What is florida s definition of life insurance replacement information

Home » Trending » What is florida s definition of life insurance replacement informationYour What is florida s definition of life insurance replacement images are ready. What is florida s definition of life insurance replacement are a topic that is being searched for and liked by netizens today. You can Download the What is florida s definition of life insurance replacement files here. Find and Download all free photos.

If you’re searching for what is florida s definition of life insurance replacement pictures information related to the what is florida s definition of life insurance replacement topic, you have come to the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

What Is Florida S Definition Of Life Insurance Replacement. The rules of engagement are stringent. The money from your life insurance policy can help your family pay bills and cover living expenses. There are two basic types of life insurance: According to florida’s life insurance replacement laws, a policyowner must be provided with a written comparison and.

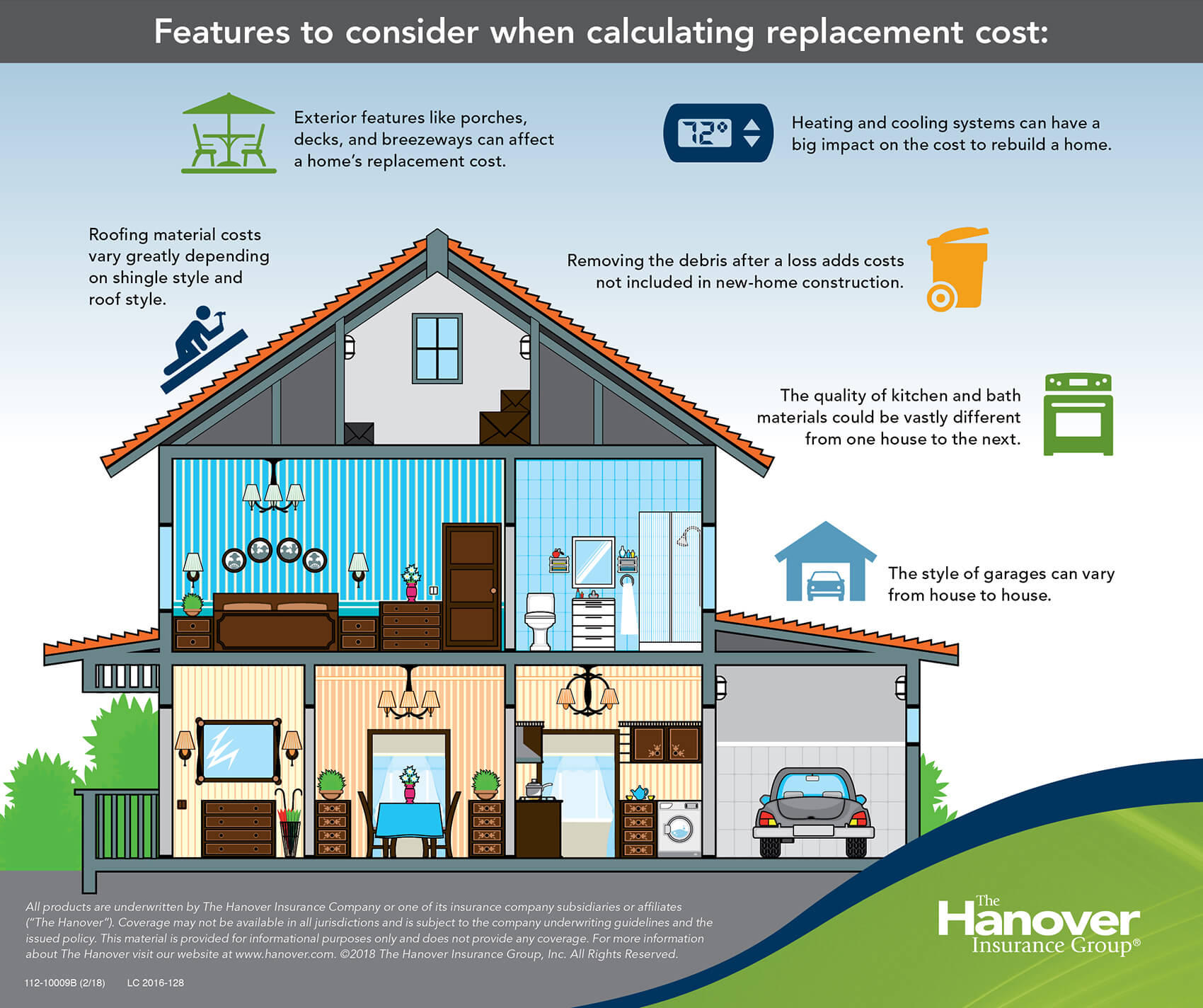

Understanding your home�s replacement cost The Hanover From hanover.com

Understanding your home�s replacement cost The Hanover From hanover.com

We will spare you the history lesson and only add that whole life insurance is the original type of life insurance. Protects individuals and their families from financial hardship when illness or injury prevents them from earning a living. Depending on the insurance company, evidence of insurability may include two. If an annuity owner is a florida resident and the insurance company licensed to sell annuities in florida becomes insolvent, a fixed deferred annuity will be guaranteed by the florida life & health insurance guaranty association (flhiga) for up to an aggregate amount of $250,000. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. Replacement of life insurance or annuities (this notice must be signed by the applicant and broker, with the original sent to standard insurance company and a copy left with the applicant.) definition:

Agents are required to complete a definition of replacement form for every life insurance or annuity sale in the state of new york, whether or not a replacement is proposed.

Fifth, it gives advantages to tricks over honestly and could damage the insurance industry in the long run. Replacement policy [insurance] law and legal definition. The rules of engagement are stringent. Reasons why they would replace their policy with a new one include changing the level of. In part, evidence of insurability is a statement that proves to the insurance carrier that you qualify for the coverage you’re applying for. Financial services commission of ontario subject:

Source: bucaramangacity.com

Source: bucaramangacity.com

Replacement policy is an insurance policy between an insurance company and a consumer which promises to pay the insured the replacement value of the subject of the policy if a loss occurs. Agents are required to complete a definition of replacement form for every life insurance or annuity sale in the state of new york, whether or not a replacement is proposed. A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. The notice shall list all life insurance policies or annuities proposed to be replaced, properly identified by name of insurer, the insured or annuitant, and policy or contract number if available; Replacement cost is a term used to describe the amount it would cost an individual or business to replace an existing asset with a similar asset at today’s market prices.

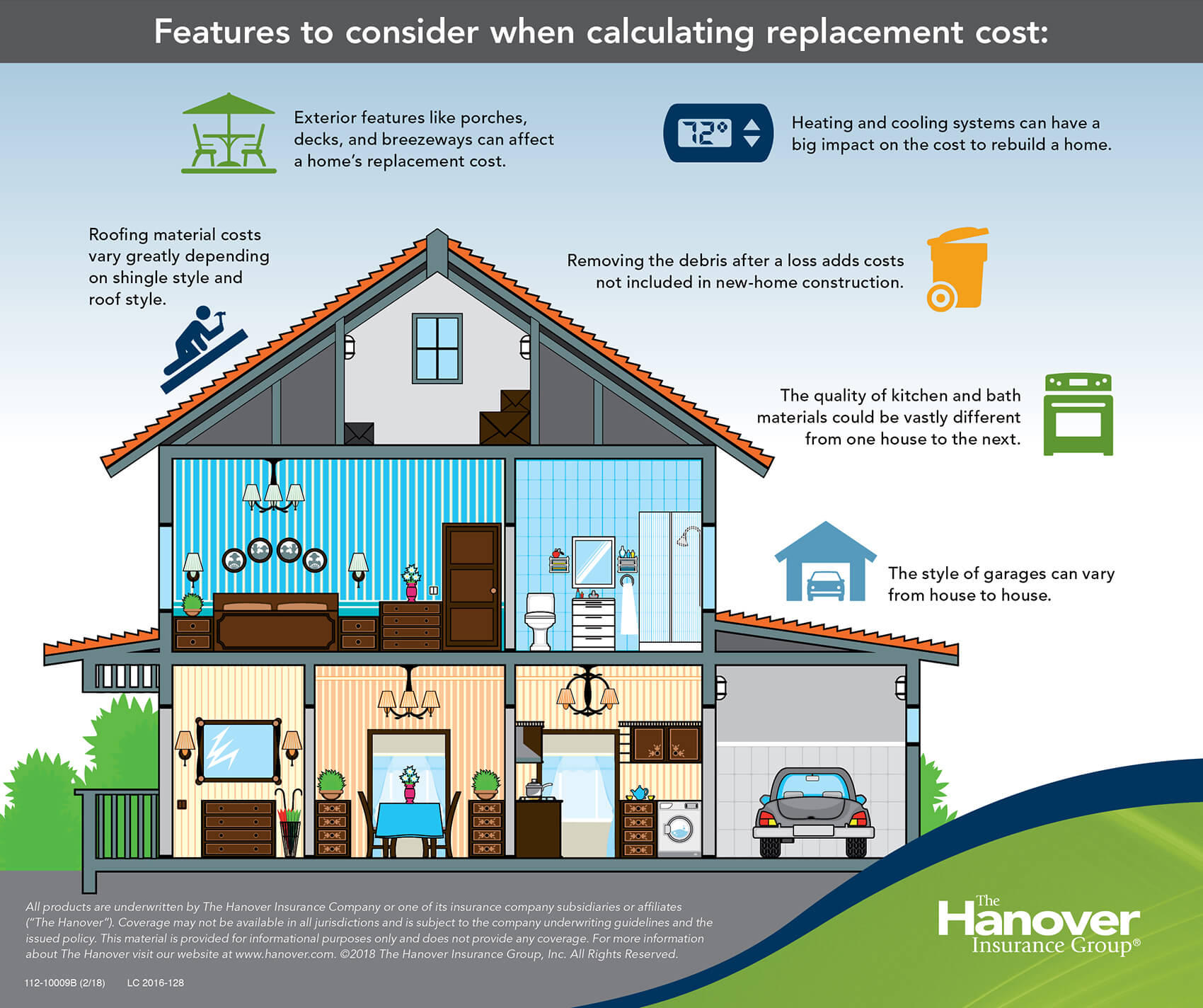

Source: partners4prosperity.com

Source: partners4prosperity.com

Replacing an existing policy with another should be done for only. Replacement cost is a term used to describe the amount it would cost an individual or business to replace an existing asset with a similar asset at today’s market prices. The notice shall list all life insurance policies or annuities proposed to be replaced, properly identified by name of insurer, the insured or annuitant, and policy or contract number if available; Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Sixth, it can ruin long term relations, especially in life insurances.

Source: floridainsuranceguy.com

Source: floridainsuranceguy.com

Regulation 60 covers replacement of life insurance policies with a new life insurance policy or annuity, and replacement of annuities with a new annuity. Replacement cost is a term used to describe the amount it would cost an individual or business to replace an existing asset with a similar asset at today’s market prices. Helpful hint any replacement policies must be advantageous to the. Fifth, it gives advantages to tricks over honestly and could damage the insurance industry in the long run. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical.

Source: i-dont-wanna-be-afraid.blogspot.com

Source: i-dont-wanna-be-afraid.blogspot.com

Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. The term is used in the finance and real estate industries, but it’s most commonly associated with the property insurance industry, particularly homeowners insurance. If the policy has cash values or the replacing agent wants to transfer the basis of the policy to the new policy, a 1035 exchange form will also be required. Income replacement is one of the main reasons many people, especially those who have loved ones depending on them financially, have life insurance. Agents are required to complete a definition of replacement form for every life insurance or annuity sale in the state of new york, whether or not a replacement is proposed.

Source: hanover.com

Source: hanover.com

The term is used in the finance and real estate industries, but it’s most commonly associated with the property insurance industry, particularly homeowners insurance. Sixth, it can ruin long term relations, especially in life insurances. If an annuity owner is a florida resident and the insurance company licensed to sell annuities in florida becomes insolvent, a fixed deferred annuity will be guaranteed by the florida life & health insurance guaranty association (flhiga) for up to an aggregate amount of $250,000. There are two basic types of life insurance: Every life insurance company requires notification of the replacement a life insurance policy.

Source: mappusinsurance.com

Source: mappusinsurance.com

A term life insurance policy provides coverage for a specific period of time, typically between 10 and 30 years. Fifth, it gives advantages to tricks over honestly and could damage the insurance industry in the long run. Depending on the insurance company, evidence of insurability may include two. Replacement cost is the amount it would cost to replace or rebuild an item of similar quality using materials and goods that are currently available. Regulation 60 covers replacement of life insurance policies with a new life insurance policy or annuity, and replacement of annuities with a new annuity.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

The rules of engagement are stringent. Replacing an existing policy with another should be done for only. The rules of engagement are stringent. Replacement policy [insurance] law and legal definition. Florida�s replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy.

Source: pinterest.com

Source: pinterest.com

The notice shall list all life insurance policies or annuities proposed to be replaced, properly identified by name of insurer, the insured or annuitant, and policy or contract number if available; The rules of engagement are stringent. Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. The florida replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. Florida�s replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy.

Source: insuranceland.org

Source: insuranceland.org

These are long term policies and having rebating on them can hurt both sights. Replacement cost is a term used to describe the amount it would cost an individual or business to replace an existing asset with a similar asset at today’s market prices. It is, however, a practice that can lead to ethical lapses. The money from your life insurance policy can help your family pay bills and cover living expenses. The two most common other than calling it whole life are “straight life” or “permanent life”.

Source: icainsurance.com

Source: icainsurance.com

The rules of engagement are stringent. Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. Financial services commission of ontario subject: Helpful hint any replacement policies must be advantageous to the. Replacement is any transaction where, in connection with the purchase of new insurance or a new annuity, you

Source: youtube.com

Source: youtube.com

Pays a person you select a set amount of money if or when you die. Replacement cost is a term used to describe the amount it would cost an individual or business to replace an existing asset with a similar asset at today’s market prices. The notice shall list all life insurance policies or annuities proposed to be replaced, properly identified by name of insurer, the insured or annuitant, and policy or contract number if available; Replacement cost coverage insures your property for what it would cost to repair or replace your damaged property without subtracting its. Pays a person you select a set amount of money if or when you die.

Source: wjfarmerinsurance.com

Source: wjfarmerinsurance.com

The florida replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. We will spare you the history lesson and only add that whole life insurance is the original type of life insurance. A replacement policy sometimes contains clauses which release the insurer from the cost of complying. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another.

Source: sungateinsurance.com

Source: sungateinsurance.com

Florida�s replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. Regulation 60 covers replacement of life insurance policies with a new life insurance policy or annuity, and replacement of annuities with a new annuity. Replacement policy is an insurance policy between an insurance company and a consumer which promises to pay the insured the replacement value of the subject of the policy if a loss occurs. Depending on the insurance company, evidence of insurability may include two. If an annuity owner is a florida resident and the insurance company licensed to sell annuities in florida becomes insolvent, a fixed deferred annuity will be guaranteed by the florida life & health insurance guaranty association (flhiga) for up to an aggregate amount of $250,000.

Source: youtube.com

Source: youtube.com

Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. Income replacement is one of the main reasons many people, especially those who have loved ones depending on them financially, have life insurance. Replacement of life insurance or annuities (this notice must be signed by the applicant and broker, with the original sent to standard insurance company and a copy left with the applicant.) definition: Replacing an existing policy with another should be done for only. We will spare you the history lesson and only add that whole life insurance is the original type of life insurance.

Source: npa1.org

Source: npa1.org

If the policy has cash values or the replacing agent wants to transfer the basis of the policy to the new policy, a 1035 exchange form will also be required. We will spare you the history lesson and only add that whole life insurance is the original type of life insurance. Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. Having life insurance for income replacement means if you pass away, your family could have the financial support they need to maintain the lifestyle they’re used to. Financial services commission of ontario subject:

Source: pinterest.com

Source: pinterest.com

Reasons why they would replace their policy with a new one include changing the level of. It is, however, a practice that can lead to ethical lapses. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. A replacement policy sometimes contains clauses which release the insurer from the cost of complying. These are long term policies and having rebating on them can hurt both sights.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Replacement of life insurance or annuities (this notice must be signed by the applicant and broker, with the original sent to standard insurance company and a copy left with the applicant.) definition: Life insurance is designed to replace your income, providing financial support to your dependents if you die prematurely. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. These are long term policies and having rebating on them can hurt both sights. Replacement policy [insurance] law and legal definition.

Source: allstate.com

Source: allstate.com

Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Replacement of life insurance or annuities (this notice must be signed by the applicant and broker, with the original sent to standard insurance company and a copy left with the applicant.) definition: The money from your life insurance policy can help your family pay bills and cover living expenses. We will spare you the history lesson and only add that whole life insurance is the original type of life insurance. Term and permanent life insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is florida s definition of life insurance replacement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information