What is an insuring agreement Idea

Home » Trending » What is an insuring agreement IdeaYour What is an insuring agreement images are available in this site. What is an insuring agreement are a topic that is being searched for and liked by netizens now. You can Get the What is an insuring agreement files here. Get all free photos.

If you’re searching for what is an insuring agreement images information connected with to the what is an insuring agreement keyword, you have pay a visit to the right blog. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

What Is An Insuring Agreement. There are two fundamental forms of insurance agreement: The uncertainty may be either when the event will occur (for example. Declarations, insuring agreements, general agreements, conditions and limitations, and riders. It details what’s covered under the policy and what the insurer and the insured have agreed to do under the insurance contract.

Insurance Agreement Template Download PDF From agreements.org

Insurance Agreement Template Download PDF From agreements.org

The insuring agreement is usually contained in a coverage form from which a policy is constructed. This page is usually the first part of an insurance policy. Legal definition of insuring agreement. Insuring agreement definition insuring agreement — that portion of the insurance policy in which the insurer promises to make payment to or on behalf of the insured. The part of an insurance contract that states what the insurer agrees to do and the conditions under which it so agrees. An insuring agreement is the part of an insurance contract that will give exact information about risks or insurance coverages in exchange for premium payments at a certain value and interval.

In the insurance agreement, the insurer undertakes to do certain things, such as paying losses for guaranteed risks, providing certain services or defending the insured in liability action.

In the insurance agreement, the insurer undertakes to do certain things, such as paying losses for guaranteed risks, providing certain services or defending the insured in liability action. 4 rows an insuring agreement is a section of an insurance contract that outlines the exact risks that an. In insurance, the insurance policy is a contract between the insurer and the policyholder, which the insurance contract or agreement is a contract whereby the insurer the uncertainty can be either as to when the event will happen (e.g. An insurance contract is the section of an insurance contract in which the insurance company specifies exactly for what risks it provides insurance coverage in exchange for premium payments at a given value and interval. This could mean paying for bodily injury, property damage, and legal defense costs up to the policy limits in a covered car accident. Subject to the “fortuity” principle, the event must be uncertain.

Source: paramythia.info

Source: paramythia.info

What is an insuring agreement and its importance? In the insurance agreement, the insurer undertakes to do certain things, such as paying losses for guaranteed risks, providing certain services or defending the insured in liability action. 3 liability coverage one of the first steps in understanding crime insurance is to become familiar with the five basic components of the policy: What is an insuring agreement and its importance? These provisions help to establish working.

Source: iedunote.com

Source: iedunote.com

It identifies insured persons, risks or assets covered, insurance limits and the insurance period (i.e. What is the purpose of the insuring clause? The part of an insurance policy setting out in basic terms what the policy covers. It details what’s covered under the policy and what the insurer and the insured have agreed to do under the insurance contract. An insuring agreement is the section of an insurance contract in which the insurance company specifies exactly which circumstances it will provide insurance coverage for in exchange for premium payments.

Source: signnow.com

Source: signnow.com

The part of an insurance policy setting out in basic terms what the policy covers. Legal definition of insuring agreement. As a result, a compensation and insurance contract must be entered into to. Insurance is necessary when a dispute arises over whether a particular injury is covered or not. Forgery or alteration the insurer shall indemnify the insured for loss resulting directly from forgery or

Source: templateroller.com

Source: templateroller.com

4 rows an insuring agreement is a section of an insurance contract that outlines the exact risks that an. What is the purpose of the insuring clause? An insurance contract is the section of an insurance contract in which the insurance company specifies exactly for what risks it provides insurance coverage in exchange for premium payments at a given value and interval. The date the policy is in effect). The insuring agreement is usually contained in a coverage form from which a policy is constructed.

Source: winsurtech.com

Source: winsurtech.com

These often lead to lawsuits in which each party proposes competing interpretations of the insurance agreement. What does insuring agreement mean april 15, 2021 / in / by rich. In insurance, the insurance policy is a contract between the insurer and the policyholder, which the insurance contract or agreement is a contract whereby the insurer the uncertainty can be either as to when the event will happen (e.g. Employee dishonesty the insurer shall indemnify the insured or any plan for loss of or damage to money, securities or property resulting directly from employee theft or employee forgery. There are two fundamental forms of insurance agreement:

What is the agreement of insurance contract? Legal definition of insuring agreement. Can a policy holder have both paper and electronic policies?. In insurance, the insurance policy is a contract between the insurer and the policyholder, which the insurance contract or agreement is a contract whereby the insurer the uncertainty can be either as to when the event will happen (e.g. There are two fundamental forms of insurance agreement:

Source: template.net

Source: template.net

An insuring agreement is the part of an insurance contract that will give exact information about risks or insurance coverages in exchange for premium payments at a certain value and interval. An insurance contract is the section of an insurance contract in which the insurance company specifies exactly for what risks it provides insurance coverage in exchange for premium payments at a given value and interval. The part of an insurance contract that states what the insurer agrees to do and the conditions under which it so agrees. The part of an insurance policy setting out in basic terms what the policy covers. This page is usually the first part of an insurance policy.

Source: template.net

Source: template.net

An insurance contract is the section of an insurance contract in which the insurance company specifies exactly for what risks it provides insurance coverage in exchange for premium payments at a given value and interval. The insurance contract or agreement is a contract whereby the insurer promises to pay benefits to the insured or on their behalf to a third party if certain defined events occur. The insuring agreement is usually contained in a coverage form from which a policy is constructed. There are two fundamental forms of insurance agreement: An insurance contract is the section of an insurance contract in which the insurance company specifies exactly for what risks it provides insurance coverage in exchange for premium payments at a given value and interval.

Source: discoverdando.com

Source: discoverdando.com

3 liability coverage one of the first steps in understanding crime insurance is to become familiar with the five basic components of the policy: They define who and what is covered by the policy and what the insurer promises to do and not do in exchange for your premium. An insuring agreement is the portion of a cover tighten in which the assurance friendship. What is the agreement of insurance contract? This page is usually the first part of an insurance policy.

These often lead to lawsuits in which each party proposes competing interpretations of the insurance agreement. It details what’s covered under the policy and what the insurer and the insured have agreed to do under the insurance contract. The insuring agreement is usually contained in a coverage form from which a policy is constructed. The insuring agreements are needed to issue a dispute over whether or not an item. The insuring agreement is usually contained in a coverage form.

Insurance is necessary when a dispute arises over whether a particular injury is covered or not. The insuring agreement is usually contained in a coverage form from which a policy is constructed. An insuring agreement is the section of an insurance contract in which the insurance company specifies exactly which circumstances it will provide insurance coverage for in exchange for premium payments. These often lead to lawsuits in which each party proposes competing interpretations of the insurance agreement. The insurance contract or agreement is a contract whereby the insurer promises to pay benefits to the insured or on their behalf to a third party if certain defined events occur.

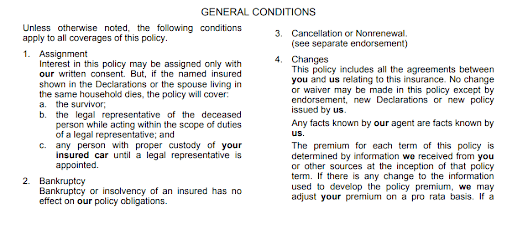

Insuring agreements the insuring agreements are typically the main part of the policy. An insuring agreement is the part of an insurance contract that will give exact information about risks or insurance coverages in exchange for premium payments at a certain value and interval. In a life insurance policy, the time of the insured’s death is uncertain) or as to if it will (29). The insurance contract or agreement is a contract whereby the insurer promises to pay benefits to the insured or on their behalf to a third party if certain defined events occur. An insuring agreement is the part of an insurance contract in which the insurance company explains exactly which risks it will give insurance coverage for in exchange for premium payments at a.

Source: dexform.com

Source: dexform.com

The uncertainty may be either when the event will occur (for example. The insuring agreement is usually contained in a coverage form from which a policy is constructed. Insuring agreement — that portion of the insurance policy in which the insurer promises to make payment to or on behalf of the insured. There are two fundamental forms of insurance agreement: In the insurance agreement, the insurer undertakes to do certain things, such as paying losses for guaranteed risks, providing certain services or defending the insured in liability action.

Source: signnow.com

Source: signnow.com

This list helps the policyholder understand the specific areas in which their coverage extends. They define who and what is covered by the policy and what the insurer promises to do and not do in exchange for your premium. 4 rows an insuring agreement is a section of an insurance contract that outlines the exact risks that an. Forgery or alteration the insurer shall indemnify the insured for loss resulting directly from forgery or The insuring agreement is usually contained in a coverage form.

Source: sampletemplates.com

Source: sampletemplates.com

The insuring agreement is usually contained in a coverage form from which a policy is constructed. The insuring agreements are needed to issue a dispute over whether or not an item. Can a policy holder have both paper and electronic policies?. Insurance is necessary when a dispute arises over whether a particular injury is covered or not. This page is usually the first part of an insurance policy.

The insuring agreement is usually contained in a coverage form. Insuring agreements the insuring agreements are typically the main part of the policy. Can a policy holder have both paper and electronic policies?. There are two fundamental forms of insurance agreement: These provisions help to establish working.

Source: pinterest.com

Source: pinterest.com

3 liability coverage one of the first steps in understanding crime insurance is to become familiar with the five basic components of the policy: These often lead to lawsuits in which each party proposes competing interpretations of the insurance agreement. What is the agreement of insurance contract? Insuring agreement definition insuring agreement — that portion of the insurance policy in which the insurer promises to make payment to or on behalf of the insured. What does insuring agreement mean april 15, 2021 / in / by rich.

Source: winsurtech.com

Source: winsurtech.com

The part of an insurance policy setting out in basic terms what the policy covers. This could mean paying for bodily injury, property damage, and legal defense costs up to the policy limits in a covered car accident. Insurance is necessary when a dispute arises over whether a particular injury is covered or not. It identifies insured persons, risks or assets covered, insurance limits and the insurance period (i.e. The insuring agreement is usually contained in a coverage form from which a policy is constructed.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is an insuring agreement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information