What is face value of life insurance information

Home » Trending » What is face value of life insurance informationYour What is face value of life insurance images are available. What is face value of life insurance are a topic that is being searched for and liked by netizens today. You can Download the What is face value of life insurance files here. Get all free vectors.

If you’re looking for what is face value of life insurance images information related to the what is face value of life insurance topic, you have come to the ideal site. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

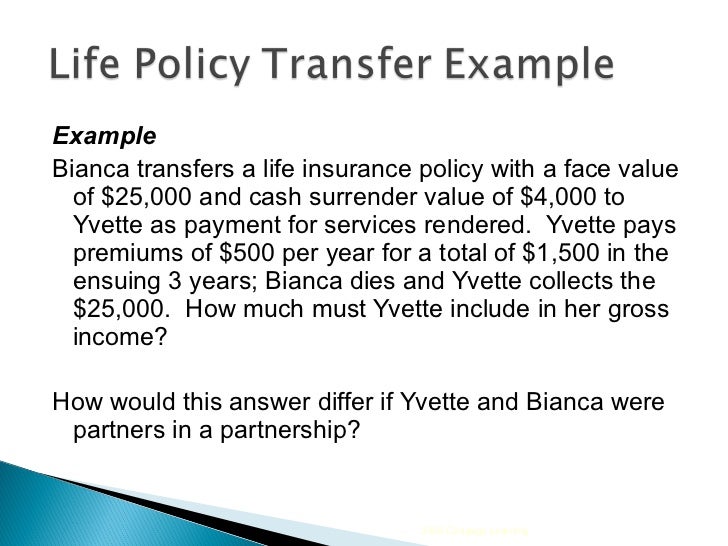

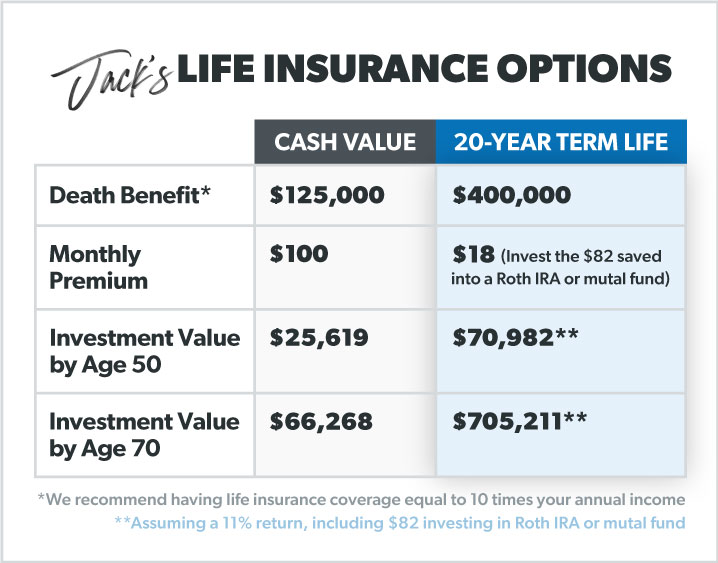

What Is Face Value Of Life Insurance. Both the cash value and face value are different in terms of how their monetary amounts are determined. Endowment is a taxable event. The face value of a life insurance policy is the death benefit. The cash value is built up through the amount paid, in which if you pay $5, then you also accrue $5 in cash value.

Face Value Life Insurance Face Value Insurance From insuranceinforme.blogspot.com

Face Value Life Insurance Face Value Insurance From insuranceinforme.blogspot.com

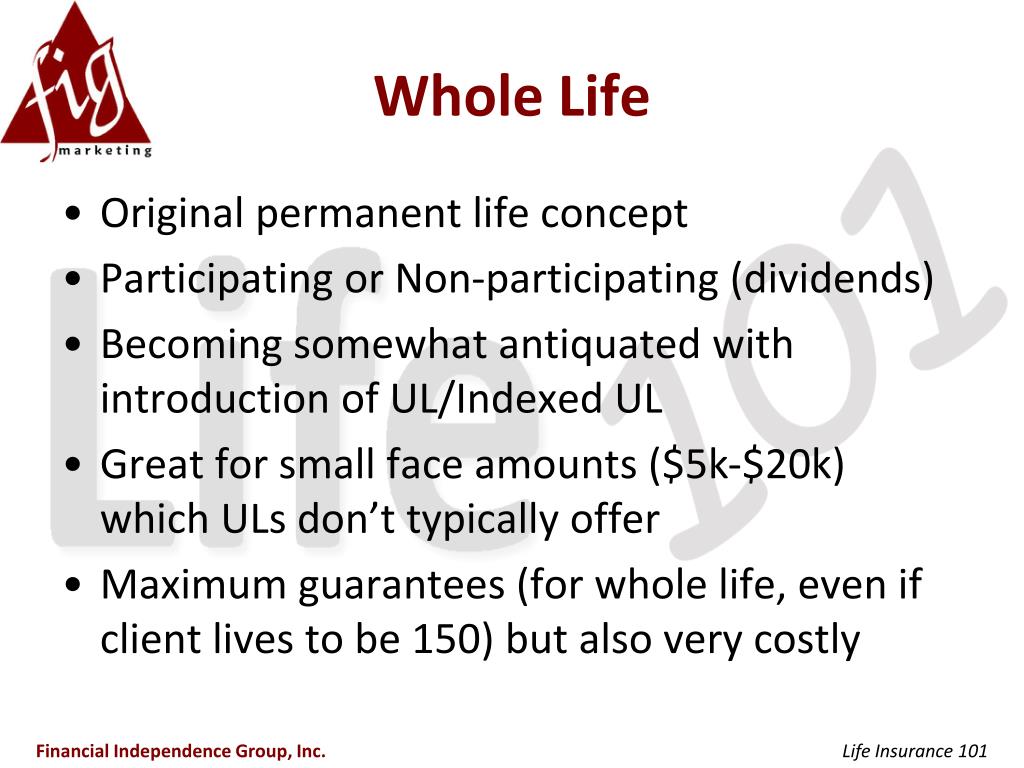

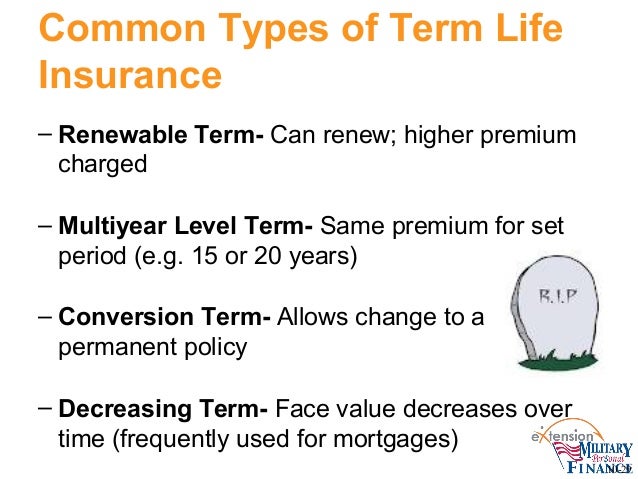

When this happens most policy�s “endow” and the policy owner receives the cash benefit. In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. In the case of whole life insurance the face amount is the. Endowment is a taxable event. It is used for life insurance policies. Face value can also be used synonymously with “face amount” or “coverage amount.”

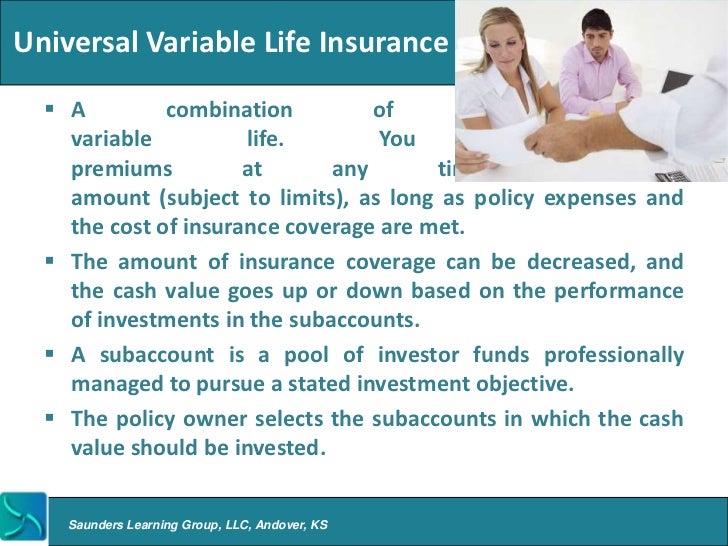

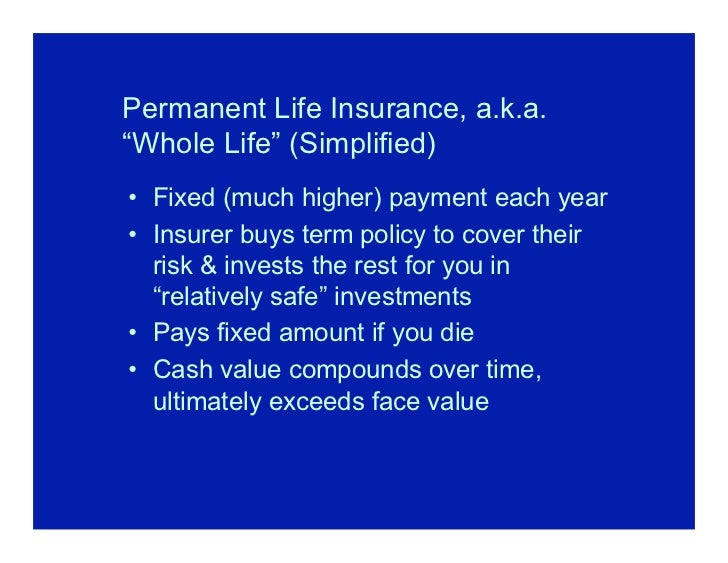

Cash value life insurance is a form of permanent life insurance—lasting for the lifetime of the holder—that features a cash value savings component.

What is the face amount of life insurance? The face value definition in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured. The face value is the death benefit, or the amount beneficiaries receive if the insured person dies while a policy is in force. Face value = annual premium/premium rate x $1,000. Within your policy, it is officially denoted as the death benefit. What is the face value of a life insurance policy?

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

Face amount is the gross total amount of cash quantified in an agreement or insurance policy. This event also cancels the life insurance policy. Many factors are used to correctly ascertain the fair market value of a life insurance policy, and calculating these factors is not an easy task. 2 the face value of life insurance is the dollar amount equated to the worth of your policy. What happens when you pass away?

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

Endowment is a taxable event. The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy, and it’s a primary factor in determining the amount of premium you pay. The life insurance is a contract to protect your heirs against the financial loss of your death. Annual premium = premium rate/$1,000 x face value. What is cash value life insurance?

Source: erroresseguramente.blogspot.com

What is the face value of a life insurance policy? The definition of fair market value is “the price at which a willing buyer is willing to pay to a willing seller for a given good or service.”. But only permanent life insurance policies have cash value, which functions similar to a savings or investment account that you can use while you’re still alive. Learn more about calculating the face value of life. Endowment is a taxable event.

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. The definition of fair market value is “the price at which a willing buyer is willing to pay to a willing seller for a given good or service.”. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. The cash value, or surrender value, is a savings component included in some life insurance policies that can accumulate cash value from premium payments. The face value of a whole life insurance policy is also known as the death benefit of the policy.

Source: eskotti.blogspot.com

Source: eskotti.blogspot.com

All life insurance policies have a face amount, which is also called the death benefit, this is the amount that’s paid to your beneficiaries after you die. Whole life and universal life policies are considered permanent life insurance because they will provide coverage for the lifetime of the insured. When you buy a life insurance policy, you insure your life for a specific benefit, stated as the face amount. Annual premium = premium rate/$1,000 x face value. Many factors are used to correctly ascertain the fair market value of a life insurance policy, and calculating these factors is not an easy task.

Source: howtoshopforlifeinsurancenensan.blogspot.com

Source: howtoshopforlifeinsurancenensan.blogspot.com

What is the face amount of life insurance? It is used for life insurance policies. It can also be referred to as the death benefit or the face amount of life insurance. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. Cash value and face value are two elements that make up a permanent life policy.

Source: seniorslifeinsurancedookuni.blogspot.com

Source: seniorslifeinsurancedookuni.blogspot.com

What is the face value of a life insurance policy? The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. But only permanent life insurance policies have cash value, which functions similar to a savings or investment account that you can use while you’re still alive. What happens when you pass away? It is used for life insurance policies.

Source: inthebox.buzz

Source: inthebox.buzz

What is the face value of a life insurance policy? Face amount is the gross total amount of cash quantified in an agreement or insurance policy. Annual premium = premium rate/$1,000 x face value. What is the face amount of life insurance? Whole life and universal life policies are considered permanent life insurance because they will provide coverage for the lifetime of the insured.

Source: howtoshopforlifeinsurancenensan.blogspot.com

Source: howtoshopforlifeinsurancenensan.blogspot.com

When you buy a life insurance policy, you insure your life for a specific benefit, stated as the face amount. All life insurance policies have a face amount, which is also called the death benefit, this is the amount that’s paid to your beneficiaries after you die. Depending on the type of insurance policy, the death benefit may decrease over time, such as with credit life insurance purchased to cover a home mortgage that decreases as the mortgage is paid off. If you die, your beneficiaries receive this payment from the life insurance company. This event also cancels the life insurance policy.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

Learn more about calculating the face value of life. In the case of whole life insurance the face amount is the. The face value of a whole life insurance policy is also known as the death benefit of the policy. Death benefit, the amount that�s paid out to beneficiaries when the insured person passes away.this is often referred to as the face value of your policy, or the amount of life insurance coverage you purchased (for example, a $500,000 whole life insurance policy).; It can also be referred to as the death benefit or the face amount of life insurance.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

In short, your face value is the amount of money your beneficiaries will receive from. What happens when you pass away? Learn more about calculating the face value of life. Face value can also be used synonymously with “face amount” or “coverage amount.” The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away.

Source: slideshare.net

Source: slideshare.net

The face value of a whole life insurance policy is also known as the death benefit of the policy. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. Cash value life insurance is a type of life insurance policy that’s in place for your whole life and comes with a sort of savings account built into it. The face value of a life insurance policy is the death benefit. Some permanent life insurance policies offer two features:

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

That amount is often the amount you choose when you apply for and purchase life insurance coverage. What is cash value life insurance? The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy, and it’s a primary factor in determining the amount of premium you pay. The life insurance is a contract to protect your heirs against the financial loss of your death. With an added cash value option, your life insurance policy can help contribute to a retirement nest egg or rainy day fund for immediate access to cash.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

Both the cash value and face value are different in terms of how their monetary amounts are determined. This event also cancels the life insurance policy. Annual premium = premium rate/$1,000 x face value. In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. What is the face value of a life insurance policy?

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. Within your policy, it is officially denoted as the death benefit. When this happens most policy�s “endow” and the policy owner receives the cash benefit. Whole life and universal life policies are considered permanent life insurance because they will provide coverage for the lifetime of the insured. Many factors are used to correctly ascertain the fair market value of a life insurance policy, and calculating these factors is not an easy task.

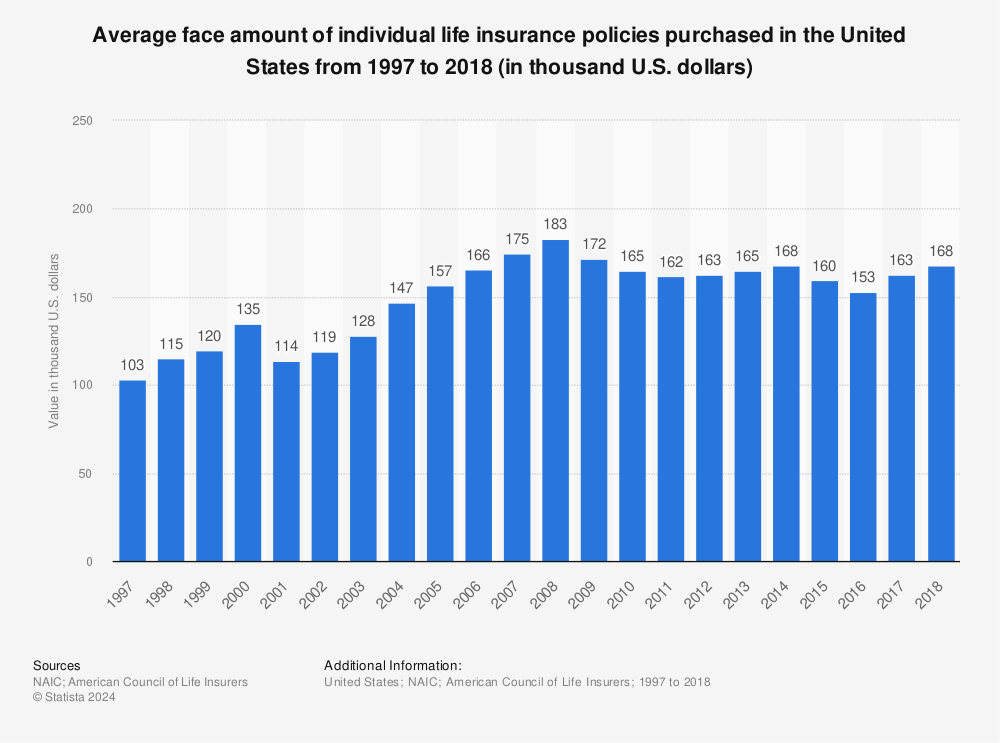

Source: statista.com

Source: statista.com

The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. What is cash value life insurance? All life insurance policies have a face amount, which is also called the death benefit, this is the amount that’s paid to your beneficiaries after you die. In the case of whole life insurance the face amount is the. Cash value life insurance is a form of permanent life insurance—lasting for the lifetime of the holder—that features a cash value savings component.

Source: howtoshopforlifeinsurancenensan.blogspot.com

Source: howtoshopforlifeinsurancenensan.blogspot.com

This event also cancels the life insurance policy. 2 the face value of life insurance is the dollar amount equated to the worth of your policy. Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. This event also cancels the life insurance policy. Learn more about calculating the face value of life.

Source: fsco.gov.on.ca

Source: fsco.gov.on.ca

In short, your face value is the amount of money your beneficiaries will receive from. Face value can also be used synonymously with “face amount” or “coverage amount.” When this happens most policy�s “endow” and the policy owner receives the cash benefit. When you buy a life insurance policy, you insure your life for a specific benefit, stated as the face amount. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is face value of life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information