What is fr44 insurance information

Home » Trending » What is fr44 insurance informationYour What is fr44 insurance images are ready in this website. What is fr44 insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the What is fr44 insurance files here. Download all free images.

If you’re looking for what is fr44 insurance pictures information connected with to the what is fr44 insurance keyword, you have visit the right blog. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

What Is Fr44 Insurance. Bankrate understands the difficulties of getting car insurance. There are filing fees you will need to pay for the dmv to record the fr44. An fr44 filing is typically for the worst driving offenses such as maiming or […] $120,000 bodily injury per accident.

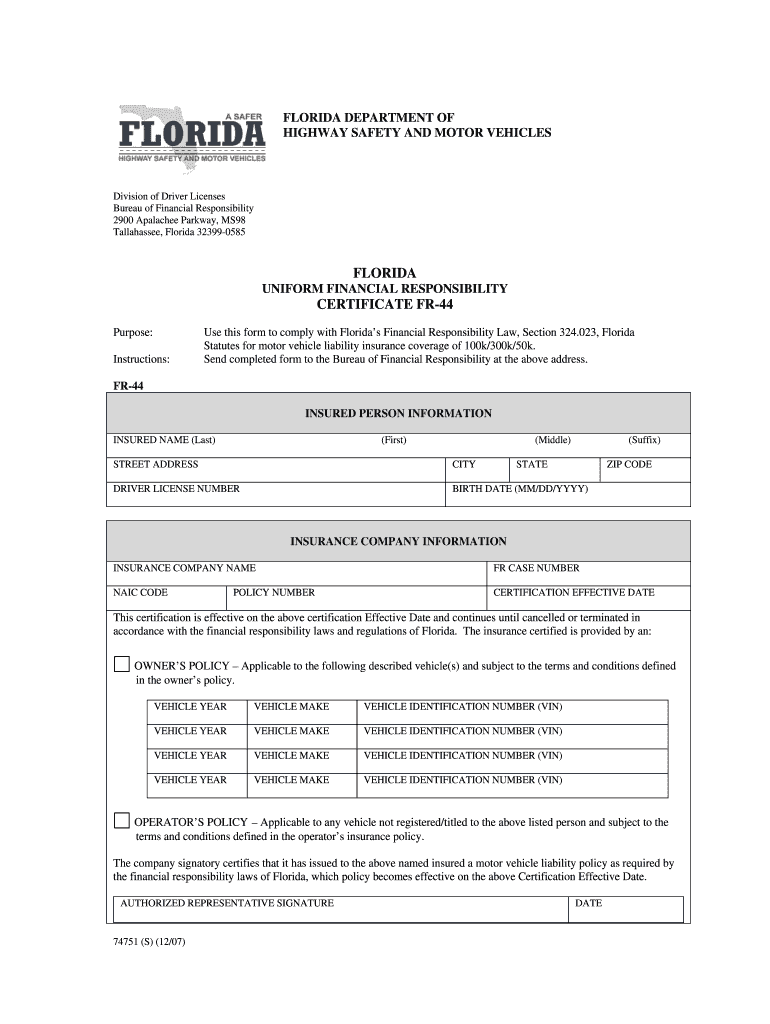

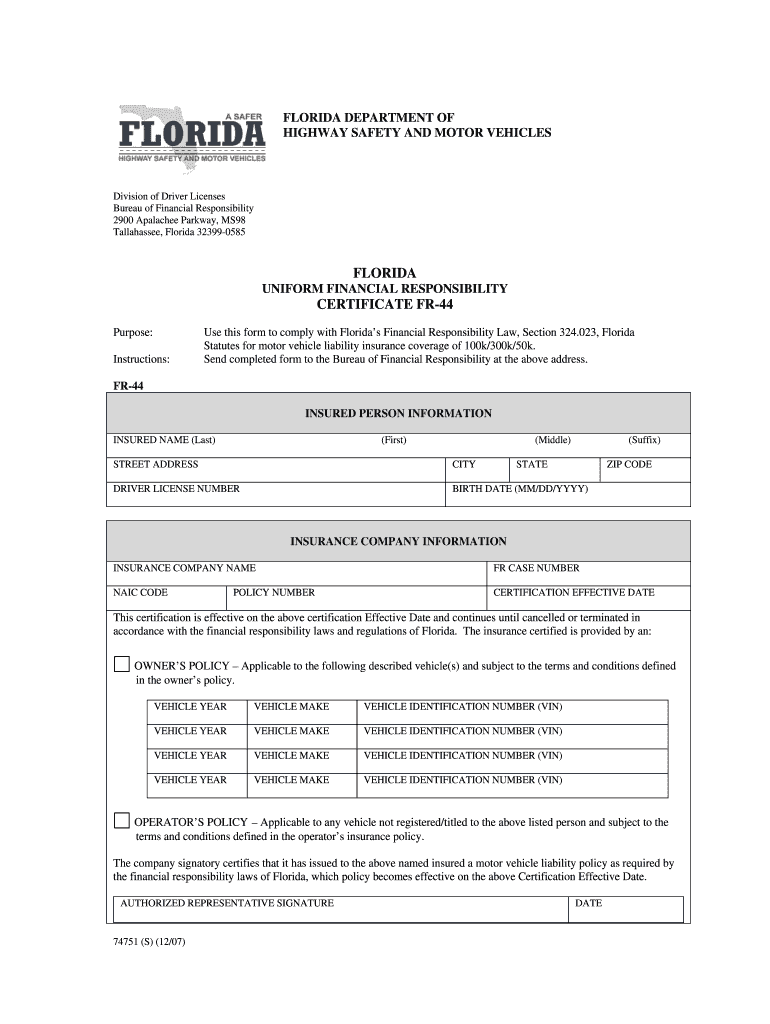

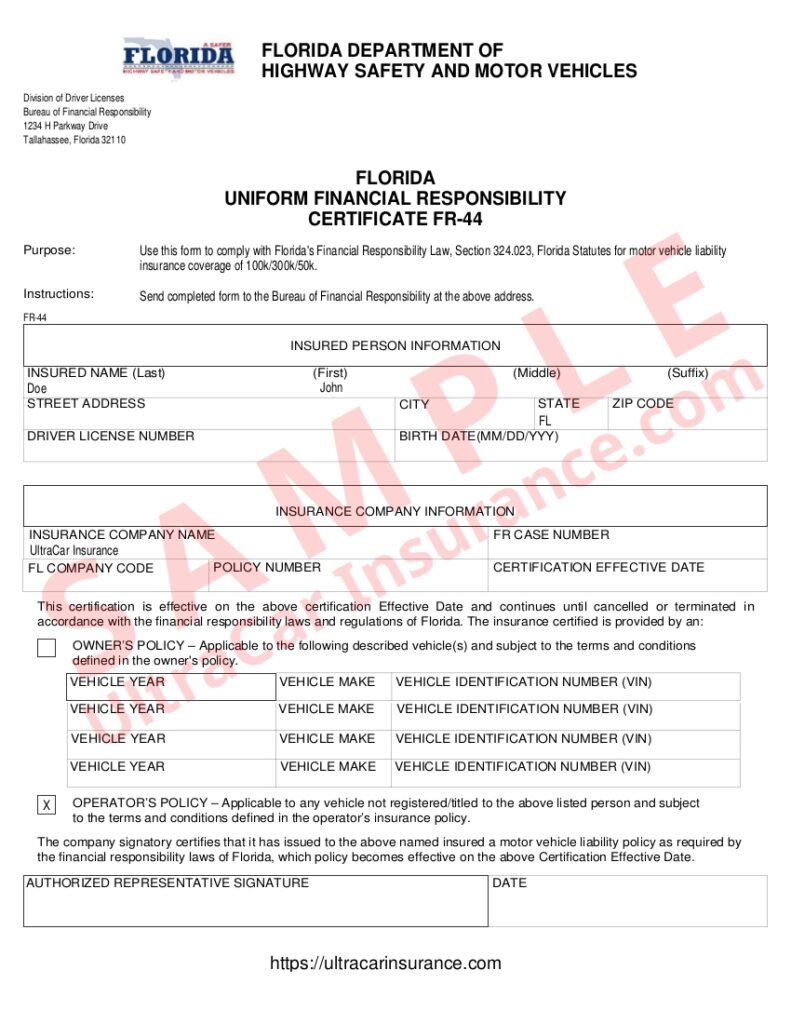

Fr44 Insurance Florida Form Pdf Fill Out and Sign From signnow.com

Fr44 Insurance Florida Form Pdf Fill Out and Sign From signnow.com

$40,000 property damage per accident. $120,000 bodily injury per accident. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements. The document is issued by your insurance carrier once you have purchased car insurance and sent to the dmv by your carrier. The fr44 insurance system is only used in two states—florida and virginia—but it functions much the same as the sr22 form used in other states. The fr44 filing was created to make sure that a driver convicted of a dui carries liability limits of 100/300/50.

You’re also not allowed to cancel your insurance coverage.

The fr stands for “financial responsibility.”. If you have been convicted in fl for dui after october 2007. $120,000 for bodily injury or death of two or more people. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui. $120,000 bodily injury per accident. The terms “sr22 insurance” and “fr44 insurance“, much like “dui insurance“, are used by the general public, but are not official types of insurance.

Source: mysecretmsblog.blogspot.com

Source: mysecretmsblog.blogspot.com

It is a certificate that you have the required insurance coverages to obtain insurance. If you have been convicted in fl for dui after october 2007. Our agency helps with auto insurance for people who have a dui or dwi on their records, as well as adding an sr22 or fr44 filing to the insurance policy. Fr44 insurance is a document that proves financial responsibility by demonstrating the policyholder has sufficient auto insurance in place. An fr44 filing is typically for the worst driving offenses such as maiming or […]

Source: youtube.com

Source: youtube.com

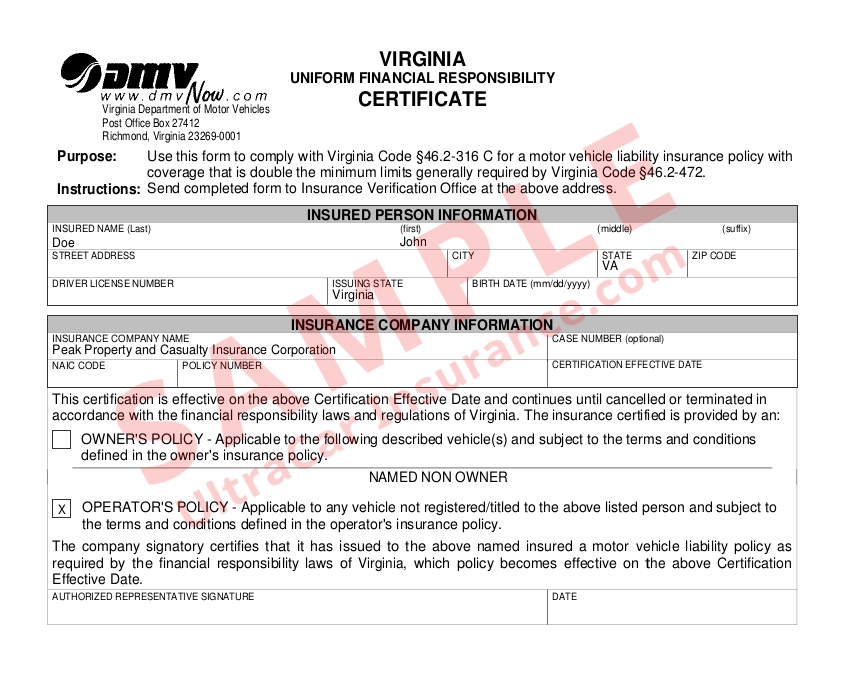

Like an sr22, an fr44 is not actually insurance either. The higher coverage significantly impacts your auto insurance rate if you own a car. If you are needed to submit an fr44 form, you must contact your auto insurance company, as it will submit the form to the state after you have purchased the required quantity of auto insurance. An fr44 is a document that verifies that you have the required auto insurance while on the road. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements.

Source: theandrewagency.com

Source: theandrewagency.com

$30,000 per person / $60,000 per accident uninsured motorist bodily injury. $60,000 bodily injury per person. There are filing fees you will need to pay for the dmv to record the fr44. Fr44 insurance is a certification that essentially reassures insurance companies that you can carry double florida’s (or virginia’s) minimum liability requirements for the next 3 years. $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of.

Source: fr44insuranceflorida.us

Source: fr44insuranceflorida.us

In florida, you’ll need $100,000 bodily injury coverage (per person), $300,000 bodily injury coverage (per accident), and $50,000 property damage coverage. Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations. An fr44 is a document that verifies that you have the required auto insurance while on the road. An fr44 is a form that ensures you are carrying the proper car insurance out on the road. The higher coverage significantly impacts your auto insurance rate if you own a car.

Source: fr44fast.com

Source: fr44fast.com

$60,000 bodily injury per person. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui. The fr44 filing was created to make sure that a driver convicted of a dui carries liability limits of 100/300/50. Our agency helps with auto insurance for people who have a dui or dwi on their records, as well as adding an sr22 or fr44 filing to the insurance policy.

Source: cheap-florida-fr44.com

Source: cheap-florida-fr44.com

$60,000 for bodily injury or death to one person. Driving while under the influence. $120,000 for bodily injury or death of two or more people. Fr44 insurance is a document that proves financial responsibility by demonstrating the policyholder has sufficient auto insurance in place. Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations.

Source: slideshare.net

Source: slideshare.net

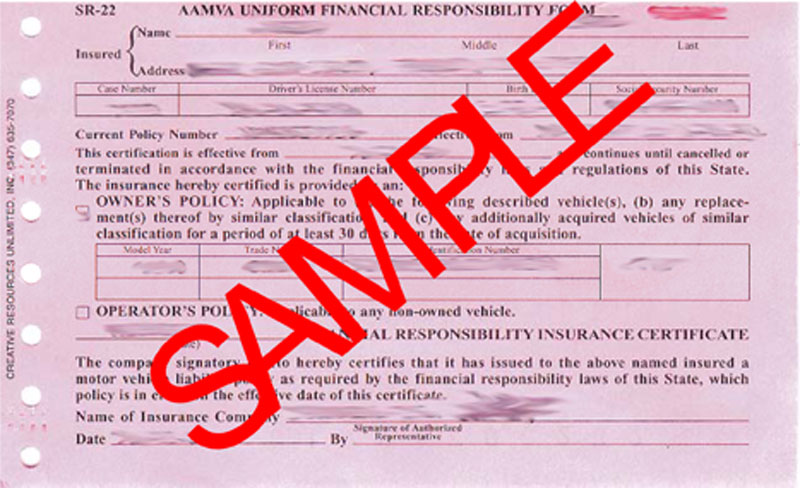

An fr44 filing is similar in theory to an sr 22, except that it may indicate that you maintain more than just the minimum amount of coverage required by the state requesting it. The fr44 filing was created to make sure that a driver convicted of a dui carries liability limits of 100/300/50. $40,000 property damage per accident. In florida, you’ll need $100,000 bodily injury coverage (per person), $300,000 bodily injury coverage (per accident), and $50,000 property damage coverage. This form has higher limits than sr22.

Source: issuu.com

Source: issuu.com

Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations. Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations. Bankrate understands the difficulties of getting car insurance. If you have been convicted in fl for dui after october 2007. $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of.

Source: youtube.com

Source: youtube.com

The fr stands for “financial responsibility.”. In florida, you’ll need $100,000 bodily injury coverage (per person), $300,000 bodily injury coverage (per accident), and $50,000 property damage coverage. Minimum coverage requirements for fr44 insurance in virginia are 60/120/40: What is the fr44 filing? $60,000 bodily injury per person.

Source: cheap-florida-fr44.com

Source: cheap-florida-fr44.com

$60,000 bodily injury per person. An fr44 form is not insurance, it is a form endorsed to your auto insurance policy, and filed with the state department of motor vehicles. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui. Bankrate understands the difficulties of getting car insurance. Auto insurance companies issue the fr44, filed with the florida department of highway safety and motor vehicles (dmv), once your premium is paid in full.

Source: signnow.com

Source: signnow.com

Florida and virginia also use sr22s, reserving the fr44s for more serious violations. Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations. $120,000 bodily injury per accident. If you are needed to submit an fr44 form, you must contact your auto insurance company, as it will submit the form to the state after you have purchased the required quantity of auto insurance. An fr44 filing is typically for the worst driving offenses such as maiming or […]

Source: youtube.com

Source: youtube.com

$60,000 bodily injury per person. Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations. $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of. The penalties for driving without insurance can be severe. The higher coverage significantly impacts your auto insurance rate if you own a car.

Source: mylovingstardoll.blogspot.com

Source: mylovingstardoll.blogspot.com

The document is issued by your insurance carrier once you have purchased car insurance and sent to the dmv by your carrier. $60,000 bodily injury per person. If you are required to have an fr44 filing, you need to purchase more than just the minimum amount of. It is a certificate that you have the required insurance coverages to obtain insurance. You’re also not allowed to cancel your insurance coverage.

Source: ultracarsr22insurance.com

Source: ultracarsr22insurance.com

An fr44 is a form that ensures you are carrying the proper car insurance out on the road. The document is issued by your insurance carrier once you have purchased car insurance and sent to the dmv by your carrier. If you are required to have an fr44 filing, you need to purchase more than just the minimum amount of. Fr44 insurance is similar to sr22 insurance but typically it is required for more serious violations. It is a certificate that you have the required insurance coverages to obtain insurance.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

The fr44 filing was created to make sure that a driver convicted of a dui carries liability limits of 100/300/50. An fr44 filing is similar in theory to an sr 22, except that it may indicate that you maintain more than just the minimum amount of coverage required by the state requesting it. If you are required to have an fr44 filing, you need to purchase more than just the minimum amount of. Fr44 insurance is a certification that essentially reassures insurance companies that you can carry double florida’s (or virginia’s) minimum liability requirements for the next 3 years. $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of.

Source: youtube.com

Source: youtube.com

Florida and virginia currently use fr44. Like an sr22, an fr44 is not actually insurance either. Virginia’s financial responsibility law requires all drivers to maintain a minimum amount of liability insurance coverage of $25,000/$50,000/$20,000. An fr44 filing is similar in theory to an sr 22, except that it may indicate that you maintain more than just the minimum amount of coverage required by the state requesting it. An fr44 form is not insurance, it is a form endorsed to your auto insurance policy, and filed with the state department of motor vehicles.

Source: authorstream.com

Source: authorstream.com

$60,000 for bodily injury or death to one person. What is the fr44 filing? $30,000 per person / $60,000 per accident uninsured motorist bodily injury. Similar to an sr22 the fr44 is simply a proof of financial responsibility that shows the state the driver has minimum liability insurance protection. You’re also not allowed to cancel your insurance coverage.

Source: cheapfr44insurance.com

Source: cheapfr44insurance.com

The fr44 filing was created to make sure that a driver convicted of a dui carries liability limits of 100/300/50. An fr44 form is not insurance, it is a form endorsed to your auto insurance policy, and filed with the state department of motor vehicles. Like an sr22, an fr44 is not actually insurance either. Virginia’s financial responsibility law requires all drivers to maintain a minimum amount of liability insurance coverage of $25,000/$50,000/$20,000. The fr44 insurance system is only used in two states—florida and virginia—but it functions much the same as the sr22 form used in other states.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is fr44 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information