What is building and contents insurance Idea

Home » Trending » What is building and contents insurance IdeaYour What is building and contents insurance images are available in this site. What is building and contents insurance are a topic that is being searched for and liked by netizens today. You can Get the What is building and contents insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for what is building and contents insurance pictures information connected with to the what is building and contents insurance keyword, you have come to the right site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

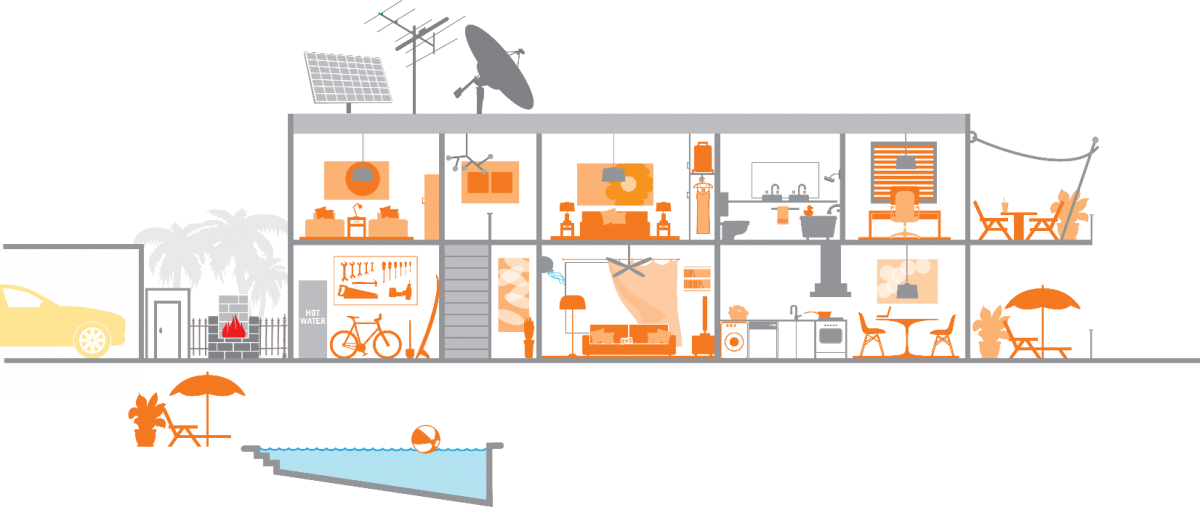

What Is Building And Contents Insurance. Buildings and contents insurance is placed under the bracket of home insurance. These policies cover the building itself, including the roof, usually the outbuildings (such as a garage, garden shed, or greenhouse) and permanent fixtures and fittings (e.g. Buildings insurance, on the other hand, protects the fabric of your home, such as the roof, walls, windows and permanent fixtures like a fitted kitchen, garage, conservatory and outbuildings. It is essential for all mortgaged houses, and the majority of other homeowners who do not have a mortgage will also have this type of insurance.

Building & Contents Insurance From simplymortgages.org.uk

Building & Contents Insurance From simplymortgages.org.uk

The main difference between contents insurance and buildings insurance is that contents insurance covers the stuff within your home, for example: Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too. Buildings insurance covers the structure of the house and any permanent fixtures inside it. When you compare buildings and contents insurance, it’s helpful to think about. The structure includes things like the roof, windows and walls as well as permanent fixtures like bathroom suites and fitted kitchens. This includes its windows, walls roof, outbuildings, and fitted kitchens and bathrooms.

It is essential for all mortgaged houses, and the majority of other homeowners who do not have a mortgage will also have this type of insurance.

The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; This includes its windows, walls roof, outbuildings, and fitted kitchens and bathrooms. Buildings insurance covers the structure of the house and any permanent fixtures inside it. The insurer usually provides a discount if both are taken. Contents insurance helps pay to replace or repair your personal belongings if they�re stolen or damaged by a covered peril, such as a fire. The main difference between contents insurance and buildings insurance is that contents insurance covers the stuff within your home, for example:

Source: over50insurance.com.au

Source: over50insurance.com.au

Some contents insurance policies also provide restricted cover for personal possessions temporarily taken away from the home by the policyholder. So, if someone breaks into your home and steals your laptop , or your clothing and furniture are ruined in a fire, you may find that contents insurance helps cover the loss. When you compare buildings and contents insurance, it’s helpful to think about. Buildings insurance covers the structure of the house and any permanent fixtures inside it. Dwelling, buildings, and contents insurance (db&c) is a comprehensive property insurance policy that covers the structure of a home or building and the contents located inside from certain specified perils up to specified coverage limits.

Source: pinterest.com

Source: pinterest.com

When you compare buildings and contents insurance, it’s helpful to think about. This includes its windows, walls roof, outbuildings, and fitted kitchens and bathrooms. Sofas tv laptop ipad jewellery clothing. If you needed to rebuild some or all of your house you would claim on this. Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too.

Source: russoinsurance.co.uk

Source: russoinsurance.co.uk

Contents insurance this covers all the personal possessions in your home in case they�re damaged or stolen. There are three main types of contents insurance policy: Dwelling, buildings, and contents insurance (db&c) is a comprehensive property insurance policy that covers the structure of a home or building and the contents located inside from certain specified perils up to specified coverage limits. If you needed to rebuild some or all of your house you would claim on this. Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too.

Source: abertayha.co.uk

Source: abertayha.co.uk

Contents insurance helps pay to replace or repair your personal belongings if they�re stolen or damaged by a covered peril, such as a fire. Building and contents insurance is a term describing personal coverage very similar to business property coverage. You�ll need contents insurance to insure these. The difference between buildings and contents insurance is that buildings insurance covers the physical structure of the property including the walls, roof and floors, while contents insurance covers items inside the property, like furniture and freestanding appliances. If you needed to rebuild some or all of your house you would claim on this.

Source: basikmoney.com

Source: basikmoney.com

The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; This is basically anything that isn’t a part of the building itself and you can carry out, so everything from your curtains to your clothes. Buildings and contents insurance cover your home in the event of damage caused by extreme weather, fire in the home, water damage or if items in your home were damaged or stolen in a burglary. The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; This includes its windows, walls roof, outbuildings, and fitted kitchens and bathrooms.

Source: rapidcover.co.uk

Source: rapidcover.co.uk

The difference between buildings and contents insurance is that buildings insurance covers the physical structure of the property including the walls, roof and floors, while contents insurance covers items inside the property, like furniture and freestanding appliances. For instance, if you have a fitted kitchen or bathroom, your insurance is likely to pay for any repairs you need. The difference between buildings and contents insurance is that buildings insurance covers the physical structure of the property including the walls, roof and floors, while contents insurance covers items inside the property, like furniture and freestanding appliances. The insurer usually provides a discount if both are taken. You�ll need contents insurance to insure these.

Source: angletwichfinancial.co.uk

Source: angletwichfinancial.co.uk

Buildings insurance, on the other hand, protects the fabric of your home, such as the roof, walls, windows and permanent fixtures like a fitted kitchen, garage, conservatory and outbuildings. Buildings insurance this covers the cost of repairing the actual structure of your home. If you needed to rebuild some or all of your house you would claim on this. Sofas tv laptop ipad jewellery clothing. Contents insurance can cover a large range of personal possessions and protect your wallet in case of unforseen theft or damage.

Source: insuranceproceedstaxable.blogspot.com

Source: insuranceproceedstaxable.blogspot.com

For instance, if you have a fitted kitchen or bathroom, your insurance is likely to pay for any repairs you need. The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; Buildings insurance covers the structure of the house and any permanent fixtures inside it. Sofas tv laptop ipad jewellery clothing. Generally it’s what could go in the removal van if you moved house, plus things such as carpets and curtains.

Source: hdgroup.ie

Source: hdgroup.ie

Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too. Home buildings insurance is cover for your home but not its contents. Contents insurance helps pay to replace or repair your personal belongings if they�re stolen or damaged by a covered peril, such as a fire. The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; Buildings insurance covers the cost of repairing damage to the structural parts of your property.

Source: abcdeal.co.uk

Source: abcdeal.co.uk

Anything that falls out is your contents. In fact, your policy may even cover the contents of your freezer. Buildings insurance does not cover the items inside your house, like furniture, carpets, clothes, electronics and personal items. The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too.

Source: dev.mobilewebsitepro.com

Source: dev.mobilewebsitepro.com

Buildings and contents insurance cover your home in the event of damage caused by extreme weather, fire in the home, water damage or if items in your home were damaged or stolen in a burglary. Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too. Contents insurance is for your belongings. Buildings insurance covers the structure of the house and any permanent fixtures inside it. Building and contents insurance is a term describing personal coverage very similar to business property coverage.

Source: visual.ly

Source: visual.ly

It is essential for all mortgaged houses, and the majority of other homeowners who do not have a mortgage will also have this type of insurance. For instance, if you have a fitted kitchen or bathroom, your insurance is likely to pay for any repairs you need. What is buildings and contents insurance? This is basically anything that isn’t a part of the building itself and you can carry out, so everything from your curtains to your clothes. Contents coverage can also be paid on a replacement cost or actual cash value basis.

Source: financialbrokers.co.uk

Source: financialbrokers.co.uk

Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too. Buildings insurance covers the structure of the house and any permanent fixtures inside it. Home insurance protects both your property’s structure and the items within it. Buildings insurance covers the cost of repairing damage to the structural parts of your property. Home and contents insurance comparison

Source: friendlyscore.com

Source: friendlyscore.com

Contents insurance covers your stuff within the home. The easiest way to think of contents (also called business personal property) coverage is if you took your building and turned it upside down; Contents insurance can cover a large range of personal possessions and protect your wallet in case of unforseen theft or damage. Contents insurance this covers all the personal possessions in your home in case they�re damaged or stolen. Buildings and contents insurance cover your home in the event of damage caused by extreme weather, fire in the home, water damage or if items in your home were damaged or stolen in a burglary.

Source: marktill.co.uk

Source: marktill.co.uk

Buildings and contents insurance is placed under the bracket of home insurance. Contents insurance can cover a large range of personal possessions and protect your wallet in case of unforseen theft or damage. Contents insurance this covers all the personal possessions in your home in case they�re damaged or stolen. It is a combined insurance that will cover or replace any damage that might occur to the house or its contents, including loss. If you needed to rebuild some or all of your house you would claim on this.

Source: 99.co

Source: 99.co

Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too. As the name suggests, contents insurance covers the belongings you keep in your property. This is basically anything that isn’t a part of the building itself and you can carry out, so everything from your curtains to your clothes. This includes its windows, walls roof, outbuildings, and fitted kitchens and bathrooms. Buildings insurance this covers the cost of repairing the actual structure of your home.

Source: harrisbegley.co.uk

Source: harrisbegley.co.uk

It is a combined insurance that will cover or replace any damage that might occur to the house or its contents, including loss. As the name suggests, contents insurance covers the belongings you keep in your property. Buildings insurance this covers the cost of repairing the actual structure of your home. Contents insurance covers your stuff within the home. This insurance covers household items belonging to you, and to family members who live with you.

Source: startrescue.co.uk

Source: startrescue.co.uk

In fact, your policy may even cover the contents of your freezer. Contents insurance is quite often combined with buildings insurance but, unlike buildings insurance, it is not a condition of the mortgage. Building insurance and contents insurance are designed to work together, to provide comprehensive protection for your home and belongings. Home insurance protects both your property’s structure and the items within it. Buildings insurance covers damage to your home’s structure, such as the walls, roofing, floors, and often fixtures and fittings too.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is building and contents insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information