What is cpi insurance information

Home » Trending » What is cpi insurance informationYour What is cpi insurance images are available in this site. What is cpi insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is cpi insurance files here. Get all free photos.

If you’re looking for what is cpi insurance images information connected with to the what is cpi insurance topic, you have visit the right site. Our site always provides you with hints for viewing the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

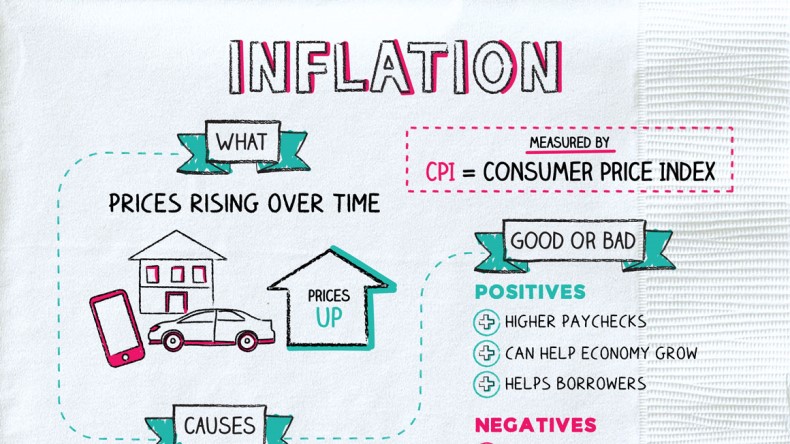

What Is Cpi Insurance. One type includes policies where the premiums and benefits are based on the consumer price index ( cpi ). The consumer price index (cpi) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as. Nov 6, 2019 — collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. Collateral protection insurance (cpi) is a type of car insurance imposed.

Fails to insure the car adequately. The provider confirms which borrowers have not provided adequate proof of. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. Collateral protection insurance (cpi) is a type of car insurance imposed. Or your title does not name langley fcu a lienholder during the life of a vehicle loan you have with langley federal credit union.

Collateral protection insurance (cpi) cpi enables lenders to manage and mitigate risk by transferring the.

Indexed life insurance is a policy that is dependent on outside factors to determine the value and price of the policy. Cpi requires no individual underwriting. If your lender gets collateral protection insurance for your vehicle, it will charge you for the policy, generally by folding the premiums into your monthly loan payment. Cpi is a form of decreasing term life insurance that insures all or some of the outstanding debt from the risk of death or incapacity. A borrower who does not This category includes two different types of policies.

Source: ons.gov.uk

Vehicle collateral protection insurance (cpi) credit unions; Risk of uninsured collateral to an insurance provider. Indexed life insurance is a policy that is dependent on outside factors to determine the value and price of the policy. Cpi is ordered by the lender, who wants to protect the vehicle until the loan is paid off, and the borrower is. This category includes two different types of policies.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. Cpi is a form of decreasing term life insurance that insures all or some of the outstanding debt from the risk of death or incapacity. Or your title does not name langley fcu a lienholder during the life of a vehicle loan you have with langley federal credit union. Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle.

This category includes two different types of policies. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. A borrower who does not Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. The cpi provider receives information on all new loans and updates on existing loans in a lender’s portfolio and tracks the insurance status of each.

Source: mantlefp.com

Source: mantlefp.com

Collateral protection insurance (cpi) is a type of car insurance imposed by lenders. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. If you have financed or leased a vehicle , then the lender will need to protect that vehicle (the ‘collateral’) with collateral protection insurance. One type includes policies where the premiums and benefits are based on the consumer price index ( cpi ). If your lender gets collateral protection insurance for your vehicle, it will charge you for the policy, generally by folding the premiums into your monthly loan payment.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

Cpi is a form of decreasing term life insurance that insures all or some of the outstanding debt from the risk of death or incapacity. A borrower who does not Indexed life insurance is a policy that is dependent on outside factors to determine the value and price of the policy. Fails to purchase auto insurance; In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle.

Source: napkinfinance.com

Source: napkinfinance.com

Nov 6, 2019 — collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. The provider confirms which borrowers have not provided adequate proof of. Risk of uninsured collateral to an insurance provider. Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. One type includes policies where the premiums and benefits are based on the consumer price index ( cpi ).

![]() Source: goldeneagle-insurance.com

Source: goldeneagle-insurance.com

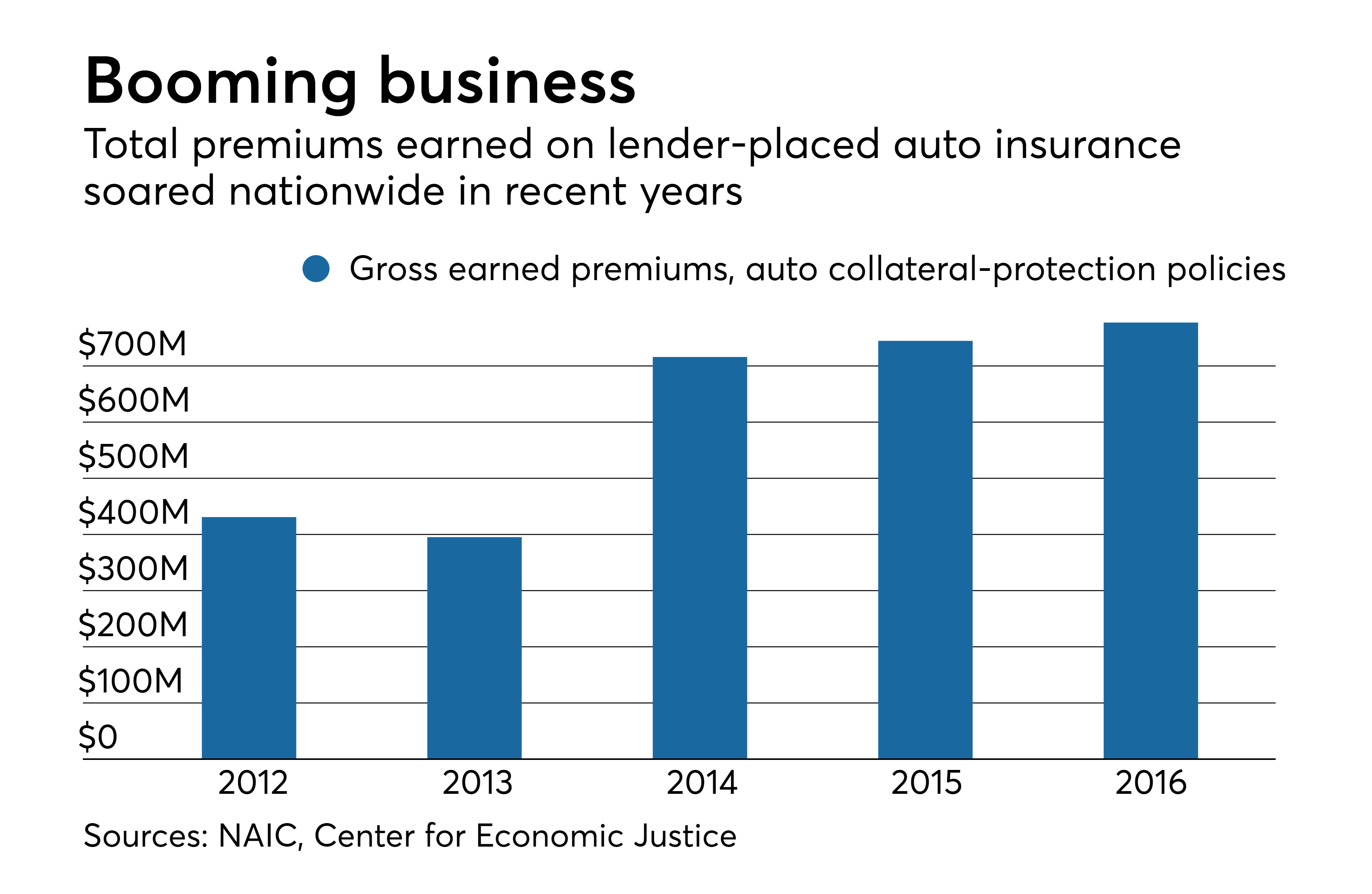

With 40 years and over 18 million loans tracked, we discovered that while 8% of borrowers don’t verify their insurance on collateral, only 1 to 3% that will. Collateral protection insurance (cpi) cpi enables lenders to manage and mitigate risk by transferring the. Vehicle collateral protection insurance (cpi) credit unions; If you have financed or leased a vehicle , then the lender will need to protect that vehicle (the ‘collateral’) with collateral protection insurance. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance.

Source: lietaer.com

Source: lietaer.com

The cpi is a measure of consumer price inflation produced to international standards and in line with european regulations. The consumer price index (cpi) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as. Risk of uninsured collateral to an insurance provider. Collateral protection insurance (cpi) is a type of car insurance imposed by lenders. The provider confirms which borrowers have not provided adequate proof of.

Source: verifacto.com

Source: verifacto.com

Fails to insure the car adequately. This category includes two different types of policies. Cpi is ordered by the lender, who wants to protect the vehicle until the loan is paid off, and the borrower is. Cpi requires no individual underwriting. Cpi is a form of decreasing term life insurance that insures all or some of the outstanding debt from the risk of death or incapacity.

Source: verifacto.com

Source: verifacto.com

Today, our focus is on the first product, collateral protection insurance (cpi). Collateral protection insurance (cpi) is a type of car insurance imposed. Fails to insure the car adequately. Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. What is the best insurance to avoid cpi?

Source: inflationdata.com

Source: inflationdata.com

First published in january 1996 as the harmonised index of consumer prices (hicp), the cpi is the inflation measure used in the government’s target for inflation. One type includes policies where the premiums and benefits are based on the consumer price index ( cpi ). Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

The other type, called equity indexed life insurance refers to. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance (cpi) is a type of car insurance imposed by lenders. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Cpi is a form of decreasing term life insurance that insures all or some of the outstanding debt from the risk of death or incapacity.

Source: youtube.com

Source: youtube.com

Indexed life insurance is a policy that is dependent on outside factors to determine the value and price of the policy. When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional interest on the policy. Cpi is a form of decreasing term life insurance that insures all or some of the outstanding debt from the risk of death or incapacity. It protects the lender’s loan balance in case of loss of collateral while uninsured. There are many great car insurance companies on the market, each with its own unique coverage and discount offerings and algorithm for calculating rates.

Source: thebuzzernews.blogspot.com

Nov 6, 2019 — collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. The cpi provider receives information on all new loans and updates on existing loans in a lender’s portfolio and tracks the insurance status of each. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Collateral protection insurance — or cpi — is a type of car insurance purchased by your lender to protect your vehicle if you don�t have the required amount of insurance coverage. Cpi requires no individual underwriting.

Source: acronymsandslang.com

Source: acronymsandslang.com

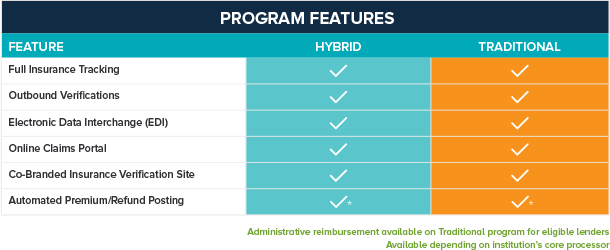

Banks finance companies auto dealers utilities with the right technology, you can cancel out the noise of insurance tracking. With 40 years and over 18 million loans tracked, we discovered that while 8% of borrowers don’t verify their insurance on collateral, only 1 to 3% that will. Or your title does not name langley fcu a lienholder during the life of a vehicle loan you have with langley federal credit union. When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional interest on the policy. Cpi requires no individual underwriting.

Source: forbes.com

Source: forbes.com

Or your title does not name langley fcu a lienholder during the life of a vehicle loan you have with langley federal credit union. The other type, called equity indexed life insurance refers to. Collateral protection insurance (cpi) is a type of car insurance imposed. Collateral protection insurance (cpi) is a type of car insurance imposed by lenders. Banks finance companies auto dealers utilities with the right technology, you can cancel out the noise of insurance tracking.

Source: seekingalpha.com

Source: seekingalpha.com

If you have financed or leased a vehicle , then the lender will need to protect that vehicle (the ‘collateral’) with collateral protection insurance. Cpi requires no individual underwriting. Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle.

Source: commons.wikimedia.org

Source: commons.wikimedia.org

Langley will notify you about this condition. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. What is the best insurance to avoid cpi?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is cpi insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information