What is compliance insurance information

Home » Trend » What is compliance insurance informationYour What is compliance insurance images are available. What is compliance insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is compliance insurance files here. Download all free vectors.

If you’re looking for what is compliance insurance pictures information linked to the what is compliance insurance topic, you have come to the ideal site. Our website always gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

What Is Compliance Insurance. Pci compliance means that your systems are secure, reducing the chances of data breaches. It may be exercised by a person, a team, a committee. The role will be hybrid based, working 2 days in the office and 3 days at home; As the name implies, these professionals monitor changes in all jurisdictions to ensure the insurance company, its employees.

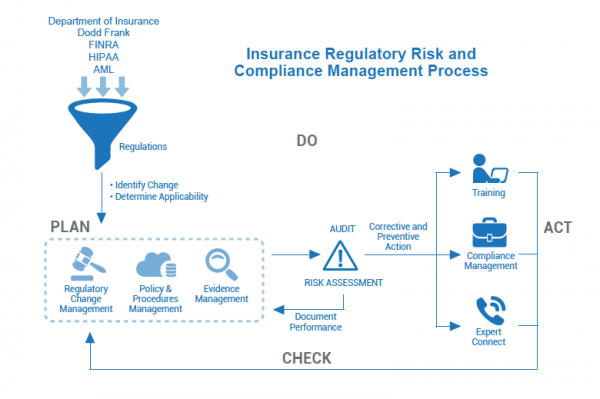

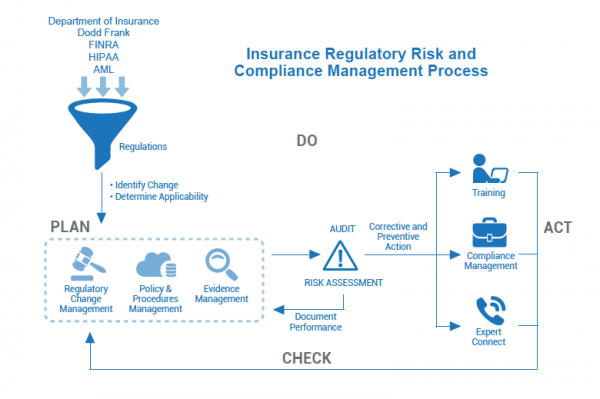

Insurance Regulatory Risk and Compliance Management Software From 360factors.com

Insurance Regulatory Risk and Compliance Management Software From 360factors.com

Agria pet insurance has a fantastic opportunity for a compliance monitoring officer to join the team. The role will be hybrid based, working 2 days in the office and 3 days at home; It is the compliance officer’s duty to ensure continual monitoring and review of compliance procedures to help identify possible areas where improvements could be made. Implications include insurers operating in a “best interest” role for clients,. Compliance isn’t only about preventing problems and ensuring that everyone is abiding by laws, rules, and regulations. Compliance is the state of being in accordance with established guidelines or specifications, or the process of becoming so.

However, there is an option to work from the office 5 days a week, if preferred.

Often legally binding and enforced by government agencies, compliance standards are federal, state, and municipal regulations that restrict the way organizations conduct business. With the expansion of services in the insurance industry — particularly services similar to those in the financial industry — many companies continue to look for new ways to market themselves to stay. Often legally binding and enforced by government agencies, compliance standards are federal, state, and municipal regulations that restrict the way organizations conduct business. A compliance department identifies risks that an organization faces and advises on how to avoid or address them. An insurance company is regulated by insurance regulatory and development authority of india. This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs.

Source: blinkis.co.uk

Source: blinkis.co.uk

This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs. Listed below are the important regulators in the united states financial system. Implications include insurers operating in a “best interest” role for clients,. Employees can enroll when they’re initially eligible, during the annual open enrollment period, or during a special enrollment period. In its simplest form, the main purpose of this professional is to ensure the organization does not get cited, fined or sued for failure to comply with regulations.

Source: ispartnersllc.com

Source: ispartnersllc.com

The primary purpose of a sox compliance audit is to verify the company�s financial statements, however, cybersecurity is increasingly important. This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs. Ensuring that businesses understand and are compliant with rules where they operate. What information is collected by the insurers?. Additionally, financial compliance and regulations vary internationally.

Source: mpowermed.com

Source: mpowermed.com

Actuarial function, internal audit, and risk management. A sox compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. The compliance has become highly vital with the digitalization of insurance activities including collection of premiums and payment of claims. Agria pet insurance has a fantastic opportunity for a compliance monitoring officer to join the team. It is the compliance officer’s duty to ensure continual monitoring and review of compliance procedures to help identify possible areas where improvements could be made.

Source: 360factors.com

Source: 360factors.com

Ensuring that businesses understand and are compliant with rules where they operate. It’s also about the positive impact a robust and ethical compliance program can have on a business or organization. Compliance isn’t only about preventing problems and ensuring that everyone is abiding by laws, rules, and regulations. A sox compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. Pci compliance means that your systems are secure, reducing the chances of data breaches.

Source: zeguro.com

Source: zeguro.com

An insurance company is regulated by insurance regulatory and development authority of india. What information is collected by the insurers?. An insurance company is regulated by insurance regulatory and development authority of india. Compliance or regulatory compliance is a term used across industries to describe rules and policies that prohibit or regulate specific products, services, or processes. Compliance is the state of being in accordance with established guidelines or specifications, or the process of becoming so.

Source: laporte-insurance.com

Source: laporte-insurance.com

Compliance isn’t only about preventing problems and ensuring that everyone is abiding by laws, rules, and regulations. Compliance is the state of being in accordance with established guidelines or specifications, or the process of becoming so. Software, for example, may be developed in compliance with specifications created by a standards body, and then deployed by user organizations in compliance with a vendor�s licensing agreement. Listed below are the important regulators in the united states financial system. It’s also about the positive impact a robust and ethical compliance program can have on a business or organization.

Source: aplusletter.com

Source: aplusletter.com

As the name implies, these professionals monitor changes in all jurisdictions to ensure the insurance company, its employees. The federal reserve regulates the monetary policy for the united states. As the name implies, these professionals monitor changes in all jurisdictions to ensure the insurance company, its employees. Listed below are the important regulators in the united states financial system. The compliance function is an internal control function that complements those already existing in insurance companies:

Source: go2insurance360.com

Source: go2insurance360.com

The irda is a statutory body who issues compliance, checklist and procesure for insurance company in india. Compliance is the state of being in accordance with established guidelines or specifications, or the process of becoming so. A sox compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. The role will be hybrid based, working 2 days in the office and 3 days at home; Agria pet insurance has a fantastic opportunity for a compliance monitoring officer to join the team.

Source: rwaconsultancy.com

Source: rwaconsultancy.com

An insurance company is regulated by insurance regulatory and development authority of india. Often legally binding and enforced by government agencies, compliance standards are federal, state, and municipal regulations that restrict the way organizations conduct business. Implications include insurers operating in a “best interest” role for clients,. Employees can enroll when they’re initially eligible, during the annual open enrollment period, or during a special enrollment period. Compliance isn’t only about preventing problems and ensuring that everyone is abiding by laws, rules, and regulations.

Source: pinterest.com

Source: pinterest.com

It is the compliance officer’s duty to ensure continual monitoring and review of compliance procedures to help identify possible areas where improvements could be made. It is the compliance officer’s duty to ensure continual monitoring and review of compliance procedures to help identify possible areas where improvements could be made. However, there is an option to work from the office 5 days a week, if preferred. Listed below are the important regulators in the united states financial system. Software, for example, may be developed in compliance with specifications created by a standards body, and then deployed by user organizations in compliance with a vendor�s licensing agreement.

Source: ioausa.com

Source: ioausa.com

Often legally binding and enforced by government agencies, compliance standards are federal, state, and municipal regulations that restrict the way organizations conduct business. With the expansion of services in the insurance industry — particularly services similar to those in the financial industry — many companies continue to look for new ways to market themselves to stay. It may be exercised by a person, a team, a committee. Actuarial function, internal audit, and risk management. Compliance or regulatory compliance is a term used across industries to describe rules and policies that prohibit or regulate specific products, services, or processes.

Source: jobs.ie

Source: jobs.ie

An insurance company is regulated by insurance regulatory and development authority of india. A sox compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. Employees can enroll when they’re initially eligible, during the annual open enrollment period, or during a special enrollment period. The compliance function is an internal control function that complements those already existing in insurance companies: The role will be hybrid based, working 2 days in the office and 3 days at home;

Source: www2.deloitte.com

Source: www2.deloitte.com

Additionally, financial compliance and regulations vary internationally. As the name implies, these professionals monitor changes in all jurisdictions to ensure the insurance company, its employees. An insurance company is regulated by insurance regulatory and development authority of india. Compliance is a framework for ensuring an organization and its people comply with laws and regulations that are applicable to it and minimizing the risk of noncompliance, notes gerry zack, ceo. Pci compliance means that your systems are secure, reducing the chances of data breaches.

Source: accurateservices.co.in

Source: accurateservices.co.in

This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs. Compliance is a framework for ensuring an organization and its people comply with laws and regulations that are applicable to it and minimizing the risk of noncompliance, notes gerry zack, ceo. The federal reserve is the central bank of the united states. Implications include insurers operating in a “best interest” role for clients,. This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs.

Source: propertycasualty360.com

Source: propertycasualty360.com

With the expansion of services in the insurance industry — particularly services similar to those in the financial industry — many companies continue to look for new ways to market themselves to stay. As the name implies, these professionals monitor changes in all jurisdictions to ensure the insurance company, its employees and its contractors remain compliant. Compliance or regulatory compliance is a term used across industries to describe rules and policies that prohibit or regulate specific products, services, or processes. A compliance department identifies risks that an organization faces and advises on how to avoid or address them. What information is collected by the insurers?.

Source: rampartbenefitplanning.com

Source: rampartbenefitplanning.com

Ensuring that businesses understand and are compliant with rules where they operate. In its simplest form, the main purpose of this professional is to ensure the organization does not get cited, fined or sued for failure to comply with regulations. Software, for example, may be developed in compliance with specifications created by a standards body, and then deployed by user organizations in compliance with a vendor�s licensing agreement. Employees can enroll when they’re initially eligible, during the annual open enrollment period, or during a special enrollment period. This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs.

Source: pinterest.com

Source: pinterest.com

A compliance department identifies risks that an organization faces and advises on how to avoid or address them. This gives us the ability to assist you with the assessment, design, and enhancement of your compliance program and other regulatory compliance needs. The compliance function is an internal control function that complements those already existing in insurance companies: A sox compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. Actuarial function, internal audit, and risk management.

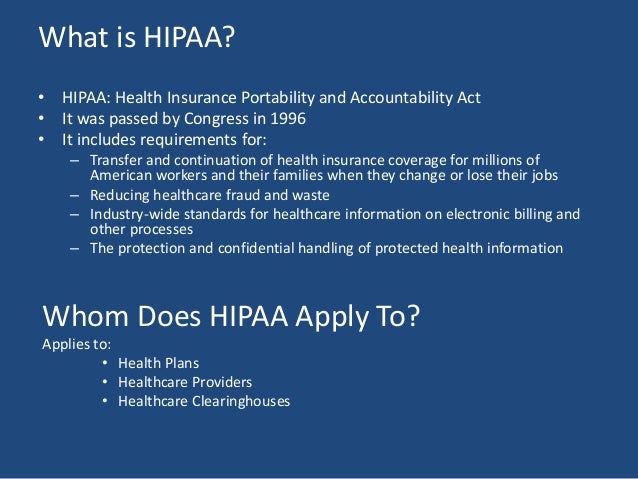

Source: slideshare.net

Source: slideshare.net

The role will be hybrid based, working 2 days in the office and 3 days at home; What information is collected by the insurers?. The primary purpose of a sox compliance audit is to verify the company�s financial statements, however, cybersecurity is increasingly important. Employees can enroll when they’re initially eligible, during the annual open enrollment period, or during a special enrollment period. Additionally, financial compliance and regulations vary internationally.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is compliance insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information