What is considered full coverage auto insurance in missouri information

Home » Trend » What is considered full coverage auto insurance in missouri informationYour What is considered full coverage auto insurance in missouri images are available in this site. What is considered full coverage auto insurance in missouri are a topic that is being searched for and liked by netizens today. You can Find and Download the What is considered full coverage auto insurance in missouri files here. Find and Download all royalty-free photos and vectors.

If you’re looking for what is considered full coverage auto insurance in missouri images information related to the what is considered full coverage auto insurance in missouri keyword, you have visit the right site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

What Is Considered Full Coverage Auto Insurance In Missouri. What is considered full coverage insurance to one driver may not be the same as even another driver in the same household. $25,000 for total property damage. While there is no car insurance coverage that goes by the name “full coverage, most individuals think of full coverage as a policy that combines the following: $25,000 for bodily injury, per person.

Car Insurance Requirements in Missouri From everquote.com

Car Insurance Requirements in Missouri From everquote.com

What is considered full coverage auto insurance in missouri. While there is no car insurance coverage that goes by the name “full coverage, most individuals think of full coverage as a policy that combines the following: Car insurance in missouri is more expesive than the national average for full coverage, but less than the national average for minimum coverage, which is around $1,500 annually for full coverage and about $600. Others (such as rental reimbursement) may be optional, depending on the insurer and your situation. You need auto insurance to get behind the wheel of a car and drive on public roads but with different levels of coverage available, it can be difficult to decide which one is right for you. Full coverage auto insurance costs more than twice as much as minimum coverage.

The aim of writing this buzzle article is to provide a clear full coverage auto insurance definition, that clears out this confusion.

Full coverage is a common term used in auto insurance. Full coverage in missouri also includes optional collision and comprehensive insurance. $25,000 for total property damage. There is no such thing as a full coverage insurance policy; That statistic represents 8% of the national total of 7,035 similar accidents. Some coverages (such as auto liability) are required by state law.

Source: everquote.com

Source: everquote.com

It is simply a term that refers to a collection of insurance coverages that not only includes liability coverage but collision and comprehensive as well. Full coverage insurance is a car insurance term used to describe a policy that includes collision and comprehensive coverage in addition to the bodily injury and property damage liability coverage required by law. Correct and detailed information will allow insurers to offer you accurate and the best price. You need auto insurance to get behind the wheel of a car and drive on public roads but with different levels of coverage available, it can be difficult to decide which one is right for you. It often refers to a package that includes liability, collision, and comprehensive insurance.

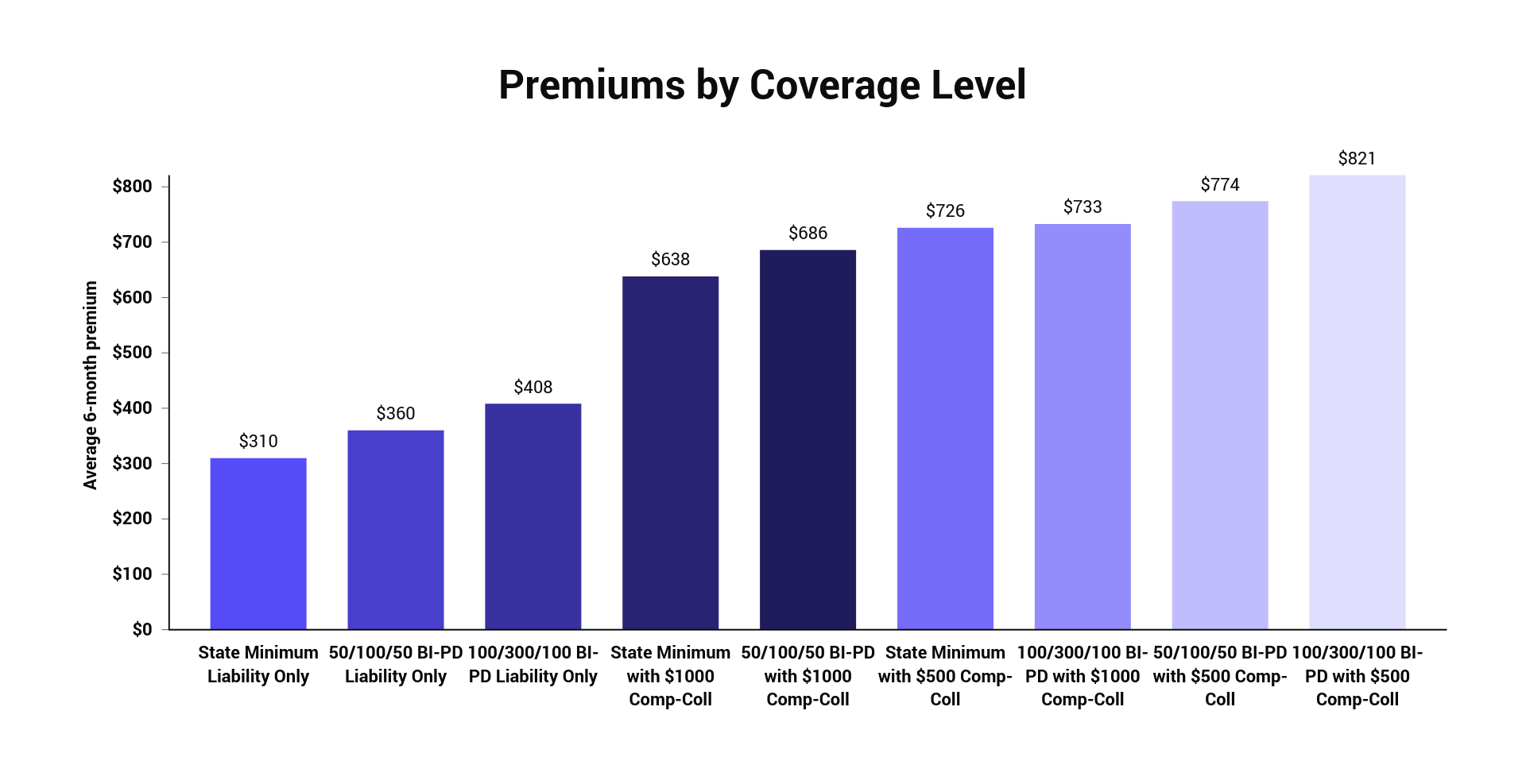

Source: thezebra.com

Source: thezebra.com

So, it�s up to you to choose car insurance that fits your needs — making sure your coverage meets state requirements and helps you protect your. While there is no car insurance coverage that goes by the name “full coverage, most individuals think of full coverage as a policy that combines the following: What is considered full coverage auto insurance in ca? Full coverage auto insurance costs more than twice as much as minimum coverage. Full coverage car insurance usually includes a few of the below coverages depending on your state.

Source: ransin.com

Source: ransin.com

Missouri, the gateway to the west, is considered to be a fundamental part of america�s westward missouri car insurance rates and coverage. What is considered full coverage car insurance. This is the bare minimum coverage the state requires by law. Answer by mo full coverage covers your car and the other persons car. You need auto insurance to get behind the wheel of a car and drive on public roads but with different levels of coverage available, it can be difficult to decide which one is right for you.

Source: shawneemissionpost.com

Source: shawneemissionpost.com

Covers damages/injuries to another vehicle or person. What is considered full coverage auto insurance you should fill the forms to the best of your knowledge. Most of the questions will be necessary to find out about you, your driving records, car and coverage requirements. Others (such as rental reimbursement) may be optional, depending on the insurer and your situation. What is considered full coverage auto insurance in ca?

Source: cowanhilgemanlaw.com

Source: cowanhilgemanlaw.com

It covers damages or injuries you cause to another vehicle or person, up to a certain limit. The aim of writing this buzzle article is to provide a clear full coverage auto insurance definition, that clears out this confusion. Full coverage in missouri also includes optional collision and comprehensive insurance. There is no such thing as a full coverage insurance policy; Full coverage auto insurance costs more than twice as much as minimum coverage.

Source: slideshare.net

Source: slideshare.net

It often refers to a package that includes liability, collision, and comprehensive insurance. Anyone know of a place where they have a zero down option? Full coverage insurance in missouri is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage. Full coverage car insurance refers to a policy that includes optional collision and comprehensive coverage that pays for damage to your car. It is simply a term that refers to a collection of insurance coverages that not only includes liability coverage but collision and comprehensive as well.

Source: slideshare.net

Source: slideshare.net

Full coverage car insurance usually includes a few of the below coverages depending on your state. What is considered full coverage auto insurance in missouri. The aim of writing this buzzle article is to provide a clear full coverage auto insurance definition, that clears out this confusion. The most recommended type of auto insurance is full coverage auto insurance. Full coverage auto insurance costs more than twice as much as minimum coverage.

Source: erwininsurancehersheypamononobi.blogspot.com

Source: erwininsurancehersheypamononobi.blogspot.com

The most recommended type of auto insurance is full coverage auto insurance. Covers damages/injuries to another vehicle or person. For instance, liability coverage is mandatory in almost all states. Full coverage insurance in north carolina is usually defined as a policy that provides more than the state’s minimum liability coverage, which is 30000 in bodily injury coverage per person, up to 60000 per accident, and 25000 in property damage coverage. What is considered full coverage auto insurance in nevada if you have an accident and it�s discovered that you�d neglected to maintain your vehicle roadworthy, by way of example excessively worn tyres, and that was a contributory element in the accident, your insurer will likely refuse to cover up.

Source: bellinghamautoacservice.com

Source: bellinghamautoacservice.com

Missouri, the gateway to the west, is considered to be a fundamental part of america�s westward missouri car insurance rates and coverage. It can also include other options that you may want or need. Some coverages (such as auto liability) are required by state law. Full coverage is a common term used in auto insurance. Correct and detailed information will allow insurers to offer you accurate and the best price.

Source: quotesgram.com

Source: quotesgram.com

Full coverage insurance in north carolina is usually defined as a policy that provides more than the state’s minimum liability coverage, which is 30000 in bodily injury coverage per person, up to 60000 per accident, and 25000 in property damage coverage. That statistic represents 8% of the national total of 7,035 similar accidents. Car insurance in missouri is more expesive than the national average for full coverage, but less than the national average for minimum coverage, which is around $1,500 annually for full coverage and about $600. Policies and coverage offered by insurers will vary by state. It covers damages or injuries you cause to another vehicle or person, up to a certain limit.

Source: directautoinsurance.org

Source: directautoinsurance.org

Missouri, the gateway to the west, is considered to be a fundamental part of america�s westward missouri car insurance rates and coverage. $25,000 for bodily injury, per person. For instance, liability coverage is mandatory in almost all states. Full coverage usually means that a person has purchased all the state required auto insurance coverages in addition to optional physical damage (comprehensive and collision) for the. It is simply a term that refers to a collection of insurance coverages that not only includes liability coverage but collision and comprehensive as well.

Source: pinterest.com

Source: pinterest.com

Full coverage is a common term used in auto insurance. Full coverage is a common term used in auto insurance. Car insurance in missouri is more expesive than the national average for full coverage, but less than the national average for minimum coverage, which is around $1,500 annually for full coverage and about $600. Full coverage usually means that a person has purchased all the state required auto insurance coverages in addition to optional physical damage (comprehensive and collision) for the. What is considered full coverage auto insurance you should fill the forms to the best of your knowledge.

What is considered full coverage auto insurance in ca? Full coverage usually means that a person has purchased all the state required auto insurance coverages in addition to optional physical damage (comprehensive and collision) for the. This is the bare minimum coverage the state requires by law. Full coverage car insurance refers to a policy that includes optional collision and comprehensive coverage that pays for damage to your car. What is considered full coverage insurance to one driver may not be the same as even another driver in the same household.

Source: dipsegovia.info

Source: dipsegovia.info

What is considered full coverage auto insurance in ca? It can also include other options that you may want or need. What is considered full coverage auto insurance in missouri. However, there seems to be a lot of confusion regarding what is considered full coverage auto insurance. There is no such thing as a full coverage insurance policy;

Source: slideshare.net

Source: slideshare.net

It can also include other options that you may want or need. Full coverage usually means that a person has purchased all the state required auto insurance coverages in addition to optional physical damage (comprehensive and collision) for the. Comprehensive auto insurance provides the most comprehensive coverage and is not always the most expensive. What is considered full coverage insurance to one driver may not be the same as even another driver in the same household. Full coverage car insurance usually includes a few of the below coverages depending on your state.

Source: taylorimagecollection.blogspot.com

Source: taylorimagecollection.blogspot.com

So, it�s up to you to choose car insurance that fits your needs — making sure your coverage meets state requirements and helps you protect your. Correct and detailed information will allow insurers to offer you accurate and the best price. Car insurance in missouri is more expesive than the national average for full coverage, but less than the national average for minimum coverage, which is around $1,500 annually for full coverage and about $600. The aim of writing this buzzle article is to provide a clear full coverage auto insurance definition, that clears out this confusion. This is the bare minimum coverage the state requires by law.

Source: bellinghamautoacservice.com

Source: bellinghamautoacservice.com

What is considered full coverage car insurance. What is considered full coverage auto insurance in missouri. What is considered full coverage auto insurance in ca? There is no such thing as a full coverage insurance policy; Full coverage insurance in north carolina is usually defined as a policy that provides more than the state’s minimum liability coverage, which is 30000 in bodily injury coverage per person, up to 60000 per accident, and 25000 in property damage coverage.

Source: thezebra.com

Source: thezebra.com

What is considered full coverage auto insurance you should fill the forms to the best of your knowledge. What is considered full coverage insurance in nc? You need auto insurance to get behind the wheel of a car and drive on public roads but with different levels of coverage available, it can be difficult to decide which one is right for you. Covers damages/injuries to another vehicle or person. Car insurance in missouri is more expesive than the national average for full coverage, but less than the national average for minimum coverage, which is around $1,500 annually for full coverage and about $600.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is considered full coverage auto insurance in missouri by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information