What is compulsory insurance information

Home » Trending » What is compulsory insurance informationYour What is compulsory insurance images are available in this site. What is compulsory insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is compulsory insurance files here. Get all free images.

If you’re searching for what is compulsory insurance pictures information related to the what is compulsory insurance topic, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

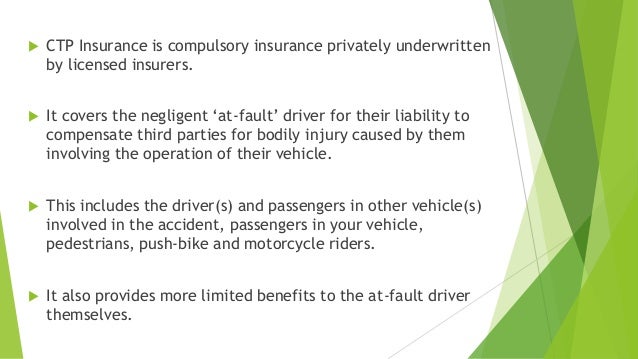

What Is Compulsory Insurance. It is often intended to prevent the insured from financial ruin, ensure the compensation of victims (without burdening the state), or both. While you can reduce your insurance cost with a higher voluntary excess, there is a risk that the excess may end up being higher than the value of the car. In most states, your ctp is included with your registration, unlike nsw where you must purchase it as a. Ctp insurance stands for compulsory third party insurance.

COMPULSORY INSURANCE Image With Words Associated With From dreamstime.com

COMPULSORY INSURANCE Image With Words Associated With From dreamstime.com

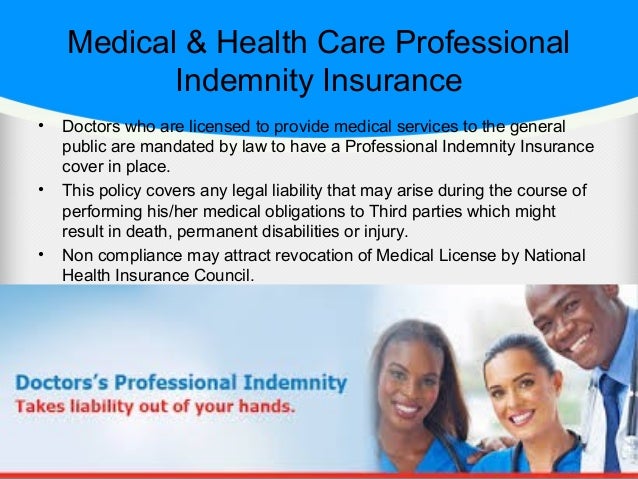

Compulsory third party insurance, also known as the abbreviation, ctp insurance, is used to provide compensation and cover for people injured or killed by an accident. This chapter explores the phenomenon of compulsory liability insurance, and its implications. But some insurance is compulsory? Your insurance policy might have a voluntary and compulsory excess. For example, a consumer can decide to purchase a life insurance policy but is not required to by law. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident.

While you can reduce your insurance cost with a higher voluntary excess, there is a risk that the excess may end up being higher than the value of the car.

Bodily injury to others protects you, or someone you allow to drive your car, from legal liability if you accidentally injure or cause the death of. Compulsory insurance is a type of insurance that protects victims against the costs of recovering from an accident. Not only will compulsory insurance cover basic insurance needs, it is also reduced to a simple package that applies to every insurance company in israel. Compulsory third party insurance, also known as the abbreviation, ctp insurance, is used to provide compensation and cover for people injured or killed by an accident. Basic property insurance covers a wide range of threats but omits others. Compulsory liability insurance 9.1 introduction.

Source: dreamstime.com

Source: dreamstime.com

This means that each company is able to. The characteristics of the above 2nd and 3rd compulsory insurance: This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party. Compulsory liability insurance 9.1 introduction. Compulsory insurance is insurance that individuals, businesses, or other entities are required by law to have in force.

Source: slideshare.net

Source: slideshare.net

This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. Remember, compulsory and voluntary excesses apply together. Health insurance under an obligatory public scheme, enforced by law. This chapter explores the phenomenon of compulsory liability insurance, and its implications.

Source: slideshare.net

Source: slideshare.net

This chapter explores the phenomenon of compulsory liability insurance, and its implications. Compulsory insurance, also called mandatory insurance, is the kind of insurance made compulsory by the government {law}, most especially for the aim of providing protection to the third parties and the general public. Health insurance under an obligatory public scheme, enforced by law. The payment of gratuity(amendment) act, 1987 has prescribed provisions for compulsory insurance for employees, which introduces employer’s liabilities for payment towards the gratuity under the act from lic established under lic of india act, 1956 or any other prescribed insurance company. However, compulsory insurance requirements are not always easy to enforce.

Source: ebay.com

Source: ebay.com

The obligation may be placed on employers to pay contributions on behalf of employees. Health insurance under an obligatory public scheme, enforced by law. As the name suggests, ctp insurance is compulsory in all states of america and you cannot register a vehicle without first buying ctp insurance. This chapter explores the phenomenon of compulsory liability insurance, and its implications. But some insurance is compulsory?

Source: slideserve.com

Source: slideserve.com

However, compulsory insurance requirements are not always easy to enforce. In certain professions, the risk of damage is particularly high. For example, a consumer can decide to purchase a life insurance policy but is not required to by law. The existence of compulsion plainly demonstrates the significant role of public purpose in securing the satisfaction of tort liabilities through insurance. Compulsory liability insurance 9.1 introduction.

Source: jbsolis.com

Compulsory insurance, also called mandatory insurance, is the kind of insurance made compulsory by the government {law}, most especially for the aim of providing protection to the third parties and the general public. 32:900 (b) (2) or (m)”. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. Compulsory insurance v non compulsory insurance. This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party.

Source: policybazaar.com

Source: policybazaar.com

For starters, minimum coverage won’t provide compensation for any property damage, even if the car is a total loss. For starters, minimum coverage won’t provide compensation for any property damage, even if the car is a total loss. Bodily injury to others protects you, or someone you allow to drive your car, from legal liability if you accidentally injure or cause the death of. Health insurance under an obligatory public scheme, enforced by law. It is not unusual for companies to also be required by law to maintain some type of liability coverage.

Source: klforexpats.com

Source: klforexpats.com

This means that each company is able to. Ctp insurance stands for compulsory third party insurance. Multiple types of property insurance policies can protect your business assets and buildings against outside theft, fire, storm and other perils. The obligation may be placed on employers to pay contributions on behalf of employees. Compulsory health insurance legislation was defeated in california and new york, and by 1918, social health insurance was no longer on the table.

Source: slideshare.net

Source: slideshare.net

Health insurance under an obligatory public scheme, enforced by law. This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party. The payment of gratuity(amendment) act, 1987 has prescribed provisions for compulsory insurance for employees, which introduces employer’s liabilities for payment towards the gratuity under the act from lic established under lic of india act, 1956 or any other prescribed insurance company. If you’re a young or inexperienced driver, don’t be surprised if your compulsory excess is higher than someone who�s older or has been driving for a while. Compulsory insurance is insurance that individuals, businesses, or other entities are required by law to have in force.

Source: thewca.uk

Source: thewca.uk

This chapter explores the phenomenon of compulsory liability insurance, and its implications. This is commonly known as compulsory motor vehicle insurance or compulsory mvi. Not only will compulsory insurance cover basic insurance needs, it is also reduced to a simple package that applies to every insurance company in israel. In certain professions, the risk of damage is particularly high. Compulsory insurance, also called mandatory insurance, is the kind of insurance made compulsory by the government {law}, most especially for the aim of providing protection to the third parties and the general public.

Source: phukethospital.com

Source: phukethospital.com

Basic property insurance covers a wide range of threats but omits others. Compulsory insurance, also called mandatory insurance, is the kind of insurance made compulsory by the government {law}, most especially for the aim of providing protection to the third parties and the general public. This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party. Compulsory insurance v non compulsory insurance. For flood insurance, for instance, you need to contact the federal government�s flood insurance program.

Source: boccadutri.com

Source: boccadutri.com

Disability insurance is a type of compulsory health insurance that is required in many jurisdictions. Compulsory insurance usually covers perils that carry heavy financial costs. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. Ctp insurance stands for compulsory third party insurance. Compulsory insurance v non compulsory insurance.

Source: slideshare.net

Source: slideshare.net

Compulsory third party insurance, also known as the abbreviation, ctp insurance, is used to provide compensation and cover for people injured or killed by an accident. For starters, minimum coverage won’t provide compensation for any property damage, even if the car is a total loss. Compulsory insurance, also called mandatory insurance, is the kind of insurance made compulsory by the government {law}, most especially for the aim of providing protection to the third parties and the general public. Your insurance policy might have a voluntary and compulsory excess. Compulsory insurance is insurance that individuals, businesses, or other entities are required by law to have in force.

Source: covernote.co.nz

Source: covernote.co.nz

This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party. This is commonly known as compulsory motor vehicle insurance or compulsory mvi. For starters, minimum coverage won’t provide compensation for any property damage, even if the car is a total loss. Health insurance under an obligatory public scheme, enforced by law. The severe economic dislocation of the great depression quickly overwhelmed state, local, and.

Source: slideshare.net

Source: slideshare.net

If you’re a young or inexperienced driver, don’t be surprised if your compulsory excess is higher than someone who�s older or has been driving for a while. Compulsory liability insurance 9.1 introduction. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. In most states, your ctp is included with your registration, unlike nsw where you must purchase it as a. This form of compulsory insurance is normally aimed at protecting customers and others from losses that occur due to the negligence of the insured party.

Source: dreamstime.com

Source: dreamstime.com

In certain professions, the risk of damage is particularly high. Payment for such insurance amounts to a tax. For flood insurance, for instance, you need to contact the federal government�s flood insurance program. The characteristics of the above 2nd and 3rd compulsory insurance: The severe economic dislocation of the great depression quickly overwhelmed state, local, and.

Source: jbsolis.com

You cannot register your vehicle without having a policy in place. Compulsory health insurance legislation was defeated in california and new york, and by 1918, social health insurance was no longer on the table. The obligation may be placed on employers to pay contributions on behalf of employees. The payment of gratuity(amendment) act, 1987 has prescribed provisions for compulsory insurance for employees, which introduces employer’s liabilities for payment towards the gratuity under the act from lic established under lic of india act, 1956 or any other prescribed insurance company. There are four insurance coverages that are compulsory in massachusetts:

Source: youtube.com

Source: youtube.com

Remember, compulsory and voluntary excesses apply together. However, compulsory insurance requirements are not always easy to enforce. Basic property insurance covers a wide range of threats but omits others. All drivers are required by law (under the road traffic act of 1930) to have in force an insurance policy to cover their liability for bodily injury to or damage to third party property which arises from. Your insurance policy might have a voluntary and compulsory excess.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is compulsory insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information