and ultimately sell or transition the business to another group of owners or family members.

Source: blog.moneyfrog.in

Source: blog.moneyfrog.in

Let’s talk about…presenting an insured retirement strategy to your client an insured retirement strategy works with an ivari universal life insurance policy. Let’s talk about…presenting an insured retirement strategy to your client an insured retirement strategy works with an ivari universal life insurance policy. A client must be 50 years of age to apply. In general, here are some of the profiles that the strategy fits: In fact, 64% of private industry workers had access to a defined contribution plan in 2020.

Source: crossroadsfinancial.ca

Source: crossroadsfinancial.ca

However, an insured annuity should not make up your entire retirement plan. You are looking for a conservative investment strategy requiring little or no management. While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. What is an insured retirement plan 10 ways to build wealth in your business to fund your exit strategy tips for business wealth management business owners work hard at perfecting their business to make a living, earn a profit and ultimately sell or transition the business to another group of owners or family members. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges,.

![]() Source: dreamstime.com

Source: dreamstime.com

In general, here are some of the profiles that the strategy fits: But at least the clients have insurance coverage immediately, they can always lower their contribution momentarily while establishing their economic stability in canada, then later on increased the contribution once. Instead, you should consider it as part of a larger diversified plan that includes other types of investments. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges,. The corporate insured retirement plan:

Source: myconfidence.com

Source: myconfidence.com

What is insured retirement plan? What is an insured retirement plan (irp)? What are the best types of insured retire. More specifically, it’s a line of credit that allows one to access the cash value inside of their permanent policy. When you retire, instead of withdrawing these funds directly from the life insurance policy, you use the policy as collateral on a loan.

Source: forbes.com

Source: forbes.com

The corporate insured retirement plan: Who should consider insured retirement plan? An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. An irp allows individuals to fund a permanent life insurance policy over its base premium. The insured retirement plan provides a corporation with valuable life insurance.

Source: pinterest.com

Source: pinterest.com

Instead, you should consider it as part of a larger diversified plan that includes other types of investments. Let’s talk about…presenting an insured retirement strategy to your client an insured retirement strategy works with an ivari universal life insurance policy. While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. However, an insured annuity should not make up your entire retirement plan. A client must be 50 years of age to apply.

Source: babyboomerhealthandfitness.com

Source: babyboomerhealthandfitness.com

The monthly payment is flexible anyways. While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. N if you are at least 10 to 15 years away from retirement, you are maximizing your annual rsp contributions and There is absolutely nothing wrong with this strategy, but it can have a lot of moving parts and is certainly not for everybody.

Source: medium.com

Source: medium.com

An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. The age of the insured (older owner means higher cost of pure net insurance) the health of the insured (less healthy individuals means a higher cost of net pure insurance) the size of the policy (the larger the. The monthly payment is flexible anyways. The corporate insured retirement plan: The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value.

Source: blogs.ubc.ca

Source: blogs.ubc.ca

This policy will serve two objectives: The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value. Let’s talk about…presenting an insured retirement strategy to your client an insured retirement strategy works with an ivari universal life insurance policy. However, an insured annuity should not make up your entire retirement plan. An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges,.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

You are looking for a conservative investment strategy requiring little or no management. What is insured retirement plan? An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. 1) need to replace income or protect the value of an estate*; This policy will serve two objectives:

Source: wealthnation.io

Source: wealthnation.io

What is insured retirement plan? You are looking for a conservative investment strategy requiring little or no management. Instead, you should consider it as part of a larger diversified plan that includes other types of investments. Who should consider insured retirement plan? An irp allows individuals to fund a permanent life insurance policy over its base premium.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is an insured retirement plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information