What is breach of warranty insurance information

Home » Trend » What is breach of warranty insurance informationYour What is breach of warranty insurance images are available in this site. What is breach of warranty insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is breach of warranty insurance files here. Download all royalty-free photos.

If you’re looking for what is breach of warranty insurance pictures information connected with to the what is breach of warranty insurance keyword, you have come to the ideal blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

What Is Breach Of Warranty Insurance. There are two types of warranties. In certain cases, your insurance service provider will explicitly attach warranties to your insurance, to limit their risk. Therefore, it is important to understand the effect of warranties, as a part of your policy, and make sure you have an adequate policy. Breach of warranty is a legal concept that may arise in product liability cases.

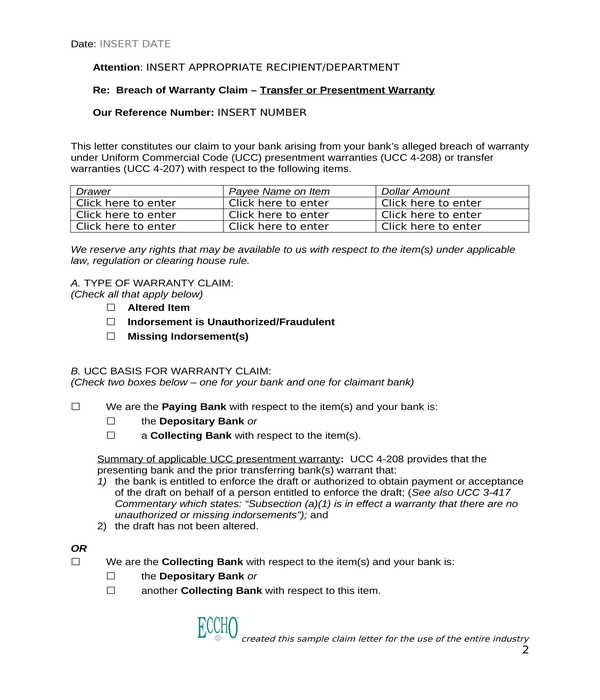

(PDF) Legal Effect of Breach of Warranty in Construction From researchgate.net

(PDF) Legal Effect of Breach of Warranty in Construction From researchgate.net

A thing that we all generally know and accept is that, typically, a commercial general liability insurance policy doesn’t cover breaches of contract. This is regardless of whether the breach has anything to do with the cause of the loss. Section 55 (1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. Effect of breach of insurance policy warranty march 6, 2018 insurance the commercial court in london has recently held that breach of a specific policy provision described as a warranty in a buildings insurance policy allowed an insurer to avoid coverage for a fire claim, but was not grounds for making the policy completely void from inception, as Your insurance carrier could deny coverage based on breaching the pilot warranty.

Breach of warranty is a legal concept that may arise in product liability cases.

Any loss recoveries under this clause are payable only to the lienholder or lessor. Regardless of whether the insured is a consumer, or a business insured, the insurer is not automatically discharged from liability where there is. Therefore, it is important to understand the effect of warranties, as a part of your policy, and make sure you have an adequate policy. Any loss recoveries under this clause are payable only to the lienholder or lessor. Insurance and breach of warranty a breach of warranty clause helps ensure that your company is protected against claims or lawsuits made by clients for not guaranteeing that your products or services are not of proper quality. Section 55 (1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to.

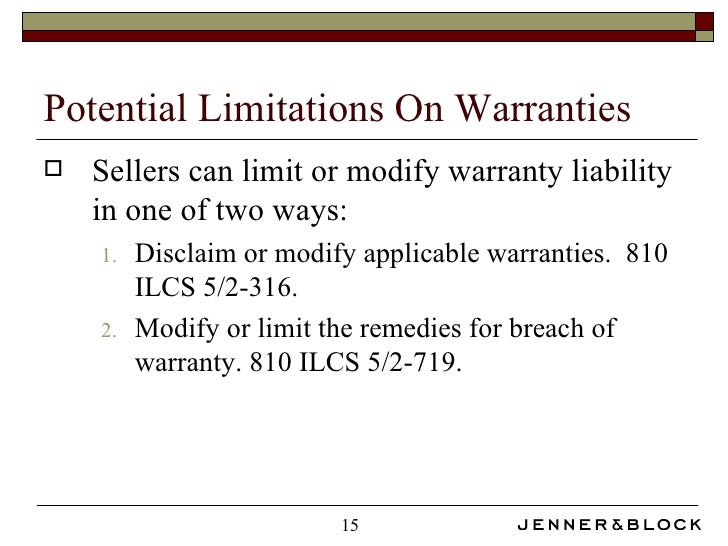

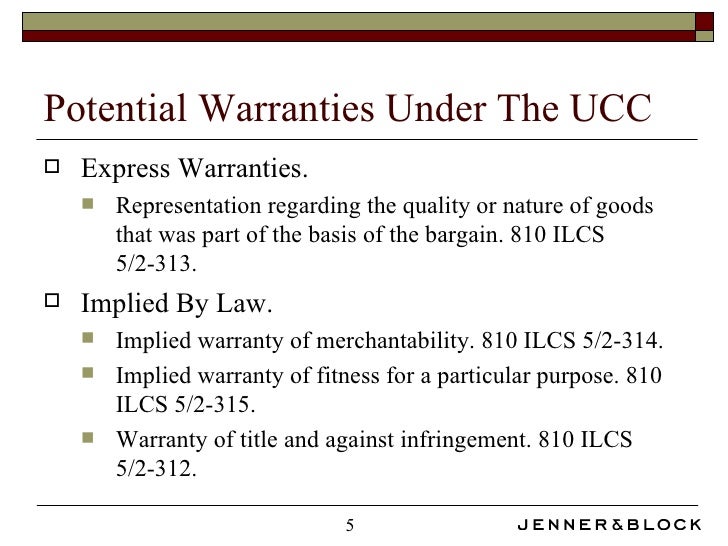

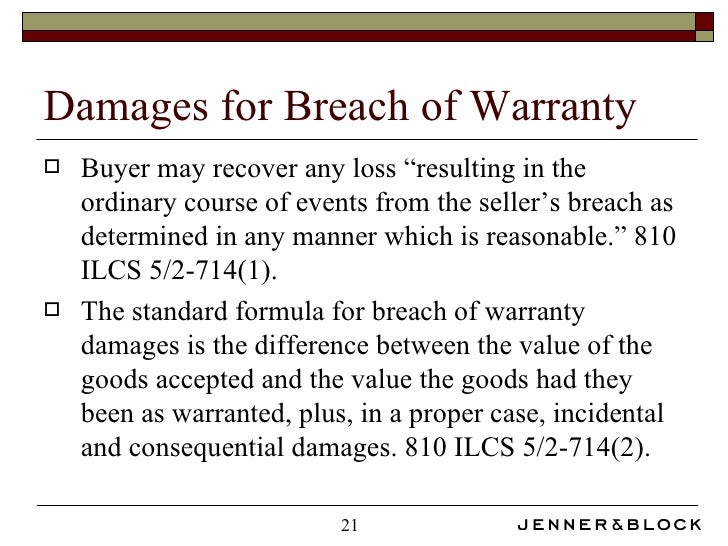

Source: slideserve.com

Source: slideserve.com

This is regardless of whether the breach has anything to do with the cause of the loss. Applied the measure of damages contained in s.53 which provides: The law in relation to warranties and breach of warranty was reformed by the insurance act 2015 which has effect from 12 august 2016. Damages for breach of warranty are calculated on a contractual basis and aim to put the claimant in the position he would have been in had the warranties been true. Promises or warranties that are made by either a manufacturer or seller may in turn be used against them in court should those claims turn out to not be true.

Source: aplifecareplanning.com

Source: aplifecareplanning.com

If the policy carried a bow, breach of warranty, in favor of the financial institution, the insurance company would pay up to the amount stipulated in the bow but not more than the remaining lien amount. It is essentially a minor term of a contract. Regardless of whether the insured is a consumer, or a business insured, the insurer is not automatically discharged from liability where there is. Keep in mind, a breach of warranty is not an automatic coverage. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage.

Source: attorneydocs.com

Source: attorneydocs.com

The law assumes that a seller gives certain warranties concerning goods that are sold and that he or she must stand behind these assertions. The estimated loss directly and naturally resulting, in the ordinary course of. Therefore, it is important to understand the effect of warranties, as a part of your policy, and make sure you have an adequate policy. The first type deals with the quality of the product. In certain cases, your insurance service provider will explicitly attach warranties to your insurance, to limit their risk.

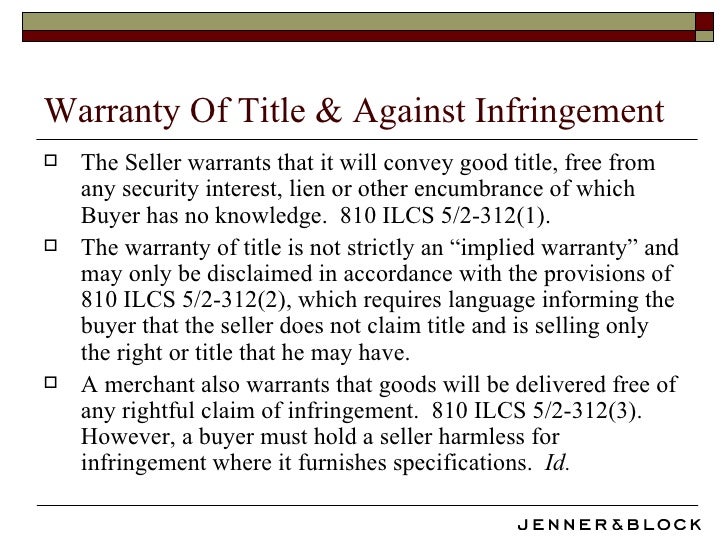

Source: slideshare.net

Source: slideshare.net

This has the effect of incorporating the declaration into the insurance contract as a warranty. This is regardless of whether the breach has anything to do with the cause of the loss. The law in relation to warranties and breach of warranty was reformed by the insurance act 2015 which has effect from 12 august 2016. Under the current law, the position is clear: Instead, if a warranty is breached, cover will simply be suspended from the time of the breach

Source: differencebetween.net

Source: differencebetween.net

It is essentially a minor term of a contract. Promises or warranties that are made by either a manufacturer or seller may in turn be used against them in court should those claims turn out to not be true. Section 55 (1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. Insurer’s remedies for breach of warranty one of the biggest changes that will be brought in by the act is that, if a warranty is breached, automatic and permanent termination of cover will no longer be the insurer’s sole remedy for breach of warranty. This has the effect of incorporating the declaration into the insurance contract as a warranty.

Source: wegnerlegal.com

Source: wegnerlegal.com

Any incorrect or inaccurate answer given in the proposal form, however trivial, will be a breach of warranty and entitle the insurer to treat the contract as repudiated. Breach of warranty a warranty is a stipulation that a particular fact related to the subject of the contract is or will be as promised or stated. The problem lies in the change to the law regarding warranties generally under the new act. If a buyer purchases an oven, but it doesn’t bake at the temperature it says it does, then the buyer will have certain protections against faulty products. In certain cases, your insurance service provider will explicitly attach warranties to your insurance, to limit their risk.

Source: slideshare.net

Source: slideshare.net

Therefore, it is important to understand the effect of warranties, as a part of your policy, and make sure you have an adequate policy. Applied the measure of damages contained in s.53 which provides: In the context of a finance transaction, warranties (and representations) are the statements which an obligor makes in a finance document about itself and the circumstances of the debt or security. The first type deals with the quality of the product. Breach of warranty a warranty is a stipulation that a particular fact related to the subject of the contract is or will be as promised or stated.

Source: slideshare.net

Source: slideshare.net

Insurance and breach of warranty a breach of warranty clause helps ensure that your company is protected against claims or lawsuits made by clients for not guaranteeing that your products or services are not of proper quality. For example, an unapproved pilot flies your aircraft an has an accident. Breach of warranty a “breach or violation by the insured of any warranty, condition, or provision” only excuses the insurer from paying—essentially, it only constitutes a material breach—if “such. Events, from the breach of warranty. The estimated loss directly and naturally resulting, in the ordinary course of.

Source: picserver.org

Source: picserver.org

In certain cases, your insurance service provider will explicitly attach warranties to your insurance, to limit their risk. The first type deals with the quality of the product. If a breach happens, then your insurer has the right to cancel the insurance policy. There are two types of warranties. This would be called a policy warranty violation.

Source: creative-commons-images.com

Source: creative-commons-images.com

Breach of contractor�s warranty defeats coverage insurers who insure the liability of contractors will often include in their policy a warranty that compels the general contractor to obtain proof that all its subcontractors are insured. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. Any loss recoveries under this clause are payable only to the lienholder or lessor. This is regardless of whether the breach has anything to do with the cause of the loss. For example, an unapproved pilot flies your aircraft an has an accident.

Source: youtube.com

Source: youtube.com

A warranty is an important aspect in an insurance contract as it is a fundamental term of the policy. If a buyer purchases an oven, but it doesn’t bake at the temperature it says it does, then the buyer will have certain protections against faulty products. The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached. If a breach happens, then your insurer has the right to cancel the insurance policy. Breach of contractor�s warranty defeats coverage insurers who insure the liability of contractors will often include in their policy a warranty that compels the general contractor to obtain proof that all its subcontractors are insured.

Source: sampleforms.com

Source: sampleforms.com

(2) the measure of damages for breach of warranty is. In the context of a finance transaction, warranties (and representations) are the statements which an obligor makes in a finance document about itself and the circumstances of the debt or security. Breach of warranty is a legal concept that may arise in product liability cases. The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached. This would be called a policy warranty violation.

Source: mccanninjurylaw.com

Source: mccanninjurylaw.com

In certain cases, your insurance service provider will explicitly attach warranties to your insurance, to limit their risk. Section 55 (1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. Applied the measure of damages contained in s.53 which provides: In general, a breach of warranty is less severe than a. The implication is, if the insured violates the warranty, then the insurer can deny responsibility of a claim, or even terminate the insurance policy.

Source: slideshare.net

Source: slideshare.net

If a breach happens, then your insurer has the right to cancel the insurance policy. Regardless of whether the insured is a consumer, or a business insured, the insurer is not automatically discharged from liability where there is. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product. A warranty is an important aspect in an insurance contract as it is a fundamental term of the policy. Effect of breach of insurance policy warranty march 6, 2018 insurance the commercial court in london has recently held that breach of a specific policy provision described as a warranty in a buildings insurance policy allowed an insurer to avoid coverage for a fire claim, but was not grounds for making the policy completely void from inception, as

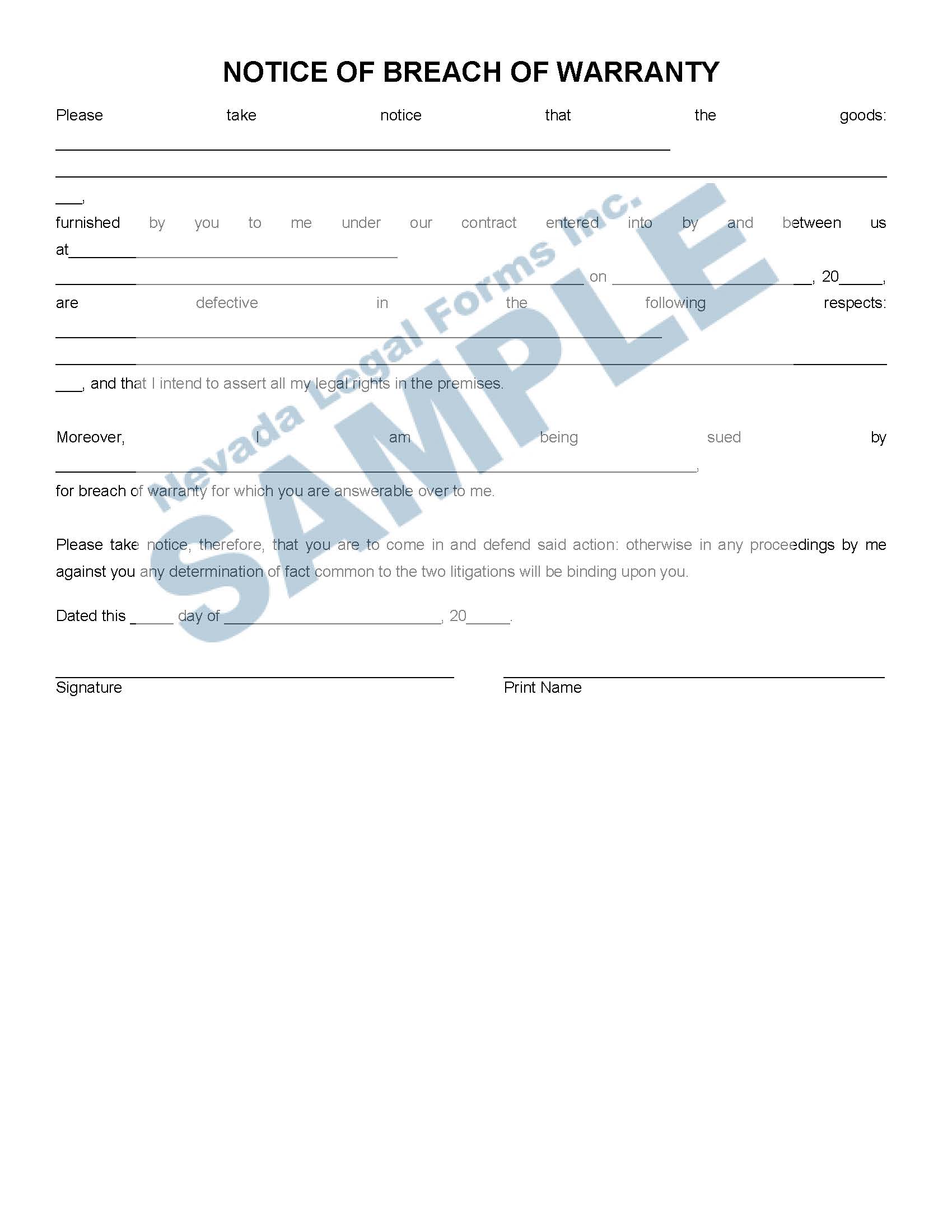

Source: nevadalegalforms.com

Source: nevadalegalforms.com

Regardless of whether the insured is a consumer, or a business insured, the insurer is not automatically discharged from liability where there is. Therefore, it is important to understand the effect of warranties, as a part of your policy, and make sure you have an adequate policy. Promises or warranties that are made by either a manufacturer or seller may in turn be used against them in court should those claims turn out to not be true. It is essentially a minor term of a contract. Instead, if a warranty is breached, cover will simply be suspended from the time of the breach

Source: picpedia.org

Source: picpedia.org

It is essentially a minor term of a contract. A thing that we all generally know and accept is that, typically, a commercial general liability insurance policy doesn’t cover breaches of contract. Insurance and breach of warranty a breach of warranty clause helps ensure that your company is protected against claims or lawsuits made by clients for not guaranteeing that your products or services are not of proper quality. For example, an unapproved pilot flies your aircraft an has an accident. Your insurance carrier could deny coverage based on breaching the pilot warranty.

Source: policyholderinsurancelaw.com

Under the current law, the position is clear: Promises or warranties that are made by either a manufacturer or seller may in turn be used against them in court should those claims turn out to not be true. Warranties are meant to protect the recipient against loss, should the fact be or become untrue. In the context of a finance transaction, warranties (and representations) are the statements which an obligor makes in a finance document about itself and the circumstances of the debt or security. Any incorrect or inaccurate answer given in the proposal form, however trivial, will be a breach of warranty and entitle the insurer to treat the contract as repudiated.

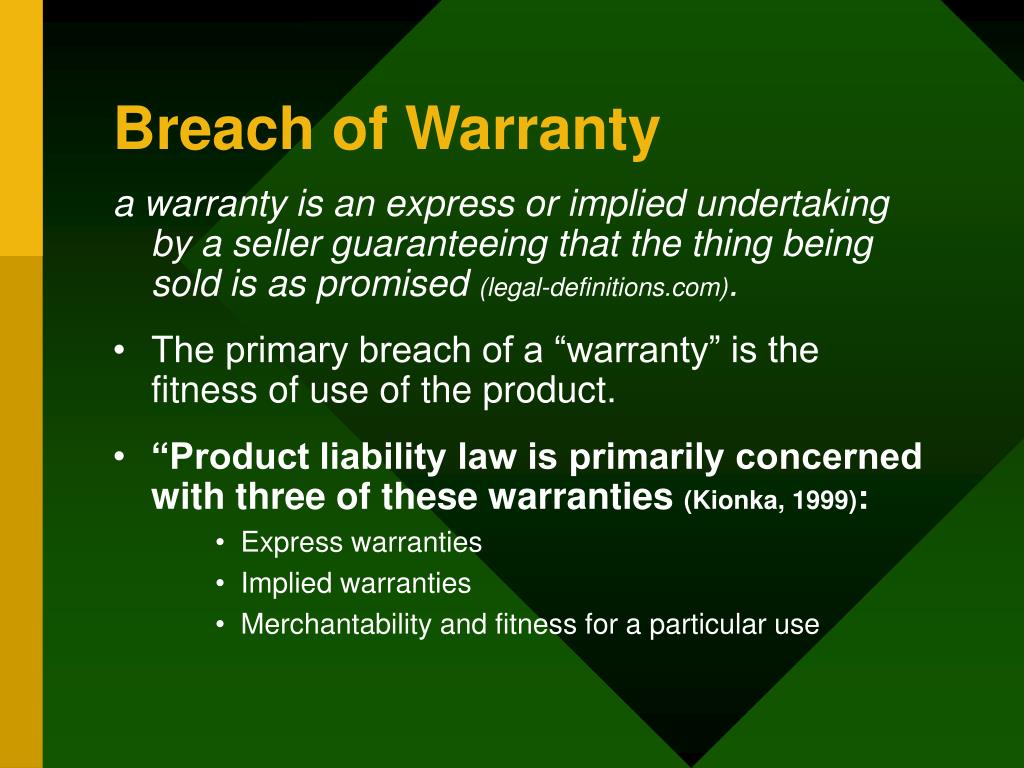

Source: slideserve.com

Source: slideserve.com

In certain cases, your insurance service provider will explicitly attach warranties to your insurance, to limit their risk. Your insurance carrier could deny coverage based on breaching the pilot warranty. Therefore, it is important to understand the effect of warranties, as a part of your policy, and make sure you have an adequate policy. For example, an unapproved pilot flies your aircraft an has an accident. Regardless of whether the insured is a consumer, or a business insured, the insurer is not automatically discharged from liability where there is.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is breach of warranty insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information