What is extended replacement cost on homeowners insurance Idea

Home » Trend » What is extended replacement cost on homeowners insurance IdeaYour What is extended replacement cost on homeowners insurance images are available in this site. What is extended replacement cost on homeowners insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What is extended replacement cost on homeowners insurance files here. Download all royalty-free photos.

If you’re looking for what is extended replacement cost on homeowners insurance images information linked to the what is extended replacement cost on homeowners insurance interest, you have come to the right blog. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

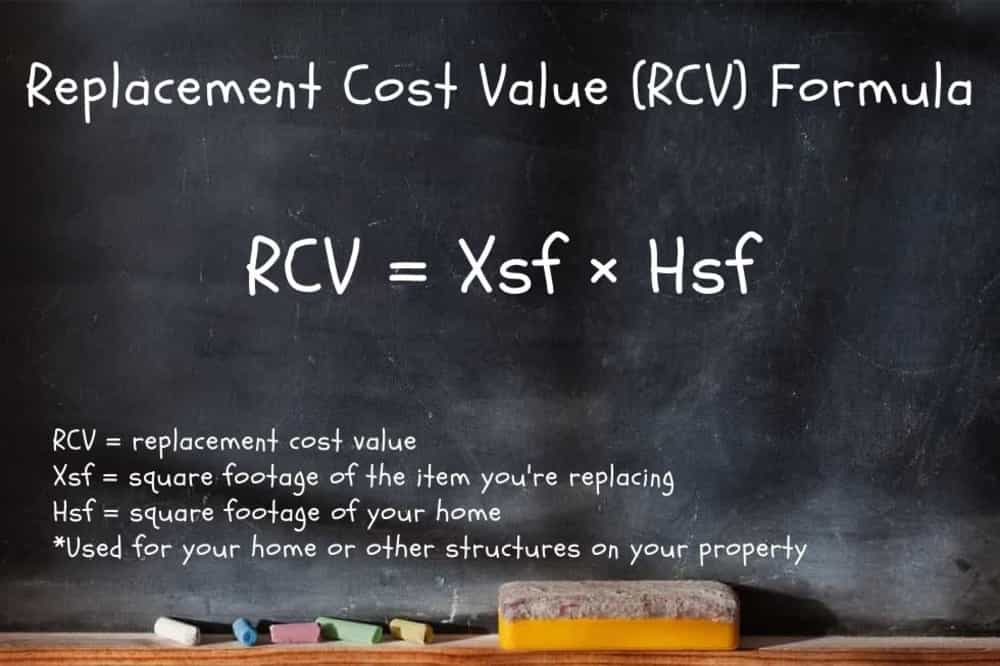

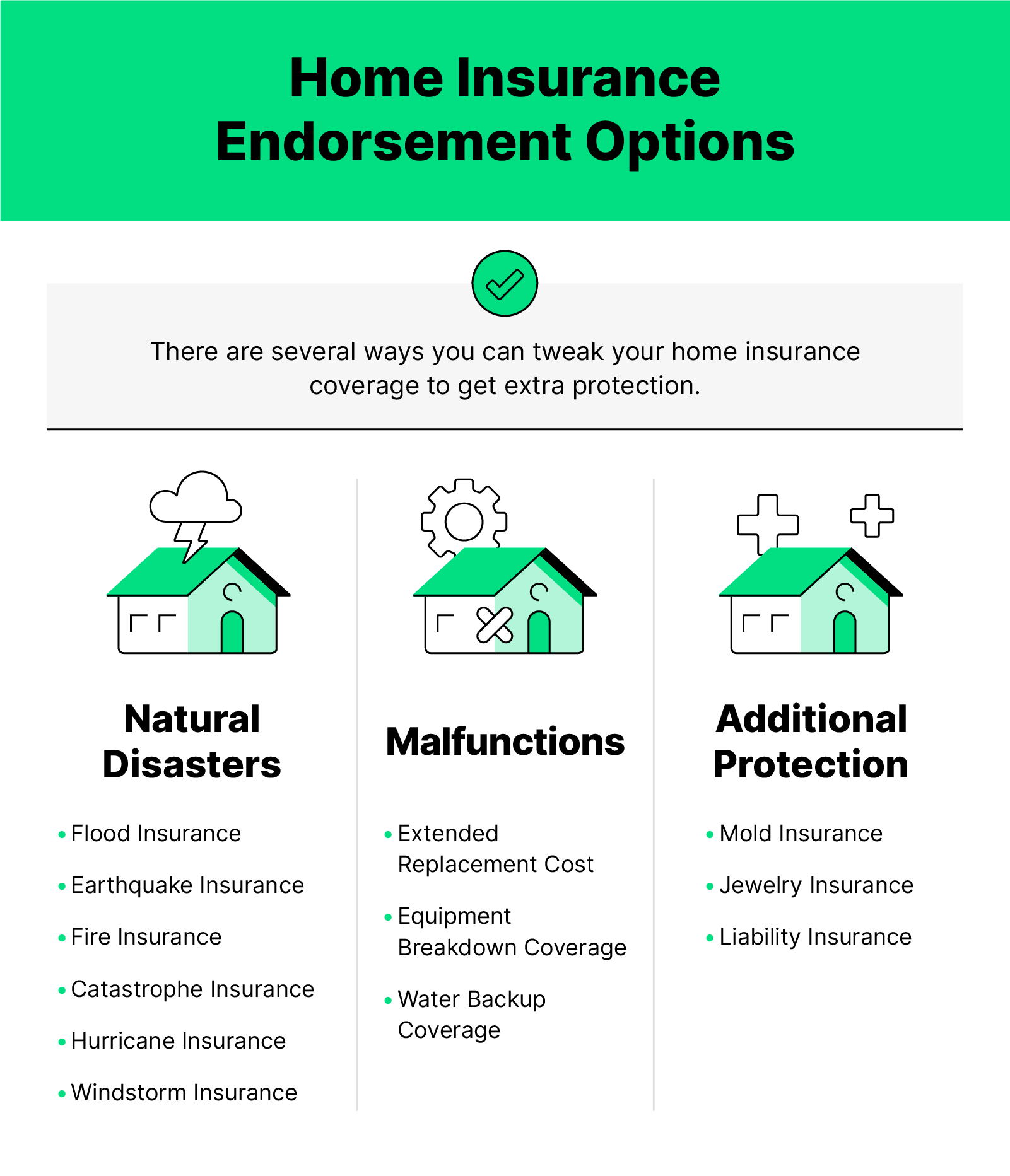

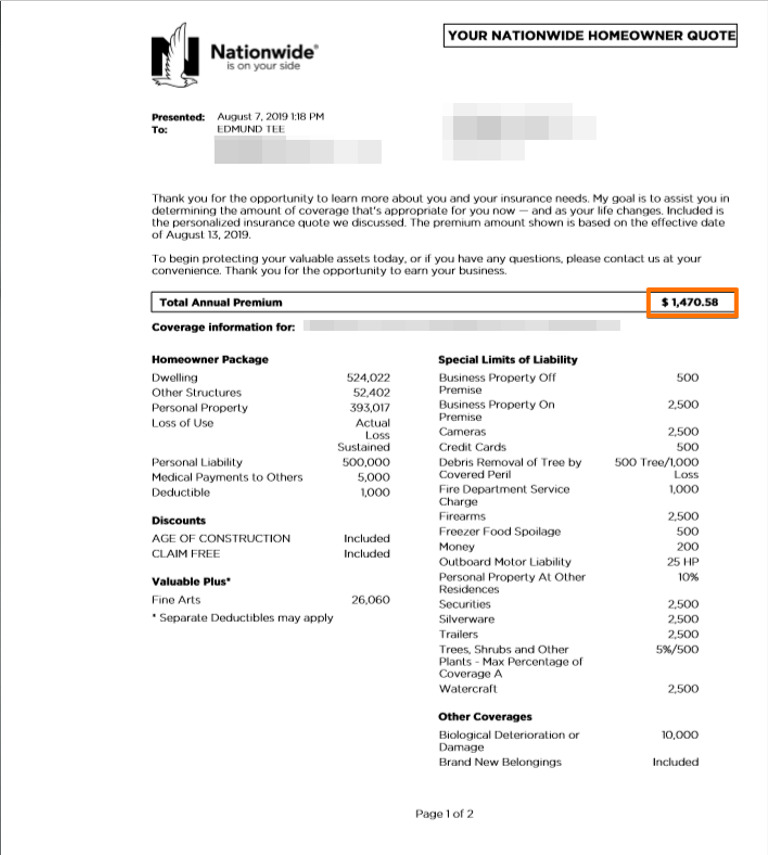

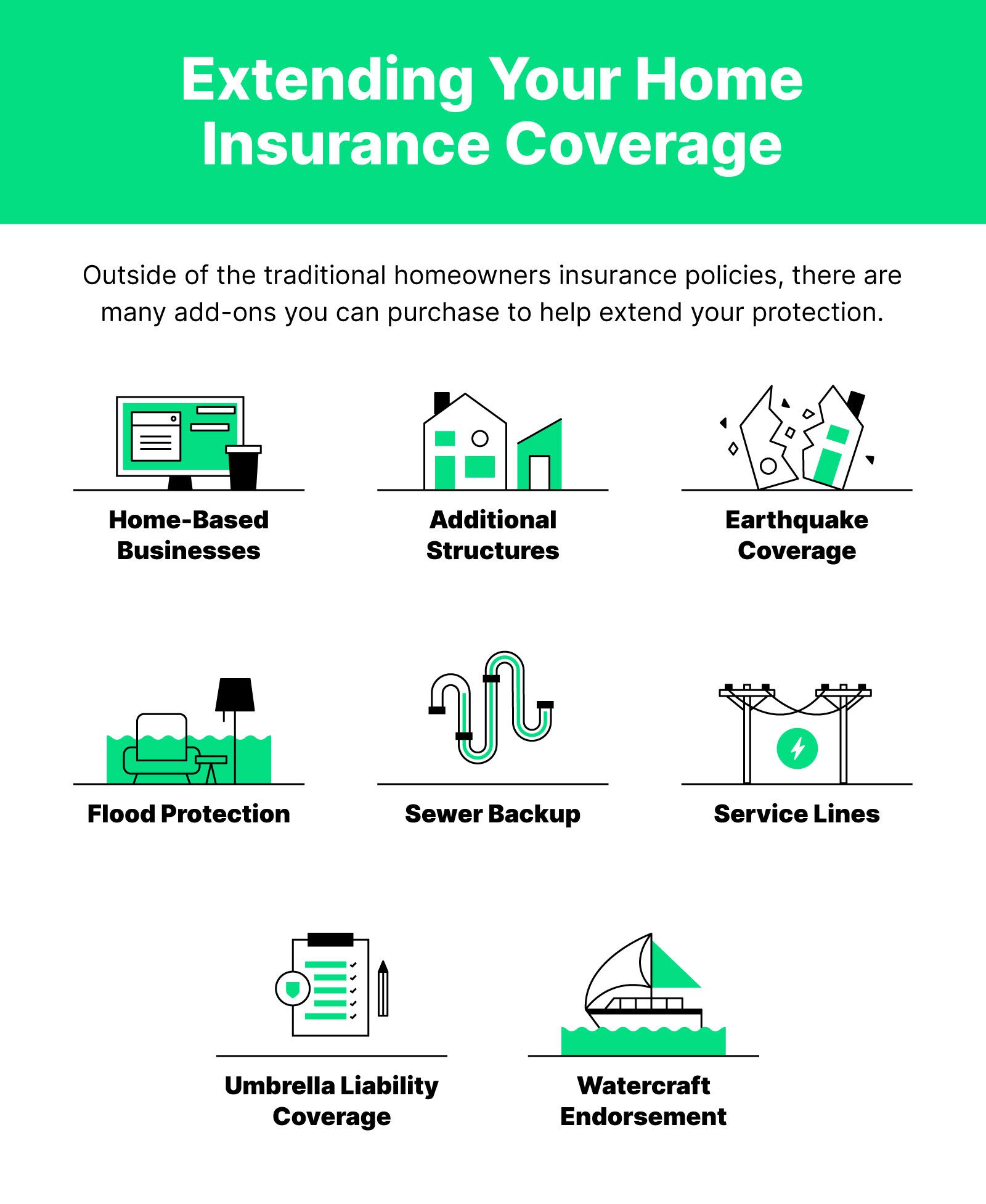

What Is Extended Replacement Cost On Homeowners Insurance. If your home is damaged, extended replacement cost provides coverage for your home to be rebuilt or repaired to its condition before the damage, even if if the cost to replace the house itself is more. Buying extended replacement cost coverage ensures that you have enough protection in case of increased costs. Rather than a guaranteed replacement policy, some insurance companies offer an extended replacement policy. Guaranteed replacement cost coverage pays to rebuild your house no matter that the cost.

Extended Replacement Cost Homeowners Insurance Insurance From jorbear1.blogspot.com

Extended Replacement Cost Homeowners Insurance Insurance From jorbear1.blogspot.com

Let�s say this particular homeowner extended theirs by 25%. It takes into account current construction techniques, prices for labor and materials, and the location of your home. Guaranteed replacement cost coverage pays to rebuild your house no matter that the cost. For example, if you have a policy with $200,000 of coverage and your home is totally destroyed, your insurance will pay up to $200,000 in repairs for a covered loss. Rather than a guaranteed replacement policy, some insurance companies offer an extended replacement policy. So if your dwelling coverage is set at $400,000, extended replacement cost coverage would provide up to $500,000 total to rebuild, if you need it.

Also known as extended dwelling coverage or increased replacement cost, extended replacement cost may help repair or rebuild your home after a covered loss when the cost of materials and labor have increased in.

The actual cost to rebuild your home is $280,000. 3 rows extended replacement cost is a homeowners insurance endorsement that provides an added. Most companies offer extended replacement in increments of 25% and 50% of your home’s dwelling coverage limit, meaning if your home is insured for $300,000 and you have 25% extended replacement cost, then your home is essentially insured for $375,000. Depending on the insurance company you chose, and the coverage options they offer, you may get only $200,000 for your claim, or $240,000, if you have an extended replacement cost option, or the full $280,00 it takes to rebuild, if you have a replacement cost guarantee. If you had $300,000 in coverage a, then: This type of coverage is the most.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

Depending on the insurance company you chose, and the coverage options they offer, you may get only $200,000 for your claim, or $240,000, if you have an extended replacement cost option, or the full $280,00 it takes to rebuild, if you have a replacement cost guarantee. What is extended replacement cost? If you had $300,000 in coverage a, then: Guaranteed replacement cost coverage pays to rebuild your house no matter that the cost. Extended replacement cost value coverage will pay out more than the face value of your dwelling coverage, up to a specified limit, if that’s what it takes to fix your home.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

For a home insured at $300,000, extended replacement cost would give you an extra $75,000 to work with. In the times of natural disaster where building material and labor costs go up substantially, your extended replacement cost coverage kicks in to add an additional 15% to 25% of coverage to your homeowners policy. If you had $300,000 in coverage a, then: Who should consider getting extended replacement cost What is extended replacement cost (erc) mean on my homeowners’ policy?

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

In the times of natural disaster where building material and labor costs go up substantially, your extended replacement cost coverage kicks in to add an additional 15% to 25% of coverage to your homeowners policy. Extended replacement cost is an expansion of your current dwelling coverage limit — it helps cover extra costs associated with rebuilding that are outside of your control and in excess of the coverage a limit on your policy. For example, if you have a policy with $200,000 of coverage and your home is totally destroyed, your insurance will pay up to $200,000 in repairs for a covered loss. Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. This coverage could pay a benefit ranging from approximately 120 to 125 percent.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

Extended replacement cost is an expansion of your current dwelling coverage limit — it helps cover extra costs associated with rebuilding that are outside of your control and in excess of the coverage a limit on your policy. Who should consider getting extended replacement cost Let�s say this particular homeowner extended theirs by 25%. Most companies offer extended replacement in increments of 25% and 50% of your home’s dwelling coverage limit, meaning if your home is insured for $300,000 and you have 25% extended replacement cost, then your home is essentially insured for $375,000. If your home is destroyed by a covered event — such as a fire or a windstorm — your insurer will only cover your dwelling up to your selected limit.

Source: pinterest.com.mx

Source: pinterest.com.mx

Extended replacement cost value coverage will pay out more than the face value of your dwelling coverage, up to a specified limit, if that’s what it takes to fix your home. This coverage will pay for the cost of rebuilding your home up to the policy amount. For a home insured at $300,000, extended replacement cost would give you an extra $75,000 to work with. We will even pay for upgrades made necessary by the loss due to modern building codes. Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home.

Source: dipsegovia.info

Source: dipsegovia.info

Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home. Let�s say this particular homeowner extended theirs by 25%. Extended replacement cost is an insurance endorsement that you can buy and add to your homeowners insurance coverage. The actual cost to rebuild your home is $280,000. Extended replacement cost coverage will pay a specific percentage over dwelling limit, such as 20% over.

Source: hippo.com

Source: hippo.com

In the unfortunate case your $270,000 home catches fire and burns to the ground, and is estimated to cost $300,000 to replace, extended replacement coverage will kick in and and pay the additional $30,000 to make you whole again. It takes into account current construction techniques, prices for labor and materials, and the location of your home. Most companies offer extended replacement in increments of 25% and 50% of your home’s dwelling coverage limit, meaning if your home is insured for $300,000 and you have 25% extended replacement cost, then your home is essentially insured for $375,000. Answer replacement cost is the total cost to rebuild your home just as it stands today. 3 rows extended replacement cost is a homeowners insurance endorsement that provides an added.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

Answer replacement cost is the total cost to rebuild your home just as it stands today. Rather than a guaranteed replacement policy, some insurance companies offer an extended replacement policy. If your home is destroyed by a covered event — such as a fire or a windstorm — your insurer will only cover your dwelling up to your selected limit. There are other levels of extended replacement cost as well. What is extended replacement cost (erc) mean on my homeowners’ policy?

Source: reviewhomewarranties.com

Source: reviewhomewarranties.com

Rather than a guaranteed replacement policy, some insurance companies offer an extended replacement policy. If you had $300,000 in coverage a, then: If your home is damaged, extended replacement cost provides coverage for your home to be rebuilt or repaired to its condition before the damage, even if if the cost to replace the house itself is more. For example, say your home has a replacement cost value (rcv) of $150,000, but you selected a coverage a limit of $120,000 on your homeowners insurance policy. This type of coverage is the most.

Source: tmib.com

Source: tmib.com

Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home. Guaranteed replacement cost coverage pays to rebuild your house no matter that the cost. In the times of natural disaster where building material and labor costs go up substantially, your extended replacement cost coverage kicks in to add an additional 15% to 25% of coverage to your homeowners policy. Let�s say this particular homeowner extended theirs by 25%. While both types of coverage help with the costs of rebuilding your home or replacing damaged items after a covered loss, actual cash value policies are based on the items� depreciated value while replacement cost coverage does.

Source: revisi.net

Source: revisi.net

An extended replacement cost (erc) can give you a little extra insurance coverage. 3 rows extended replacement cost is a homeowners insurance endorsement that provides an added. It takes into account current construction techniques, prices for labor and materials, and the location of your home. We will even pay for upgrades made necessary by the loss due to modern building codes. If your home is destroyed by a covered event — such as a fire or a windstorm — your insurer will only cover your dwelling up to your selected limit.

Source: news.leavitt.com

Source: news.leavitt.com

Extended replacement cost refers to an insurance policy that usually provides a benefit over and above the limits specified by the policy for replacing a damaged house. Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. That means that they would have an. Extended replacement cost coverage will pay a specific percentage over dwelling limit, such as 20% over. Extended replacement cost value coverage will pay out more than the face value of your dwelling coverage, up to a specified limit, if that’s what it takes to fix your home.

Source: lerablog.org

Source: lerablog.org

Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. Replacement cost is not the same as your home’s market value. We will even pay for upgrades made necessary by the loss due to modern building codes. Extended replacement cost refers to an insurance policy that usually provides a benefit over and above the limits specified by the policy for replacing a damaged house. Rather than a guaranteed replacement policy, some insurance companies offer an extended replacement policy.

Source: jorbear1.blogspot.com

For a home insured at $300,000, extended replacement cost would give you an extra $75,000 to work with. It takes into account current construction techniques, prices for labor and materials, and the location of your home. Extended replacement cost is an additional coverage option on your homeowner’s insurance. Most companies offer extended replacement in increments of 25% and 50% of your home’s dwelling coverage limit, meaning if your home is insured for $300,000 and you have 25% extended replacement cost, then your home is essentially insured for $375,000. Guaranteed replacement cost coverage pays to rebuild your house no matter that the cost.

Source: hippo.com

Source: hippo.com

Rather than a guaranteed replacement policy, some insurance companies offer an extended replacement policy. This coverage will pay for the cost of rebuilding your home up to the policy amount. We will even pay for upgrades made necessary by the loss due to modern building codes. Instead of guaranteed cost coverage, the extended replacement option covers an additional 20% to 25% of the replacement value of the home. Replacement cost is not the same as your home’s market value.

Source: reviewhomewarranties.com

Source: reviewhomewarranties.com

Guaranteed replacement coverage guaranteed replacement coverage is the premier choice of coverage for homeowners. Most extended replacement cost riders allow homeowners to extend their coverage by 10% to 50%. Replacement cost and actual cash value refer to how your homeowners insurance policy reimburses you for property damage after a covered loss. If your home is destroyed by a covered event — such as a fire or a windstorm — your insurer will only cover your dwelling up to your selected limit. Guaranteed replacement coverage guaranteed replacement coverage is the premier choice of coverage for homeowners.

Source: alignable.com

What is extended replacement cost (erc) mean on my homeowners’ policy? For a home insured at $300,000, extended replacement cost would give you an extra $75,000 to work with. Also known as extended dwelling coverage or increased replacement cost, extended replacement cost may help repair or rebuild your home after a covered loss when the cost of materials and labor have increased in. An extended replacement cost (erc) can give you a little extra insurance coverage. The actual cost to rebuild your home is $280,000.

Source: pahvantpost.com

Source: pahvantpost.com

If your home is destroyed by a covered event — such as a fire or a windstorm — your insurer will only cover your dwelling up to your selected limit. Extended replacement cost is an additional coverage option on your homeowner’s insurance. If you had $300,000 in coverage a, then: The limit can be a dollar amount or a percentage, such as 25% above your dwelling coverage amount. This coverage will pay for the cost of rebuilding your home up to the policy amount.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is extended replacement cost on homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information