What is contractual liability insurance information

Home » Trending » What is contractual liability insurance informationYour What is contractual liability insurance images are available. What is contractual liability insurance are a topic that is being searched for and liked by netizens today. You can Get the What is contractual liability insurance files here. Find and Download all free photos.

If you’re looking for what is contractual liability insurance pictures information connected with to the what is contractual liability insurance keyword, you have come to the ideal site. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

What Is Contractual Liability Insurance. This is contractual liability or liability assumed under contract. Any time you sign a contract, you agree to do something for someone else or assume liability. A contractual liability insurance policy protects a policyholder from liabilities an insured undertook or. This is where contractual liability coverage comes into play.

Example Solution Contractual Liability Insurance Policy From contractualliabilityinsurance.com

Example Solution Contractual Liability Insurance Policy From contractualliabilityinsurance.com

The definition of contractual liability is “insurance that protects the assured, in the event a loss occurs, for which he has assumed liability, express or implied, under a written contract.” When you sign a contract, whether with a client, your landlord, an event space, or independent contractor, you take on liability. Sometimes you as well indemnify them or hold them harmless if something unforeseen happens. What does contractual liability mean? Contractual liability insurance protects against liabilities that policyholders assume when entering into a contract. Blanket contractual liability insurance is liability insurance that provides coverage for all contracts in which the insured is assuming liability.

Any time you sign a contract, you agree to do something for someone else or assume liability.

A contractual liability insurance policy clip / service contract reimbursement insurance policy scrip is often required by lenders to satisfy their requirements before they will advance on a vehicle loan that includes a vehicle service contract or other ancillary product. Sometimes you as well indemnify them or hold them harmless if something unforeseen happens. Sometimes, contractual liability is straightforward. Of all the insurance your small business has, contractual liability insurance might be one form you don’t realize you carry. Contractual liability insurance is a liability that one party assumes while it signs a contract with another party. What is contractual liability insurance?

Source: issuu.com

Source: issuu.com

Contractual liability insurance — insurance that covers liability of the insured assumed in a contract. When you sign a contract, whether with a client, your landlord, an event space, or independent contractor, you take on liability. Any time you sign a contract, you agree to do something for someone else or assume liability. Contractual liability insurance is an insurance policy or an insurance coverage that can be placed to assist with mitigating some (not all). Sometimes, contractual liability is straightforward.

Source: studylib.net

Source: studylib.net

When you or your business enters into a contractual agreement with another business entity, you may be required to carry clip insurance in addition to the cgl policy. Contractual liability in insurance means that you’re liable for the responsibilities addressed to you in the contract. Contractual liability insurance has and is still hard to obtain, especially on a blanket cover basis. This is contractual liability or liability assumed under contract. Contractual liability insurance comes in handy when dealing with.

Source: elliottinsurance.com.au

Source: elliottinsurance.com.au

Contractual liability insurance protects against liabilities that policyholders assume when entering into a contract. What does contractual liability mean? Contractual liability insurance — insurance that covers liability of the insured assumed in a contract. So, do you need contractual liability insurance? A contractual liability insurance policy protects a policyholder from liabilities an insured undertook or.

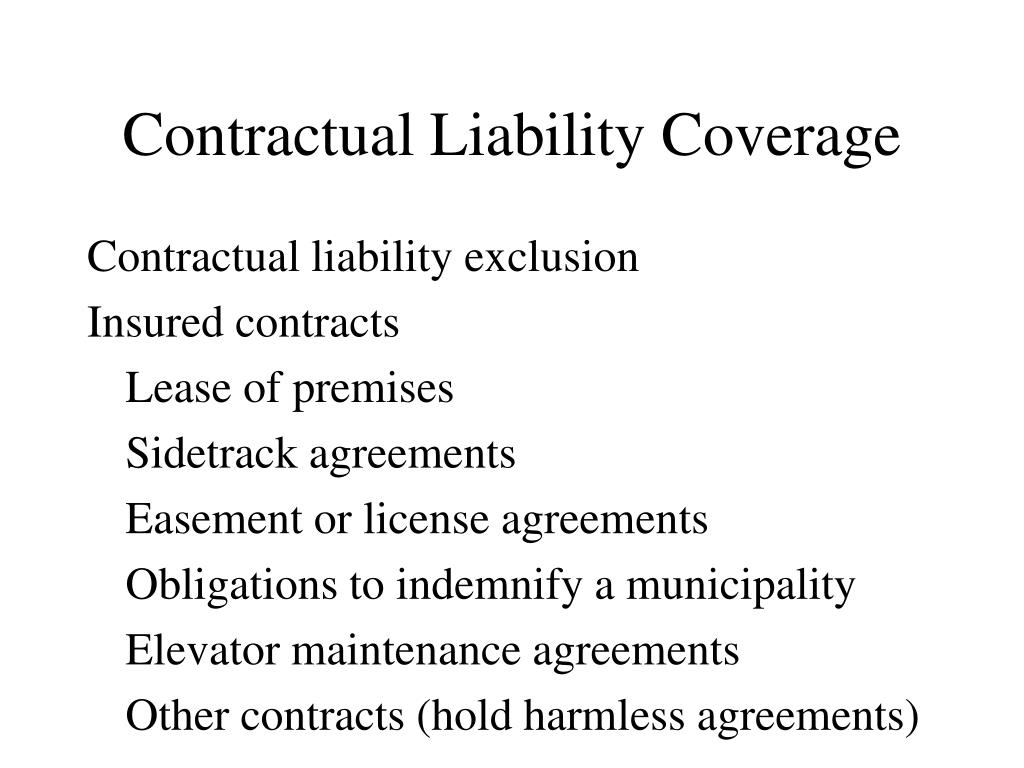

Source: slideserve.com

Source: slideserve.com

Contractual liability in insurance means that you’re liable for the responsibilities addressed to you in the contract. Blanket contractual liability insurance is liability insurance that provides coverage for all contracts in which the insured is assuming liability. Contractual liability insurance contractual liability is a transfer of risk that occurs when one party assumes liability on behalf of another via a contract. When you or your business enters into a contractual agreement with another business entity, you may be required to carry clip insurance in addition to the cgl policy. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party.

Source: contractualliabilityinsurance.com

Source: contractualliabilityinsurance.com

Let�s begin at the beginning. The definition of contractual liability is “insurance that protects the assured, in the event a loss occurs, for which he has assumed liability, express or implied, under a written contract.” When you or your business enters into a contractual agreement with another business entity, you may be required to carry clip insurance in addition to the cgl policy. A contractual liability insurance policy clip / service contract reimbursement insurance policy scrip is often required by lenders to satisfy their requirements before they will advance on a vehicle loan that includes a vehicle service contract or other ancillary product. If you have a commercial general liability (cgl) policy, this form of insurance coverage is automatically included to appear in it, without the need for a special endorsement.

Source: robfreeman.com

Source: robfreeman.com

A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party. Liability of the insured that would be imposed without the contract or agreement. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party. What is contractual liability insurance?

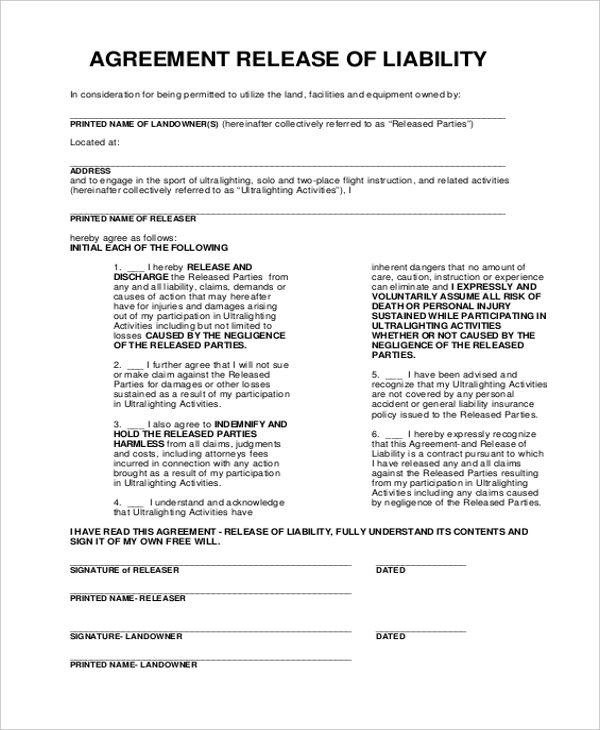

Source: agreements.org

Source: agreements.org

Under the standard commercial general liability (cgl) policy, such coverage is limited to liability assumed in any of a number of specifically defined insured contracts or to liability that the insured would have even in the absence. Contractual liability insurance comes in handy when dealing with. More on insured contract later. Let�s begin at the beginning. A contractual liability insurance policy provides additional insurance over and beyond a commercial general liability insurance policy.

Source: webberinsurance.com.au

Source: webberinsurance.com.au

What is contractual liability insurance? What is contractual liability insurance? Contractual liability is the liability you take on in a contract. Contractual liability insurance is an insurance policy or an insurance coverage that can be placed to assist with mitigating some (not all) contractual liability exposures. A contractual liability insurance policy clip / service contract reimbursement insurance policy scrip is often required by lenders to satisfy their requirements before they will advance on a vehicle loan that includes a vehicle service contract or other ancillary product.

Source: abterrace.com.au

Source: abterrace.com.au

Whenever you sign a contract, you agree to perform something for someone else or you assume some liability. A contractual liability insurance policy protects a policyholder from liabilities an insured undertook or. Contractual liability involves the financial consequences emanating from. Contractual liability insurance contractual liability is a transfer of risk that occurs when one party assumes liability on behalf of another via a contract. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party.

Source: contractualliabilityinsurance.com

Source: contractualliabilityinsurance.com

Of all the insurance your small business has, contractual liability insurance might be one form you don’t realize you carry. The definition of contractual liability is “insurance that protects the assured, in the event a loss occurs, for which he has assumed liability, express or implied, under a written contract.” Contractual liability insurance is a liability that one party assumes while it signs a contract with another party. In this blog what is contractual liability insurance? What is contractual liability insurance?

Source: signnow.com

Source: signnow.com

A contractual liability is a responsibility or an obligation that a party must adhere to as per the terms of a contract that the party agreed to and signed. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party. 1 this includes an indemnity agreement in which you assume financial responsibility on behalf of someone else for claims of third party bodily injury and property damage. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party. The part of the contract that�s relevant here is a specific section, generally referred to as a hold harmless clause.

Source: holmesmurphy.com

Source: holmesmurphy.com

Liability of the insured that would be imposed without the contract or agreement. So, do you need contractual liability insurance? What does this look like? If you have a commercial general liability (cgl) policy, this form of insurance coverage is automatically included to appear in it, without the need for a special endorsement. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party.

Source: dreamstime.com

Source: dreamstime.com

A contractual liability insurance policy protects a policyholder from liabilities an insured undertook or. Contractual liability insurance is a liability that one party assumes while it signs a contract with another party. This is where contractual liability coverage comes into play. 1 this includes an indemnity agreement in which you assume financial responsibility on behalf of someone else for claims of third party bodily injury and property damage. Contractual liability in insurance means that you’re liable for the responsibilities addressed to you in the contract.

Source: slideserve.com

Source: slideserve.com

Any time you sign a contract, you agree to do something for someone else or assume liability. More on insured contract later. If you have a commercial general liability (cgl) policy, this form of insurance coverage is automatically included to appear in it, without the need for a special endorsement. When you sign a contract, whether with a client, your landlord, an event space, or independent contractor, you take on liability. The part of the contract that�s relevant here is a specific section, generally referred to as a hold harmless clause.

Source: slideserve.com

Source: slideserve.com

Contractual liability involves the financial consequences emanating from. If you have a commercial general liability (cgl) policy, this form of insurance coverage is automatically included to appear in it, without the need for a special endorsement. This is contractual liability or liability assumed under contract. What is contractual liability insurance? Liability assumed in a contract or agreement that is an insured contract.

Source: acronymsandslang.com

Source: acronymsandslang.com

What is contractual liability insurance? This is contractual liability or liability assumed under contract. Contractual liability is risk that you assume on behalf of another party due to a contract you�ve signed with them. Sometimes you as well indemnify them or hold them harmless if something unforeseen happens. Most general liability policies exclude bodily injury and property damage liability.

Source: slideserve.com

Source: slideserve.com

Sometimes, contractual liability is straightforward. Contractual liability insurance is a liability that one party assumes while it signs a contract with another party. Under the standard commercial general liability (cgl) policy, such coverage is limited to liability assumed in any of a number of specifically defined insured contracts or to liability that the insured would have even in the absence. A contractual liability insurance policy legally and financially protects business owners from the liabilities they assume when signing a contract with a third party. Contractual liability involves the financial consequences emanating from.

Source: sampleforms.com

Source: sampleforms.com

Contractual liability insurance has and is still hard to obtain, especially on a blanket cover basis. Liability of the insured that would be imposed without the contract or agreement. Of all the insurance your small business has, contractual liability insurance might be one form you don’t realize you carry. Liability assumed in a contract or agreement that is an insured contract. So, do you need contractual liability insurance?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is contractual liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information