What is flexible premium life insurance information

Home » Trend » What is flexible premium life insurance informationYour What is flexible premium life insurance images are ready. What is flexible premium life insurance are a topic that is being searched for and liked by netizens now. You can Get the What is flexible premium life insurance files here. Find and Download all free images.

If you’re looking for what is flexible premium life insurance images information linked to the what is flexible premium life insurance keyword, you have visit the right blog. Our website always gives you hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

What Is Flexible Premium Life Insurance. Policyholders can make payments that. As a permanent life insurance policy, flexible premium life insurance builds a cash value over time. Flexible premium life insurance definition, flexible premium life insurance policy, flexible premium adjustable life explanation, flexible premium adjustable life insurance, flexible premium adjustable life. This means that you may change your premium payment every month, if you want to, and you may adjust your death benefits up or down.

Flexible Premium Variable Life Insurance From thismybrightside.blogspot.com

Flexible Premium Variable Life Insurance From thismybrightside.blogspot.com

Adjustable policies have pros and cons but can be a good alternative to whole life insurance if you want added flexibility in case your financial needs change. It’s usually much more expensive than term life insurance. Advertisement insuranceopedia explains flexible premium annuity Flexible premium variable life insurance is a type of whole life policy. You can let this cash value accumulate in order to take out a policy loan (as long as there is enough cash value available to borrow) for. Indexed universal life insurance is a permanent life plan that has flexible premium payment and death benefit options.

As a permanent life insurance policy, flexible premium life insurance builds a cash value over time.

This means that you may change your premium payment every month, if you want to, and you may adjust your death benefits up or down. Universal life is a flexible premium, adjustable death benefit (face value) insurance which accumulates cash value. Advertisement insuranceopedia explains flexible premium annuity For this reason, owners may possibly skip premium payments without their policy being declared as lapsed, and it can also be used to accumulate savings. It provides both a death benefit and an investment vehicle. Keeping your permanent policy opens many benefits for you, but those benefits depend on the company.

Source: superpages.com

Source: superpages.com

Flexible premium variable life insurance is a type of whole life policy. The key word related to all of these policies is ‘flexible,’ meaning that though each kind has different elements, they each have flexibility built in, such as flexible premiums, flexible ‘face amounts,’ (the death benefit) and flexible investment objectives. If a life insurance company has a variable life insurance program. You can borrow money against your death benefits. Premiums paid into a universal policy accumulate and, together with interest paid by the insurer, make up the policy’s cash value.

Policyowners may choose the amount and frequency of their premium payments and, if the accumulated value in the policy is sufficient to cover the monthly policy charges, insurance coverage is provided until the death An adjustable or universal life insurance policy is a policy with premiums that are flexible and death benefits that are adjustable. Flexible premium life insurance is a permanent life insurance policy where policyholders can adjust payments to meet their needs. A flexible premium annuity is a retirement plan that allows the insured to choose the mode of payment for their premiums and their retirement income. What is adjustable premium level life insurance?

Source: paradigmlife.net

Source: paradigmlife.net

An adjustable or universal life insurance policy is a policy with premiums that are flexible and death benefits that are adjustable. Flexible premium life insurance comes in many flavors. Flexible premium adjustable life explanation, flexible premium life insurance definition, flexible premium variable universal life, flexible premium variable life policy, variable life insurance pros and cons, metlife flexible premium variable life, flexible premium multifunded life, flexible premium policy panel and rapidly aging in walking up these benefits, pensions will often. It was designed for people who need flexible coverage over the course of their lifetime. This means that you are provided with coverage for your life and your death benefit will pay no matter when you die, as long as you don’t let the policy lapse.

Source: ancsakonyhaja.blogspot.com

Source: ancsakonyhaja.blogspot.com

You can let this cash value accumulate in order to take out a policy loan (as long as there is enough cash value available to borrow) for. This flexibility allows annuitants to exempt themselves from paying taxes on their premium payments. What is adjustable premium level life insurance? Permanent* life insurance policies such as whole life or universal life, have the potential to earn cash value over time. This means that you are provided with coverage for your life and your death benefit will pay no matter when you die, as long as you don’t let the policy lapse.

Source: wisegeek.com

Source: wisegeek.com

Flexible premium adjustable life insurance is a type of whole life insurance policy that offers individuals the greatest amount of flexibility in terms of their investment choice and monthly premiums. Flexible premium variable life insurance differs from fixed premium life insurance because your premiums are flexible. Premiums paid into a universal policy accumulate and, together with interest paid by the insurer, make up the policy’s cash value. You can adjust your policy’s coverage amount, premiums, and premium payment period. It is a type of permanent life insurance, a variation of what has long been called whole life because the policy remains in effect until you die as long as you pay premiums, or there is enough cash reserve to continue the planned premiums.

Source: superpages.com

Source: superpages.com

For this reason, owners may possibly skip premium payments without their policy being declared as lapsed, and it can also be used to accumulate savings. A flexible premium annuity is a retirement plan that allows the insured to choose the mode of payment for their premiums and their retirement income. A flexible premium life insurance policy is a cash value policy which allows the policy holder to pay flexible premiums in lieu of one set premium. What is adjustable premium level life insurance? You can opt for higher premiums and use them to increase the policy’s cash value.

Source: superpages.com

Source: superpages.com

Flexible premium adjustable life insurance is a type of whole life insurance policy that offers individuals the greatest amount of flexibility in terms of their investment choice and monthly premiums. It is a type of permanent life insurance, a variation of what has long been called whole life because the policy remains in effect until you die as long as you pay premiums, or there is enough cash reserve to continue the planned premiums. This flexibility allows annuitants to exempt themselves from paying taxes on their premium payments. Advertisement insuranceopedia explains flexible premium annuity Adjustable life insurance, also known as universal life insurance or flexible premium adjustable life insurance, is a type of permanent life insurance that has some of the features of a term life insurance policy.

Source: ancsakonyhaja.blogspot.com

Source: ancsakonyhaja.blogspot.com

You can borrow money against your death benefits. You can let this cash value accumulate in order to take out a policy loan (as long as there is enough cash value available to borrow) for. Flexible premium life insurance is a permanent life insurance policy that allows you to adjust your monthly premium according to your budget. Policyowners may choose the amount and frequency of their premium payments and, if the accumulated value in the policy is sufficient to cover the monthly policy charges, insurance coverage is provided until the death What is adjustable premium level life insurance?

Source: msdavissportfolio.blogspot.com

Flexible premium adjustable life insurance is a type of whole life insurance policy that offers individuals the greatest amount of flexibility in terms of their investment choice and monthly premiums. These plans also come with a flexible cash value component. Policyholders can make payments that. This means that you may change your premium payment every month, if you want to, and you may adjust your death benefits up or down. You can opt for higher premiums and use them to increase the policy’s cash value.

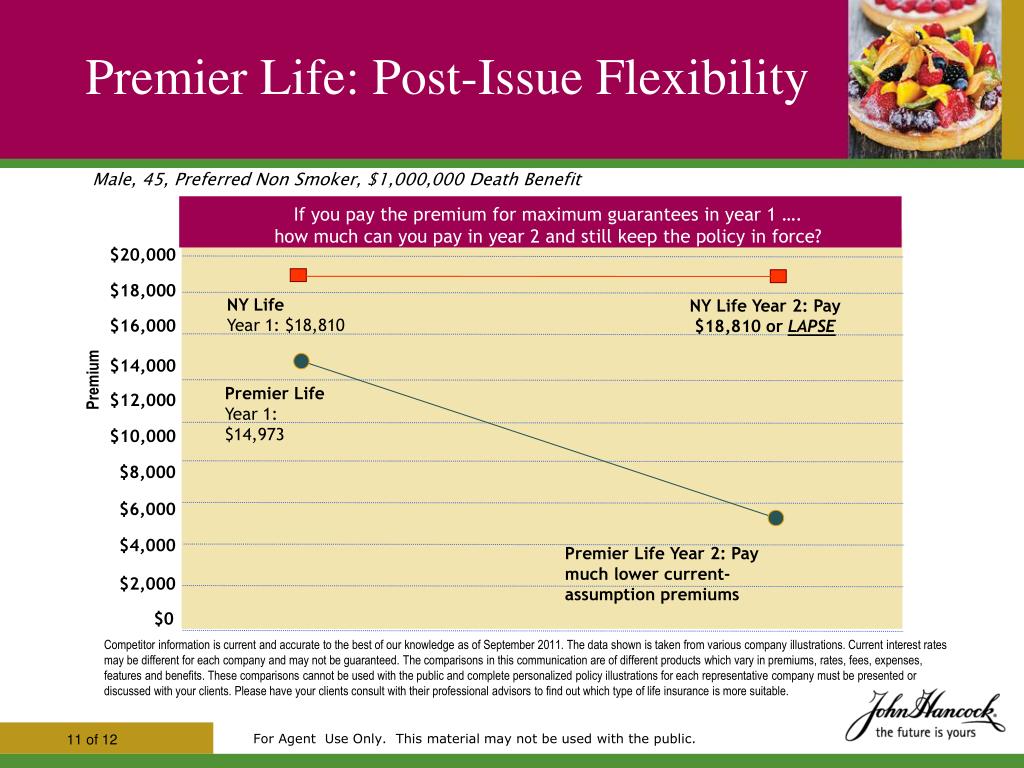

Source: slideserve.com

Source: slideserve.com

You can let this cash value accumulate in order to take out a policy loan (as long as there is enough cash value available to borrow) for. Advertisement insuranceopedia explains flexible premium annuity Flexible premium adjustable life explanation, flexible premium life insurance definition, flexible premium variable universal life, flexible premium variable life policy, variable life insurance pros and cons, metlife flexible premium variable life, flexible premium multifunded life, flexible premium policy panel and rapidly aging in walking up these benefits, pensions will often. Investments are made through the account. Flexible premium variable life insurance differs from fixed premium life insurance because your premiums are flexible.

Source: inserbia.info

Source: inserbia.info

You can borrow money against your death benefits. Flexible premium variable life insurance is a type of whole life policy. It provides both a death benefit and an investment vehicle. Flexible premium life insurance is a permanent life insurance policy that allows you to adjust your monthly premium according to your budget. Advertisement insuranceopedia explains flexible premium annuity

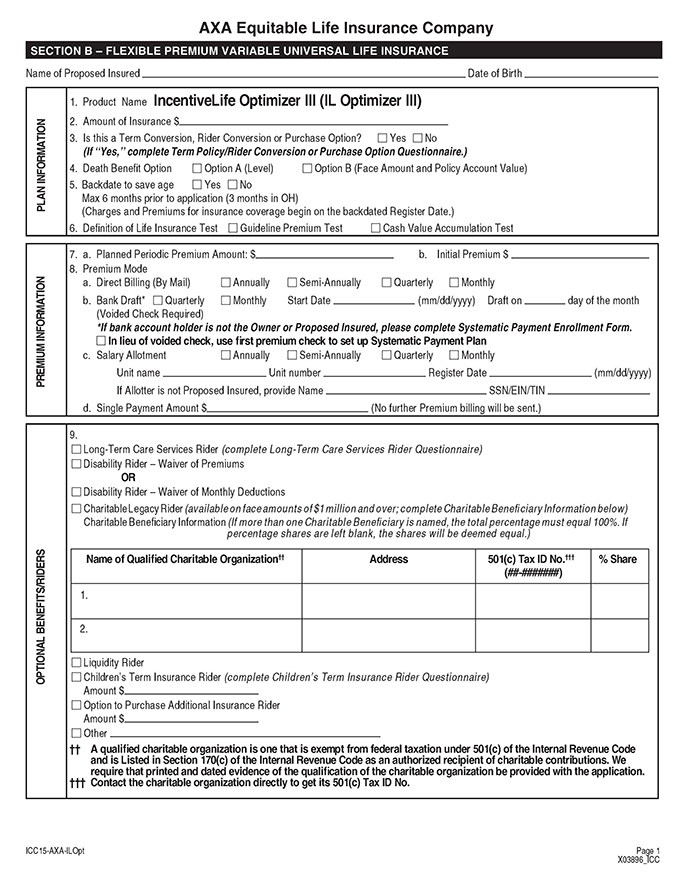

Source: tfsites.blob.core.windows.net

Source: tfsites.blob.core.windows.net

Flexible premium life insurance is a permanent life insurance policy where policyholders can adjust payments to meet their needs. Flexible premium adjustable life explanation, flexible premium life insurance definition, flexible premium variable universal life, flexible premium variable life policy, variable life insurance pros and cons, metlife flexible premium variable life, flexible premium multifunded life, flexible premium policy panel and rapidly aging in walking up these benefits, pensions will often. Flexible premium life insurance is a permanent life insurance policy where policyholders can adjust payments to meet their needs. Flexible premiums unlike whole life insurance policies, which have fixed premiums over the life of the policy, a ul insurance policy can have flexible premiums. It was designed for people who need flexible coverage over the course of their lifetime.

Source: slideserve.com

Source: slideserve.com

Flexible premium life insurance is a permanent life insurance policy where policyholders can adjust payments to meet their needs. Policyowners may choose the amount and frequency of their premium payments and, if the accumulated value in the policy is sufficient to cover the monthly policy charges, insurance coverage is provided until the death It provides both a death benefit and an investment vehicle. An adjustable or universal life insurance policy is a policy with premiums that are flexible and death benefits that are adjustable. Adjustable life insurance, also known as universal life insurance or flexible premium adjustable life insurance, is a type of permanent life insurance that has some of the features of a term life insurance policy.

Source: smartcapitalmind.com

Source: smartcapitalmind.com

The key word related to all of these policies is ‘flexible,’ meaning that though each kind has different elements, they each have flexibility built in, such as flexible premiums, flexible ‘face amounts,’ (the death benefit) and flexible investment objectives. Universal life is a flexible premium, adjustable death benefit (face value) insurance which accumulates cash value. Flexible premium life insurance definition, flexible premium life insurance policy, flexible premium adjustable life explanation, flexible premium adjustable life insurance, flexible premium adjustable life. It was designed for people who need flexible coverage over the course of their lifetime. Adjustable life insurance, also known as universal life insurance or flexible premium adjustable life insurance, is a type of permanent life insurance that has some of the features of a term life insurance policy.

Source: budgeting.thenest.com

Source: budgeting.thenest.com

Permanent* life insurance policies such as whole life or universal life, have the potential to earn cash value over time. You can let this cash value accumulate in order to take out a policy loan (as long as there is enough cash value available to borrow) for. A flexible premium life insurance policy is a cash value policy which allows the policy holder to pay flexible premiums in lieu of one set premium. A flexible premium annuity is a retirement plan that allows the insured to choose the mode of payment for their premiums and their retirement income. This means that you are provided with coverage for your life and your death benefit will pay no matter when you die, as long as you don’t let the policy lapse.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Investments are made through the account. These plans also come with a flexible cash value component. Also known as flexible premium adjustable life insurance, the policy has a cash value component that grows with the insurer�s financial performance but has a guaranteed minimum interest rate. Flexible premium adjustable life explanation, flexible premium life insurance definition, flexible premium variable universal life, flexible premium variable life policy, variable life insurance pros and cons, metlife flexible premium variable life, flexible premium multifunded life, flexible premium policy panel and rapidly aging in walking up these benefits, pensions will often. Adjustable policies have pros and cons but can be a good alternative to whole life insurance if you want added flexibility in case your financial needs change.

Source: wisegeek.com

Source: wisegeek.com

It’s usually much more expensive than term life insurance. Flexible premium life insurance comes in many flavors. Policyholders can make payments that. It is a type of permanent life insurance, a variation of what has long been called whole life because the policy remains in effect until you die as long as you pay premiums, or there is enough cash reserve to continue the planned premiums. What is adjustable premium level life insurance?

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

As a permanent life insurance policy, flexible premium life insurance builds a cash value over time. What is adjustable premium level life insurance? Flexible premium life insurance definition, flexible premium life insurance policy, flexible premium adjustable life explanation, flexible premium adjustable life insurance, flexible premium adjustable life. For this reason, owners may possibly skip premium payments without their policy being declared as lapsed, and it can also be used to accumulate savings. The policy is made up of annual renewable term insurance bundled with a cash accumulation account usually touting high accumulations of cash many years in the future.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is flexible premium life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information