What is credit life insurance Idea

Home » Trending » What is credit life insurance IdeaYour What is credit life insurance images are available in this site. What is credit life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is credit life insurance files here. Find and Download all royalty-free vectors.

If you’re searching for what is credit life insurance pictures information connected with to the what is credit life insurance topic, you have come to the ideal site. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

What Is Credit Life Insurance. Credit life insurance provides cover in the event of you having outstanding debt when you die. Not only this, but insurers can actually help to reduce the risk of financial loss through credit management support. If you’re wondering how this works, you’ve come to the right place. Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts.

What Is Credit Life Insurance, and Do You Need It? From vtalkinsurance.com

What Is Credit Life Insurance, and Do You Need It? From vtalkinsurance.com

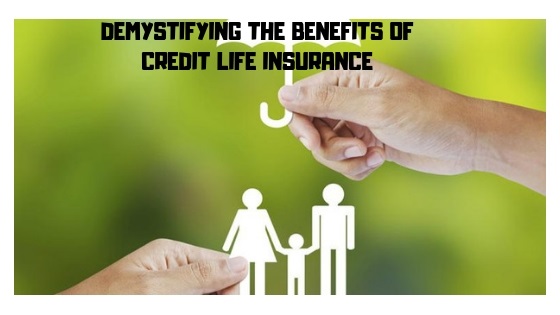

Tap card to see definition 👆. When purchased, the cost of the policy may be added to the principal amount of the loan. Credit disability insurance (also called credit accident and health insurance): Credit disability insurance covers loan payments if you become disabled and you�re unable to work. Credit life insurance costs more than traditional life insurance. Other types of credit insurance repay loans in less extreme circumstances, such as involuntary unemployment.

Credit life insurance is a type of insurance protection/cover that can provide cover for debt repayments in the event of death, disability, unemployment (retrenchment), inability to earn an income and dread disease.

Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. Credit life insurance is a specific type of credit insurance that pays out if you die. Credit life insurance is a type of insurance protection/cover that can provide cover for debt repayments in the event of death, disability, unemployment (retrenchment), inability to earn an income and dread disease. Credit life insurance costs more than traditional life insurance. Regarding credit life which of the following statements is true? Credit life insurance pays a policyholder’s debts when the policyholder dies.

Source: vtalkinsurance.com

Source: vtalkinsurance.com

Credit life insurance is a form of credit insurance, which includes other insurance products that pay your debts if you are unable to, like unemployment or disability credit insurance. Credit life insurance is a type of life insurance policy that provides coverage for outstanding debt when the insured individual passes away. This prevents your loved ones from having to pay your balance out of your estate. The premiums are higher because there’s a greater risk associated when compared to traditional life insurance. It usually also pays out if you are disabled or retrenched.

Source: theedgesearch.com

Source: theedgesearch.com

Credit disability insurance (also called credit accident and health insurance): Instead, the policyholder’s creditors receive the value of a credit life insurance policy. Credit life insurance is an insurance policy specifically designed to pay off a loan in the case of an untimely death. Credit life insurance protects your partner from paying off the remaining amount on their own. Credit unemployment insurance covers loan payments.

Source: getinsurance.ng

Source: getinsurance.ng

As the balance of the loan decreases, the amount of the credit life insurance decreases. Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. This prevents your loved ones from having to pay your balance out of your estate. Pays your debt on a specific loan or line of credit if you die before the loan is paid off. Credit life insurance costs more than traditional life insurance.

Source: autoinsurance.org

Source: autoinsurance.org

Credit unemployment insurance covers loan payments. 6 however, it is illegal for an entity to require credit life insurance in a loan, so it isn�t required to have credit life insurance for a loan. Credit life insurance can be purchased when getting a loan for a vehicle (such as a car or truck), mortgage, or unsecured debt including credit card debt. Credit life insurance policies are typically associated with major loans. What is credit life insurance?

Source: thebalance.com

Source: thebalance.com

There are five major types of credit insurance coverage: Pays your debt on a specific loan or line of credit if you die before the loan is paid off. Regarding credit life which of the following statements is true? As the balance of the loan decreases, the amount of the credit life insurance decreases. Click again to see term 👆.

Source: bestfinancecare.com

Source: bestfinancecare.com

Credit life insurance is a form of credit insurance, which includes other insurance products that pay your debts if you are unable to, like unemployment or disability credit insurance. It usually also pays out if you are disabled or retrenched. Credit life insurance is insurance that�s intended to pay off a borrower�s debts at their death. There’s a greater risk associated with credit life insurance when compared to traditional life insurance, so there is a higher cost for credit life policy premiums. The cost of the insurance will decrease as the debt is paid down by the borrower, but the premium will remain.

Source: profinanceblog.com

Source: profinanceblog.com

There are five major types of credit insurance coverage: Credit life is issued as a guaranteed issue policy with a decreasing term. Credit life insurance costs more than traditional life insurance. Not only this, but insurers can actually help to reduce the risk of financial loss through credit management support. Therefore the question of whether consumers are getting a fair deal when they purchase it is

Source: oldmutualfinance.co.za

Source: oldmutualfinance.co.za

May be limited to a certain number of payments or total amount paid. There are five major types of credit insurance coverage: With some of these plans, the face value of your loan determines the size of the policy. Credit life insurance is an insurance policy specifically designed to pay off a loan in the case of an untimely death. When purchased, the cost of the policy may be added to the principal amount of the loan.

Source: rbfcu.org

Source: rbfcu.org

As the balance of the loan decreases, the amount of the credit life insurance decreases. When the debt is paid down by the borrower, the cost of insurance decreases. Credit life insurance can be purchased when getting a loan for a vehicle (such as a car or truck), mortgage, or unsecured debt including credit card debt. Unlike term or universal life insurance, it doesn’t pay out to the policyholder’s chosen beneficiaries. Credit life insurance pays a policyholder’s debts when the policyholder dies.

0.jpg?itok=OhDUaYf “Group Term Life SNIC”) Source: snic.com.bh

With some of these plans, the face value of your loan determines the size of the policy. May be limited to a certain number of payments or total amount paid. Credit life insurance is an insurance policy specifically designed to pay off a loan in the case of an untimely death. There are five major types of credit insurance coverage: Other types of credit insurance repay loans in less extreme circumstances, such as involuntary unemployment.

Source: bankrate.com

Source: bankrate.com

Credit life insurance is a type of life insurance policy that provides coverage for outstanding debt when the insured individual passes away. Click card to see definition 👆. Credit life insurance is insurance that�s intended to pay off a borrower�s debts at their death. If you take out a mortgage to buy a home, for example, or a large. With some of these plans, the face value of your loan determines the size of the policy.

Source: moneyshop.co.za

Source: moneyshop.co.za

In some circumstances, lenders may be required. If you are unable to work because of a disability, this coverage makes your monthly minimum loan payments for a limited time period. Credit life insurance pays off a debt if you pass away. Tap card to see definition 👆. Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in rare cases, unemployment.

Credit life insurance pays off a debt if you pass away. However, the premium will remain constant. Credit life insurance pays off a debt if you pass away. Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. If the borrower dies during the term, the lender is the beneficiary of the insurance contract.

Source: thebalance.com

Source: thebalance.com

Makes the remaining loan payments to the lender in. Credit disability insurance (also called credit accident and health insurance): Credit life insurance protects your partner from paying off the remaining amount on their own. What is credit life insurance? Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts.

Source: policyadvice.net

Source: policyadvice.net

The premiums are higher because there’s a greater risk associated when compared to traditional life insurance. If you’re wondering how this works, you’ve come to the right place. Credit life insurance provides cover in the event of you having outstanding debt when you die. Credit life insurance is a specific type of credit insurance that pays out if you die. There are five major types of credit insurance coverage:

Source: mcintyre.co.za

Source: mcintyre.co.za

There’s a greater risk associated with credit life insurance when compared to traditional life insurance, so there is a higher cost for credit life policy premiums. Debtor pays the premium for credit life insurance. Credit life insurance costs more than traditional life insurance. Regarding credit life which of the following statements is true? Click again to see term 👆.

![Credit Life Insurance Know your rights [Part 3/4] My Credit Life Insurance Know your rights [Part 3/4] My](https://blog.mycreditcheck.co.za/wp-content/uploads/2018/07/Credit-Life-Insurance-Part-3-600x600.png) Source: blog.mycreditcheck.co.za

Source: blog.mycreditcheck.co.za

In some cases, credit life insurance policies can be written into the loan you are getting. Makes the remaining loan payments to the lender in. Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. Credit life insurance is a type of insurance protection/cover that can provide cover for debt repayments in the event of death, disability, unemployment (retrenchment), inability to earn an income and dread disease. 6 however, it is illegal for an entity to require credit life insurance in a loan, so it isn�t required to have credit life insurance for a loan.

Source: pccu.co.uk

Source: pccu.co.uk

Credit life is issued as a guaranteed issue policy with a decreasing term. Makes the remaining loan payments to the lender in. Credit life insurance costs more than traditional life insurance. As the balance of the loan decreases, the amount of the credit life insurance decreases. Click card to see definition 👆.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is credit life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information