What is face amount in life insurance information

Home » Trending » What is face amount in life insurance informationYour What is face amount in life insurance images are available. What is face amount in life insurance are a topic that is being searched for and liked by netizens now. You can Get the What is face amount in life insurance files here. Find and Download all royalty-free vectors.

If you’re searching for what is face amount in life insurance pictures information connected with to the what is face amount in life insurance topic, you have come to the ideal blog. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

What Is Face Amount In Life Insurance. The cash value is often stated on the top sheet of the policy, hence the name face amount. Only permanent life insurance policies, such as whole life and universal life, have a cash value account. Other life insurances have their face amounts refunded or repaid when the contract says to. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder.

Face amount of life insurance insurance From greatoutdoorsabq.com

Face amount of life insurance insurance From greatoutdoorsabq.com

In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts. In the case of whole life insurance the face amount is the initial death benefit that can fluctuate for numerous contractual reasons. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. You might hear it called your death benefit, coverage amount. Determining how much to choose for the face amount can be a challenge.

The amount paid out on a life insurance policy (such as $100,000 upon the death of the person named on the policy) is also termed the face amount, because it is stated on the first.

The face value of life insurance is the dollar amount equated to the worth of your policy. This number may be influenced by your income, family size, location, and financial goals. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder. In permanent insurance, the death benefit may be higher or lower than the face amount, depending on if the. On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company. Other life insurances have their face amounts refunded or repaid when the contract says to.

Source: zanran.com

Source: zanran.com

You can usually choose the policy to be in the amount of money you desire. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. It is used for life insurance policies. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. Face value is a factor in determining the monthly insurance premiums and.

Source: revisi.net

Source: revisi.net

You can usually choose the policy to be in the amount of money you desire. On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. Face value is a factor in determining the monthly insurance premiums and. It can also be referred to as the death benefit or the face amount of life insurance.

Source: slideserve.com

Source: slideserve.com

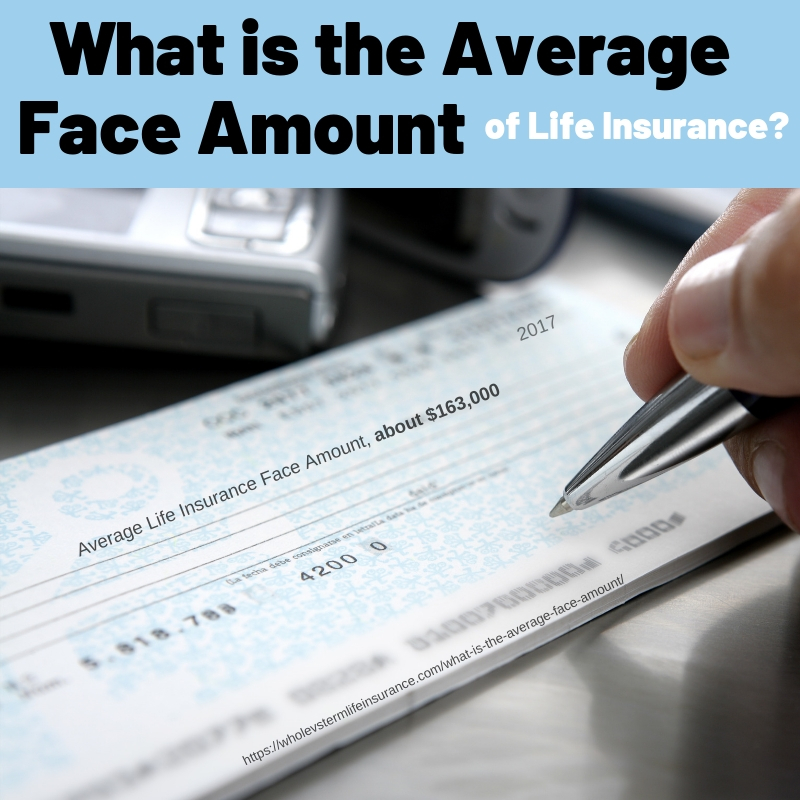

You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder. The average face amount of life insurance for calendar year 2017 was $163,000. The face value of a life insurance policy is the death benefit. Face value is a factor in determining the monthly insurance premiums and.

Source: alqurumresort.com

Source: alqurumresort.com

Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. The face value of a life insurance policy is the death benefit. Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the. The face amount of your life insurance means the total amount of money agreed upon by the insurance policy. In a life insurance contract, the stated sum of money to be paid to the beneficiary upon the insured

Source: pt.slideshare.net

Source: pt.slideshare.net

The average face amount of life insurance for calendar year 2017 was $163,000. The amount of premium depends on the age at which you purchase the life insurance policy and the amount of premium is calculated based on the face amount. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. There are other types of life insurance where the concept of the face amount is more complex. In life insurance, the policy’s face value should be high.

Source: wnd.com

Source: wnd.com

The amount paid out on a life insurance policy (such as $100,000 upon the death of the person named on the policy) is also termed the face amount, because it is stated on the first. You can usually choose the policy to be in the amount of money you desire. In life insurance, the policy’s face value should be high. Only permanent life insurance policies, such as whole life and universal life, have a cash value account. Face value is a factor in determining the monthly insurance premiums and.

Source: revisi.net

Source: revisi.net

All life insurance policies have a face value. The face amount in life insurance means the amount of insurance you buy. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts. It is used for life insurance policies. 1 we recommend doing your research and looking at your family’s spending habits and expenses to settle on the right face value.

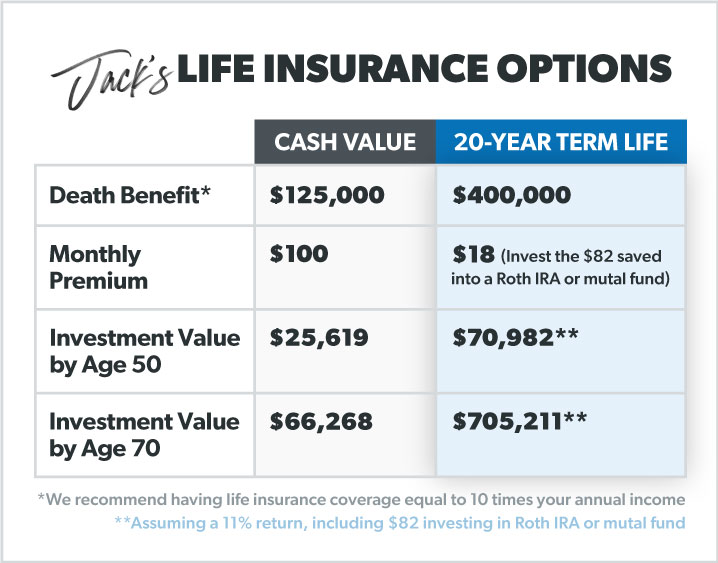

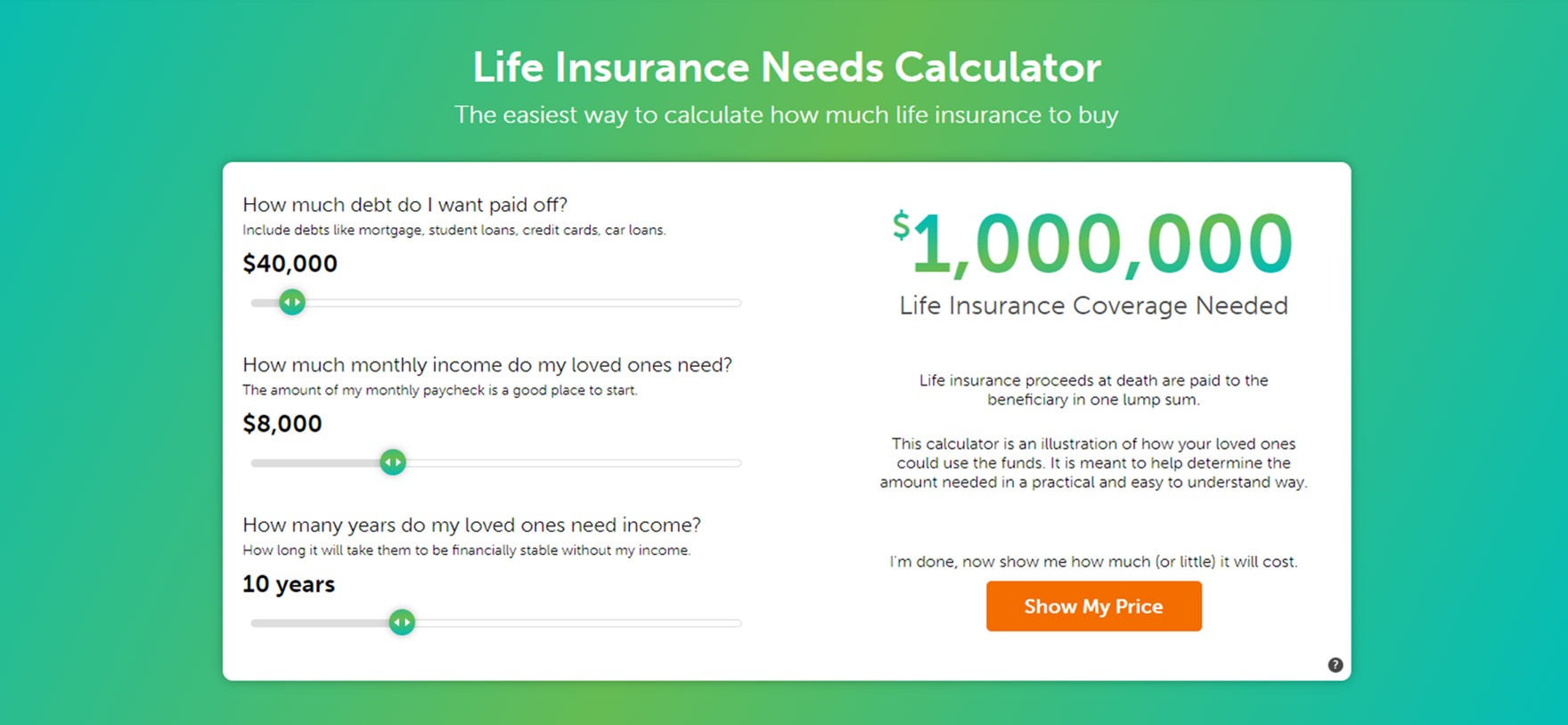

Source: daveramsey.com

Source: daveramsey.com

The amount of premium depends on the age at which you purchase the life insurance policy and the amount of premium is calculated based on the face amount. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company. You might hear it called your death benefit, coverage amount. In short, your face value is the amount of money your beneficiaries will receive from your insurance company at the time of your death.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Face amount is the gross total amount of cash quantified in an agreement or insurance policy. The face amount of your life insurance means the total amount of money agreed upon by the insurance policy. Face value is a factor in determining the monthly insurance premiums and. The face value of a life insurance policy or death benefit represents the amount of money that beneficiaries will receive from the insurance company at the time of death. With this topic, financial education and literacy are what matters.

Source: revisi.net

Source: revisi.net

Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. It is also the amount that is paid to the beneficiary or insured (if the policy matures), minus any loans, or increased by any values stated in the contract. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. 1 we recommend doing your research and looking at your family’s spending habits and expenses to settle on the right face value. In a life insurance contract, the stated sum of money to be paid to the beneficiary upon the insured

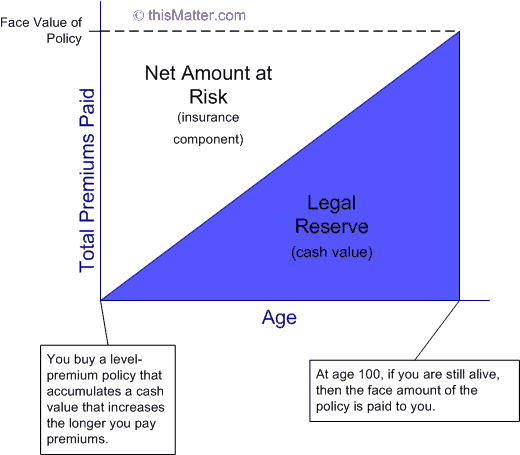

Source: thismatter.com

Source: thismatter.com

The death benefit is the amount that is actually paid to the beneficiary when death occurs. The face value of a life insurance policy is the death benefit. The average face amount of life insurance for calendar year 2017 was $163,000. There are other types of life insurance where the concept of the face amount is more complex. Face value is a factor in determining the monthly insurance premiums and.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The face amount of your life insurance means the total amount of money agreed upon by the insurance policy. There are other types of life insurance where the concept of the face amount is more complex. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. The face amount of a life insurance policy is the original dollar amount for which the policy was taken out. The death benefit is the amount that is actually paid to the beneficiary when death occurs.

Source: npa1.org

Source: npa1.org

Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. What is the face amount on an insurance policy? This is the amount of money someone will receive after your death. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract.

Source: quotacy.com

Source: quotacy.com

The face value of a life insurance policy is the death benefit. It is used for life insurance policies. This number may be influenced by your income, family size, location, and financial goals. In permanent insurance, the death benefit may be higher or lower than the face amount, depending on if the. The average face amount of life insurance for calendar year 2017 was $163,000.

Source: iammrfoster.com

Source: iammrfoster.com

1 we recommend doing your research and looking at your family’s spending habits and expenses to settle on the right face value. In life insurance, the policy’s face value should be high. A $100,000 life insurance policy has a face value of $100,000 and you borrowed $5,000 against it, thus your heirs will get $95,000 instead of $100,000 if your insurance provider subtracts the outstanding $5,000 loan from the face value. There are other types of life insurance where the concept of the face amount is more complex. When a life insurance policy is identified by a dollar amount, this amount is the face value.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

The face amount in life insurance means the amount of insurance you buy. A $500,000 policy therefore has a face value of $500,000. Normally, the face amount is a round number like $50,000 or $100,000. Face amount is calculated based on the amount of premium and the face. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your.

Source: mishkanet.com

Source: mishkanet.com

The face amount of life insurance is a very important component within a policy because it can help provide support to family members. In the case of whole life insurance the face amount is the initial death benefit that can fluctuate for numerous contractual reasons. In life insurance, the policy’s face value should be high. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts. The face amount is the purchased amount at the beginning of life insurance.

Source: revisi.net

Source: revisi.net

The face value is the amount of money your insurer has agreed to pay out when you die. In all cases, life insurance face value is the amount of money given to. The face amount in life insurance is how much coverage your life policy has or in other words, how much life insurance money is given to the beneficiary following the premature demise of the policyholder. The amount paid out on a life insurance policy (such as $100,000 upon the death of the person named on the policy) is also termed the face amount, because it is stated on the first. Face value is a factor in determining the monthly insurance premiums and.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is face amount in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information