What is churning in insurance information

Home » Trending » What is churning in insurance informationYour What is churning in insurance images are available. What is churning in insurance are a topic that is being searched for and liked by netizens today. You can Download the What is churning in insurance files here. Get all royalty-free vectors.

If you’re looking for what is churning in insurance images information connected with to the what is churning in insurance topic, you have come to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

What Is Churning In Insurance. Churning is illegal and unethical and. Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions.

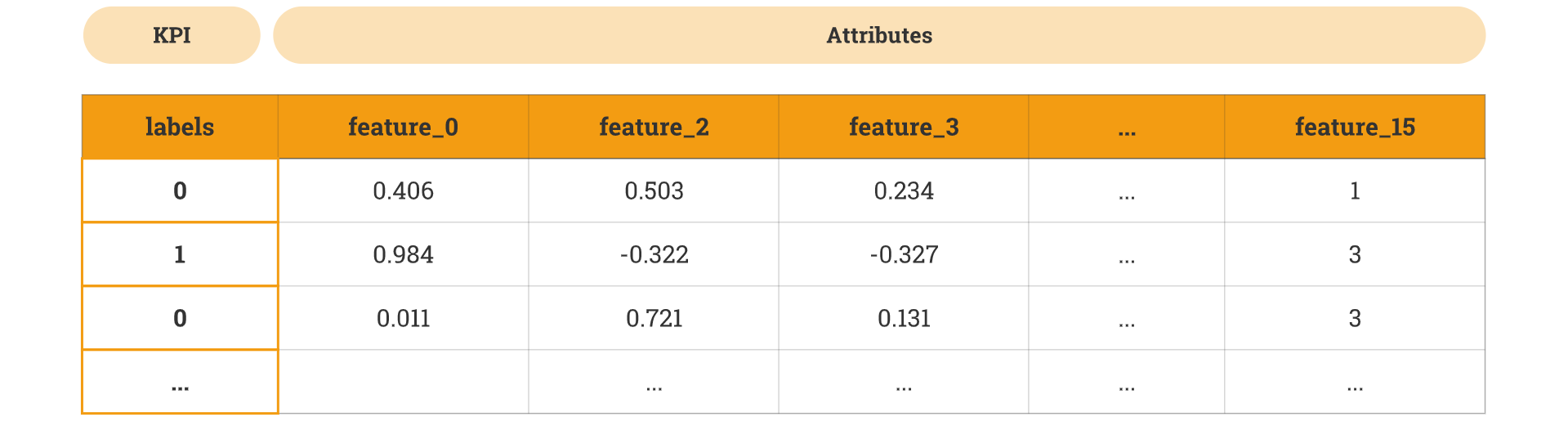

GitHub RahulGupta16/MachineHackInsuranceChurn From github.com

GitHub RahulGupta16/MachineHackInsuranceChurn From github.com

Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund. Individuals may avoid seeking health care when they need it during gaps in insurance coverage. Thereof, what is the definition of churning in insurance? Insurance churning can affect quality, cost, and continuity of care.

Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).

Insurance churning can affect quality, cost, and continuity of care. What does churning mean in life insurance? If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning. Also known as “twisting,” this practice is illegal in most states and is also against most insurance company policies. Churning is an illegal practice and it. Individuals may avoid seeking health care when they need it during gaps in insurance coverage.

Source: analyticsindiamag.com

Source: analyticsindiamag.com

You’re faced with using various attributes, like. Churning in insurance is when a producer replaces a client’s coverage with one from the. Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. The basics what is churn? Churning is defined as the practice by which policy values in an existing life insurance policy or annuity contract are used to purchase another policy or contract with that same insurer for the purpose of earning additional premiums or.

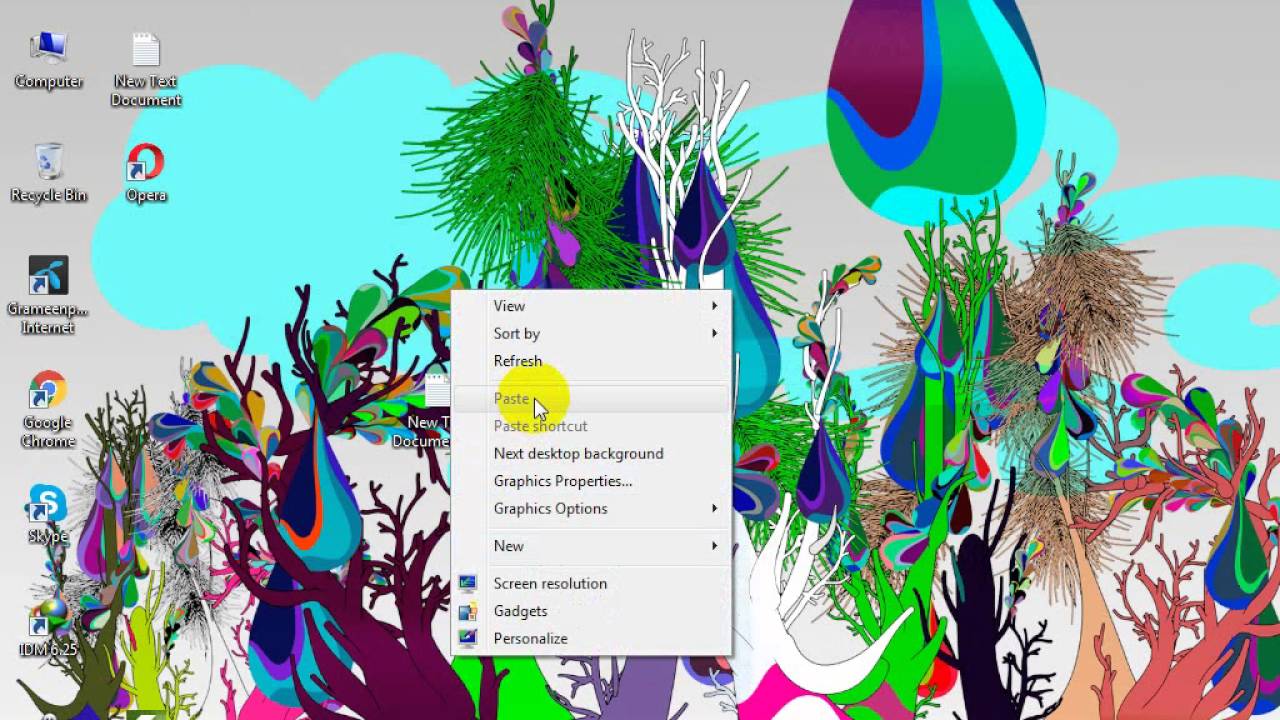

Source: youtube.com

Source: youtube.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Churning is the practice of an insurer replacing existing coverage with a new policy based on misrepresentations. Insurance churning can affect quality, cost, and continuity of care. Churning in insurance is when a producer replaces a client’s coverage with one from the.

Source: chrt.org

Source: chrt.org

Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Also known as “twisting,” this practice is illegal in most states and is also against most insurance company policies. Life insurance churning is especially common as a result of the high. Insurance churning can affect quality, cost, and continuity of care. Churning is in effect twisting of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a).

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. The basics what is churn? Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Thereof, what is the definition of churning in insurance? Insurance churning can affect quality, cost, and continuity of care.

Source: campinghiking.net

Source: campinghiking.net

What does churning mean in the insurance industry? Churning in insurance is when a producer replaces a client’s coverage with one from the. Also known as “twisting,” this practice is illegal in most states and is also against most insurance company policies. Insurance churning can affect quality, cost, and continuity of care. Even if consumers maintain continuous coverage while transitioning between different insurance plans, they may find that their regular health care providers do not accept their new insurance plan.

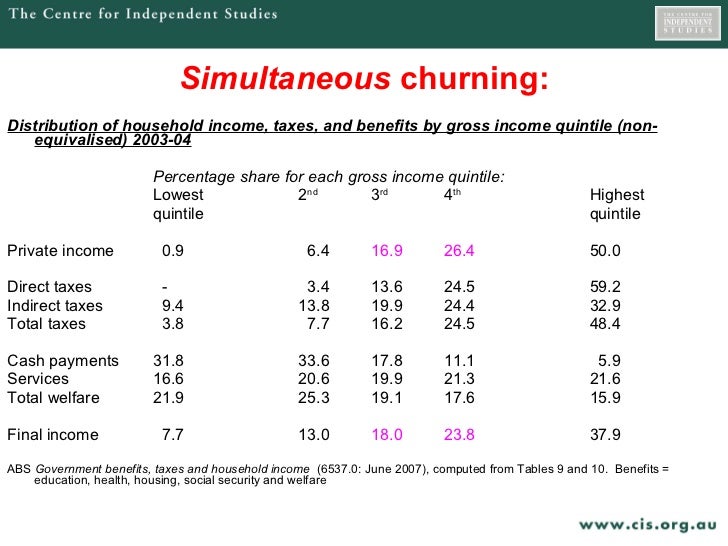

Source: slideshare.net

Source: slideshare.net

This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund. Twisting is a replacement contract with similar or worse benefits from a different carrier. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Churning is when they convince you to buy a new policy with the same company as your existing policy. Churning is the practice of an insurer replacing existing coverage with a new policy based on misrepresentations.

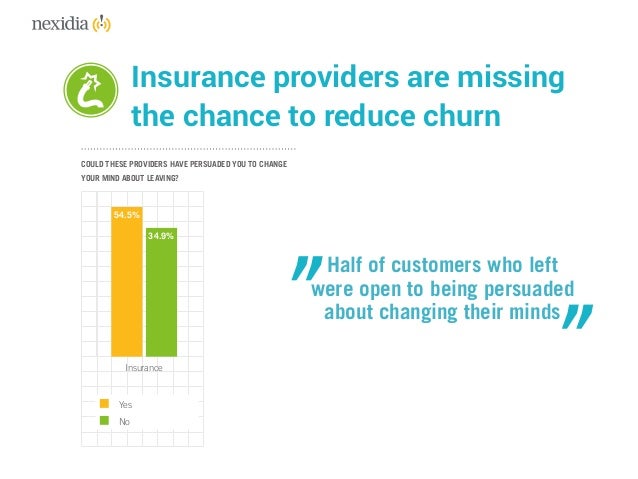

Source: business2community.com

Source: business2community.com

Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. Insurance churning is when an agent intentionally convinces you to switch to an allegedly better insurance policy within the same company, although the replacement would only benefit the agent. Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. Churning is an illegal practice and it. The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

What does churning mean in the insurance industry? Individuals may avoid seeking health care when they need it during gaps in insurance coverage. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund. In industry jargon) to pay for it.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning. Churning is when they convince you to buy a new policy with the same company as your existing policy. Insurance churning is when an agent intentionally convinces you to switch to an allegedly better insurance policy within the same company, although the replacement would only benefit the agent. Life insurance churning is especially common as a result of the high.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Insurance companies use churning to describe the rate at which their customers leave due to reasons like selling assets, going elsewhere for more competitive rates, or voluntary churn where insurers choose to. Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Again, the new policy must not provide better benefits or have other pluses to it for the sale to count as churning. (coverage with carrier a is replaced with (5).

Source: thecreditsolutionprogram.com

Source: thecreditsolutionprogram.com

Even if consumers maintain continuous coverage while transitioning between different insurance plans, they may find that their regular health care providers do not accept their new insurance plan. Insurance companies use churning to describe the rate at which their customers leave due to reasons like selling assets, going elsewhere for more competitive rates, or voluntary churn where insurers choose to. Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. Thereof, what is the definition of churning in insurance?

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

In industry jargon) to pay for it. What does churning mean in life insurance? Churning is defined as the practice by which policy values in an existing life insurance policy or annuity contract are used to purchase another policy or contract with that same insurer for the purpose of earning additional premiums or. The basics what is churn? Brokers may often churn stocks and bonds, mutual funds, annuities, and life insurance policies.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund. Churn has nothing to do with milk and butter, but refers to a consumer’s transition between different types of coverage and/or becoming uninsured. Life insurance churning is especially common as a result of the high. (coverage with carrier a is replaced with (5). Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).

![[PDF] Customer churn prediction for an insurance company [PDF] Customer churn prediction for an insurance company](https://d3i71xaburhd42.cloudfront.net/20286dfd510e6cb5c374384f415aab12b4b87132/24-Figure1.3-1.png) Source: semanticscholar.org

Source: semanticscholar.org

Churning is an illegal practice and it has no benefit for the insured. While replacement of existing coverage is a perfectly legitimate. Thereof, what is the definition of churning in insurance? The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of. Insurance churning can affect quality, cost, and continuity of care.

Source: hackardlaw.com

Source: hackardlaw.com

Insurance churning can affect quality, cost, and continuity of care. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Individuals may avoid seeking health care when they need it during gaps in insurance coverage.

Source: github.com

Source: github.com

Also known as “twisting,” this practice is illegal in most states and is also against most insurance company policies. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Twisting is a replacement contract with similar or worse benefits from a different carrier. This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Source: chrt.org

Source: chrt.org

The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of. While replacement of existing coverage is a perfectly legitimate. (coverage with carrier a is replaced with coverage from carrier a). The basics what is churn? Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value (called ?juice?

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Again, the new policy must not provide better benefits or have other pluses to it for the sale to count as churning. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value (called ?juice? Insurance companies use churning to describe the rate at which their customers leave. Thereof, what is the definition of churning in insurance? Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is churning in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information