What is eoi insurance information

Home » Trend » What is eoi insurance informationYour What is eoi insurance images are available in this site. What is eoi insurance are a topic that is being searched for and liked by netizens now. You can Get the What is eoi insurance files here. Get all free photos.

If you’re searching for what is eoi insurance images information linked to the what is eoi insurance topic, you have visit the right site. Our site always gives you hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

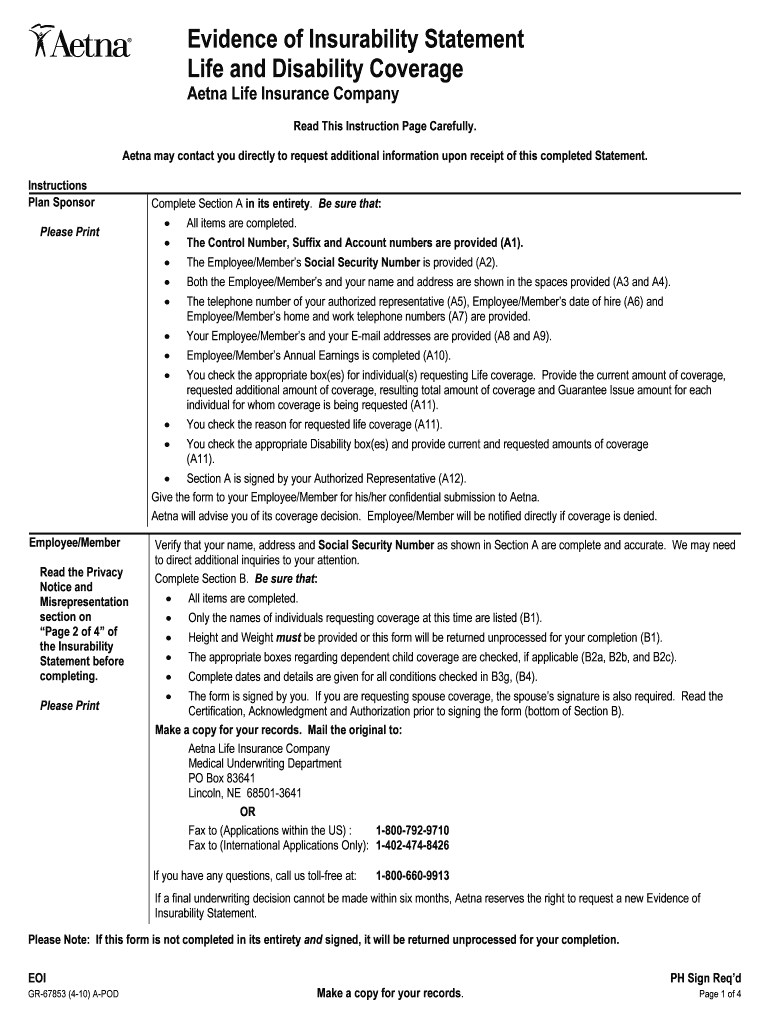

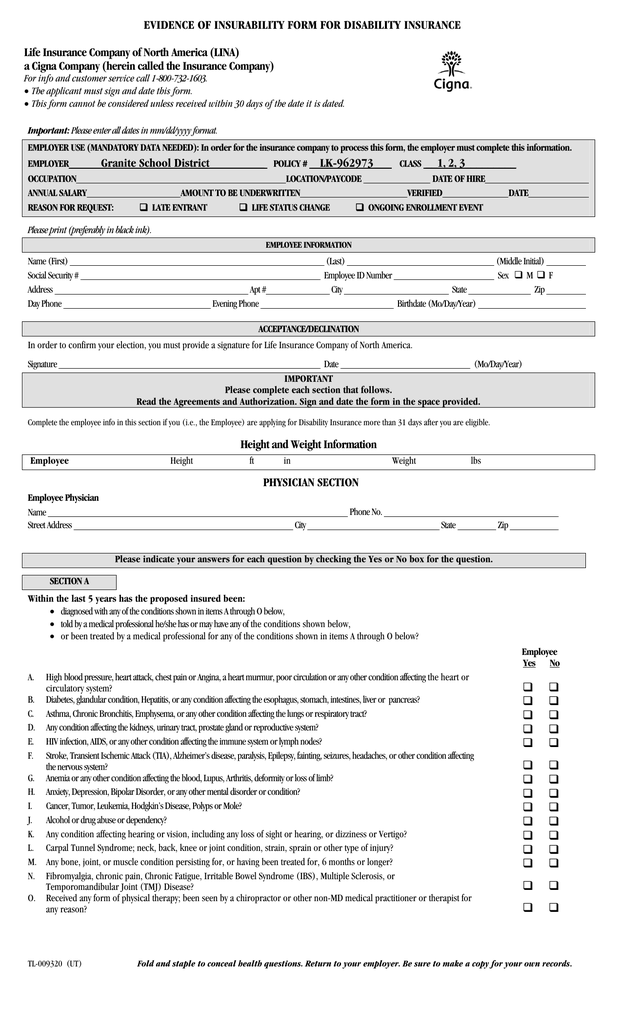

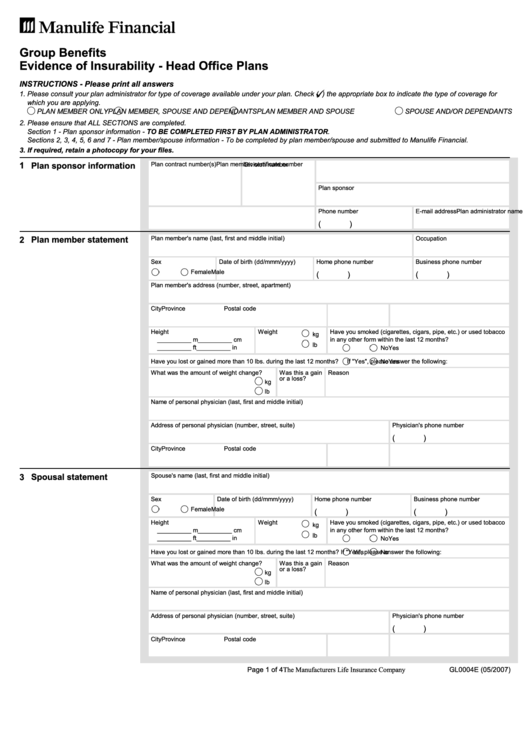

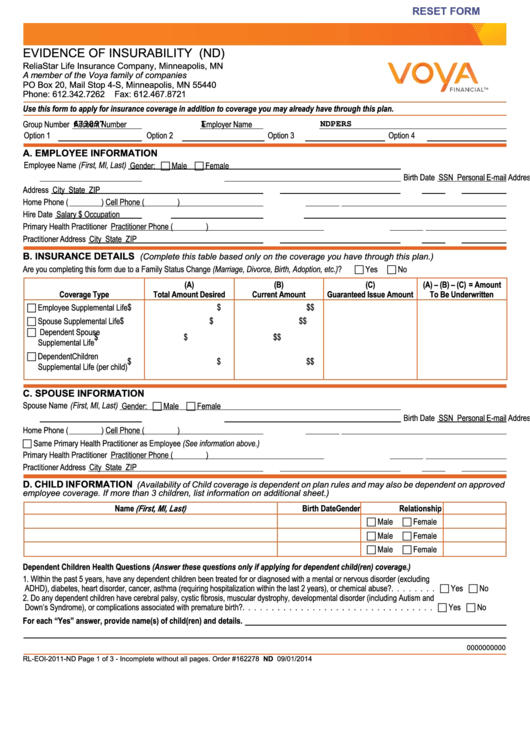

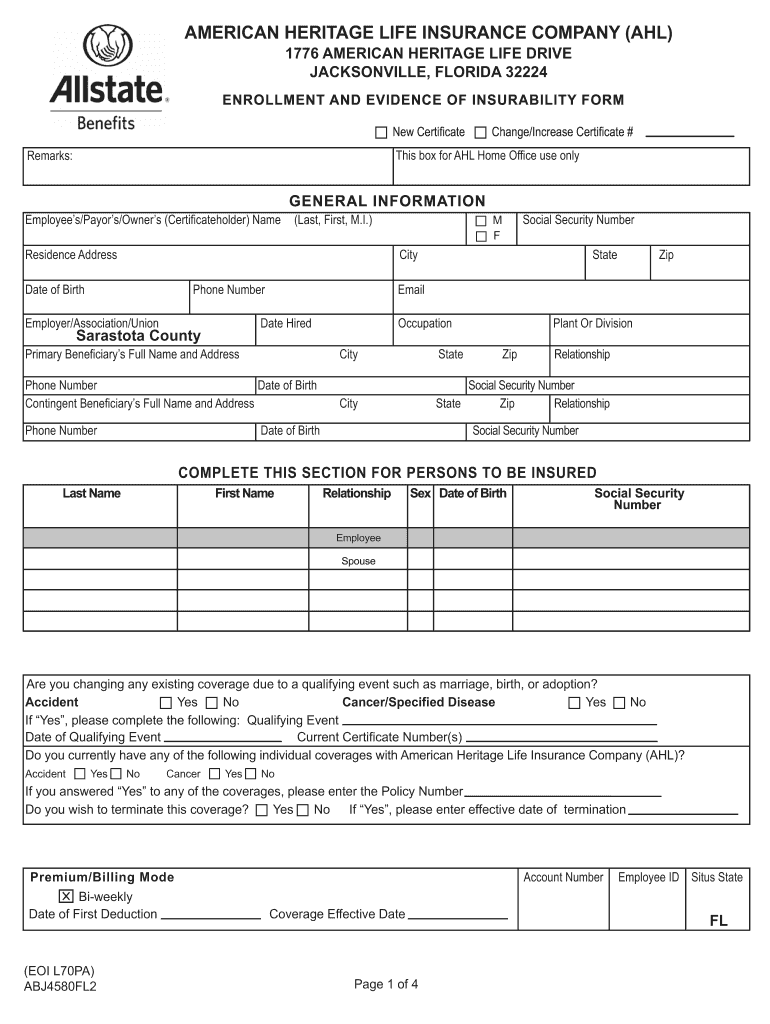

What Is Eoi Insurance. What is evidence of insurability? Evidence of insurability (eoi) is a health questionnaire that helps your insurance carrier determine whether you qualify for new coverage. Coverage does not become effective until approval of the eoi. Proof of good health, also known as evidence of insurability (eoi), is an application process in which you provide information on the condition of your health or your dependent’s health to get certain types of insurance coverage.

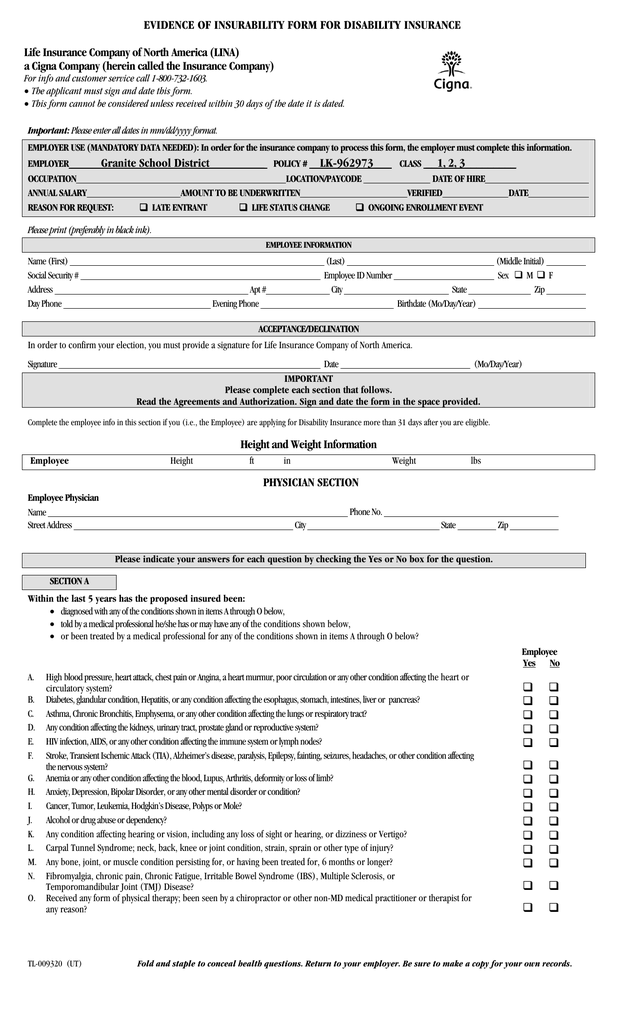

EVIDENCE OF INSURABILITY FORM FOR DISABILITY INSURANCE From studylib.net

EVIDENCE OF INSURABILITY FORM FOR DISABILITY INSURANCE From studylib.net

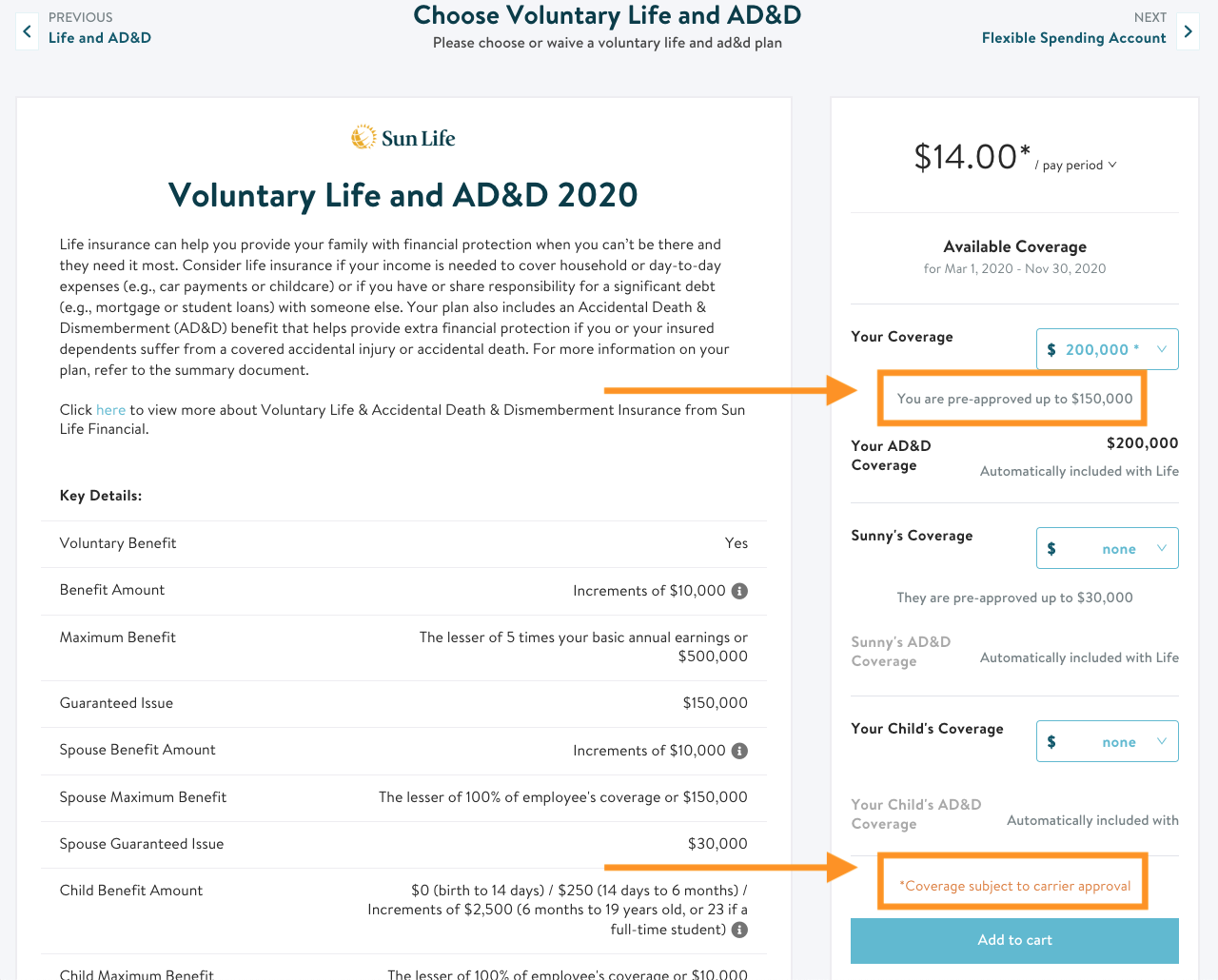

Buying an insurance amount higher than. This commonly requires answering a few simple health questions to determine if you meet health standards for requested insurance. Eoi is the information we use to verify your good health when you re purchasing life, disability, or critical illness insurance. The eoi form is a comprehensive medical questionnaire that gives your carrier the information they need to make their decision. When you are taking an exam to get a life insurance, you are providing evidence of insurability. Proof of good health, also known as evidence of insurability (eoi), is an application process in which you provide information on the condition of your health or your dependent’s health to get certain types of insurance coverage.

Evidence of insurability (eoi) is the process where your insurance carrier determines whether you (or your dependents) are considered healthy enough to be eligible for certain benefits.

It is whatever is required to show that you are qualified to obtain that policy. Evidence of insurability (eoi) employer guide in order to apply for coverage, your group insurance policy may require that employees and dependents provide eoi. This is often done through the form of documentation such as a medical questionnaire. Evidence of insurability (eoi) is a health questionnaire that helps your insurance carrier determine whether you qualify for new coverage. Eoi is required to be completed by an employee who requests insurance amounts that fall outside benefit plan guidelines. We require eoi if you are:

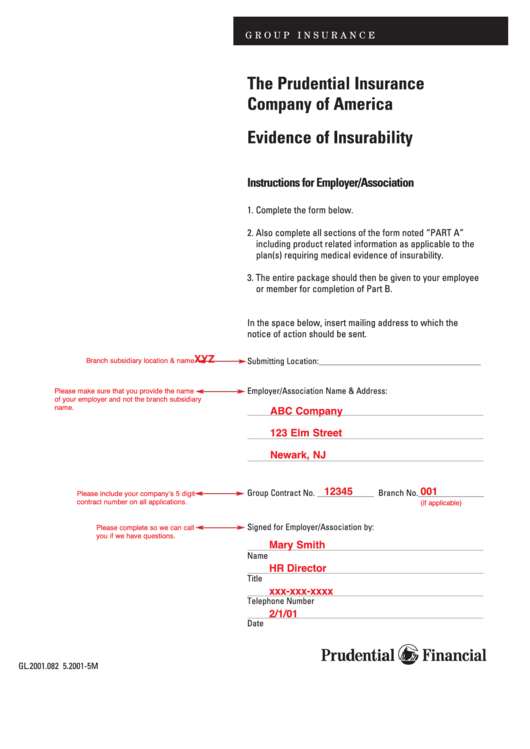

Source: utahtrust.gov

Source: utahtrust.gov

When you are taking an exam to get a life insurance, you are providing evidence of insurability. The guaranteed amount for your plan already enrolled and want to increase coverage. Eoi is required to be completed by an employee who requests insurance amounts that fall outside benefit plan guidelines. It�s used by insurance companies to verify whether a person meets the definition of good health. Evidence of insurability (eoi) for optional and dependent term life insurance what is eoi?

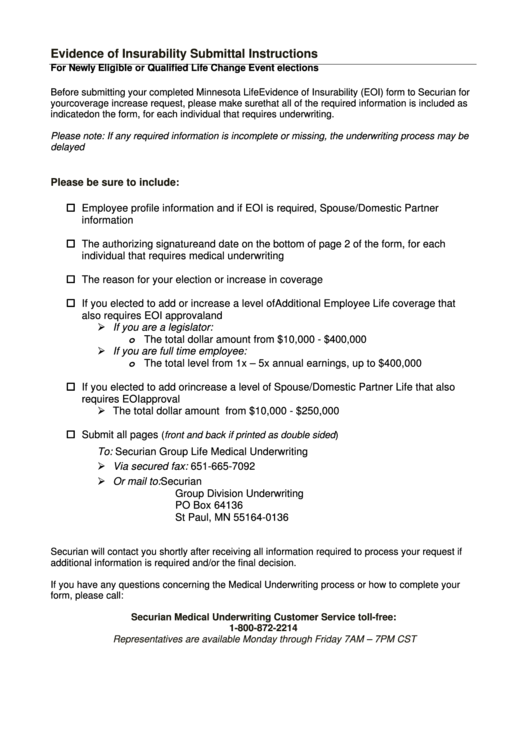

Source: eoidirect.com

Source: eoidirect.com

Evidence of insurability (eoi) is part of the application process for a life or health insurance policy during which an applicant provides health information. An expression of interest (eoi) is one of the initial transaction documents templates free business templates to use in your personal or professional life. What is evidence of insurability (eoi)? Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. Evidence of insurability (eoi) is a process where your insurance carrier determines whether you (or your dependents) are eligible for certain benefits.

Source: fill.io

Source: fill.io

What is evidence of insurability? The guaranteed amount for your plan already enrolled and want to increase coverage. Evidence of insurability (eoi) is personal health information that life insurance plan participants provide to the insurance carrier. Eoi stands for evidence of insurability. During the life insurance application process, underwriters evaluate your evidence of insurability (eoi), or financial background, to determine how much coverage to offer you.

Source: pdffiller.com

Source: pdffiller.com

While most insurers use a basic questionnaire to verify overall health before granting policy access to prospective clients, eoi goes beyond basic information to establish a more specific level or explore a specific area of. You can receive that amount of coverage automatically, with no questions asked, if you apply for it Proof of good health, also known as evidence of insurability (eoi), is an application process in which you provide information on the condition of your health or your dependent’s health to get certain types of insurance coverage. Providing this documentation is a step in the application process for some types of insurance coverage. Buying an insurance amount higher than.

Source: issuu.com

Source: issuu.com

Proof of good health, also known as evidence of insurability (eoi), is an application process in which you provide information on the condition of your health or your dependent’s health to get certain types of insurance coverage. Eoi is the information we use to verify your good health when you re purchasing life, disability, or critical illness insurance. Templates include excel, word, and powerpoint. Also how do i get an eoi? These can be used for transactions, shared by the buyer with the seller in a potential m&a m&a synergies m&a.

Source: revisi.net

Source: revisi.net

What is eoi and when is it needed? Also how do i get an eoi? During the life insurance application process, underwriters evaluate your evidence of insurability (eoi), or financial background, to determine how much coverage to offer you. Group life insurance plans might not require eoi for a certain amount of life insurance, but then require eoi for additional coverage, or coverage for family members. What is evidence of insurability (eoi)?

Source: formsbank.com

Source: formsbank.com

What is an expression of interest (eoi)? Evidence of insurability (eoi) provides information on the condition of your health or a dependent’s health in order to qualify you for certain life insurance coverage. It is whatever is required to show that you are qualified to obtain that policy. Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. It’s used by insurance companies to verify whether a person meets the definition of good health.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

Eoi is required to be completed by an employee who requests insurance amounts that fall outside benefit plan guidelines. Coverage does not become effective until approval of the eoi. Group life insurance plans might not require eoi for a certain amount of life insurance, but then require eoi for additional coverage, or coverage for family members. Evidence of insurability (eoi) is a process where your insurance carrier determines whether you (or your dependents) are eligible for certain benefits. This process involves an eoi form, which is a comprehensive medical questionnaire you fill out and submit to your carrier that gives them the information they.

Source: hub.jhu.edu

Source: hub.jhu.edu

An applicant begins the eoi/medical underwriting process by submitting a medical history statement (mhs), which along with other information obtained during the underwriting evaluation is used by the standard to make the underwriting determination. When you are taking an exam to get a life insurance, you are providing evidence of insurability. This commonly requires answering a few simple health questions to determine if you meet health standards for requested insurance. Group life insurance plans might not require eoi for a certain amount of life insurance, but then require eoi for additional coverage, or coverage for family members. Eoi shows the insurer that the insured person meets the health and risk criteria required by that company in order to get a certain policy.

Source: allfinanceterms.com

Source: allfinanceterms.com

It�s used by insurance companies to verify whether a person meets the definition of good health. Evidence of insurability (eoi) for optional and dependent term life insurance what is eoi? What is evidence of insurability (eoi)? It is whatever is required to show that you are qualified to obtain that policy. The organization plays an important role in providing health care access to the marginalized communities and.

Source: help.maxwellhealth.com

Source: help.maxwellhealth.com

Evidence of insurability (eoi) is the process where your insurance carrier determines whether you (or your dependents) are considered healthy enough to be eligible for certain benefits. What is evidence of insurability? When life insurance does not require eoi, that can make the policy very expensive, as in guaranteed issue. Evidence of insurability (eoi) is a process where your insurance carrier determines whether you (or your dependents) are eligible for certain benefits. Coverage does not become effective until approval of the eoi.

Source: formsbank.com

Source: formsbank.com

Eoi is the information we use to verify your good health when you re purchasing life, disability, or critical illness insurance. It�s used by insurance companies to verify whether a person meets the definition of good health. Carriers may request an eoi for group term life insurance for two reasons with each basic and voluntary life insurance: Eoi shows the insurer that the insured person meets the health and risk criteria required by that company in order to get a certain policy. Evidence of insurability (eoi) is a health questionnaire that helps your insurance carrier determine whether you qualify for new coverage.

Source: pdffiller.com

Source: pdffiller.com

The organization plays an important role in providing health care access to the marginalized communities and. That’s called the guaranteed issue amount. Evidence of insurability (eoi) is a record of a person’s past and current health events. This commonly requires answering a few simple health questions to determine if you meet health standards for requested insurance. Most of us who deal with employee benefits refer to this application as an eoi form.

Source: studylib.net

Source: studylib.net

What is evidence of insurability? Evidence of insurability (eoi) for optional and dependent term life insurance what is eoi? Evidence of insurability (eoi) evidence of insurability (eoi) is a record of a person’s past and current health events. These can be used for transactions, shared by the buyer with the seller in a potential m&a m&a synergies m&a. In part, evidence of insurability is a statement that proves to the insurance carrier that you qualify for.

Source: formsbank.com

Source: formsbank.com

What is eoi and when is it needed? Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. What is evidence of insurability? It’s used by insurance companies to verify whether a person meets the definition of good health. Expression of interest (eoi) for insurance services job posted on 23 feb, 2022 apply before 28 feb, 2022 fairmed foundation nepal fairmed is a swiss development organization dedicated to work with its motto “health for the poorest”.

Source: formsbank.com

Source: formsbank.com

Also how do i get an eoi? Evidence of insurability (eoi) provides information on the condition of your health or a dependent’s health in order to qualify you for certain life insurance coverage. Also how do i get an eoi? Buying an insurance amount higher than. We require eoi if you are:

Source: uslegalforms.com

Source: uslegalforms.com

You can receive that amount of coverage automatically, with no questions asked, if you apply for it The application itself requires approval from your insurance provider or carrier before the coverage will take effect. Evidence of insurability (eoi) provides information on the condition of your health or a dependent’s health in order to qualify you for certain life insurance coverage. Proof of good health, also known as evidence of insurability (eoi), is an application process in which you provide information on the condition of your health or your dependent’s health to get certain types of insurance coverage. Evidence of insurability (eoi) is the process where your insurance carrier determines whether you (or your dependents) are considered healthy enough to be eligible for certain benefits.

Source: resourcecenter.maxwellhealth.com

Source: resourcecenter.maxwellhealth.com

Evidence of insurability (eoi) is part of the application process for a life or health insurance policy during which an applicant provides health information. When you are taking an exam to get a life insurance, you are providing evidence of insurability. These can be used for transactions, shared by the buyer with the seller in a potential m&a m&a synergies m&a. Key takeaways the amount of life insurance coverage you. Evidence of insurability (eoi) is a record of a person’s past and current health events.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is eoi insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information