What is consideration in insurance Idea

Home » Trend » What is consideration in insurance IdeaYour What is consideration in insurance images are ready. What is consideration in insurance are a topic that is being searched for and liked by netizens today. You can Get the What is consideration in insurance files here. Find and Download all royalty-free vectors.

If you’re looking for what is consideration in insurance pictures information related to the what is consideration in insurance topic, you have visit the ideal site. Our website frequently provides you with hints for seeing the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

What Is Consideration In Insurance. When was the oriental life insurance company established? In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. Insurance company or the insurer, agrees to compensate the loss or damage sustained by another party, i.e. For insurers, consideration also refers to the money paid out to you should you file an insurance claim.

5. Insurance considerations From slideshare.net

5. Insurance considerations From slideshare.net

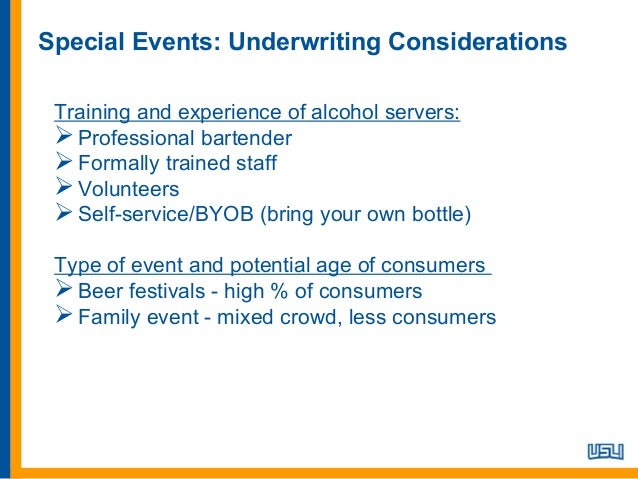

The consideration clause spells out exactly how much premium payments are and when they are due. In an insurance contract, the specified premium and an agreement to the provisions and stipulations Some examples of perils include fire, a lightning strike, burglary and a hailstorm or windstorm. Comment * related questions on insurance. You�ve already learned what is meant by the term consideration when dealing with insurance. A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided.

In real estate agreements, consideration clauses outline compensation according to the terms of the contract.

In return, the insurer promises to. Insurance refers to a contractual arrangement in which one party, i.e. In insurance, “peril” is an event that causes damage to your home or property and consequently, results in financial loss. The legal consideration for a life policy consists of the application and payment of the initial premium.it may also list the effective date. For insurers, consideration also refers to the money paid out to you should you file an insurance claim. From the insurance company the services they provide per the policy is the.

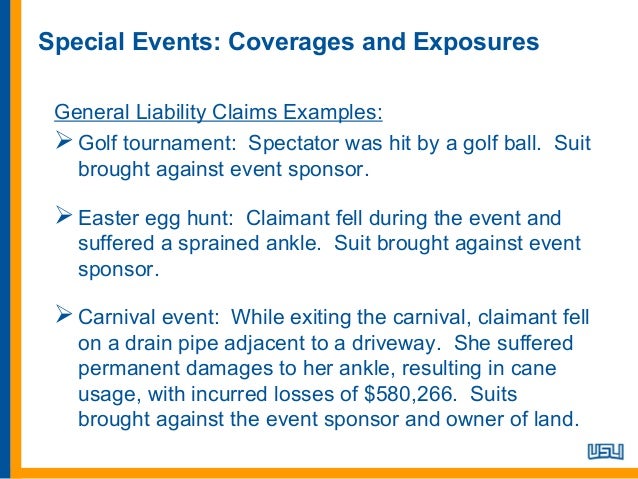

Source: slideshare.net

Source: slideshare.net

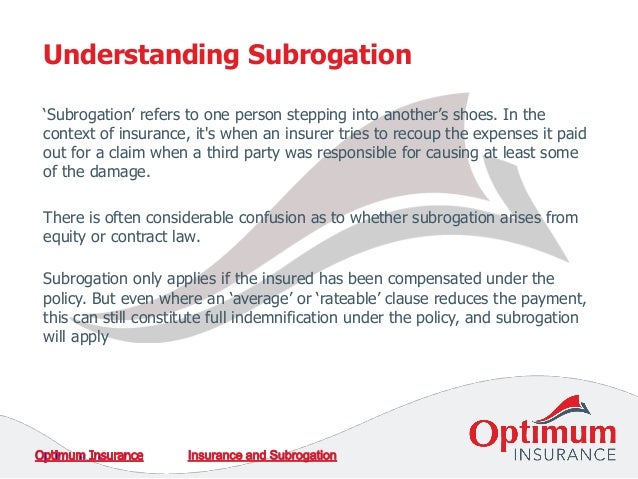

In real estate agreements, consideration clauses outline compensation according to the terms of the contract. The exchange of these premiums is basically a promise of indemnity, whereas the third party then gives up a right to sue the insured. A consideration clause is a provision most commonly used in insurance policies that provides information on how much the coverage costs and when to pay. A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. In the case of insurance, legal consideration refers to the premiums paid, the funds paid to a third party and the protection against being sued.

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

The insureds consideration is the premium; Your subscription includes six components: In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. The exchange of these premiums is basically a promise of indemnity, whereas the third party then gives up a right to sue the insured. For insurers, consideration also refers to the money paid out to you should you file an insurance claim.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

When was the oriental life insurance company established? Your subscription includes six components: Insurance company or the insurer, agrees to compensate the loss or damage sustained by another party, i.e. The insureds consideration is the premium; The insured, by paying a definite amount, in exchange for an adequate consideration called as premium.

Source: forum-cidadadnia.blogspot.com

Source: forum-cidadadnia.blogspot.com

A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. In the case of insurance, legal consideration refers to the premiums paid, the funds paid to a third party and the protection against being sued. Consideration is the thing of value exchanged under a contract. Essentially, the consideration clause in an insurance policy provides for information relating to how much the insurance policy may cost and when the premiums are due (like a payment schedule).

Source: piperreport.com

Source: piperreport.com

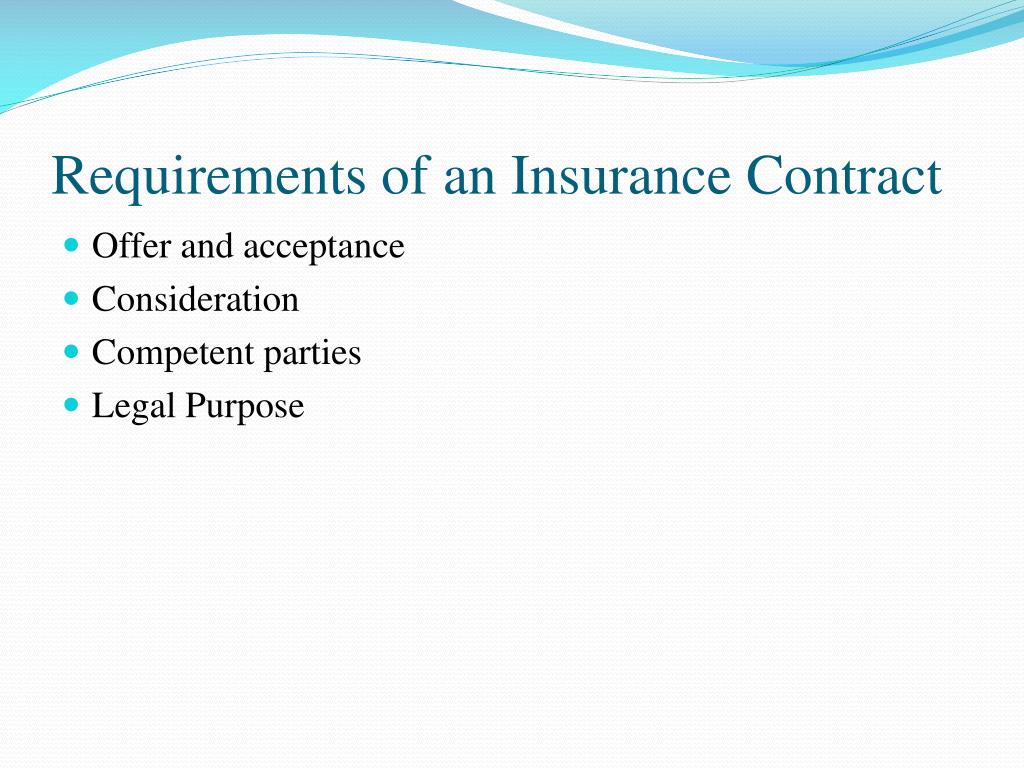

In insurance, what is the applicant’s consideration? You need to be legally competent to enter into an agreement with your insurer. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. In real estate agreements, consideration clauses outline compensation according to the terms of the contract. In the case of an insurance policy the consideration is always the same.

Source: slideshare.net

Source: slideshare.net

A consideration clause is a stipulation in an insurance policy that outlines the cost of coverage and when payments should be made. In an insurance contract, the specified premium and an agreement to the provisions and stipulations The consideration clause spells out exactly how much premium payments are and when they are due. You�ve already learned what is meant by the term consideration when dealing with insurance. In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid.

Source: kingsbusiness.co.uk

Source: kingsbusiness.co.uk

A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. Insurance refers to a contractual arrangement in which one party, i.e. The “consideration” clause will also outline any other type of compensation that is contractually agreed upon by the parties. In real estate agreements, consideration clauses outline compensation according to the terms of the contract.

Source: neamb.com

Source: neamb.com

In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. Suc stands for sum under consideration (insurance industry). The premium is the consideration from the insured, and the promise to indemnify, is the consideration from the insurers. People also ask, what is the consideration given by an insurer? A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided.

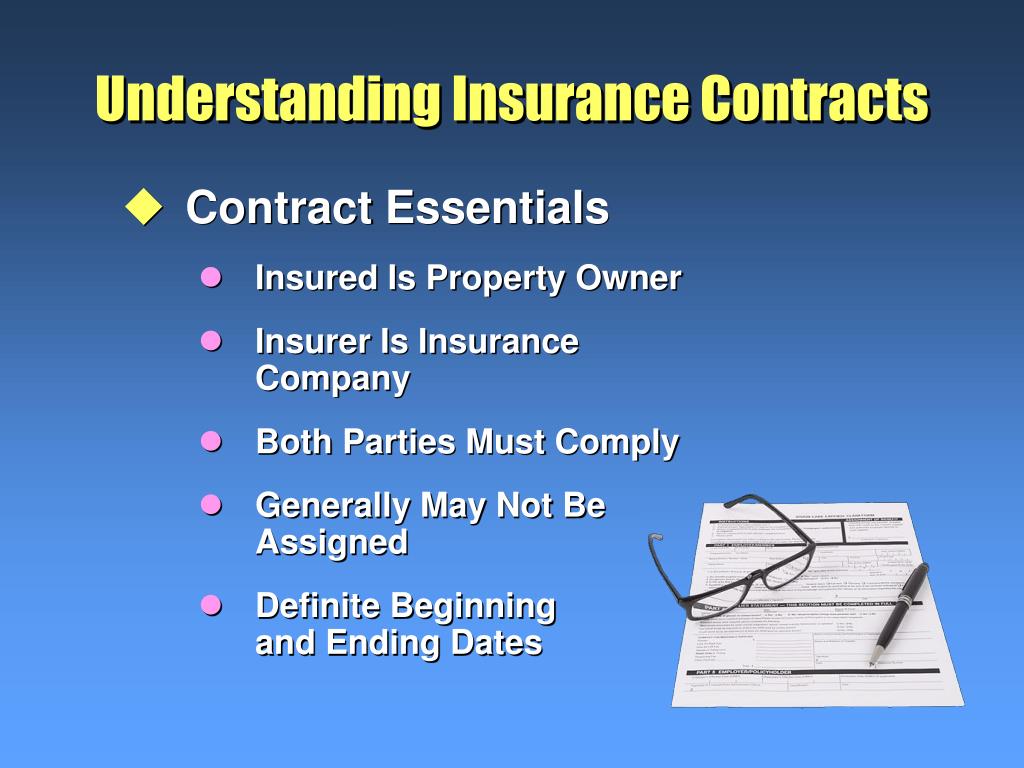

Source: slideserve.com

Source: slideserve.com

Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. Some examples of perils include fire, a lightning strike, burglary and a hailstorm or windstorm. A consideration clause is a provision most commonly used in insurance policies that provides information on how much the coverage costs and when to pay. Essentially, the consideration clause in an insurance policy provides for information relating to how much the insurance policy may cost and when the premiums are due (like a payment schedule). Comment * related questions on insurance.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. The consideration that an insurance applicant brings to the contract is their answers on the application , which are primarily known as representations. This is the premium or the future premiums that you have to pay to your insurance company. Insurance case finder, cgl reporter, insurance law reporter, canadian coverage caselaw, case law library, and fundamentals of insurance law. Such moment implies not only the death of the client, but may also include.

Source: neamb.com

Source: neamb.com

Insurance case finder, cgl reporter, insurance law reporter, canadian coverage caselaw, case law library, and fundamentals of insurance law. A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. In insurance, what is the applicant’s consideration? The insured, by paying a definite amount, in exchange for an adequate consideration called as premium. Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t.

Source: slideshare.net

Source: slideshare.net

Such moment implies not only the death of the client, but may also include. Some examples of perils include fire, a lightning strike, burglary and a hailstorm or windstorm. In an insurance contract, the specified premium and an agreement to the provisions and stipulations In return, the insurer promises to. Suc is defined as sum under consideration (insurance industry) very rarely.

Source: softproductionafrica.com

Source: softproductionafrica.com

For insurers, consideration also refers to the money paid out to you should you file an insurance claim. A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. Any insurance policy that is issued by an insurance company to an insured is considered a contract. The exchange of these premiums is basically a promise of indemnity, whereas the third party then gives up a right to sue the insured. In return, the insurer promises to.

Source: slideshare.net

Source: slideshare.net

A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. For insurers, consideration also refers to the money paid out to you should you file an insurance claim. In an insurance contract, the specified premium and an agreement to the provisions and stipulations In insurance, what is the applicant’s consideration? In insurance, “peril” is an event that causes damage to your home or property and consequently, results in financial loss.

Source: slideshare.net

Source: slideshare.net

Basics of a consideration clause consideration clauses are most commonly used in insurance. This is the premium or the future premiums that you have to pay to your insurance company. Should i buy a life insurance policy even if my employer has insured me in. Your subscription includes six components: In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

In the case of insurance, legal consideration refers to the premiums paid, the funds paid to a third party and the protection against being sued. In the case of insurance, legal consideration refers to the premiums paid, the funds paid to a third party and the protection against being sued. Insurance case finder, cgl reporter, insurance law reporter, canadian coverage caselaw, case law library, and fundamentals of insurance law. In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. Likewise, what is the applicant�s consideration in an insurance contract?

Source: bhaktiinvestment.com

Source: bhaktiinvestment.com

Should i buy a life insurance policy even if my employer has insured me in. In insurance, “peril” is an event that causes damage to your home or property and consequently, results in financial loss. From the insurance company the services they provide per the policy is the. This means that each party to the contract must provide some value to the relationship. The insured, by paying a definite amount, in exchange for an adequate consideration called as premium.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

Perils are typically named in your insurance policy, so you know which ones are covered and which ones aren’t. Other industries can also use consideration clauses. In an insurance contract, the specified premium and an agreement to the provisions and stipulations Should i buy a life insurance policy even if my employer has insured me in. Such moment implies not only the death of the client, but may also include.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is consideration in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information